Surface Transforms PLC Contract Award from OEM 8 and Trading Update (8215Y)

14 Settembre 2020 - 8:00AM

UK Regulatory

TIDMSCE

RNS Number : 8215Y

Surface Transforms PLC

14 September 2020

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

14 September 2020

Surface Transforms plc

("Surface Transforms" or the "Company")

Contract Award from Global Vehicle Manufacturer

and 2020 Trading Update

Surface Transforms (AIM:SCE) is pleased to announce that it has

been notified of its selection as a tier one supplier of a carbon

ceramic brake disc on a vehicle by a global vehicle manufacturer -

henceforth to be described by the Company as OEM 8.

Pursuant to this selection, Surface Transforms has signed a

contract with OEM 8 specifying the agreed detailed pricing, volume,

payment terms and other generic supply terms for the contracted

model. The Company has also received an order for engineering

samples required by OEM 8 to complete their homologation activity

on this high performance car.

Specifically, the selection is for Surface Transforms to be the

standard fit, sole supplier of the carbon ceramic brake disc on

both axles of this car.

The lifetime revenue on this specific vehicle model contract ,

commencing in the summer of 2021, is estimated to be approximately

GBP27.5m. In line with normal automotive practice, there are no

minimum values in the contract. Forecast production volumes in the

contract show a ramp up to full series volume commencing in 2021

with annual revenue being approximately GBP8m p.a. for the

following three years. The contract currently covers series

production to 2024 but may potentially be extended. The contract is

priced in GBP.

Impact on capacity and cost base

Whilst the one-year period to start of production is shorter

than historically seen, the Company has the capacity within its

existing Small Volume Production Cell and OEM Production Cell One

to fulfil this large contract, albeit with some accelerated timing

of previously planned capital expenditure. The volumes set out in

the OEM 8 contract, together with the "steady state" volumes of

previously announced contracts with German OEM 5, British OEM 6,

Koenigsegg, and other customers will fill circa 60% of total

Surface Transforms installed capacity by December 2022.

In light of the above increase in contracted revenue, which more

than double the previously projected contracted turnover in 2022

and, in the expectation of further contract awards, the Company

will be increasing manufacturing support headcount adding

approximately GBP0.5m, GBP1.3m and GBP2.0m p.a. in 2020, 2021 and

2022 respectively. This additional headcount will provide the

necessary support infrastructure for all contracted sales and

further prospective - but as yet uncontracted - sales pipeline.

Trading Update for 2020

Additionally, and independently of this contract award, the

Company is pleased to announce that near OEM and retrofit sales

have continued to grow, despite Covid-19. The Board now anticipate

current FY20 revenues will be approximately GBP400k higher than

market expectations with Group revenue for the year expected to

increase to approximately GBP2.0m. This increased revenue will

mitigate the working capital impact of additional overhead in FY20

following the Board's decision to invest in the Company's

headcount.

Further contract announcements

The Company continues to expect to make further contract award

announcements over the next six months.

Kevin Johnson, CEO commented: "This, truly game changing, award

builds upon the recent trend of significant contract wins with

mainstream automotive manufacturers. The award, which on its own,

doubles previous revenue projections for FY22 and accelerates

Surface Transforms' transition into profitability and operational

cash generation.

The Board is delighted with this award and want to particularly

thank both our employees and the customer for their considerable

efforts in concluding the work needed for nomination against the

background of the Covid 19 pandemic and lockdown.

This is a very good day for Surface Transforms and we look

forward to further extending our relationship with this major new

customer and making further contract announcements with both OEM 8

and other, existing and new, customers."

For enquiries, please contact

Surface Transforms plc +44 151 356 2141

Kevin Johnson, CEO

Michael Cunningham, CFO

David Bundred, Chairman

Zeus Capital Limited (Nominated Adviser and Joint Broker) +44 203 829 5000

David Foreman / Dan Bate/ Jordan Warburton (Corporate

Finance)

Dominic King (Corporate Broking)

finnCap Ltd (Joint Broker ) +44 20 7220 0500

Ed Frisby/Giles Rolls (Corporate Finance)

Richard Chambers (ECM)

For further Company details, visit www.surfacetransforms.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCKKNBPOBKDCCD

(END) Dow Jones Newswires

September 14, 2020 02:00 ET (06:00 GMT)

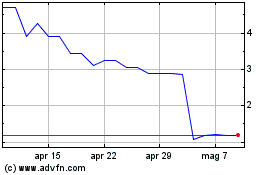

Grafico Azioni Surface Transforms (LSE:SCE)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Surface Transforms (LSE:SCE)

Storico

Da Apr 2023 a Apr 2024