TIDMVLX

RNS Number : 0567F

Volex PLC

12 November 2020

12 November 2020

VOLEX plc

Half year results for the 26 weeks ended 4 October 2020

Robust H1 performance - resilient business model responding well

to Covid-19

Volex plc ("Volex"), a global provider of integrated

manufacturing services and power products, today announces its half

year results for the 26 weeks ended 4 October 2020 ("H1

FY2021").

26 weeks to 26 weeks to

4 October 29 September %

Financial Summary 2020 2019 Change

---------------------------------- ------------ ------------- -------------

Revenue $202.5m $195.7m 3.5

Underlying* operating profit $20.8m $15.9m 30.8

Statutory operating profit $14.3m $10.4m 37.5

Underlying* profit before tax $20.9m $15.3m 36.6

Statutory profit before tax $14.4m $9.7m 48.5

Basic earnings per share 10.2c 5.3c 92.5

Underlying diluted earnings per

share 12.9c 8.5c 51.8

Interim dividend per share 1.1p 1.0p 10.0

Net funds (before IFRS 16 Leases

liability)** $32.0m $7.9m 305.1

* Before adjusting items (non-recurring items and amortisation

of acquired intangibles) and share-based payments

** Net funds are presented before the lease liability of $11.7m

(29 September 2019: $7.3m).

Financial and Corporate Highlights

-- Operational agility and our unique geographic footprint,

coupled with the decision to diversify our capabilities and

customer base, has allowed Volex to navigate an exceptionally

difficult period in the wider global economy caused by the Covid-19

pandemic

-- Underlying gross margins have continued to improve

significantly from 23.1% in H1 FY2020 to 25.1% in H1 FY2021, driven

by a disciplined approach to capital allocation and cost control

across both divisions

-- Underlying operating profit has increased by 30.8% to a

record $20.8 million resulting in our underlying operating margin

improving from 8.1% to 10.3%

-- Interim dividend increased by 10% to 1.1 pence per share

reflecting our confidence in the ongoing prospects of the

business

-- Post period end, we have today announced that we have signed

an agreement to acquire De-Ka Elektroteknik Sanayi ve Ticaret

Anonim Sirketi ("DEKA"), a leading European power cord manufacturer

headquartered in Turkey, accelerating our strategy of creating the

most efficient and lowest-cost global producer in the industry

-- We have also signed a new, three-year $100 million

multi-currency revolving credit facility to replace our current $30

million credit facility, increasing our capacity for investment in

future growth. The facility consists of a $70 million committed

facility with a $30m accordion feature and is effective from 12

November 2020

-- Daren Morris has left the Board with immediate effect and

will be leaving the business. Jon Boaden, who joined the business

in April 2019 as Deputy Chief Financial Officer, has been promoted

to the role of CFO. We have also announced that Sir Peter

Westmacott, a senior British Diplomat, has agreed to join the Board

as an Independent Non-Executive Director and member of the

Company's Nominations Committee.

Operational and Divisional Highlights

-- Power Products - sales of products for use in electric

vehicles grew by 78% year-on-year and overall profitability

continues to improve due to our focus on automation and vertical

integration

-- Integrated Manufacturing Services - we have improved

profitability levels as a result of our focus on higher value-added

products despite very challenging conditions in the medical

installation business as a result of Covid-19

-- Upgrade of capacity and facilities - during the period we

have relocated our Suzhou plant to a new state-of-the-art facility

and we have also commenced work on our new cable extrusion plant in

Batam which we expect to be operational by the summer of 2021

Outlook

-- Having delivered a robust performance in the first half of

the year, coupled with a strong forward order-book, the Board

remains confident in delivering on full-year expectations, absent

any material disruptions to our business that may be caused by

Covid-19

-- We continue to monitor the dynamic and evolving situation in

relation to the Covid-19 pandemic closely and are mindful of the

impact that future government-imposed restrictions designed to

control the spread of the virus could have on our business in

various geographies

-- The longer-term prospects for our business remain strong and

we continue to invest in increasing capacity in our key facilities

to meet customer demand and to implement vertical integration to

improve our competitiveness and profitability

Nat Rothschild, Volex's Executive Chairman said:

"Our response to the unprecedented challenges of Covid-19 is a

fitting testament to Volex's forward planning, resilience and

agility. In a period of profound global disruption, we have

prioritised keeping our people safe and protecting our operations

while growing our operating profit, improving our margins and

continuing to progress well with our strategic objectives.

This relentless focus on operational and process improvements

gives us sufficient confidence to increase our interim dividend by

10%.

Today we have also announced our acquisition of DEKA, a

world-class Power Products business. As one of the two leading

power cord producers in Europe, with a strong management team and a

world-class customer list, DEKA is a perfect fit with our business

model, and the acquisition accelerates our strategy of creating the

most efficient and lowest-cost global producer in the industry,

providing an immediate and scalable European platform.

Our outlook for the remainder of the year remains unchanged,

absent any material disruptions that may be caused by Covid-19, and

we continue to invest across the business in order to meet customer

demand and deliver on our long-term growth prospects."

For further information please contact:

+44 (0)7747 488

Volex plc 785

Nat Rothschild, Executive Chairman

Jon Boaden, Chief Financial Officer

N+1 Singer - Nominated Adviser & Joint Broker +44 (0)20 7496 3000

Shaun Dobson

Iqra Amin

Panmure Gordon - Joint Broker +44 (0)20 7886 2500

Hugh Rich

Powerscourt - Media Enquiries + 44 (0)20 7250 1446

James White

Jack Holden

About Volex plc

Volex plc (AIM:VLX) is a leading integrated manufacturing

specialist. The Group designs and manufactures products that ensure

a critical connection never fails and are used in everything from

defibrillators and ventilators through to data networking equipment

and vehicle telematics. Headquartered in the United Kingdom, Volex

serves the needs of its blue-chip customer base from its

manufacturing sites located across nine countries and three

continents, employing over 6,000 people. Volex's products are sold

through its own global sales force and through distributors to

Original Equipment Manufacturers ('OEMs') and Electronic

Manufacturing Services companies. For more information please visit

www.volex.com

RESULTS FOR THE 26 WEEKSED 4 OCTOBER 2020

Group overview

Volex occupies a unique niche through our capability in

integrated manufacturing services. Having 14 factories located in

key manufacturing hubs and a size and scale that only a very small

number of competitors can match, Volex is set to benefit from an

accelerating trend towards supply chain consolidation.

In a world becoming more global and interconnected, our

customers demand larger global suppliers to support them as they

consolidate their fragmented supplier bases. We have seen this

trend particularly in the medical technology sector and on the

Power side of Volex's business. Customers demand scale, reputation,

quality and a global presence, all of which Volex can provide.

The Covid-19 pandemic and the implementation of import tariffs

by the US government have shown how important it is to be able to

offer multiple manufacturing locations to our customers and our

diversification has proven to be a key strength over the past six

months.

Our ability to identify acquisitions in a highly fragmented

market is also a key part of our success. These acquisitions enable

us to acquire competencies such as the capability to manufacture

complete sub-systems, electro-mechanical as well as electronic

sub-assemblies, and advanced niche PCB assembly products, in order

to become more valuable to our customers.

The ongoing benefits of moving up the value chain and deepening

integration with our customers is a key element of our strategy,

and as a result of our strong balance sheet and the prioritisation

of free cash flow over revenue, we retain a high degree of

strategic flexibility, allowing us to continue to look for

value-enhancing acquisitions while remaining committed to a

progressive dividend policy.

Today we announced the acquisition of DEKA, a world-class Power

Products manufacturer. This positions us as a global market leader

in the Power Products industry. Combining DEKA's strong position in

Europe with our significant scale in North America and Asia will

unlock customer opportunities and allow us to identify substantial

supply chain synergies.

As announced today, Daren Morris, who initially joined the

business in June 2014 as a Non-Executive Director before becoming

Chief Financial Officer in September 2014, has left the Board with

immediate effect and will be leaving the business. Jon Boaden, who

joined the business in April 2019 as Deputy Chief Financial

Officer, has been promoted to the role of CFO having played a key

role in the significant growth and development of the Group's

business since joining over 18 months ago. Separately Sir Peter

Westmacott, a senior British diplomat, has agreed to join the Board

as an Independent Non-Executive Director and member of the

Company's Nominations Committee. His substantial record,

acknowledged by successive Prime Ministers, of policy and business

delivery, will be a key asset to Volex.

We are also pleased to have signed a new $70 million

multi-currency revolving credit facility with a $30 million

accordion feature to replace our current $30 million credit

facility. The new facility has a three-year term with the option of

a one-year extension. It is provided by three relationship banks

and was oversubscribed.

Finally, we will also pay an interim dividend of 1.1 pence per

share on 15 December 2020 to those shareholders on the register as

at 20 November 2020. We are delivering strong and consistent cash

flows and this supports our intention to maintain a sustainable and

progressive dividend policy as we move forward.

Covid-19

The challenges posed by Covid-19 first became apparent when we

re-opened our Chinese facilities following an extended lunar new

year closure in February 2020. We put in place precautionary best

practice measures to protect our employees in these sites, and as

we realised that the pandemic was spreading rapidly across the

globe, we rapidly rolled out these 'best practices' across all our

locations. Our factory teams globally have performed exceptionally

by implementing and maintaining these measures, all of which remain

in place.

However, no prevention activity can guarantee that we will not

see any disruption at our key locations and, while we believe that

we are taking appropriate steps to mitigate the risk posed by

Covid-19, we continue to monitor infection rates among our

workforce and the subsequent impact on our operational activities

closely.

More broadly, we also remain acutely aware of the impact that

future government-imposed restrictions designed to control the

spread of the virus could have on our business, our customers and

our partners in various geographies.

Trading performance overview

The half year to 4 October 2020 has seen the Group continue to

grow and deliver improved margins.

$'000 26 weeks ended 26 weeks ended

4 October 29 September

2020 2019

Total Total

Revenue 202,465 195,706

Cost of Sales (151,706) (150,429)

---------------- ---------------

Underlying gross

profit* 50,759 45,277

Underlying gross

margin 25.1% 23.1%

Operating costs (29,951) (29,331)

---------------- ---------------

Underlying operating

profit* 20,808 15,946

================ ===============

Underlying operating

margin 10.3% 8.1%

---------------- ---------------

* Before adjusting items and share-based payment charges

Revenue for the first half of the year is up by 3.5% on the

comparable period in FY2020. We have seen some variations in

customer demand due to the pandemic.

In our Integrated Manufacturing Services ("IMS") division,

demand for data centre products has been strong with an increase in

sales of nearly 50% over the prior period. Sales into medical

end-markets have shown variability depending on the application.

Our largest customer in this segment has seen increased demand, but

a number of smaller customers in the imaging and oncology-related

markets have seen significant delays in orders and installations

due to difficulty in accessing hospitals stemming from restrictions

in relation to the Covid-19 pandemic.

Demand for our high-speed data centre products has been

excellent, with sales up by 57%. This reflects strong underlying

demand drivers as the move to remote working has increased global

reliance on cloud computing. In addition, data centre customers

have looked to reduce their supply chain exposure by building

inventory. The pandemic disrupted sales to a number of our medical

and industrial technology customers during the period, but we are

starting to see an improvement in demand from these customers.

Overall, the strength in the data centre product sales has helped

to offset weakness in medical and industrial, and margins have

improved.

Demand for Power Products ("Power") started slowly as a number

of our customers responded to the challenges of operating under

pandemic conditions. Sales volumes improved during the period with

all our Power sites at high levels of utilisation at the end of the

first half, and a strong performance from the sale of our new

products for the electric vehicles market.

Profitability in H1 FY2021 has shown a significant improvement

in comparison to H1 FY2020. Margins in both divisions have

increased as a result of a change in mix towards higher-margin

products and customers.

Margins have also improved due to lower input costs. This has

come from a combination of lower copper prices, beneficial foreign

exchange rates and price reductions negotiated with suppliers. The

favourable position on copper and foreign exchange rates may not

continue in the second half as we see a weakening of the US dollar

and an increase in the price of copper and other commodities.

Travel costs were significantly lower than usual in the first half

of the year and we expect this to continue for the remainder of the

year.

Integrated Manufacturing Services

$'000 26 weeks 26 weeks 53 weeks

ended 4 ended 29 ended

October September 5 April

2020 2019 2020

Revenue 114,723 104,613 220,346

---------- ------------ ---------

Underlying gross

profit 30,852 26,917 54,801

Underlying gross

margin 26.9% 25.7% 24.9%

Operating costs (15,627) (15,196) (31,460)

---------- ------------ ---------

Underlying operating

profit 15,225 11,721 23,431

========== ============ =========

Underlying operating

margin 13.3% 11.2% 10.6%

---------- ------------ ---------

Customers trust Volex to deliver connectivity solutions in a

variety of performance-critical applications including medical

devices, data centres and advanced industrial technology. With a

customer-centric approach and experienced production engineers who

ensure we maintain rigorous quality standards, Volex is a

manufacturing partner for some of the biggest names in

technology.

Revenue for H1 FY2021 was $114.7 million, up 9.7% on the prior

period. This includes six months of revenue from Servatron, a

business we acquired in July 2019, rather than the two months of

Servatron revenue in the comparative period.

We are very proud of our capabilities in the medical devices

supply chain. We were involved in a number of projects to

accelerate the manufacture and delivery of devices specifically

intended to support patients being treated for the effects of

Covid-19. At the same time, demand for the critical data

connectivity products we manufacture for large diagnostic imaging

and radiological and surgical treatment devices was materially

lower. This reflects the fact that many hospitals have postponed

scheduled installations and maintenance while the facilities focus

on dealing with the pandemic and have suspended non-critical

procedures. We believe that the underlying demand for

installations, maintenance and upgrades remains, but the timing of

a recovery will be dependent on our customers being able to return

to having normalised access to medical facilities.

There has been an improvement to both underlying gross margin

and underlying operating margin. This has been achieved through an

improvement in product mix and savings in production costs. The

strength of the US dollar, which is the primary sales currency,

versus many emerging market currencies where we operate has also

helped margins during the period.

We continue to focus on quality which delivers benefits to our

bottom line. Much of the improvement is delivered through

re-engineering our processes as well as investing in equipment to

deliver exceptional consistency and high throughput.

Power Products

$'000 26 weeks 26 weeks 53 weeks

ended 4 ended 29 ended

October September 5 April

2020 2019 2020

Revenue 87,742 91,093 171,008

---------- ------------ ---------

Underlying gross

profit 19,907 18,360 35,860

Underlying gross

margin 22.7% 20.2% 21.0%

Operating costs (11,436) (11,213) (21,807)

---------- ------------ ---------

Underlying operating

profit 8,471 7,147 14,053

========== ============ =========

Underlying operating

margin 9.7% 7.8% 8.2%

---------- ------------ ---------

Volex designs and manufactures power cords and related products

that are sold to the manufacturers of a broad range of electrical

and electronic devices and appliances. Volex products are used in

home entertainment and home computing devices, domestic and

personal healthcare appliances, power tools and electric vehicles.

Many of our customers are global household names operating in

premium segments of the consumer market.

Revenues in the first half were marginally lower in comparison

to the same period in the previous year. Although all Volex Power

Products sites were open and fully operational during the period,

in the first quarter some customers experienced disruption to

production which reduced demand for both consumer electronics and

electric vehicle products.

Our high-quality and well-engineered products have been well

received by customers for electric vehicle applications. Revenue

from our automotive customers is up 78% year-on-year and this

segment now represents over 15% of our sales for Power Products in

the first half of the year. We believe that there is significant

further opportunity for growth in this area.

As many countries saw a shift to homeworking, we saw strong

sales into the consumer electronics segment once our customers

resumed normal operations in late April and May. This trend

continued throughout the period. With demand strong in this area,

we maximised our production to support our customers. This resulted

in high levels of utilisation across all Power Products sites in

the second quarter of FY2021.

Underlying gross margins have improved from 20.2% to 22.7%. Last

year we acquired Ta Hsing, a cable extrusion business. We have made

excellent progress integrating this capability into our Power

Products division, reducing input costs and improving margins. We

also continue to roll out targeted automation. This is focused on

the areas where it gives us the best return and is compatible with

our requirements to maintain a flexible manufacturing approach.

Most sales are in US dollars, but a proportion of the cost base is

in the local currency relevant to the production location. The

strength of the dollar has helped improve margins, as have lower

costs for certain raw materials.

Group adjusting items and share-based payments

Adjusting items and share-based payments totalled $6.5 million

in the period (H1 FY2020: $5.6 million). These costs are made up of

$2.3 million (H1 FY2020: $2.8 million) of amortisation of

acquisition-related intangible assets, $4.0 million (H1 FY2020:

$2.6 million) of share-based payments expense and $0.2 million (H1

FY2020: $0.2 million) of acquisition costs related to the

acquisition of DEKA. Share-based payments include awards made to

incentivise senior management as well as awards granted to the

management teams within acquired companies.

Group taxation

The Group incurred a tax credit of $1.1 million (H1 FY2020: tax

charge of $2.0 million), representing an effective tax rate of

-7.4% (H1 FY2020: 20.1%). The underlying tax charge of $nil (H1

FY2020: $2.4 million) represents an ETR of 0.2% (H1 FY2020:

15.7%).

An underlying deferred tax credit of $2.9 million (H1 FY2020:

charge of $1.2 million) arose due to an increase in the deferred

tax asset recognised on trading losses and short-term timing

differences due to the utilisation based on future forecast taxable

profits in certain regions. As at the reporting date the Group has

recognised deferred tax assets of $12.2 million (H1 FY2020: $ 3.4

million, FY2020: $9.0m). Of this deferred tax asset $6.5 million

(H1 FY2020: $2.4 million, FY2020: $4.5 million) is in relation to

tax losses and $5.7 million (H1 FY2020: $1.0 million, FY2020: $4.5

million) in relation to short term timing differences.

Group net debt and cash flows

We are pleased to have signed a new $100 million multi-currency

revolving credit facility to replace our current $30 million credit

facility. The new facility has a three-year term with the option of

a one-year extension. The facility consists of a $70m committed

facility with a $30m accordion feature and is effective from 12

November 2020. It is provided by three relationship banks and was

oversubscribed.

The new facility has a more relaxed net debt to EBITDA covenant

as compared to the existing credit facility which will give the

Group more flexibility to undertake future acquisitions. This

facility provides additional headroom and further scope to make

value-accretive investments to grow our business.

Our business is cash generative with excellent cash conversion.

Coming into the period, levels of inventory were lower than usual

as a result of the pandemic. During the first half of the year,

inventory has increased, replenishing finished goods in our

customer hub locations. This has offset an element of the cash

generated by our underlying business operations.

Net funds (before lease liabilities) was unchanged from the year

end standing at $32.0 million ($32.1 million at 5 April 2020). The

Group generated a free cash flow after capital expenditure and tax,

but before the cost of acquisitions, of $8.0 million. This included

a cash operating inflow of $23.5 million and an adverse working

capital movement of $11.0 million, as well as capital expenditure

of $2.6 million and tax paid of $1.8 million. The adverse working

capital movement is due to very low inventory levels at the end of

FY2020 when customers had consumed Power Products stock while the

production sites were closed for an extended Lunar New Year holiday

due to the pandemic. In the first half of FY2021 inventory levels

have returned to normal, causing an adverse working capital

movement. Accounts receivable and accounts payable also increased

as invoicing and supply chain activity returned to normal levels

following the sites closures . The Group had lease liabilities of

$11.7 million. This produces a statutory net funds position of

$20.3 million.

Risks and uncertainties

Risks to Volex are anticipated and regularly assessed and

internal controls are enhanced where necessary to ensure that such

risks are appropriately mitigated. There are a number of potential

risks that could have a material impact on the Group's financial

performance. The principal risks and uncertainties include

competitive threats, legal and regulatory issues, dependency on key

suppliers or customers, movements in commodity prices or exchange

rates, and quality issues. These risks and the relevant

risk-mitigation activities are set out in the FY2020 Annual Report

and Accounts on pages 30 to 34, a copy of which is available on the

website at www.volex.com.

Outlook

We remain closely focused on ensuring our employees' welfare and

are planning for a range of possible outcomes in relation to the

ongoing Covid-19 pandemic.

Having delivered a robust performance in the first half of the

year, coupled with a strong forward order-book, the Board remains

confident in delivering on full-year expectations, absent any

material disruptions to our business that may be caused by

Covid-19.

The longer-term prospects for our business remain strong and we

continue to invest in increasing capacity in our key facilities to

meet customer demand and to implement vertical integration to

improve our competitiveness and profitability.

Nat Rothschild Jon Boaden

Group Executive Chairman Group Chief Financial Officer

12 November 2020 12 November 2020

Unaudited consolidated income statement

For the 26 weeks ended 4 October 2020 (26 weeks ended 29

September 2019)

26 weeks ended 4 October 26 weeks ended 29 September

2020 2019

Adjusting Adjusting

Before items and Before items

Adjusting share-based Adjusting and share-based

items payments Total items payments Total

Notes $'000 $'000 $'000 $'000 $'000 $'000

------------------------------ ----- ---------- ------------ --------- ---------- ---------------- ---------

Revenue 2 202,465 - 202,465 195,706 - 195,706

Cost of sales (151,706) - (151,706) (150,429) - (150,429)

------------------------------ ----- ---------- ------------ --------- ---------- ---------------- ---------

Gross profit 50,759 - 50,759 45,277 - 45,277

Operating expenses (29,951) (6,502) (36,453) (29,331) (5,559) (34,890)

------------------------------ ----- ---------- ------------ --------- ---------- ---------------- ---------

Operating profit 2 20,808 (6,502) 14,306 15,946 (5,559) 10,387

Share of net profit from

associates 637 - 637 - - -

Finance income 155 - 155 93 - 93

Finance costs (720) - (720) (776) - (776)

Profit on ordinary activities

before taxation 20,880 (6,502) 14,378 15,263 (5,559) 9,704

Taxation 4 (37) 1,096 1,059 (2,401) 451 (1,950)

------------------------------ ----- ---------- ------------ --------- ---------- ---------------- ---------

Profit for the period

attributable to the owners

of the parent 20,843 (5,406) 15,437 12,862 (5,108) 7,754

------------------------------ ----- ---------- ------------ --------- ---------- ---------------- ---------

Earnings per share (cents)

Basic 5 13.7 10.2 8.8 5.3

Diluted 5 12.9 9.5 8.5 5.1

------------------------------ ----- ---------- ------------ --------- ---------- ---------------- ---------

53 weeks ended 5 April

2020

Adjusting

Before Items and

Adjusting share-based

items payments Total

Notes $'000 $'000 $'000

------------------------------ ----- ---------- ------------ ---------

Revenue 2 391,354 - 391,354

Cost of sales (300,693) - (300,693)

------------------------------ ----- ---------- ------------ ---------

Gross profit 90,661 - 90,661

Operating expenses (59,031) (14,545) (73,576)

------------------------------ ----- ---------- ------------ ---------

Operating profit 2 31,630 (14,545) 17,085

Share of net loss from

associates - - -

Finance income 328 - 328

Finance costs (1,552) - (1,552)

------------------------------ ----- ---------- ------------ ---------

Profit on ordinary activities

before taxation 30,406 (14,545) 15,861

Taxation 4 (3,504) 2,339 (1,165)

------------------------------ ----- ---------- ------------ ---------

Profit/(loss) for the

period attributable to

the owners of the parent 26,902 (12,206) 14,696

------------------------------ ----- ---------- ------------ ---------

Earnings per share (cents)

Basic 5 18.2 9.9

Diluted 5 17.3 9.5

------------------------------ ----- ---------- ------------ ---------

Unaudited consolidated statement of comprehensive income

For the 26 weeks ended 4 October 2020 (26 weeks ended 29

September 2019)

(Audited)

26 weeks 26 weeks 53 weeks

to to to

5 October 29 September 5 April

2020 2019 2020

$'000 $'000 $'000

-------------------------------------------------- ------------- ---------------- ----------

Profit for the period 15,437 7,754 14,696

Items that will not be reclassified subsequently

to profit or loss :

Actuarial loss on defined benefit pension

schemes (148) (488) (1,343)

Tax relating to items that will not be 359 - -

reclassified

-------------------------------------------------- ------------- ---------------- ----------

211 (488) (1,343)

Items that may be reclassified subsequently

to profit or loss :

Gain/(loss) arising on cash flow hedges

during the period 2,067 (771) (2,266)

Exchange gain/(loss) on translation of

foreign operations 2,705 (1,558) 151

Tax relating to items that may be reclassified (65) - -

-------------------------------------------------- ------------- ---------------- ----------

4,707 (2,329) (2,115)

Other comprehensive income/(loss) for

the period 4,918 (2,817) (3,458)

Total comprehensive income for the period 20,355 4,937 11,238

-------------------------------------------------- ------------- ---------------- ----------

Unaudited consolidated statement of financial position

As at 4 October 2020 (29 September (Audited)

2019)

4 October 29 September 5 April

Note 2020 2019 2020

$'000 $'000 $'000

------------------------------------ ------ ----------- -------------- ----------

Non-current assets

Goodwill 26,767 25,751 25,760

Other intangible assets 13,842 18,498 15,537

Property, plant and equipment 22,577 22,152 21,565

Right of use assets 9,381 5,709 8,345

Investments in associates 637 - -

Other receivables 4,590 2,829 4,488

Deferred tax asset 12,158 3,353 8,955

------------------------------------ ------ ----------- -------------- ----------

89,952 78,292 84,650

------------------------------------ ------ ----------- -------------- ----------

Current assets

Inventories 66,878 54,394 57,995

Trade receivables 70,655 76,587 56,382

Other receivables 9,158 7,162 7,987

Current tax assets 1,908 1,772 2,154

Derivative financial instruments 379 - -

Cash and bank balances 8 34,229 17,880 32,305

------------------------------------ ------ ----------- -------------- ----------

183,207 157,795 156,823

------------------------------------ ------ ----------- -------------- ----------

Total assets 273,159 236,087 241,473

------------------------------------ ------ ----------- -------------- ----------

Current liabilities

Borrowings 8 2,198 9,922 225

Trade payables 47,914 39,815 39,653

Other payables 42,211 35,958 38,453

Current tax liabilities 9,193 4,299 8,384

Retirement benefit obligation 1,038 989 982

Lease liabilities 3,648 3,568 3,498

Provisions 929 661 834

Derivatives financial instruments 170 393 1,819

107,301 95,605 93,848

------------------------------------ ------ ----------- -------------- ----------

Net current assets 75,906 62,190 62,975

------------------------------------ ------ ----------- -------------- ----------

Non-current liabilities

Borrowings - 38 -

Other payables 1,435 1,557 570

Non-current tax liabilities - 1,134 -

Deferred tax liabilities 3,032 6,529 6,130

Retirement benefit obligation 2,323 1,378 2,492

Lease liabilities 8,040 3,715 7,385

Provisions 293 263 516

15,123 14,614 17,093

------------------------------------ ------ ----------- -------------- ----------

Total liabilities 122,424 110,219 110,941

------------------------------------ ------ ----------- -------------- ----------

Net assets 150,735 125,868 130,532

------------------------------------ ------ ----------- -------------- ----------

Equity attributable to owners of

the parent

Share capital 6 60,322 59,566 60,189

Share premium account 46,414 46,414 46,414

Non-distributable reserve 2,455 2,455 2,455

Hedging and translation reserve (4,799) (9,720) (9,506)

Own shares 7 (590) (1,509) (1,024)

Retained earnings 46,933 28,662 32,004

------------------------------------ ------ ----------- -------------- ----------

Total equity 150,735 125,868 130,532

------------------------------------ ------ ----------- -------------- ----------

Unaudited Consolidated Statement of Changes in Equity

For the 26 weeks ended 4 October 2020 (26 weeks ended 29

September 2019)

Non-distribut-able Hedging

reserves and Retained

Share premium translation earnings/ Total

Share capital account reserve Own shares (losses) equity

$'000 $'000 $'000 $'000 $'000 $'000 $'000

--------------------- ------------- ------------- ------------------ ------------ ---------- ---------- -------

Balance 31 March

2019 58,792 44,532 2,455 (7,391) (1,890) 19,150 115,648

Profit for the period

attributable to the

owners of the parent - - - - - 7,754 7,754

Other comprehensive

income/ (loss) for

the period - - - (2,329) - (488) (2,817)

--------------------- ------------- ------------- ------------------ ------------ ---------- ---------- -------

Total comprehensive

income/ (loss) for

the period - - - (2,329) - 7,266 4,937

Shares issued 692 1,882 - - - - 2,574

Exercise of deferred

bonus shares 82 - - - - (82) -

Own shares

sold/(utilised)

in the period - - - - 381 (139) 242

Reserve entry for

share option

charges/(credit) - - - - - 2,467 2,467

Balance at 29

September

2019 59,566 46,414 2,455 (9,720) (1,509) 28,662 125,868

--------------------- ------------- ------------- ------------------ ------------ ---------- ---------- -------

Balance 5 April 2020 60,189 46,414 2,455 (9,506) (1,024) 32,004 130,532

Profit for the period

attributable to the

owners of the parent - - - - - 15,437 15,437

Other comprehensive

income/ (loss) for

the period - - - 4,707 - 211 4,918

--------------------- ------------- ------------- ------------------ ------------ ---------- ---------- -------

Total comprehensive

income/ (loss) for

the period - - - 4,707 - 15,648 20,355

Exercise of deferred

bonus shares 133 - - - - (133) -

Own shares

sold/(utilised)

in the period - - - - 434 (1,912) (1,478)

Dividend - - - - - (3,791) (3,791)

Reserve entry for

share option

charges/(credit) - - - - - 2,911 2,911

Tax effect of share

options - - - - - 2,206 2,206

Balance at 4 October

2020 60,322 46,414 2,455 (4,799) (590) 46,933 150,735

--------------------- ------------- ------------- ------------------ ------------ ---------- ---------- -------

Unaudited consolidated statement of cash flows

For the 26 weeks ended 4 October 2020 (26 weeks ended 29

September 2019)

*RESTATED (Audited)

26 weeks 26 weeks 53 weeks

to to to

4 October 29 September 5 April

Notes 2020 2019 2020

$'000 $'000 $'000

------------------------------------------- ------- ------------- --------------- ----------

Profit for the period 15,437 7,754 14,696

Adjustments for:

Finance income (155) (92) (328)

Finance costs 720 775 1,552

Income tax (income)/expense (1,059) 1,950 1,165

Share of net profit from associates (637) - -

Depreciation of property, plant and

equipment 1,863 1,836 3,643

Depreciation of right-of-use asset 1,540 - 2,714

Impairment of right-of-use asset - - 65

Effects of foreign exchange rate

changes - 7 5

Amortisation of intangible assets 2,311 2,811 5,749

Loss on disposal of property, plant

and equipment 47 521 838

Share option charge 4,048 2,629 8,737

(Decrease)/increase in provisions (643) (741) (1,090)

------------------------------------------- ------- ------------- --------------- ----------

Operating cash flow before movements

in working capital 23,472 17,450 37,746

Decrease/(increase) in inventories (7,506) 1,153 (2,943)

Decrease/(increase) in receivables (13,720) 4,534 20,499

(Decrease)/increase in payables 10,178 (6,974) 2,041

Movement in working capital (11,048) (1,287) 19,597

Cash generated by operations 12,424 16,163 57,343

------------- --------------- ----------

Cash generated by operations before

adjusting items 12,614 17,574 58,749

Cash utilised by adjusting items (190) (1,411) (1,406)

------------- --------------- ----------

Taxation paid (1,796) (2,330) (5,135)

Interest paid (191) (483) (473)

------------------------------------------- ------- ------------- --------------- ----------

Net cash generated from operating

activities 10,437 13,350 51,735

------------------------------------------- ------- ------------- --------------- ----------

Cash flow from investing activities

Interest received 12 7 22

Acquisition of businesses, net of

cash acquired 9 - (22,701) (22,701)

Contingent consideration for businesses

acquired (1,142) - (2,850)

Proceeds on disposal of property,

plant and equipment 108 177 564

Purchases of property, plant and

equipment (2,518) (1,915) (4,910)

Purchases of intangible assets (76) (7) (40)

Proceeds from the repayment of preference

shares 25 - 25

Net cash used in investing activities (3,591) (24,439) (29,890)

------------------------------------------- ------- ------------- --------------- ----------

Cash flow before financing activities 6,846 (11,089) (21,845)

------------- --------------- ----------

Cash (used)/generated before adjusting

items 7,036 (9,678) (23,251)

Cash utilised in respect of adjusting

items (190) (1,411) (1,406)

------------- --------------- ----------

*Restatement: The net purchase of shares for share schemes was

reclassified from investing to financing activities to reflect the

nature of the transactions. This is consistent with the

presentation in the FY2020 financial report.

Unaudited consolidated statement of cash flows (continued)

For the 26 weeks ended 4 October 2020 (26 weeks ended 29

September 2019)

(Audited)

26 weeks * RESTATED 53 weeks

to to

4 October 26 weeks to 5 April

Notes 2020 29 September 2020

2019

$'000 $'000 $'000

Cash flow before financing activities 6,846 (11,089) 21,845

Cash flow from financing activities

Dividend paid (3,791) - (1,956)

Net purchase of shares for share

schemes (1,552) 394 (4,634)

New bank loan raised - 7,000 7,000

Other loans 2,584 - -

Repayment of borrowings (43) (7,097) (7,056)

Refinancing costs paid - (592) (659)

Interest element of lease payments (315) - (553)

Payment of lease liabilities (1,948) (1,257) (3,150)

Receipt from lease debtor 267 - 499

Net cash used in financing activities 8 (4,798) (1,552) (10,509)

---------------------------------------- ------- ------------- ---------------- ----------

Net increase/(decrease) in cash

and cash equivalents 2,048 (12,641) 11,336

Cash and cash equivalents at beginning

of period 8 31,649 20,593 20,593

Effect of foreign exchange rate

changes 532 (550) (280)

---------------------------------------- ------- ------------- ---------------- ----------

Cash and cash equivalents at end

of period 8 34,229 7,402 31,649

---------------------------------------- ------- ------------- ---------------- ----------

*Restatement: The net purchase of shares for share schemes was

reclassified from investing to financing activities to reflect the

nature of the transactions. This is consistent with the

presentation in the FY2020 financial report.

Notes to the Interim Statements

1. Basis of preparation

These interim financial statements have been prepared in

accordance with IAS 34 'Interim Financial Reporting' as adopted by

the European Union. The condensed consolidated interim financial

information should be read in conjunction with the annual financial

statements for the 53 weeks ended 5 April 2020, which were prepared

in accordance with IFRSs as adopted by the European Union.

This condensed consolidated interim financial information does

not comprise statutory accounts within the meaning of section 434

of the Companies Act 2006. The financial information presented for

the 26 weeks ended 4 October 2020 ('H1 FY2021') and the 26 weeks

ended 29 September 2019 ('H1 FY2020') has not been reviewed by the

auditors. The financial information for the 53 weeks ended 5 April

2020 ('FY 2020') is extracted and abridged from the Group's full

accounts for that year. The statutory accounts for FY2020 have been

filed with the Registrar of Companies for England and Wales and

have been reported on by the Group's auditors. The Report of the

Auditors was not qualified and did not contain a statement under

section 498 of the Companies Act 2006.

The Directors confirm that, to the best of their knowledge, the

interim financial statements have been prepared in accordance with

IAS 34 'Interim Financial Reporting' as adopted by the European

Union and the AIM Rules for Companies, and that the interim report

includes a fair review of the information required. The interim

report was approved by the Board of Directors on 11 November

2020.

This interim report can be downloaded or viewed via the Group's

website at www.volex.com . Copies of the annual report for the 53

weeks ended 5 April 2020 are available at the Company's registered

office at Unit C1 Antura, Bond Close, Basingstoke, Hampshire,

England, RG24 8PZ, and can also be downloaded or viewed via the

Group's website.

Subsequent to the end of the period, the Group signed a new,

three-year $100 million multi-currency revolving credit facility to

replace our current $30 million credit facility. The facility has

an available limit of $70 million (FY2020: $30 million). The

facility consists of a $70m committed facility with a $30m

accordion feature and is effective from 12 November 2020. As at 4

October 2020 the Group had net funds of $20.3 million.

The Group's forecast and projections, taking reasonable account

of possible changes in trading performance and the cash outflow

associated with the acquisition of DEKA, show that the Group should

continue to operate with sufficient headroom under the revolving

credit facility for the foreseeable future. The Directors believe

that the Group is well placed to manage its business within the

available facilities. Accordingly, they continue to adopt the going

concern basis in preparing these condensed financial

statements.

These condensed financial statements have also been prepared

using accounting policies consistent with International Financial

Reporting Standards as adopted for use in the European Union

('IFRS') and consistent with those disclosed in the annual report

and accounts for the year ended 5 April 2020. The only new

significant accounting policy relates to the accounting for

Government Grants.

1. Basis of preparation (continued)

In line with IAS20 'Accounting for Government Grants',

government grants are recognised when there is reasonable assurance

that it will be received and that the Group will comply with the

conditions attached to it. Government grants intended to compensate

the Group for expenses incurred are deducted from the relevant

costs in the income statement on a systematic basis in the same

periods in which the expenses are incurred, unless the conditions

for receiving the grant are met after the related expenses have

been recognised. In this case, the grant is recognised when it

becomes receivable. Government grants intended to compensate the

Group for the acquisition of an asset are deducted from the

acquisition cost of the related asset. This policy has been applied

during the period to government incentives in respect of the Suzhou

site relocation.

Impact of standards issued but not yet applied by the Group

There are no new standards, amendments to standards or

interpretations that are expected to have a material impact on the

Group's results.

2. Business and geographical segments

Business segments

The internal reporting provided to the Group's Board for the

purpose of resource allocation and assessment of Group performance

is based upon the nature of products which the Group supplies. As

certain sites of the Group become capable of supplying both Power

Products and IMS customers we continue to evaluate the best way of

segmenting our financial performance. In addition to the operating

divisions, a Central division exists to capture all of the

corporate costs incurred in supporting the operations.

Division Description

Power Products The sale and manufacture of power cords, duck heads

(formerly and related products that are sold to manufacturers

Power Cords) of a broad range of electrical and electronic devices

and appliances. Volex products are used in laptops,

PCs, tablets, printers, TVs, games consoles, power

tools, kitchen appliances and electric vehicles.

-----------------------------------------------------------

Integrated The sale and manufacture of higher-level assemblies

Manufacturing and connectors (ranging from high-speed copper cables

Services to complex multi-branch high reliability systems) that

(formerly transfer electronic, radio-frequency and optical data.

Complex Assemblies) Volex products are used in a variety of applications

including medical equipment, data-networking equipment,

data centres, wireless base stations, mobile computing

devices, factory automation and vehicle telematics.

-----------------------------------------------------------

Central Central costs are those that are not directly attributable

to the manufacture and sale of the Group's products,

but which support the Group in its operations. Included

within this division are the costs incurred by the

executive management team and the corporate head office.

-----------------------------------------------------------

The following is an analysis of the Group's revenues and results

by reportable segment.

26 weeks to 4 October 26 weeks to 29 September

2020 2019

--------------------------------------- ------------------------ ---------------------------

Revenue Profit/(loss) Revenue Profit/(loss)

$'000 $'000 $'000 $'000

--------------------------------------- -------- -------------- ---------- ---------------

Power Products 87,742 8,471 91,093 7,147

Integrated Manufacturing Services 114,723 15,225 104,613 11,721

Unallocated central costs (excluding

share-based payments) (2,888) (2,922)

--------------------------------------- -------- -------------- ---------- ---------------

Divisional results before share-based

payments and adjusting items 202,465 20,808 195,706 15,946

Adjusting items (2,454) (2,931)

Share-based payments (4,048) (2,628)

--------------------------------------- -------- -------------- ---------- ---------------

Operating profit 14,306 10,387

Share of net profit from associates 637 -

Finance income 155 93

Finance costs (720) (776)

--------------------------------------- -------- -------------- ---------- ---------------

Profit before tax 14,378 9,704

Tax 1,059 (1,950)

--------------------------------------- -------- -------------- ---------- ---------------

Profit after tax 15,437 7,754

--------------------------------------- -------- -------------- ---------- ---------------

2. Business and geographical segments (continued)

53 weeks to 5 April

2020

-------------------------------------------- ---------- ------------------------

Revenue Profit/(loss)

$'000 $'000

-------------------------------------------- ---- ---- -------- --------------

Power Products 171,008 14,053

Integrated Manufacturing Services 220,346 23,341

Unallocated central costs (excluding share-based

payments) - (5,764)

-------------------------------------------------------- -------- --------------

Divisional results before share-based

payments and Adjusting items 391,354 31,630

Adjusting items (5,808)

Share-based payments (8,737)

-------------------------------------------------------- -------- --------------

Operating profit 17,085

Share of net result from associates -

Finance income 328

Finance costs (1,552)

-------------------------------------------------------- -------- --------------

Profit before tax 15,861

Tax (1,165)

-------------------------------------------------------- -------- --------------

Profit after tax 14,696

-------------------------------------------------------- -------- --------------

The accounting policies of the reportable segments are in

accordance with the Group's accounting policies.

The adjusting items charge within operating profit for the

period of $2,454,000 (H1 FY2020: $2,931,000, FY2020: $5,808,000)

was split $190,000 (H1 FY2020: $nil, FY2020: $58,000) to Power

Products, $2,264,000 (H1 FY2020: $2,769,000, FY2020: $5,750,000) to

IMS and $nil (H1 FY2020: $162,000, FY2020: $nil) to Central.

Other segmental information

External revenue Non-current assets

(excluding deferred tax assets)

------------------------------------------- -------------------------------------------

(Audited) (Audited)

26 weeks 26 weeks to 53 weeks 26 weeks 26 weeks to 53 weeks

to to to to

4 October 29 September 5 April 4 October 29 September 5 April

2020 2019 2020 2020 2019 2020

$'000 $'000 $'000 $'000 $'000 $'000

---------- ------------- ---------------- ---------- ------------- ---------------- ----------

Geographical segments

Asia 72,704 75,303 140,133 22,869 19,267 21,469

North

America 74,538 68,231 145,081 24,715 15,963 25,826

Europe 55,223 52,172 106,140 30,210 39,709 28,400

202,465 195,706 391,354 77,794 74,939 75,695

---------- ------------- ---------------- ---------- ------------- ---------------- ----------

3. Adjusting items and share-based payments

(Audited)

26 weeks to 26 weeks to 53 weeks to

4 October 29 September 5 April

2020 2019 2020

$'000 $'000 $'000

----------------------------------------------------------- ------------- ---------------- -------------

Amortisation of acquired intangibles 2,264 2,769 5,652

Acquisition costs 190 162 156

Total adjusting items 2,454 2,931 5,808

Share-based payments charge 4,048 2,628 8,737

----------------------------------------------------------- ------------- ---------------- -------------

Total adjusting items and share-based payments before tax 6,502 5,559 14,545

----------------------------------------------------------- ------------- ---------------- -------------

Adjusting items tax credit (1,096) (451) (2,339)

----------------------------------------------------------- ------------- ---------------- -------------

Adjusting items and share-based payments after tax 5,406 5,108 12,206

----------------------------------------------------------- ------------- ---------------- -------------

Adjusting items include costs that are one-off in nature and

significant (such as significant restructuring costs, impairment

charges or acquisition related costs) and the non-cash amortisation

of intangible assets recognised on acquisition.

The adjusting items and share-based payments are included under

the statutory classification appropriate to their nature but are

separately disclosed on the face of the income statement to assist

in understanding the underlying financial performance of the

Group.

Associated with the acquisitions, the Group has recognised

certain intangible assets related to customer relationships and

order backlogs. During H1 FY2021, the amortisation charge on these

intangible assets totalled $2,264,000 (FY2020 H1 $2,769,000,

FY2020: $5,652,000). The amortisation of these intangibles is

non-cash and split between Servatron ($1,151,000), GTK ($535,000),

Silcotec ($550,000) and MC Electronics ($28,000).

Acquisition-related costs of $190,000 (FY2020 H1: $162,000,

FY2020: $156,000) are related to acquisition of DEKA. These costs

cover due diligence and legal fees associated with the

transactions. In the prior year, the Group incurred acquisition

related costs of $156,000, split between $98,000 for Servatron Inc

and $58,000 for Ta Hsing Industries Limited. These costs

represented legal fees associated with the transactions.

4. Tax charge

The Group tax charge for the period is based on the forecast tax

charge for the year as a whole and has been influenced by the

differing tax rates in the UK and the various overseas countries in

which the Group operates.

The Group incurred a tax credit of $1.1 million (H1 FY2020: tax

charge of $2.0 million), representing an effective tax rate of

-7.4% (H1 FY2020: 20.1%). The underlying tax charge of $nil (H1

FY2020: $2.4 million) represents an ETR of 0.2% (H1 FY2020:

15.7%).

An underlying deferred tax credit of $2.9 million (H1 FY2020:

charge of $1.2 million) arose due to an increase in the deferred

tax asset recognised on trading losses and short-term timing

differences due to the utilisation based on future forecast taxable

profits in certain regions.

5. Earnings per ordinary share

The calculations of the earnings per share are based on the

following data:

(Audited)

26 weeks 26 weeks 53 weeks

to to to

4 October 29 September 5 April

2019

Earnings 2020 $'000 2020

$'000 $'000

------------------------------------------- -------------------- -------------------- -----------

Earnings for the purpose of basic earnings

per share 15,437 7,754 14,696

Adjustments for:

Adjusting items 2,454 2,931 5,808

Share-based payments charge 4,048 2,628 8,737

Tax effect of above adjustments and other

adjusting item tax movements (1,096) (451) (2,339)

------------------------------------------- -------------------- -------------------- -----------

Underlying earnings 20,843 12,862 26,902

------------------------------------------- -------------------- -------------------- -----------

Weighted average number of ordinary shares No. shares No. shares No. shares

------------------------------------------- -------------------- -------------------- -----------

Weighted average number of ordinary shares

for the purpose of basic earnings per

share 151,816,604 146,651,798 148,057,993

Effect of dilutive potential ordinary

shares - share options 10,370,884 5,807,934 7,339,875

------------------------------------------- -------------------- -------------------- -----------

Weighted average number of ordinary shares

for the purpose of diluted earnings per

share 162,187,488 152,459,732 155,397,868

------------------------------------------- -------------------- -------------------- -----------

Basic earnings per share Cents Cents Cents

------------------------------------------ ------ ------ ------

Basic earnings per share from continuing

operations 10.2 5.3 9.9

Adjustments for:

Adjusting items 1.6 2.0 3.9

Share-based payments charge 2.6 1.8 6.0

Tax effect of above adjustments and

other adjusting items tax movements (0.7) (0.3) (1.6)

------------------------------------------ ------ ------ ------

Underlying basic earnings per share 13.7 8.8 18.2

------------------------------------------ ------ ------ ------

Diluted earnings per share (Audited)

26 weeks 26 weeks 53 weeks

to to to 5 April

4 October 29 September 2020

2020 2019 $'000

$'000 $'000

--------------------------------------- ------------ --------------- -------------

Diluted earnings per share 9.5 5.1 9.5

Adjustments for:

Adjusting items 1.5 2.0 3.7

Share-based payments charge 2.6 1.7 5.6

Tax effect of above adjustments and

other adjusting items tax movements (0.7) (0.3) (1.5)

--------------------------------------- ------------ --------------- -------------

Underlying diluted earnings per share 12.9 8.5 17.3

--------------------------------------- ------------ --------------- -------------

The underlying earnings per share has been calculated on the

basis of continuing activities before adjusting items and the

share-based payments charge, net of tax. The Directors consider

that this earnings per share calculation gives a better

understanding of the Group's earnings per share in the current and

prior period.

6. Share capital

(Audited)

26 weeks 26 weeks to 53 weeks

to to

4 October 29 September 5 April

2020 2019

$'000 $'000 2020

$'000

------------------------------------ ------------- ---------------- ----------

Issued and fully paid:

152,250,802 (FY2020: 151,818,762)

Ordinary shares of 25p each 60,322 59,566 60,189

------------------------------------ ------------- ---------------- ----------

On 1 July 2020, the Group issued 432,040 shares under the 2019

deferred share bonus plan.

7. Own shares

(Audited)

26 weeks 26 weeks to 53 weeks

to to

4 October 29 September 5 April

2020 2019

$'000 $'000 2020

$'000

--------------------------------------- ------------- ---------------- ----------

At the start of the period 1,024 1,890 1,890

--------------------------------------- ------------- ---------------- ----------

Disposed of in the period on exercise

of options (434) (381) (2,630)

--------------------------------------- ------------- ---------------- ----------

Purchase of shares - - 1,764

--------------------------------------- ------------- ---------------- ----------

At end of the period 590 1,509 1,024

--------------------------------------- ------------- ---------------- ----------

The own shares reserve represents the cost of shares in the

Company held by the Volex Group plc Employee Share Trust to satisfy

future share option exercises under the Group's share option

schemes.

On the 29 April 2020, the Trust disposed of 250,000 shares to

satisfy the exercise of share options. The number of ordinary

shares held by the Volex Group plc Employee Share Trust at 5

October 2020 was 206,576 (H1 FY2020: 1,410,983, FY2020:

456,576).

8. Analysis of net funds/(debt)

Other

5 April New Cash Exchange movement $'000 non-cash changes 4 October

2020 leases flow $'000 2020

$'000 $'000 $'000 $'000

------------------------- --------- --------- -------- ------------------------- ------------------ -----------

Cash & cash equivalents 31,649 - 2,048 532 - 34,229

Bank loans (79) - 42 - - (37)

Other loans - - (2,584) - - (2,584)

Debt issue costs 510 - - 27 (114) 423

Lease liability (10,883) (2,555) 2,263 (198) (315) (11,688)

------------------------- --------- --------- -------- ------------------------- ------------------ -----------

Net funds 21,197 (2,555) 1,769 361 (429) 20,343

------------------------- --------- --------- -------- ------------------------- ------------------ -----------

4 October 2020 29 September 2019 5 April

$'000 $'000 2020

$'000

--------------------------- --------------- ------------------ --------

Cash and bank balances 34,229 17,880 32,305

Overdrafts - (10,478) (656)

Cash and cash equivalents 34,229 7,402 31,649

--------------------------- --------------- ------------------ --------

The carrying amount of the Group's financial assets and

liabilities is considered to be equivalent to their fair value.

9. Related parties

Transactions between the Company and its subsidiaries, which are

related parties, have been eliminated on consolidation and are not

disclosed in this note.

The Group has a 26.09% interest in Kepler SignalTek Limited,

which is accounted for as an associate. During the period the Group

accrued financial income of $97,000 on the preference shares (H1

FY2020: $85,000, FY2020: $196,000). The balance due from the

associate as at the period end date was $2,055,000 (H1 FY2020:

$1,910,000, FY2020: $1,990,000).

The Group also has a 43% interest in Volex-Jem Co. Ltd. During

the period the Group purchased $nil (H1 FY2020: $107,000, FY2020:

$116,000) materials from Volex - Jem Cable Precision (Dongguan) Co.

Limited, an entity controlled by Volex-Jem Co. Ltd. The balance due

to the associates as at the period end was $81,000 (H1 FY2019:

$88,000, FY2020: $115,000).

A number of share transactions with Directors have occurred

during the period in line with share awards outstanding at the

prior year end and as disclosed in the annual accounts for FY2020

and in line with the Director shareholding notices disclosed on the

Volex website ( www.volex.com ).

10. Contingent Liabilities

As a global Group, subsidiary companies, in the normal course of

business, engage in significant levels of cross-border trading. The

customs, duties and sales tax regulations associated with these

transactions are complex and often subject to interpretation. While

the Group places considerable emphasis on compliance with such

regulations, including appropriate use of external legal advisors,

full compliance with all customs, duty and sales tax regulations

cannot be guaranteed.

Through the normal course of business, the Group provides

manufacturing warranties to its customers and assurances that its

products meet the required safety and testing standards. When the

Group is notified that there is a fault with one of its products,

the Group will provide a rigorous review of the defective product

and its associated manufacturing process, and if found at fault and

contractually liable will provide for costs associated with recall

and repair, as well as rectifying the manufacturing process or

seeking recompense from its supplier. The Group does not provide

for such costs where fault has not yet been determined and

investigations are ongoing.

11. Events after the balance sheet date

Effective from the 12 November 2020 the Group signed a new,

three-year $100 million multi-currency revolving credit facility to

replace the current $30 million credit facility. The facility

consists of a $70 million committed facility with a $30 million

accordion feature.

On the 12 November 2020 the Company announced the proposed

acquisition of the entire issued share capital of De-Ka

Elektroteknik Sanayi ve Ticaret Anonim irketi ("DEKA"), for a total

consideration of up to EUR61.8 million, on a debt free basis. The

Acquisition is expected to close in January 2021, subject to

approval by the Turkish Competition Authority and admission of the

newly issued shares to trading on AIM.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GPGUWGUPUPPG

(END) Dow Jones Newswires

November 12, 2020 02:00 ET (07:00 GMT)

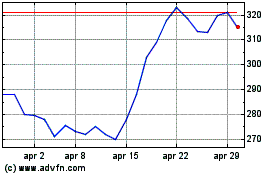

Grafico Azioni Volex (LSE:VLX)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Volex (LSE:VLX)

Storico

Da Apr 2023 a Apr 2024