TIDMEBOX TIDMBOXE

RNS Number : 6586P

Tritax EuroBox PLC

19 February 2021

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, TO US PERSONS, IN OR INTO THE

UNITED STATES, AUSTRALIA, CANADA, JAPAN, NEW ZEALAND OR THE

REPUBLIC OF SOUTH AFRICA OR INTO ANY OTHER JURISDICTION WHERE TO DO

SO MIGHT CONSTITUTE A VIOLATION OR BREACH OF ANY APPLICABLE LAW OR

REGULATION. PLEASE SEE THE IMPORTANT NOTICE AT THE OF THIS

ANNOUNCEMENT.

THIS ANNOUNCEMENT HAS BEEN DETERMINED TO CONTAIN INSIDE

INFORMATION.

THIS ANNOUNCEMENT IS AN ADVERTISEMENT AND NOT A PROSPECTUS OR A

PROSPECTUS-EQUIVALENT DOCUMENT. THIS ANNOUNCEMENT DOES NOT

CONSTITUTE OR FORM PART OF, AND SHOULD NOT BE CONSTRUED AS, AN

OFFER FOR SALE OR SUBSCRIPTION OF, OR SOLICITATION OF ANY OFFER TO

BUY OR SUBSCRIBE FOR, ANY ORDINARY SHARES IN THE COMPANY, IN ANY

JURISDICTION, INCLUDING THE UNITED STATES, NOR SHALL IT, OR ANY

PART OF IT, OR THE FACT OF ITS DISTRIBUTION, FORM THE BASIS OF, OR

BE RELIED ON IN CONNECTION WITH, ANY CONTRACT OR INVESTMENT

DECISION WHATSOEVER, IN ANY JURISDICTION. THIS ANNOUNCEMENT DOES

NOT CONSTITUTE A RECOMMATION REGARDING ANY SECURITIES. ANY

INVESTMENT DECISION MUST BE MADE EXCLUSIVELY ON THE BASIS OF THE

PROSPECTUS TO BE PUBLISHED BY THE COMPANY IN CONNECTION WITH THE

ISSUE.

19 February 2021

TRITAX EUROBOX PLC

(the " Company ")

Proposed Equity Issue

The Board of Directors (the "Directors") of Tritax EuroBox plc

(tickers: EBOX (Sterling) and BOXE (Euro)), which invests in

Continental European logistics real estate assets, today announces

the proposed issue of new ordinary shares ("New Ordinary Shares")

in the Company to raise targeted gross proceeds of approximately

GBP173 million (EUR200 million) (the "Issue") and a proposed

placing programme of further ordinary shares and/or C shares (the

"Placing Programme"), the details of which will be set out in the

prospectus which is expected to be published by the Company later

today (the "Prospectus").

Key Highlights:

-- The Issue will be by way of a placing, open offer, offer for

subscription and intermediaries offer for a target issue of

168,000,309 New Ordinary Shares at an issue price of 103 pence per

New Ordinary Share (the "Issue Price").

-- The Issue Price represents the audited IFRS NAV per Ordinary

Share as at 30 September 2020 of EUR1.19 converted at prevailing

exchange rates.

-- The Issue Price also represents a discount of 2.4% to the

Company's closing share price of 105.5 pence per Ordinary Share on

18 February 2021 (being the last business day prior to this

announcement).

-- Shareholders who qualify for the Open Offer ("Qualifying

Shareholders") will be offered the opportunity to participate in

the Open Offer on the basis of:

1 New Ordinary Share for every 5 Existing Ordinary Shares held

(the "Open Offer Entitlement").

Qualifying Shareholders are also being offered the opportunity

to subscribe for New Ordinary Shares in addition to their Open

Offer Entitlement under an excess application facility, further

details of which will be set out in the Prospectus (the "Excess

Application Facility").

-- The Company's manager, Tritax Management LLP (the "Manager"),

expects to use the net proceeds of the Issue, together with

existing resources and debt, to secure the acquisition of a

near-term investment pipeline of prime big box logistics assets,

comprising:

o Three German assets with a value of EUR317 million sourced

through the Manager's developer/asset manager relationships on an

off-market basis

o Three further assets (two in Italy, one in Germany) with a

value of EUR99 million also sourced through the Manager's

developer/asset manager relationships on an off-market basis

o EUR81 million of development opportunities within the existing

portfolio at an attractive yield on cost

-- The Manager is confident that the proceeds of the Issue can

be deployed into this pipeline within three months of completion of

the Issue.

-- Completion of the Issue at the targeted size is expected to

provide the Company with a path to an Investment Grade credit

rating, resulting in a lower cost of borrowings.

-- The Company has agreed with the Manager to reduce its

management fee by 0.15% on NAV above EUR500 million (such that

management fees will be 1.15% between NAV of EUR500 million and up

to and including EUR2 billion, as opposed to 1.15% between NAV of

EUR1 billion and up to and including EUR2 billion).

-- Placing Programme of up to 300 million further ordinary shares and/or C shares.

-- The Issue and the Placing Programme are conditional upon,

inter alia, the passing of certain shareholder resolutions (the

"Resolutions") to be proposed at a general meeting of the Company

expected to take place on 8 March 2021 (the "General Meeting"),

further details of which are set out in a circular to the Company's

shareholders expected to be posted to shareholders later today (the

"Circular"). Applications will be made for the New Ordinary Shares

to be issued pursuant to the Issue to be admitted to the premium

listing segment of the Official List of the FCA and to trading on

the London Stock Exchange's main market for listed securities

("Initial Admission").

Terms not otherwise defined in this announcement have the

meanings that will be given to them in the Prospectus. This summary

should be read in conjunction with the full text of this

announcement and the Prospectus, when available.

Background to the Issue

The Company listed on the London Stock Exchange in 2018 with the

objective of investing in Continental European logistics real

estate assets diversified by geography and tenant and targeting

well located assets in established distribution hubs, within or

close to densely populated areas.

The Company's investment portfolio now comprises 13 assets,

spread across key logistics locations in six core Continental

European countries. As at 30 September 2020, the portfolio was

independently valued at EUR839.3 million (excluding the recently

acquired asset in Nivelles, Belgium but including the First Lodz

Asset, which the Group has contracted to dispose for EUR65.5

million).

The Company operates in a market underpinned by strong

fundamentals including rising occupier demand for logistics

facilities which is being driven by an unprecedented change in

consumer behaviour created by the rapid growth of e-commerce,

internet shopping and convenience retail. The outbreak of COVID-19

has served to reinforce, magnify and accelerate these trends.

The Manager believes this transformation of the retail landscape

to fully accommodate on-line shopping has some way to go before

reaching an equilibrium. The current rates of market penetration

for on-line sales have considerable scope to grow further over the

coming years, with Continental European rates materially lagging

that of the UK. In addition, the Continental European logistics

market continues to experience a scarcity of high quality stock

caused by a relatively limited speculative development response and

declines in land availability. The combination of these factors has

resulted in low vacancy rates across most European markets and a

shortage of high quality buildings available to rent. Meanwhile

prices in the investment market have risen (and investment yields

have fallen), reflecting in part investor expectations that

logistics assets will generate higher growth than other property

asset classes as well as fierce competition for assets.

The Manager's expectation is that this positive backdrop,

characterised by strengthening demand and relatively constrained

supply, will continue to provide a favourable underpin to the

Continental European logistics sector and the activities of the

Group.

Benefits of the Issue

The Directors believes that the Issue will have the following

benefits for the Company:

-- Allow the Company to acquire its identified near-term pipeline of investment opportunities;

-- Allow the Company to build on the strong market position

already established by further diversifying specific country,

tenant and asset concentration and lowering overall portfolio

risk;

-- The greater diversification and security provided by raising

the targeted amount of new equity and securing a larger portfolio

gives the Company the potential to achieve an Investment Grade

credit rating. This is expected to provide access to a deeper pool

of potential lenders to the Company, resulting in a lower cost of

borrowing;

-- An increase in the size of the Investment Portfolio will also

spread the Group's fixed operating expenses over a larger capital

base, which the Company expects will reduce ongoing expenses per

Share;

-- Increasing the size of the Company should help improve the

liquidity and marketability of the Company's shares and broaden the

investor base over the longer term; and

-- The Company also seeks to exert a positive socio-economic

impact on occupiers and local communities. The increase in scale

will allow for the Company to accelerate its sustainability

strategy and deliver its energy and carbon reduction commitments

and positioning the portfolio for the future.

Details of the Issue

Jefferies International Limited ("Jefferies") and van Lanschot

Kempen Wealth Management N.V. ("Kempen & Co") are acting as

joint global co-ordinators and joint bookrunners to the Company in

connection with the Issue and the Placing Programme.

The Company intends to raise target gross proceeds of

approximately GBP173 million (EUR200 million) through the issue of

168,000,309 New Ordinary Shares at the Issue Price. The actual

number of New Ordinary Shares to be issued pursuant to the Issue is

not known as at the date of this announcement but will be notified

by the Company via a Regulatory Information Service prior to

Initial Admission.

T he Directors have flexibility to increase the number of New

Ordinary Shares to be issued under the Issue if they believe there

is sufficient investor demand for those shares and suitable assets

available for investment in which to deploy the net Issue proceeds.

Any such increase will be announced by the Company through a

Regulatory Information Service.

The Issue Price is 103 pence per Ordinary Share. Participants in

the Placing may elect to subscribe for the New Ordinary Shares in

Sterling at the Issue Price or in Euro at a price per New Ordinary

Share equal to the Issue Price at a GBP/EUR exchange rate to be

notified by the Company via a Regulatory Information Service (the

"Relevant Euro Exchange Rate") on or around 5 March 2021.

Applicants under the Open Offer, the Offer for Subscription and

Intermediaries Offer may subscribe for Ordinary Shares in Sterling

only.

The New Ordinary Shares to be issued under the Issue will rank

pari passu in all respects with the Existing Ordinary Shares and

each other, and will rank in full for all dividends made, paid or

declared in respect of the Ordinary Shares by reference to a record

date after their issue, including the next quarterly dividend

declared by the Company for the quarter ending 31 March 2021 which

is expected to be declared in May 2021. For the avoidance of doubt,

the first interim dividend for the period from 1 October 2020 to 31

December 2020, the record date of which was 19 February 2021, will

not be paid on the New Ordinary Shares.

The Issue, which is not underwritten, comprises the Placing, the

Open Offer, the Offer for Subscription and the Intermediaries

Offer, and is conditional upon inter alia:

-- the Resolutions relating to the Issue having been passed by

the Company's shareholders at the General Meeting;

-- the Placing Agreement having become unconditional in all

respects with respect to the Issue, save for the condition relating

to Initial Admission, and not having been terminated in accordance

with its terms before Initial Admission occurs; and

-- Initial Admission becoming effective by not later than 8.00

a.m. on 10 March 2021 (or such later time and/or date as the Joint

Bookrunners and the Company may agree, not being later than 31

March 2021).

If any of these conditions are not satisfied or, if applicable,

waived, then the Issue will not proceed.

By choosing to participate in the Placing and by making an oral

and legally binding offer to subscribe for Ordinary Shares,

investors will be deemed to have read and understood this

Announcement and the Prospectus in their entirety and to be making

such offer on the terms and subject to the conditions in the

Prospectus, and to be providing the representations, warranties and

acknowledgements contained therein.

New Ordinary Shares are being offered to Qualifying Shareholders

by way of the Open Offer. The Open Offer will provide an

opportunity for Qualifying Shareholders to participate in the Issue

by subscribing for their Open Offer Entitlements, being 1 New

Ordinary Share for every 5 Existing Ordinary Shares held and

registered in their name at a record date as outlined in the

Prospectus.

The Directors are also proposing to offer New Ordinary Shares

under an offer for subscription (the "Offer for Subscription"),

subject to the terms and conditions to be set out in the

Prospectus. The Offer for Subscription is only being made in the

UK, but subject to applicable law, the Company may allot and issue

New Ordinary Shares on a private placement basis to applicants in

other jurisdictions.

Prospective investors may also subscribe for New Ordinary Shares

pursuant to an intermediaries offer (the "Intermediaries Offer").

Only the Intermediaries' retail investor clients in the United

Kingdom, Guernsey, Jersey and the Isle of Man are eligible to

participate in the Intermediaries Offer. Investors may apply to any

one of the Intermediaries to be accepted as their client

The Offer for Subscription and the Intermediaries Offer may be

scaled back in favour of the Placing and the Placing may be scaled

back in favour of the Offer for Subscription and the Intermediaries

Offer in the Directors' discretion (in consultation with Jefferies

and Kempen & Co). The Open Offer is being made on a pre-emptive

basis to Qualifying Shareholders and is not subject to any scaling

back in favour of either the Placing, the Offer for Subscription or

the Intermediaries Offer, save that any New Ordinary Shares that

are available under the Open Offer and are not taken up by

Qualifying Shareholders pursuant to their Open Offer Entitlements

and under the Excess Application Facility may be reallocated to the

Placing and/or the Offer for Subscription and/or the Intermediaries

Offer and made available thereunder. In addition, to the extent

that any New Ordinary Shares available under the Placing or Offer

for Subscription are not fully subscribed, then such New Ordinary

Shares will be available to satisfy applications under the Excess

Application Facility, if required.

Applications will be made to the FCA for the New Ordinary Shares

to be admitted to the premium listing segment of the Official List

and to the London Stock Exchange for the New Ordinary Shares to be

admitted to trading on its main market for listed securities.

Subject to the conditions above being satisfied, it is expected

that Initial Admission will become effective on 10 March 2021 and

that dealings in the New Ordinary Shares will commence at 8.00 a.m.

on the same day.

The Placing Programme is being created to provide the Company

with the flexibility, should it wish, to raise further capital over

the 12 months from the date of publication of the Prospectus which

it may use to either repay debt or deploy into new investment

opportunities in accordance with its investment policy. Any future

issues under the Placing Programme are dependent on the Company's

pipeline of investment opportunities and drawings on the Company's

debt facilities and accordingly there is no certainty that there

will be any future issues of shares under the Placing Programme

before its expiry.

Further details of the Issue and the Placing Programme will be

set out in the Prospectus and the Circular. A copy of the

Prospectus and the Circular, when published, will be submitted to

the National Storage Mechanism and will shortly thereafter be

available for inspection at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism as well as

on the Company's website at https://www.tritaxeurobox.co.uk. Full

details of the Terms and Conditions of the Issue will be made

available in the Prospectus.

Expected Issue Timetable

Record Date for entitlements under the Open 5.30 p.m. on 17 February

Offer 2021

------------------------------------------------------ -------------------------

Publication of this Prospectus and announcement 19 February 2021

of the Issue

------------------------------------------------------ -------------------------

Ex-entitlement date for the Open Offer 19 February 2021

------------------------------------------------------ -------------------------

Open Offer Application Forms despatched 19 February 2021

to Qualifying Non-CREST Shareholders

------------------------------------------------------ -------------------------

Open Offer Entitlements and Excess Open 22 February 2021

Offer Entitlements credited to stock accounts

in CREST of Qualifying CREST Shareholders

------------------------------------------------------ -------------------------

Recommended latest time for requesting withdrawal 4.30 p.m. on 1 March

of Open Offer Entitlements and Excess Open 2021

Offer Entitlements from CREST (i.e. if your

Open Offer Entitlements and Excess Open

Offer Entitlements are in CREST and you

wish to convert them to certificated form)

------------------------------------------------------ -------------------------

Latest time and date for depositing Open 3.00 p.m. on 2 March

Offer Entitlements and Excess Open Offer 2021

Entitlements into CREST (i.e. if your Open

Offer Entitlements and Excess Open Offer

Entitlements are represented by an Open

Offer Application Form and you wish to convert

them to uncertificated form)

------------------------------------------------------ -------------------------

Latest time and date for splitting of Open 3.00 p.m. on 3 March

Offer Application Forms (to satisfy bona 2021

fide market claims only)

------------------------------------------------------ -------------------------

Latest time and date for receipt of completed 11.00 a.m. on 5 March

Open Offer Application Forms and payment 2021

in full under the Open Offer or settlement

of relevant CREST instructions (as appropriate)

------------------------------------------------------ -------------------------

Latest time and date for receipt of Offer 11.00 a.m. on 5 March

for Subscription Application Forms and payment 2021

in full under the Offer for Subscription

------------------------------------------------------ -------------------------

Latest time and date for receipt of applications 11.00 a.m. on 5 March

from Intermediaries in respect of the Intermediaries 2021

Offer

------------------------------------------------------ -------------------------

Latest time and date for receipt of placing 1.00 p.m. on 5 March

commitments under the Placing 2021

------------------------------------------------------ -------------------------

Announcement of the results of the Issue 8 March 2021

------------------------------------------------------ -------------------------

General Meeting 11.00 a.m. on 8 March

2021

------------------------------------------------------ -------------------------

Announcement of the results of the General 8 March 2021

Meeting

------------------------------------------------------ -------------------------

Admission and commencement of dealings of 8.00 a.m. on 10 March

New Ordinary Shares on the London Stock 2021

Exchange

------------------------------------------------------ -------------------------

CREST stock accounts credited (where applicable) 10 March 2021

------------------------------------------------------ -------------------------

Despatch of definitive share certificates Week commencing 22

(where applicable) March 2021 (or as soon

as possible thereafter)

------------------------------------------------------ -------------------------

The dates and times specified above are subject to change. The

Directors may (with the prior approval of Jefferies and Kempen

& Co) adjust the dates and/or times. In the event that a date

and/or time is changed, the Company will notify persons who have

applied for Ordinary Shares pursuant to the Issue or Ordinary

Shares pursuant to the Placing Programme of changes to the

timetable either by post, by electronic mail or by the publication

of a notice through a Regulatory Information Service. References to

times are to London times unless otherwise stated.

Dealing Codes

The dealing codes for the Ordinary Shares will be as

follows:

ISIN GB00BG382L74

--------------------------------------------- -------------

SEDOL (in respect of Ordinary Shares traded BG382L7

in Sterling)

--------------------------------------------- -------------

Ticker (in respect of Ordinary Shares traded EBOX

in Sterling)

--------------------------------------------- -------------

SEDOL (in respect of Ordinary Shares traded BG43LH0

in Euro)

--------------------------------------------- -------------

Ticker (in respect of Ordinary Shares traded BOXE

in Euro)

--------------------------------------------- -------------

ISIN for the Open Offer Entitlements of New GB00BM8SMY73

Ordinary Shares

--------------------------------------------- -------------

SEDOL for the Open Offer Entitlements of New BM8SMY7

Ordinary Shares

--------------------------------------------- -------------

ISIN for the Excess Open Offer Entitlements GB00BM8SMZ80

of New Ordinary Shares

--------------------------------------------- -------------

SEDOL for the Excess Open Offer Entitlements BM8SMZ8

of New Ordinary Shares

--------------------------------------------- -------------

Unless otherwise defined, capitalised terms used in this

announcement shall have the same meaning as set out in the

Prospectus expected to be published on 19 February 2021.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Tritax Group Via Maitland

Nick Preston

Mehdi Bourassi

Jefferies International Limited (Sponsor,

Joint Global Coordinator, Joint Bookrunner

and Joint Financial Adviser)

Stuart Klein

Tom Yeadon +44 (0) 20 7029 8000

Van Lanschot Kempen Wealth Management

N.V. (Joint Global Coordinator, Joint

Bookrunner and Joint Financial Adviser)

Dick Boer

Thomas ten Hoedt +31 (0) 20 348 8500

Akur Limited (Joint Financial Adviser)

Anthony Richardson

Siobhan Sergeant +44 (0) 20 7493 3631

Maitland/AMO (Communications Adviser) +44 (0) 7747 113 930

James Benjamin tritax-maitland@maitland.co.uk

Further information on Tritax EuroBox plc is available at

www.tritaxeurobox.co.uk

The Company's LEI is: 213800HK59N7H979QU3

Important information

The information in this announcement is for background purposes

only. This announcement is not an offer to sell or a solicitation

of any offer to buy the Shares in the Company in the United States,

Australia, Canada, New Zealand or the Republic of South Africa,

Japan, or in any other jurisdiction where such offer or sale would

be unlawful. This announcement does not constitute a prospectus and

investors should not subscribe for or purchase any shares referred

to in this announcement except on the basis of information

contained in the Prospectus expected to be published by the Company

shortly and not in reliance on this announcement.

This communication is not for publication or distribution,

directly or indirectly, in or into the United States of America.

This communication is not an offer of securities for sale into the

United States. The securities referred to herein have not been and

will not be registered under the U.S. Securities Act of 1933, as

amended, and may not be offered or sold in the United States,

except pursuant to an applicable exemption from registration. No

public offering of securities is being made in the United

States.

The Company has not been and will not be registered under the

U.S. Investment Company Act of 1940 (the "Investment Company Act")

and, as such, holders of the Shares will not be entitled to the

benefits of the Investment Company Act. No offer, sale, resale,

pledge, delivery, distribution or transfer of the Shares may be

made except under circumstances that will not result in the Company

being required to register as an investment company under the

Investment Company Act.

The merits or suitability of any securities must be

independently determined by the recipient on the basis of its own

investigation and evaluation of the proposed investment trust. Any

such determination should involve, among other things, an

assessment of the legal, tax, accounting, regulatory, financial,

credit and other related aspects of the securities.

This announcement may not be used in making any investment

decision. This announcement does not contain sufficient information

to support an investment decision and investors should ensure that

they obtain all available relevant information before making any

investment. This announcement does not constitute and may not be

construed as an offer to sell, or an invitation to purchase or

otherwise acquire, investments of any description, nor as a

recommendation regarding the possible offering or the provision of

investment advice by any party. No information in this announcement

should be construed as providing financial, investment or other

professional advice and each prospective investor should consult

its own legal, business, tax and other advisers in evaluating the

investment opportunity. No reliance may be placed for any purposes

whatsoever on this announcement or its completeness.

Nothing in this announcement constitutes investment advice and

any recommendations that may be contained herein have not been

based upon a consideration of the investment objectives, financial

situation or particular needs of any specific recipient.

The information and opinions contained in this announcement are

provided as at the date of the document and are subject to change

and no representation or warranty, express or implied, is or will

be made in relation to the accuracy or completeness of the

information contained herein and no responsibility, obligation or

liability or duty (whether direct or indirect, in contract, tort or

otherwise) is or will be accepted by the Company, the Manager,

Jefferies, Kempen & Co or Akur or any of their affiliates or by

any of their respective officers, employees or agents in relation

to it. No reliance may be placed for any purpose whatsoever on the

information or opinions contained in this announcement or on its

completeness, accuracy or fairness. This announcement has not been

approved by any competent regulatory or supervisory authority.

The Company has a limited trading history. Potential investors

should be aware that any investment in the Company is speculative,

involves a high degree of risk, and could result in the loss of all

or substantially all of their investment. Results can be positively

or negatively affected by market conditions beyond the control of

the Company or any other person. The returns set out in this

announcement are targets only. There is no guarantee that any

returns set out in this announcement can be achieved or can be

continued if achieved, nor that the Company will make any

distributions whatsoever. There may be other additional risks,

uncertainties and factors that could cause the returns generated by

the Company to be materially lower than the returns set out in this

announcement.

The information in this announcement may include forward-looking

statements, which are based on the current expectations and

projections about future events and in certain cases can be

identified by the use of terms such as "may", "will", "should",

"expect", "anticipate", "project", "estimate", "intend",

"continue", "target", "believe" (or the negatives thereon) or other

variations thereon or comparable terminology. These forward-looking

statements, as well as those included in any related materials, are

subject to risks, uncertainties and assumptions about the Company,

including, among other things, the development of its business,

trends in its operating industry, and future capital expenditures

and acquisitions. In light of these risks, uncertainties and

assumptions, the events in the forward-looking statements may not

occur. Prospective investors are cautioned not to place undue

reliance on such forward-looking statements.

Each of the Company, the Manager, Jefferies, Kempen & Co or

Akur and their affiliates and their respective officers, employees

and agents expressly disclaim any and all liability which may be

based on this announcement and any errors therein or omissions

therefrom.

No representation or warranty is given to the achievement or

reasonableness of future projections, management targets,

estimates, prospects or returns, if any. Any views contained herein

are based on financial, economic, market and other conditions

prevailing as at the date of this announcement. The information

contained in this announcement will not be updated.

This announcement does not constitute or form part of, and

should not be construed as, any offer or invitation or inducement

for sale, transfer or subscription of, or any solicitation of any

offer or invitation to buy or subscribe for or to underwrite, any

share in the Company or to engage in investment activity (as

defined by the Financial Services and Markets Act 2000) in any

jurisdiction nor shall it, or any part of it, or the fact of its

distribution form the basis of, or be relied on in connection with,

any contract or investment decision whatsoever, in any

jurisdiction. This announcement does not constitute a

recommendation regarding any securities. The price and value of

securities and any income derived from them can go down as well as

up and investors may not get back the full amount invested on

disposal of the securities. Past performance is not a guide to

future performance. Before purchasing any New Shares, persons

viewing this announcement should ensure they fully understand and

accept the risks that will be set out in the Prospectus, when

published.

Prospective investors should take note that, unless the Company

has consented to such acquisition in writing, the Company's Shares

may not be acquired by: (i) investors using assets of: (A) an

"employee benefit plan" as defined in Section 3(3) of US Employee

Retirement Income Security Act of 1974, as amended ("ERISA") that

is subject to Title I of ERISA; (B) a "plan" as defined in Section

4975 of the US Internal Revenue Code of 1986, as amended (the "US

Tax Code"), including an individual retirement account or other

arrangement that is subject to Section 4975 of the US Tax Code; or

(C) an entity which is deemed to hold the assets of any of the

foregoing types of plans, accounts or arrangements that is subject

to Title I of ERISA or Section 4975 of the US Tax Code; or (ii) a

governmental, church, non-US or other employee benefit plan that is

subject to any federal, state, local or non-US law that is

substantially similar to the provisions of Title I of ERISA or

Section 4975 of the US Tax Code.

Jefferies and Akur, which are each authorised and regulated in

the United Kingdom by the UK Financial Conduct Authority, and

Kempen & Co, which is authorised and regulated by the

Netherlands Authority for Financial Markets and the Dutch Central

Bank, are acting exclusively for the Company and no one else in

connection with the Issue and Admission. Neither Jefferies, Akur

nor Kempen & Co will regard any other person as their

respective clients in relation to the subject matter of this

Announcement and will not be responsible to anyone other than the

Company for providing the protections afforded to their respective

clients, nor for providing advice in relation to the Issue,

Admission, the contents of this Announcement or any transaction,

arrangement or other matter referred to herein.

In accordance with the Packaged Retail and Insurance-based

Investment Products Regulation (EU) No 1286/2014, the Key

Information Document relating to the Company is available to

investors at https://www.tritaxeurobox.co.uk/

Information to Distributors

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended ("MiFID II"); (b) Articles 9 and

10 of Commission Delegated Directive (EU) 2017/593 supplementing

MiFID II; (c) local implementing measures within the European

Economic Area; and (d) local implementing measures in the United

Kingdom as they form part of UK domestic law by virtue of the

European Union (Withdrawal) Act 2018, as amended, and regulations

made under that Act (together, the "MiFID II Product Governance

Requirements"), and disclaiming all and any liability, whether

arising in tort, contract or otherwise, which any "manufacturer"

(for the purposes of the MiFID II Product Governance Requirements)

may otherwise have with respect thereto, the New Shares have been

subject to a product approval process, which has determined that

the New Shares are: (i) compatible with an end target market of

retail investors and investors who meet the criteria of

professional clients and eligible counterparties, each as defined

in MiFID II; and (ii) eligible for distribution through all

distribution channels as are permitted by MiFID II (the "Target

Market Assessment").

Notwithstanding the Target Market Assessment, distributors

should note that: the price of the New Ordinary Shares may decline

and investors could lose all or part of their investment; the New

Shares offer no guaranteed income and no capital protection; and an

investment in the New Shares is compatible only with investors who

do not need a guaranteed income or capital protection, who (either

alone or in conjunction with an appropriate financial or other

adviser) are capable of evaluating the merits and risks of such an

investment and who have sufficient resources to be able to bear any

losses that may result therefrom. The Target Market Assessment is

without prejudice to the requirements of any contractual, legal or

regulatory selling restrictions in relation to the Issue and/or the

Placing Programme. Furthermore, it is noted that, notwithstanding

the Target Market Assessment, the Joint Bookrunners will only

procure investors who meet the criteria of professional clients and

eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of MiFID II; or (b) a recommendation to any

investor or group of investors to invest in, or purchase, or take

any other action whatsoever with respect to the New Ordinary

Shares.

Each distributor (including the Intermediaries) is responsible

for undertaking its own Target Market Assessment in respect of the

New Ordinary Shares and determining appropriate distribution

channels

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEEADAPFFKFEAA

(END) Dow Jones Newswires

February 19, 2021 02:00 ET (07:00 GMT)

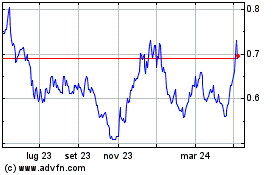

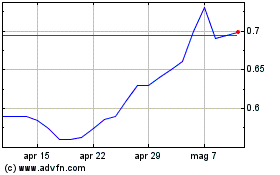

Grafico Azioni Tritax Eurobox (LSE:BOXE)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Tritax Eurobox (LSE:BOXE)

Storico

Da Apr 2023 a Apr 2024