TIDMTXP

RNS Number : 0965U

Touchstone Exploration Inc.

27 March 2019

YEAR- 2018 RESULTS

Extensive operational program drives strong financial

performance

Calgary, Alberta - March 27, 2019 - Touchstone Exploration Inc.

("Touchstone" or the "Company") (TSX / LSE: TXP) announces its

financial and operating results for the three months and year ended

December 31, 2018. Selected financial and operational information

is outlined below and should be read in conjunction with

Touchstone's December 31, 2018 audited consolidated financial

statements, the related Management's discussion and analysis and

the Annual Information Form, all of which will be available under

the Company's profile on SEDAR (www.sedar.com) and the Company's

website (www.touchstoneexploration.com). Unless otherwise stated,

tabular amounts herein are in thousands of Canadian dollars, and

amounts in text are rounded to thousands of Canadian dollars.

Paul Baay, President and Chief Executive Officer, commented:

"I am pleased to announce that we have delivered a substantial

increase in all key performance indicators in 2018, which was a

direct result of the hard work and determination demonstrated by

our team during a busy operational period. Touchstone became the

most active onshore upstream company in Trinidad, as we expanded

our original drilling program and hit our initial production

milestone of 2,000 bbls/d. We also displayed financial and

operational discipline during 2018, allowing us to achieve a 53%

annual increase in operating netback."

"Following the GBP3.8 million private placement post year-end,

Touchstone is funded to commence drilling the first exploration

well on our Ortoire block where there is a significant opportunity

to achieve a step-change in future reserves and production. We will

take a measured approach to our 2019 capital drilling program as we

focus on our exploration opportunities."

Highlights

-- Achieved annual average crude oil production of 1,718 barrels

per day ("bbls/d"), a 25% increase relative to the average 1,375

bbls/d produced in 2017.

-- Executed a $19,064,000 development program to drill 11

successful wells, complete nine wells, and perform 28 well

recompletions.

-- Increased petroleum sales 53% from the prior year, generating

$48,933,000 versus $32,020,000 in 2017.

-- Realized an operating netback of $34.58 per barrel, an

increase of 53% from the $22.56 per barrel generated in 2017.

-- Reduced per barrel operating costs by 4% and general and

administrative expenses by 3% from the prior year.

-- Generated funds flow from operations of $10,797,000 ($0.08

per share) compared to $3,110,000 ($0.03 per share) realized in

2017.

-- Recognized net earnings of $480,000 ($0.00 per share)

compared to a net loss of $947,000 ($0.01 per share) reported in

2017.

-- Exited the year with cash of $4,845,000 (which excluded 2018

crude oil sales of $6,014,000 collected subsequent to year-end) and

net debt of $19,527,000, representing 1.8 times net debt to annual

2018 funds flow from operations.

-- Subsequent to year-end, we issued 31,666,667 common shares

raising gross proceeds of $6,615,000 to primarily fund an

exploration well on our Ortoire block, which is expected to spud in

June 2019.

Financial and Operating Results Summary

Three months ended % change Year ended December % change

December 31, 31,

------------- ---------

2018 2017 2018 2017

-------------- ---------------------- ---------------------- ------------- ---------------------- ----------------------- ---------

Operating

highlights

Average daily

oil

production

(bbls/d) 1,851 1,448 28 1,718 1,375 25

Net wells

drilled 3 - - 11 4 175

Net wells

recompleted 7 7 - 28 20 40

Brent

benchmark

price

(US$/bbl) 68.76 61.45 12 71.31 54.17 32

Operating

netback(1)

($/bbl)

Realized

sales price 77.21 69.88 10 78.02 63.79 22

Royalties (19.49) (20.16) (3) (20.92) (17.89) 17

Operating

expenses (28.02) (27.58) 2 (22.52) (23.34) (4)

-------------- ---------------------- ---------------------- ------------- ---------------------- ----------------------- ---------

29.70 22.14 34 34.58 22.56 53

-------------- ---------------------- ---------------------- ------------- ---------------------- ----------------------- ---------

Financial

highlights

($000's except share and per

share amounts)

Petroleum

sales 13,151 9,308 41 48,933 32,020 53

Cash provided

by operating

activities 2,228 2,310 (4) 8,367 704 1,088

Funds flow

from

operations 1,678 892 88 10,797 3,110 247

Per share -

basic

and

diluted(1) 0.01 0.01 - 0.08 0.03 167

Net earnings

(loss) 780 3,653 (79) 480 (947) n/a

Per share -

basic

and diluted 0.01 0.03 (67) 0.00 (0.01) n/a

Capital

expenditures

Exploration 2,147 330 551 3,387 1,240 173

Development 6,380 763 736 19,064 8,138 134

-------------- ---------------------- ---------------------- ------------- ---------------------- ----------------------- ---------

8,527 1,093 680 22,451 9,378 139

-------------- ---------------------- ---------------------- ------------- ---------------------- ----------------------- ---------

Net debt(1) -

end

of period

Working

capital

deficit

(surplus) 4,527 (6,808)

Principal long-term balance

of loan 15,000 15,000

19,527 8,192 138

-------------- ---------------------- ---------------------- ------------- ---------------------- ----------------------- ---------

Weighted average shares outstanding

(000's)

Basic 129,021 105,955 22 129,021 94,204 37

Diluted 130,532 106,542 23 130,220 94,204 38

Outstanding shares - end of

period (000's) 129,021 129,021 -

Note:

(1) Non-GAAP financial measure that does not have a standardized

meaning prescribed by International Financial Reporting Standards

("IFRS") and therefore may not be comparable with the calculation

of similar measures presented by other companies. See "Advisories:

Non-GAAP Measures" for further information.

Operating Results

Touchstone was the most active onshore upstream company in

Trinidad in 2018, drilling a total of 11 developmental oil wells,

nine of which were completed and on production prior to the end of

the year. 2018 development capital expenditures totaled

$19,064,000, which included drilling and completion activities and

the recompletion of 28 wells. Fourth quarter 2018 development field

activity included drilling three crude oil development wells,

completing one of these wells and recompleting seven legacy wells

with a total capital spend of $6,380,000. The remaining two wells

of the 2018 drilling program were completed subsequent to

year-end.

Fourth quarter 2018 crude oil production averaged 1,851 bbls/d,

a 28% increase relative to the 1,448 bbls/d produced in the fourth

quarter of 2017. Fourth quarter average daily production increased

5% from the third quarter of 2018, with growth slowed by multiple

wells requiring lengthy workovers. Annual 2018 production averaged

1,718 bbls/d, representing a 25% increase from the 1,375 bbls/d

average produced in the prior year. The nine wells drilled and

completed in 2018 combined to add an average of 342 bbls/d and 198

bbls/d of incremental production in the fourth quarter and the

year, respectively. In addition, the four wells drilled in 2017

continued to perform ahead of internal expectations, contributing

an average of 354 bbls/d in the fourth quarter of 2018 and 343

bbls/d throughout 2018.

Exploration expenditures were mainly focused on our Ortoire

property, as we invested $2,147,000 and $3,387,000 during the three

months and year ended December 31, 2018, respectively (2017 -

$330,000 and $1,240,000). We continue to focus on advancing our

internally identified exploration prospects on the property in

order to complete our four well drilling obligations in 2019 and

2020. The Company has submitted four Certificate of Environmental

Compliance ("CEC") applications which are required prior to the

preparation of drilling locations. Two CECs covering seven drilling

locations have been approved by regulatory authorities to date.

Financial Results

Our fourth quarter operating netback was $5,059,000 ($29.70 per

barrel), an improvement of 71% compared to $2,950,000 ($22.14 per

barrel) recorded in the fourth quarter of 2017. A 10% increase in

realized prices and a 28% increase in crude oil production resulted

in a $3,843,000 increase in petroleum sales relative to the fourth

quarter of 2017. This was offset by higher royalties of $634,000

from increased production and the sliding scale effect of increased

commodity pricing to royalty rates, slightly offset by new well

production that qualified for royalty incentives. 2018 fourth

quarter operating costs increased by $1,100,000 from the prior year

comparative quarter based on non-recurring lease expense

adjustments of $528,000, elevated variable costs from increased

production and increased well servicing costs.

Operating netback was $34.58 per barrel in 2018, a 53% increase

from $22.56 per barrel recognized in 2017. Realized pricing for

crude oil averaged $78.02 (US$60.01) per barrel in 2018 versus

$63.79 (US$49.18) per barrel received in 2017. Relative to 2017,

Petroleum sales increased 53% to $48,933,000 based on a 22% annual

increase in realized crude oil prices and a 25% increase in

production volumes. Royalty expenses represented 26.8% of petroleum

sales during the year ended December 31, 2018 versus 28.1% in the

prior year. The decrease was a result of incremental production

achieved from our 2018 drilling program which qualified for royalty

incentives. Despite the aforementioned $528,000 one-time charge,

annual operating costs decreased 4% on a per barrel basis, which

was primarily attributable to increased production.

During the three months and year ended December 31, 2018,

Touchstone generated funds flow from operations of $1,678,000 and

$10,797,000, representing increases of $786,000 and $7,687,000 from

the prior year comparative periods, respectively. The variances

were mainly a result of elevated operating netbacks based on

increases in both production and realized pricing. In addition to

the $528,000 operating cost adjustment, the Company incurred a

non-recurring $620,000 general and administrative charge related to

the restoration of legacy office leases that expire on March 31,

2019.

Earnings before income taxes for the year were $11,866,000,

representing an increase of 113% from the $5,579,000 recorded in

2017. The increased operational financial performance achieved in

2018 was slightly offset by decreased property and equipment

impairment recoveries reported in the year, as $4,335,000 and

$7,851,000 in net impairment recoveries were recorded during the

2018 and 2017 fiscal years respectively. $2,437,000 in current

taxes were reported throughout 2018 versus $440,000 in 2017, mainly

due to increased supplemental petroleum taxes based on increased

realized prices received in 2018. 2018 deferred taxes increased

$2,863,000 from the $6,086,000 recorded in 2017 based on increased

capital activity performed in the year. After current and deferred

taxes, we recorded net earnings of $480,000 during the year ended

December 31, 2018 compared to a net loss of $947,000 in 2017.

Touchstone exited the year with a cash balance of $4,845,000, a

working capital deficit of $4,527,000 and a $15 million principal

term loan balance. Our cash and working capital balances decreased

from December 31, 2017 based on the capital-intensive nature of the

Company's development activities. The investments increased both

production and funds flow from operations from the prior year, as

net debt to trailing twelve-month funds flow from operations was

1.8 times as of December 31, 2018 versus 2.6 times as at December

31, 2017. Touchstone's $15 million credit facility does not require

the commencement of principal payments until January 1, 2020, and

the Company was well within the financial covenants as at December

31, 2018.

Subsequent to year-end, we raised gross proceeds of GBP3,800,000

($6,615,000) by way of a placing of 31,666,667 new common shares at

a price of 12 pence ($0.21) per common share. We intend to use the

net proceeds from the private placement to fund the first

exploration well on our Ortoire property. Touchstone will carefully

monitor commodity pricing volatility and will continue to take a

measured approach to our 2019 capital drilling program in an effort

to manage working capital and reduce net debt levels.

For Further Information:

Touchstone Exploration Inc.

Mr. Paul Baay, President and Chief Executive Officer Tel: +1

(403) 750-4487

Mr. Scott Budau, Chief Financial Officer

Mr. James Shipka, Chief Operating Officer

www.touchstoneexploration.com

Shore Capital (Nominated Advisor and Joint Broker)

Nominated Advisor: Edward Mansfield / Mark Percy / Daniel Bush

Tel: +44 (0) 207 408 4090

Corporate Broking: Jerry Keen

GMP FirstEnergy (Joint Broker)

Jonathan Wright / Hugh Sanderson Tel: +44 (0) 207 448 0200

Camarco (Financial PR)

Nick Hennis / Jane Glover / Billy Clegg Tel: +44 (0) 203 757

4980

About Touchstone

Touchstone Exploration Inc. is a Calgary based company engaged

in the business of acquiring interests in petroleum and natural gas

rights, and the exploration, development, production and sale of

petroleum and natural gas. Touchstone is currently active in

onshore properties located in the Republic of Trinidad and Tobago.

The Company's common shares are traded on the Toronto Stock

Exchange and the AIM market of the London Stock Exchange under the

symbol "TXP".

Advisories

Non-GAAP Measures

This announcement contains terms commonly used in the oil and

natural gas industry, including funds flow from operations per

share, operating netback and net debt. These terms do not have a

standardized meaning under IFRS and may not be comparable to

similar measures presented by other companies. Shareholders and

investors are cautioned that these measures should not be construed

as alternatives to cash provided by operating activities, net

income, total liabilities, or other measures of financial

performance as determined in accordance with Generally Accepted

Accounting Principles. Management uses these Non-GAAP measures for

its own performance measurement and to provide stakeholders with

measures to compare the Company's operations over time.

The Company calculates funds flow from operations per share by

dividing funds flow from operations by the weighted average number

of common shares outstanding during the applicable period. Funds

flow from operations is an additional subtotal found on the

Company's consolidated statements of cash flows.

The Company uses operating netback as a key performance

indicator of field results. Operating netback is presented on a

total and per barrel basis and is calculated by deducting royalties

and operating expenses from petroleum sales. If applicable, the

Company also discloses operating netback both prior to realized

gains or losses on derivatives and after the impacts of derivatives

are included. Realized gains or losses represent the portion of

risk management contracts that have settled in cash during the

period, and disclosing this impact provides Management and

investors with transparent measures that reflect how the Company's

risk management program can impact netback metrics. The Company

considers operating netback to be a key measure as it demonstrates

Touchstone's profitability relative to current commodity prices.

This measurement assists Management and investors with evaluating

operating results on a historical basis.

The Company closely monitors its capital structure with a goal

of maintaining a strong financial position in order to fund current

operations and the future growth of the Company. The Company

monitors working capital and net debt as part of its capital

structure to assess its true debt and liquidity position and to

manage capital and liquidity risk. Working capital is calculated as

current assets minus current liabilities as they appear on the

Company's consolidated statements of financial position. Net debt

is calculated by summing the Company's working capital and the

principal (undiscounted) amount of long-term debt.

Forward-Looking Statements

Certain information provided in this announcement may constitute

forward-looking statements within the meaning of applicable

securities laws. Forward-looking information in this announcement

may include, but is not limited to, statements relating the

potential undertaking, timing, locations, production rates and

costs of future well drilling, completion and exploration

activities, and the sufficiency of resources and available

financing to fund future exploration, drilling and completion

operations. Although the Company believes that the expectations and

assumptions on which the forward-looking statements are based are

reasonable, undue reliance should not be placed on the

forward-looking statements because the Company can give no

assurance that they will prove to be correct. Since forward-looking

statements address future events and conditions, by their very

nature they involve inherent risks and uncertainties. Actual

results could differ materially from those currently anticipated

due to a number of factors and risks. Certain of these risks are

set out in more detail in the Company's December 31, 2018 Annual

Information Form dated March 26, 2019 which has been filed on SEDAR

and can be accessed at www.sedar.com. The forward-looking

statements contained in this announcement are made as of the date

hereof, and except as may be required by applicable securities

laws, the Company assumes no obligation to update publicly or

revise any forward-looking statements made herein or otherwise,

whether as a result of new information, future events or

otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR JFMLTMBTTBAL

(END) Dow Jones Newswires

March 27, 2019 03:00 ET (07:00 GMT)

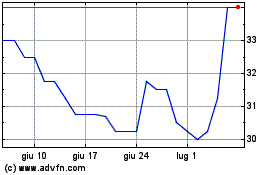

Grafico Azioni Touchstone Exploration (LSE:TXP)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Touchstone Exploration (LSE:TXP)

Storico

Da Apr 2023 a Apr 2024