Total Gabon: Third Quarter 2020 Financial Statements

12 Novembre 2020 - 6:52PM

Business Wire

Regulatory News:

Total Gabon (Paris:EC):

Main Financial Indicators

Q3 20

Q2 20

Q3 20

vs.

Q2 20

3M 20

3M 19

3M 20

vs.

3M 19

Average Brent price

$/b

42.9

29.6

+45%

41.1

64.6

-36%

Average Total Gabon crude price (1)

$/b

41.3

22.6

+83%

33.6

61.7

-46%

Crude oil production

from fields operated by Total Gabon

kb/d (2)

18.6

19.0

-2%

19.8

23.8

-17%.

Crude oil production

from Total Gabon interests (3)

kb/d

25.3

25.4

0%

26.2

32.3

-19%

Sales volumes (1)

Mb (4)

1.89

2.84

-33%

7.06

9.06

-22%

Revenues (5)

M$

95

74

+28%

282

614

-54%

Funds generated from operations (6)

M$

19

31

-39%.

105

304

-65%.

Capital expenditure

M$

25

10

n.s.

46

90

-49%

Net income

M$

11

(51)

n.s.

(46)

42

n.s.

- Excluding profit oil reverting to the Gabonese Republic as per

production sharing contracts.

- kb/d: Thousand barrels per day

- Including profit oil reverting to the Gabonese Republic as per

production sharing contracts.

- Mb: Million barrels.

- Revenue from hydrocarbon sales and services (transportation,

processing and storage), including profit oil reverting to the

Gabonese Republic as per production sharing contracts.

- Funds generated from operations are comprised of the operating

cash flow, the gains or losses on disposals of assets and the

working capital changes.

Third quarter and first nine months 2020 statements

Selling Price

The selling price of the crude oil grade marketed by Total Gabon

increased sharply to $41.3 per barrel, during the third quarter

2020 compared to the second quarter 2020.

The selling price for the first nine months 2020 averaged 33.6

$/b, down 46% compared to the first nine months 2019.

Production

Total Gabon’s equity share of operated and non-operated oil

production(1) amounted to 25,300 barrels per day during the third

quarter 2020 stable compared to the second quarter 2020. The gains

from restarting the Anguille field compressor have been impacted by

the limitations imposed by the OPEP+ quotas as well as the natural

decline of the fields.

Total Gabon’s equity share of operated and non-operated oil

production(1) amounted to 26,200 barrels per day during the first

nine months 2020 down 19% compared to the first nine months 2019,

due mainly to:

- The unavailability of the Anguille field compressor, mainly

during the second quarter;

- The partial unavailability of assets caused by compression and

sand issues on the non-operated Grondin sector;

- The limitations imposed by the OPEP+ quotas, mainly during the

third quarter,

- The natural decline of the fields.

This was partly offset by:

- The gains from the well intervention campaign during the first

quarter on the operated fields.

Revenues

Revenues amounted to $95 million in the third quarter 2020, up

28% compared to the second quarter 2020, mainly due to improved

average selling price.

Revenues amounted to $282 million during the first nine months

2020, down 54% compared to the first nine months 2019, mainly

impacted by the declining selling price between the two periods,

the slowdown in production and a less favorable crude lifting

program.

Funds generated from operations

Cash flow from operations amounted to $19 million in the third

quarter 2020, down 39% compared to the second quarter 2020. This is

mainly due to the higher working capital, notably driven by

receivables in relation to the price recovery.

Cash flow from operations amounted to $105 million during the

first nine months 2020, a significant decline compared to the first

nine months 2019. This is mainly due to the lower prices and

production. Besides the unfavorable environment and excluding

dividends payments, the cash increased by $16 million during the

first nine months 2020.

Capital Expenditure

Capital expenditure amounted to $25 million in the third quarter

2020, and to $46 million during the first nine months 2020, down

65% compared to the first nine months 2019. This includes mainly

integrity works, a well intervention campaign on the operated field

and, on the Grondin sector, the installation of a gas pipeline

intended at first to improve the gas lift activation of wells and

the resumption of the conversions of well activation from gas-lift

to electrical submersible pumps. Work for commissioning the gas

pipeline has started during the third quarter.

Net Income

Net income amounted to $11 million for the third quarter 2020

and to ($46) million during the first nine months 2020, mainly

impacted by lower prices and production.

Highlights since the beginning of the third quarter

2020

Corporate governance

Total Gabon's ordinary Shareholders' Meeting was held on

September 21, 2020 in Libreville and approved the payment of a net

dividend of $44.44 per share.

This dividend was paid in an equivalent amount of €37.70 per

share based on the European Central Bank’s rate of $1.1787 for one

euro on September 21, 2020.

Health and oil crisis

Following the dual health and oil crisis, the Company has

communicated on April 20, 2020 on the implementation of an action

plan to substantially reduce its costs and capital expenditures for

2020. This plan has not been modified and its implementation is

carried out as planned.

Tax audit

On October 2, 2020 the Company has received an assessment letter

of $22.7 million related to the tax audit performed in 2019 for the

fiscal years 2014 to 2017. The settlement during the fourth quarter

closes this procedure.

Refocus of the Company’s activities on its operated

assets

The project of assets disposal announced on July 30, 2020 by the

Company continues to progress. The transaction price does not

affect the assets valuation applied in the financial statements of

Total Gabon.

Criteria of the norm IFRS 5 “Non-current assets held for sales

and discontinued operations” have been met during the third quarter

2020; discontinuing assets depreciation has a non-significant

impact on the quarterly net income. Quantitative and qualitative

information related to the disposed of scope shall be presented in

the annual financial statements.

1 Including profit oil reverting to the Gabonese Republic as per

production sharing contracts.

Total Gabon Société anonyme incorporated in

Gabon with a Board of Directors and share capital of $76,500,000

Headquarters: Boulevard Hourcq, Port-Gentil, BP 525, Gabonese

Republic www.total.ga Registered in Port-Gentil: 2000 B

00011

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201112005915/en/

Total Gabon Media contact:

actionnariat-totalgabon@total.com

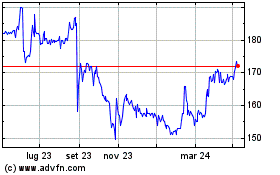

Grafico Azioni TotalEnergies EP Gabon (EU:EC)

Storico

Da Mar 2024 a Apr 2024

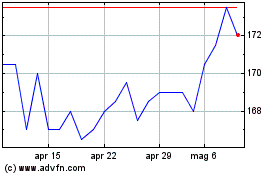

Grafico Azioni TotalEnergies EP Gabon (EU:EC)

Storico

Da Apr 2023 a Apr 2024