Boeing, Airbus Miss 2018 Jet Delivery Targets

08 Gennaio 2019 - 8:53PM

Dow Jones News

By Doug Cameron and Robert Wall

Boeing Co. and Airbus SE failed to deliver all the jets they had

once planned to make in 2018, showing how production problems are

holding back the two top plane makers as demand for airliners

soars.

Boeing Co. on Tuesday said it delivered 806 jetliners for the

year. That was a record, but fell shy of the 810 to 815 jets the

company aimed to deliver. Shortages of fuselages, engines and other

parts have slowed Boeing's output since last summer. The plane

maker last missed delivery guidance in 2011.

Airbus said Tuesday that it delivered 800 planes in 2018, also a

company record. That met its revised goal after the company in

October scaled back its production plans for the year by around 20

aircraft because of supplier problems and internal production

setbacks. It just barely met the lowered guidance of 800

planes.

Shares in both companies rose Tuesday on the news that the

production shortfall wasn't more severe. Boeing's shares rose

around 3% on Tuesday and Airbus shares closed 3.7% higher.

Together, the two aerospace giants delivered a combined 1,608

planes in 2018, compared with 1,481 a year earlier. That's up

sharply from 1,000 deliveries in 2011, reflecting the surging

demand for air travel, particularly among fast-growing carriers in

Asia.

Both plane makers are expected to announce plans in the coming

weeks for another boost in output, according to analysts, even as

some suppliers flag ongoing issues with the pace of jet orders.

Engine makers' ability to boost output this year will determine

whether Airbus and Boeing can raise delivery rates again over the

next two years, said analysts. Boeing Chief Executive Dennis

Muilenburg has said customers want the company to push output even

higher.

"We need to be assured that this demand will stay for some

time," Olivier Andries, chief executive of Safran SA's engine unit,

said at an investor event last month. A joint venture between

Safran and General Electric Co. provides engines for the new Boeing

737 Max and some Airbus A320neos. The Pratt & Whitney unit of

United Technologies Corp. also supplies engines for the Airbus

jet.

Deliveries rather than orders have become the most closely

watched measure of the aerospace rivals' performance, as they work

through order books for more than 13,000 jets due for delivery over

more than seven years. Most of a jet's purchase price is paid at

delivery, driving profits and cash to fund huge stock-buyback

programs that have lifted shares in both plane makers in the past

three years.

But the production pressure on Boeing and Airbus is showing

little sign of easing. Boeing logged 893 new orders in 2018, adding

to already multiyear wait-periods for its most popular aircraft

type. Airbus, which is expected to report order intake Wednesday,

struck several big plane deals in December, suggesting its backlog

of orders is equivalent to several years' worth of production.

Airbus and Boeing have already announced plans to boost output

of their best-selling single-aisle jets this year. Boeing will

increase monthly production of its 737 family to 57 from 52, with

Airbus raising output of its A320 family to 60 from around 52.

Airbus officials have said they see demand to push single-aisle

output to 70 planes or more a month, with the only question being

whether suppliers can keep pace to build all those aircraft.

Achieving those unprecedented production figures would depend on

timely deliveries from suppliers. Boeing deliveries in 2018 were

hurt by late shipments of engines and parts from Spirit AeroSystems

Holdings Inc., which left dozens of unfinished planes parked around

Boeing's Seattle-area facilities.

Spirit, which makes the 737 fuselage, recently reached a new

deal with Boeing that sets the terms for production through to

2030.

For Airbus, supply hiccups largely focused on late engine

deliveries, though internal delays compounded production problems.

It, too, had planes sitting at production sites awaiting parts.

Write to Doug Cameron at doug.cameron@wsj.com and Robert Wall at

robert.wall@wsj.com

(END) Dow Jones Newswires

January 08, 2019 14:38 ET (19:38 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

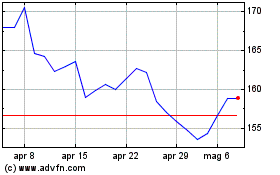

Grafico Azioni Airbus (EU:AIR)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Airbus (EU:AIR)

Storico

Da Apr 2023 a Apr 2024