SEC Rejects Proposal for Mandatory Shareholder Arbitration

12 Febbraio 2019 - 12:57AM

Dow Jones News

By Dave Michaels and Gabriel T. Rubin

WASHINGTON -- Johnson & Johnson Inc. won't have to hold a

shareholder vote that would have made the company a guinea pig for

a politically divisive fight over class-action lawsuits.

The Securities and Exchange Commission told J&J on Monday it

could choose not to hold a vote on a proposal to push all suits

brought against the company by its shareholders into private

arbitration hearings. The decision marks the first time during the

Trump administration that the SEC has ruled on the contentious

issue, which fractures along partisan lines and sometimes pits

corporate executives against their investors.

The SEC often plays the referee on divisive proposals that

proponents seek to advance at corporations' annual meetings.

Supporters of mandatory arbitration want the agency to let

companies require arbitration, saying it would be faster and less

expensive than grinding out disputes in court.

Many institutional investors, including public-sector pension

funds, say class-action access to the courts is vital for enforcing

investor-protection laws.

The SEC's staff on Monday said J&J could choose to not hold

a vote on the proposal because it would violate New Jersey state

law. New Jersey Attorney General Gurbir Grewal told the SEC last

month that mandatory arbitration would violate state law. J&J

is based in New Jersey.

J&J didn't immediately respond to a request for comment.

Hal Scott, a Harvard University professor who represents a trust

that owns J&J shares, filed the proposal in December. Mr. Scott

had told the SEC that New Jersey's attorney general relied on a

flawed and incomplete legal analysis.

Mr. Scott questioned why the New Jersey attorney general had

chosen to intervene and said that he was weighing his options as to

how to proceed, noting that he had the option to appeal the SEC

decision in court.

"I think it's sad that the SEC is not allowing shareholders of a

company to decide this issue," Mr. Scott said in an interview.

The decision allows SEC Chairman Jay Clayton to avoid an

extended fight over the issue. While many Republicans favor

mandatory arbitration, saying too many shareholder lawsuits are

without merit, Mr. Clayton has said he wants to avoid a brawl over

a subject that would pit business groups against investors and

likely splinter his agency along party lines. The SEC has four

commissioners and includes members from both Democratic and

Republican backgrounds.

"I continue to believe that any SEC policy decision on this

subject should be made by the commission in a measured and

deliberative manner," Mr. Clayton said in a statement, adding that

he supported the staff's decision.

In a letter last year to Rep. Carolyn Maloney (D., N.Y.), Mr.

Clayton said "this issue is not a priority for me" and warned that

an extended debate over it would "inevitably divert a

disproportionate share of the commission's resources" from other

more pressing issues.

Write to Dave Michaels at dave.michaels@wsj.com and Gabriel T.

Rubin at gabriel.rubin@wsj.com

(END) Dow Jones Newswires

February 11, 2019 18:42 ET (23:42 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

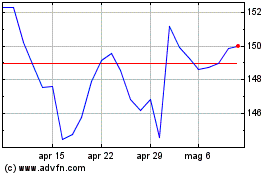

Grafico Azioni Johnson and Johnson (NYSE:JNJ)

Storico

Da Mar 2024 a Apr 2024

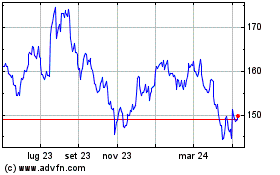

Grafico Azioni Johnson and Johnson (NYSE:JNJ)

Storico

Da Apr 2023 a Apr 2024