Santos Selling Asian Assets for $221 Million

03 Maggio 2018 - 3:06AM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Santos Ltd. (STO.AU) has struck a deal to

sell a portfolio of Asian energy assets, marking its exit from

Vietnam, Indonesia, Malaysia and Bangladesh as it continues to

reduce its debt burden.

The Australian oil-and-gas producer, a target of a takeover

offer worth about US$10.5 billion, said it was selling the assets

to Ophir Energy PLC (OPHR.LN) for US$221 million, with all its

employees associated with the operations transferring as part of

the agreement.

The assets, which Santos said were relatively "late-life" and

not prioritized for investment, include stakes in oil and gas

fields around Asia. Santos's shares of production from the assets

in the first quarter of the year was 1.4 million barrels of oil

equivalent.

The sale is expected to conclude by the end of the year, subject

to approval by Ophir's shareholders.

Santos, which had debt of US$2.5 billion at the end of March, in

early in April received a fresh takeover proposal from

private-equity-backed Harbour Energy Ltd. Harbour has begun

confirmatory due diligence to determine if it will proceed with a

formal bid.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

May 02, 2018 20:51 ET (00:51 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

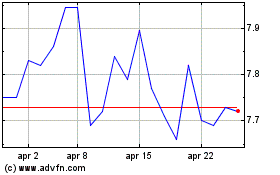

Grafico Azioni Santos (ASX:STO)

Storico

Da Mar 2024 a Apr 2024

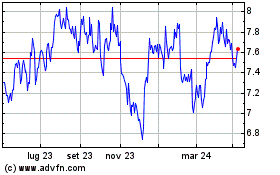

Grafico Azioni Santos (ASX:STO)

Storico

Da Apr 2023 a Apr 2024

Notizie in Tempo Reale relative a Santos Limited (Borsa Australiana): 0 articoli recenti

Più Santos Fpo Articoli Notizie