By Robert Wall

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 16, 2018).

TOULOUSE, France -- Airbus SE and Boeing Co. are cashing in on

unprecedented demand by airlines for new planes, driven by record

numbers of passengers taking to the sky.

Airbus shares surged more than 10% Thursday after reporting

higher cash flow driven by record jet output for last year. It

promised to boost plane deliveries even more this year to fill the

orders from airlines and aircraft leasing companies. Last month,

Boeing reported its own strong year of profit and sales growth, and

forecast an even better 2018 after a record number of deliveries

last year.

Passenger growth has surpassed industry expectations for several

years. Last year, passenger growth hit 7.5%, beating the 5.9%

forecast by the International Air Transport Association, an

industry body.

Today's largely synchronized global economic growth is lifting

passenger numbers. But the falling cost of air travel, in part

thanks to an increase in budget airlines around the world, is also

contributing. The surge represents the " most rapid expansion at a

global level that we've ever seen," said John Plueger, chief

executive of plane leasing firm Air Lease Corp., in a recent

interview.

Traffic growth has historically averaged around 5%, but now

looks set to average 6% in coming years, according to a recent note

by Bernstein Research.

Coinciding with all that new demand, airlines have benefited

from several years of relatively low fuel prices due to cheaper

oil, boosting returns and giving them the financial flexibility to

refresh their fleets. Overall industry profits for 2018 are

projected to rise around 11% over last year, IATA forecasts.

Boeing, the world's biggest plane maker, and No. 2 Airbus have

order backlogs that stretch out for years. That has forced both

companies to revamp supply chains and manufacturing processes to

cope. Both have fumbled in the recent past with shortages of

components like seats, toilets and even engines. But they have

largely met delivery targets and have succeeded, so far, in turning

their big order books into cash.

Airbus delivered a record 718 planes in 2017. The company said

Thursday it took in EUR2.95 billion ($3.68 billion) in free cash

flow, excluding items like acquisitions, divestitures and customer

financing. It had targeted about EUR1.4 billion, on par with the

year-earlier period. Airbus also said it plans to increase its

dividend by 11%.

Looking ahead, Airbus forecast adjusted earnings this year to

increase 20% and said cash generation should be similar to

2017.

To meet future demand, Airbus said it is raising output to

around 800 airliners this year. Boeing last month said it planned

to lift production to between 810 and 815 planes this year, up from

763 last year.

Airbus had already announced plans to boost output of its

single-aisle planes to 60 a month next year from around 50 in 2017.

Chief Executive Tom Enders said Thursday that demand could possibly

support more than 70 planes a month.

Boosting production hasn't been without its challenges,

especially for Airbus. The company has been struggling with the

supply of engines on its popular A320neo plane, slowing deliveries.

Last week, Airbus said problems with one of the engines, made by

United Technologies unit Pratt & Whitney, were delaying planes,

and on Thursday it warned engine problems could jeopardize plane

delivery goals for this year. Delivery of Pratt-powered A320neo

planes won't resume until the supplier has a fix ready, which

Airbus expects in April.

Rival engine supplier CFM International, a joint venture between

General Electric Co. and France's Safran SA, also has been behind

schedule on delivering equipment.

Mr. Enders said suppliers' ability to support Airbus's increased

output would largely dictate whether the company this year decides

to raise output of some plane models beyond current

commitments.

Airbus said yearly net profit rose sharply to EUR2.87 billion,

compared with EUR995 million in 2016, when earnings were hurt by

foreign exchange effects and plane program charges. Airbus's

operating earnings, which strip out some one-time items, were

EUR4.25 billion, compared with EUR3.96 billion a year earlier.

The Toulouse-based company reported EUR66.8 billion in sales,

little changed from a year earlier. Higher revenue from commercial

airliners was offset by weakness in the helicopter business and

defense and space. Airbus said it took a EUR1.3 billion charge on

its long-troubled A400M military transport program. That raised to

more than EUR8 billion the combined charges the company has taken

on the plane, which has been beset by delays and technical

problems.

Airbus is also wrestling with other issues. The company faces

regulatory probes in multiple jurisdictions, including a widening

review in the U.S. about the improper use of middlemen to win

contracts.

It is also in the middle of a shift in senior management, as Mr.

Enders won't seek an extension of his contract beyond April 2019,

leaving him just over a year to find a successor. And Chief

Operating Officer Fabrice Brégier, who runs the commercial plane

division that delivers most of Airbus's revenue and profit, leaves

this month.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

February 16, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

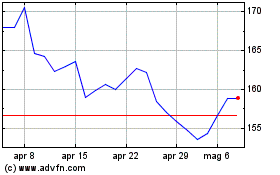

Grafico Azioni Airbus (EU:AIR)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Airbus (EU:AIR)

Storico

Da Apr 2023 a Apr 2024