Quarterly consolidated sales at 2.7 million euros

Positive EBITDA at 0.3 million euros / Positive operating

cash flow at 0.5 million euros

Consolidated available cash at 4.8 million euros as of March

31, 2021 increasing by 0.6 million euros

Regulatory News:

MEMSCAP (NYSE Euronext: MEMS), the leading provider of

innovative solutions based on MEMS (micro-electro-mechanical

systems) technology, today announced its earnings for the first

quarter ending March 31, 2021.

Analysis of the consolidated income statement

Consolidated revenue for the first quarter of 2021 was 2.7

million euros (3.3 million US dollars) compared to 3.4 million

euros (3.7 million US dollars) for the first quarter of 2020 and

2.7 million euros (3.2 million US dollars) for the fourth quarter

of 2020.

Consolidated revenue distribution by market segment, over the

first quarter of 2021, is as follows:

Market segments / Revenue (In

million euros) – Non-audited

Q1 20

%

Q1 21

%

Aerospace

1.8

54%

0.9

33%

Optical communications / Adaptive

optics

1.1

33%

0.5

17%

Medical / Biomedical

0.4

11%

1.3

48%

Others

0.1

2%

0.1

2%

Total

3.4

100%

2.7

100%

(Any apparent discrepancies in totals are due to rounding.)

MEMSCAP’s consolidated earnings for the first quarter of 2021

are given within the following table:

In million euros –

Non-audited

Q1 20

Q1 21

Revenue

3.4

2.7

- Standard products*

- Custom products

2.2

1.2

2.2

0.6

Cost of revenue

(2.4)

(2.0)

Gross margin

1.0

0.8

% of revenue

29%

28%

Operating expenses**

(1.0)

(0.9)

Operating profit / (loss)

(0.0)

(0.1)

Financial profit / (loss)

0.0

(0.0)

Income tax expense

(0.0)

(0.0)

Net profit / (loss)

(0.0)

(0.1)

(Any apparent discrepancies in totals are due to rounding.) *

Including the royalties from the dermo-cosmetics segment. ** Net of

research & development grants.

Sales for the first quarter of 2021 confirmed the positive trend

of the medical business (sales multiplied by 3.5 vs. the first

quarter of 2020, thus an increase of + 0.9 million euros). The high

level of sales in the medical business, in line with the fourth

quarter of 2020, compensated the weak demand in the avionics

business, which remains affected by the Covid-19 pandemic (-0.9

million euros vs. the first quarter of 2020). However, the avionics

business increased by +0.1 million euros compared to the fourth

quarter of 2020. The optical communications business was down by

0.6 million euros vs. the first quarter of 2020 but started to

recover compared to the fourth quarter of 2020 (+0.2 million euros

vs. the fourth quarter of 2020). This recovery was still impacted

by the ongoing maintenance imposed by the technical incident on an

industrial equipment occurred in the US facilities in the fourth

quarter of 2020.

The strategy of diversifying the Group's activities around 3

business areas thus mitigated the impacts of a deeply deteriorated

economic environment.

* * *

The Group's gross margin rate stood at 28% of consolidated sales

compared to 29% for the first quarter of 2020.

Operating expenses decreased to 0.9 million euros compared to

the amount of 1.0 million euros for the first quarter of 2020.

The Group therefore reported operating and net losses at 0.1

million euros for the first quarter of 2021 compared to breakeven

operating and net earnings for the first quarter of 2020.

For the first quarter of 2021, the Group posted a positive

EBITDA at 0.3 million euros, similarly to the first quarter of

2020. In addition, the control of the consolidated working capital

requirement led to a positive operating cash flow of 0.5 million

euros for the first quarter of 2021.

On March 31, 2021, the Group reported a significant increase of

available cash which amounted at 4.8 million euros including cash

investments (Corporate bonds) recorded under non-current financial

assets (vs. 4.2 million euros at December 31, 2020). In addition to

this amount, the available unused credit lines amounted to 0.4

million euros on March 31, 2021.

* * *

Analysis and perspectives

The first quarter of 2021 confirmed the positive trend of the

medical business, compensating for the weak demand in the avionics

business which remains affected by the Covid-19 pandemic. As

previously mentioned, the diversity of its businesses allows

MEMSCAP to face the effects of such a major health and economic

crisis, particularly impacting the avionics sector even if a slight

recovery of this business seems to be observed.

The control of operating expenses and the working capital

requirement reflected the Group’s capacity to adapt and led to an

unaudited consolidated EBITDA of +0.3 million euros and an

operating cash flow of +0.5 million euros for the quarter. Thus,

consolidated available liquidities amounted to 4.8 million euros as

of March 31, 2021.

However, the potential impact of the pandemic remains very

uncertain based on the current available information. MEMSCAP will

continue to regularly assess the impact of Covid-19 on its

business.

MEMSCAP pursues its strategy focused on avionics, medical and

optical communications segments, backed by its own intellectual

property, as well as the development of an increased flexibility of

its production capacities.

* * *

MEMSCAP general shareholders’ meeting: May 28, 2021.

Q2 2021 earnings: July 29, 2021.

About MEMSCAP

MEMSCAP is the leading provider of innovative

micro-electro-mechanical systems (MEMS)-based solutions.

MEMSCAP’s products and solutions include components, component

designs (IP), manufacturing and related services.

MEMSCAP is listed on Euronext Paris ™ - Segment C - ISIN:

FR0010298620 - MEMS.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210426005677/en/

Yann Cousinet Chief Financial Officer Ph.: +33 (0) 4 76 92 85 00

yann.cousinet@memscap.com

For more information, visit our website at:

www.memscap.com.

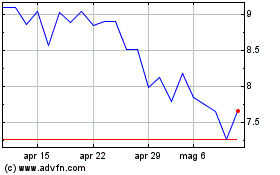

Grafico Azioni Memscap (EU:MEMS)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Memscap (EU:MEMS)

Storico

Da Apr 2023 a Apr 2024