TIDMSSPG

RNS Number : 0331Z

SSP Group PLC

15 May 2019

LEI:213800QGNIWTXFMENJ24

15 May 2019

SSP GROUP PLC

Results for six months period ended 31 March 2019

SSP Group, a leading operator of food and beverage outlets in

travel locations worldwide, announces its financial results for the

first half of its 2019 financial year, covering the six months

ended 31 March 2019.

Highlights:

-- Underlying operating profit(1) of GBP62.5m: up 14.6% at

constant currency(2) , and 13.2% at actual exchange rates

-- Revenue of GBP1,261.6m: up 6.8% at constant currency; 7.1% at actual exchange rates

-- Like-for-like sales(3) up 2.0%: driven by air passenger travel and retail initiatives

-- Net gains(4) of 4.1%: strong performances in Continental

Europe, North America and the Rest of the World

-- Underlying operating margin(1) up 30 basis points to 5.0% at

constant currency, strategic initiatives delivering well

-- Underlying profit before tax(1) of GBP54.2m: up 11.3%. Reported profit before tax of GBP51.4m

-- Underlying earnings per share(1) of 6.7 pence: up 19.6%.

Reported earnings per share of 6.1 pence

-- Capital investment of GBP108.2m, reflecting the significant

new contract opening programme, which has been first half weighted

in 2019

-- Encouraging pipeline of new contracts with wins in North

America, Brazil, India, Spain and France

-- Interim dividend of 5.8 pence per share, up 20.8 %. This

follows the completion of the c. GBP150m special dividend and share

consolidation in April 2019

Commenting on the results, Kate Swann, CEO of SSP Group

said:

"SSP has delivered another good performance in the first half of

2019, driven by strong sales growth, significant new contract

openings across the world and our programme of operational

improvements. We have continued to grow our global presence,

particularly in North America and Asia, and we have further

expanded our operations in Latin America. These are high growth

markets for SSP and present us with exciting opportunities. Given

this positive momentum, we are today raising our expectations for

net gains in the second half of the year.

"Looking forward, the second half has started well and whilst a

degree of uncertainty always exists around passenger numbers in the

short term, we continue to be well placed to benefit from the

structural growth opportunities in our markets and our programme of

operational improvements."

Financial highlights:

Year-on-year change

H1 2019 H1 2018 Actual FX Constant

GBPm GBPm rates currency(2)

Revenue 1,261.6 1,177.8 +7.1% +6.8%

Like-for-like sales growth(3) 2.0% 2.8% n/a n/a

Underlying operating profit(1) 62.5 55.2 +13.2% +14.6%

Underlying operating margin(1) 5.0% 4.7% +30 bps +30 bps

Underlying profit before tax(1) 54.2 48.7 +11.3% n/a

Underlying earnings per share (p)(1) 6.7 5.6 +19.6% n/a

Dividend per share (p) 5.8 4.8 +20.8% n/a

Underlying operating cash outflow(5) (69.8) - n/a n/a

Net debt (433.4) (290.1) +49.4% n/a

Statutory reported results:

The table below summarises the Group's statutory reported

results (where the financial highlights above are adjusted).

H1 2019 H1 2018 Year-on-year change

GBPm GBPm

Operating profit 61.6 54.2 +13.7%

Operating margin 4.9% 4.6% +30 bps

Profit before tax 51.4 48.4 +6.2%

Earnings per share (p) 6.1 5.6 +8.9%

(1) Stated on an underlying basis which excludes the revaluation

of the obligation to acquire an additional 16% ownership share of

TFS and the amortisation of intangible assets arising on the

acquisition of the SSP business in 2006. This is consistent with

the prior period.

(2) Constant currency is based on average 2018 exchange rates

weighted over the financial year by 2018 results.

(3) Like-for-like sales represent revenues generated in an

equivalent period in each financial period in outlets which have

been open for a minimum of 12 months. Like-for-like sales are

presented on a constant currency basis.

(4) Net contract gains/(losses) represent the net year-on-year

revenue impact from new outlets opened and existing units closed in

the past 12 months. Net contract gains/(losses) are presented on a

constant currency basis.

(5) Stated on an underlying basis(1) after capital expenditure,

net cash flows to/from associates and non-controlling interests,

acquisitions and tax.

Please refer to page 15 for supporting reconciliations from the

Group's statutory reported results to these performance

measures.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014.

CONTACTS:

Investor and analyst enquiries

Sarah John, Director of Investor Relations, SSP Group plc

On 15 May 2019: +44 (0) 7736 089218

Thereafter: +44 (0) 203 714 5251

E-mail: sarah.john@ssp-intl.com

Media enquiries

Peter Ogden / Lisa Kavanagh

Powerscourt

+44 (0) 207 250 1446

E-mail: ssp@powerscourt-group.com

SSP Group plc's Interim Results 2019 are available at

www.foodtravelexperts.com.

NOTES TO EDITORS

About SSP

SSP is a leading operator of food and beverage concessions in

travel locations, operating restaurants, bars, cafés, food courts,

lounges and convenience stores in airports, train stations,

motorway service stations and other leisure locations. SSP has more

than 37,000 employees and serves approximately one and a half

million customers every day.

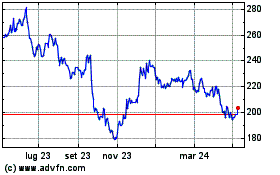

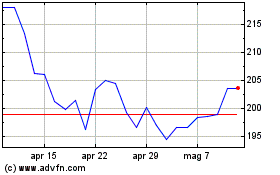

SSP operates an extensive portfolio of more than 500

international, national, local and own brands in more than 30

countries around the world. The group was owned by the private

equity business EQT until 2014 when it floated at the London Stock

Exchange at a share price of GBP2.10. Since then, the share price

has more than tripled.

www.foodtravelexperts.com

Business review

Overview

The Group delivered a good performance in the first half of the

year, driven by like-for-like sales growth, significant new

contract openings across the world and the ongoing implementation

of our programme of operational improvements. We are continuing to

invest in the growth and development of the business and to bring

new brands and concepts to our clients and customers. We have made

further good progress in the development of the business in

Continental Europe, North America and Asia Pacific. We are

recommending an interim ordinary dividend of 5.8 pence per share,

anticipating a full year pay-out ratio of 40%. This, together with

the payment of a c. GBP150m special dividend in April 2019,

reflects our confidence in the business and our commitment to

maintaining an efficient balance sheet.

Financial results

The financial performance of the Group is presented on an

underlying basis, for which the statutory reported results are

adjusted to take account of the amortisation of intangible assets

created on the acquisition of the SSP business in 2006 and the

revaluation of the obligation to acquire an additional share of

TFS. The statutory reported performance of the Group is explained

in the financial review, with a detailed reconciliation between

statutory and underlying performance provided on page 15.

The Group delivered a good financial performance in the first

half of 2019. Underlying operating profit increased to GBP62.5m, an

increase of 14.6% on a constant currency basis.

Total revenue increased by 6.8% on a constant currency basis,

including like-for-like sales growth of 2.0%, net contract gains of

4.1% and acquisitions of 0.7%. Like-for-like sales in the air

sector grew more strongly than in rail driven by the continued

growth in air passenger numbers. Like-for-like sales growth in the

second quarter was 1.5%, but was impacted by the timing of Easter,

which this year fell into the second half, and by the "Gilets

Jaunes" protests in France. Excluding these factors, like-for-like

sales growth in the second quarter would have been above 2%.

Like-for-like sales growth in the UK, North America and the Rest of

the World was in line with our expectations. In Continental Europe,

like-for-like sales were impacted by the protests in France and

disruption at some of our major airport sites as a consequence of

redevelopments, most notably Copenhagen and Malaga. With the

ongoing level of economic uncertainty and disruption, our

expectation for like-for-like sales growth in the full year is

around 2%.

We have seen significant expansion in the first half, delivering

net contract gains of 4.1% with strong contributions from

Continental Europe (+3.1%), North America (+8.7%) and the Rest of

the World (+4.2%). In Continental Europe, net gains were driven by

new unit openings at Montparnasse station in Paris, Charleroi and

Barcelona Airports, and a new contract for 29 Starbucks units in

railway stations in the Netherlands, and at the end of the first

half, the commencement of the mobilisation of the motorway service

areas across Germany. Net gains in North America included new

openings at LaGuardia, Los Angeles and Seattle Airports. In the

Rest of the World, net gains included new unit openings at airports

in Hong Kong, Phuket in Thailand and across a number of airports in

India including Delhi, Mumbai and Kolkata. In the first half, more

of our unit openings have been at brand new sites compared to the

first half last year and as a consequence we have incurred higher

preopening costs.

We continue to focus on retaining profitable contracts and our

contract renewal rate in the first half of 2019 was in line with

our historical trends.

We are encouraged by the pipeline of new contracts. In the first

half we won a number of significant new airport contracts including

in Continental Europe at Alicante, Helsinki and Athens Airports, in

North America at Oakland, Salt Lake City and Vancouver Airports,

and in India at Mumbai and Delhi Airports. Following our entry into

Latin America, winning contracts at Rio de Janeiro and San Paulo

Airports in Brazil, we have recently been awarded a further new

contract at Salvador Bahia Airport in Brazil. We expect to begin

operating these contracts progressively over the next two

years.

Following the strong start to the year and looking ahead at the

pipeline, our expectations for net gains for the full year have

increased from 3% to between 4% and 5%. Acquisitions are expected

to add c. 0.3% to revenue on a full year basis.

Underlying operating profit increased to GBP62.5m, a 14.6%

increase on a constant currency basis. The underlying operating

margin increased by 30 bps to 5.0% on a constant currency basis,

driven by solid like-for-like sales growth and the continued roll

out of our strategic initiatives and was delivered despite the

impact of higher preopening costs associated with the significant

new contract opening programme.

Looking forward to the second half and full year, and with the

expectation of lower pre-opening costs in the second half compared

to the first half, we now anticipate the overall operating margin

to increase by between 30 and 40 bps, up from our previous estimate

of 20 bps for the full year.

The underlying free cash outflow was GBP75.9m. Capital

expenditure was GBP108.2m. The increase compared to last year

reflects the phasing of the investment, with new unit development

being very first half weighted. In the full year we expect capital

spend in the region of GBP160m. The increase of approximately

GBP15m from the previous guidance reflects an increase in our

expectations for net gains from 3% to between 4% and 5% for the

full year.

The working capital usage of GBP36.3m was GBP35.8m higher than

last year, reflecting the later timing of Easter which fell in the

second half of this year. Last year we had an unusual result with

almost no cash usage in the first half, reflecting the fact that

Easter fell at the very end of the half. For the full year we

anticipate a normal cash inflow as a consequence of an increase in

the negative working capital in the business.

Net debt increased by GBP143.3m year on year to GBP433.4m,

reflecting our seasonal working capital cycle, our capital

investment programme and the payment of last year's GBP100.1m

special dividend. This represented leverage of 1.4 times EBITDA at

the end of the first half, compared with 1.1 times last year.

Strategy

Our strategy is focused on creating long-term sustainable value

for our shareholders, delivered through five key levers. We made

further progress on each of these levers in the period:

1. Optimising our offer from the positive trends in our markets

We are focused on the food and beverage markets in travel

locations, which benefit from long-term structural growth. We aim

to use our broad portfolio of brands and retailing skills to drive

profitable like-for-like sales, ensuring that we benefit from the

positive trends in these markets.

Like-for-like sales growth in the period was driven by the

ongoing roll out of our retailing programmes which are delivering

well. We continue to focus on optimising our product ranges and

have developed a wider range, including premium products to provide

customers with additional choice. We are making good use of new

technology, for example using self-order kiosks and ordering

applications and automatic coffee machines which help improve the

speed of service and increase customer transactions.

2. Growing profitable new space

The travel food and beverage market in airports and railway

stations is valued at approximately GBP17b and is characterised by

long-term structural growth. It offers excellent opportunities for

us to expand our business across the globe.

Net contract gains in the first half were 4.1%, driven by new

unit openings and high levels of contract retention. The high level

of net gains was driven by strong performances in North America and

in the Rest of the World. These large and growing markets (where we

still have a relatively small share), provide attractive expansion

opportunities and the pipeline of new contracts is encouraging. We

have strong disciplines around the contract tendering process which

enable us to deliver attractive returns from new business

investment.

Our new business growth is underpinned by our ability to deliver

attractive and effective food solutions at travel locations

internationally. An important element of this is the brand line up

we can offer. Our brands include both international brands which we

franchise, such as Burger King and Starbucks, and our own

proprietary brands such as Upper Crust and Ritazza, as well as

bespoke concepts and local heroes. This half we secured important

contract wins at airports with our own brands, including Ritazza,

Mi Casa and Millie's Cookies at Salvador, Brazil, and with Camden

Food Co at Charleroi, Belgium, and Ottowa, Canada. We also

introduced a number of new and exciting brand partners to our

portfolio, including our first ever BrewDog pub which we will be

opening at Alicante Airport in Spain, and we opened our first ever

airside M&S Food to Go at Birmingham Airport.

3. Optimising gross margins

Gross margin increased by 90 bps in the period at constant

currency. The higher growth in the air sector in the period, which

typically has higher gross margins but higher concession fees than

the rail sector, contributed approximately 10 bps of this

improvement.

This performance is encouraging given the ongoing pressure from

food cost inflation, and has been driven by the roll out of gross

margin initiatives across our regions which are progressing well.

Key areas of focus include procurement disciplines, range and

recipe rationalisation and the management of waste and losses. We

are making good progress in the introduction of equipment that

automates food preparation processes in our sites. This helps to

improve the product consistency and reduce waste. We also continue

to bring greater efficiency into the supply chain and have made

good progress in optimising delivery frequency to better align with

product demand. To support all these initiatives, we continue to

invest in both central and local resources.

4. Running an efficient and effective organisation

We have a multi-year programme of initiatives to improve

operating efficiency, which is important to the Group given the

backdrop of ongoing labour cost inflation, which continued in the

first half. In addition to this labour costs increased by 20 bps

reflecting the increase in preopening costs associated with the

significant new opening programme in the first half.

We continue to develop systems to better align labour to sales,

allowing us to optimise service levels and labour costs. The roll

out of our more standardised and systematised approach to labour

forecasting and scheduling is progressing well. Our increasing use

of automation and technology in food production and food service is

contributing both to improving the customer experience as well as

driving greater labour efficiency.

5. Optimising investment utilising best practice and shared resource

We have maintained our focus on optimising investment using best

practice and shared resource to help drive returns. We are

continuing to look at how shared back office services can reduce

cost and drive simpler, more efficient processes. We have expanded

our two outsourced shared service centres in Pune in India and Lodz

in Poland which are now used by 19 of SSP's countries for financial

transaction processing and basic administrative tasks. This year we

have also established an outsourced design centre in India to

support our unit development around the world. In addition to this,

we have made good progress in driving energy efficiencies and have

introduced a number of programmes which have helped to reduce

overall energy usage.

Summary and outlook

The Group delivered a good financial performance in the first

half of the year with solid like-for-like sales growth, strong net

gains and a further improvement in operating margin. The second

half has started well and the pipeline of new contracts is

encouraging. Looking forward to the full year, with the current

level of general economic and geopolitical uncertainty, we continue

to plan cautiously, anticipating like-for-like sales to be around

2%. However, the significant structural growth opportunities in the

travel sector and our programme to deliver operational improvements

leave us well placed to continue to deliver both for our customers

and our shareholders.

Financial review

Group performance

Change

H1 2019 H1 2018

GBPm GBPm Reported Constant currency LFL

--------- ------------------ ------

Revenue 1,261.6 1,177.8 +7.1% +6.8% +2.0%

-------- -------- --------- ------------------ ------

Underlying operating profit 62.5 55.2 +13.2% +14.6%

-------- -------- --------- ------------------ ------

Underlying operating margin 5.0% 4.7% +30 bps +30 bps

-------- -------- --------- ------------------ ------

Operating profit 61.6 54.2 13.7%

-------- -------- --------- ------------------ ------

Operating margin 4.9% 4.6% +30 bps

-------- -------- --------- ------------------ ------

Revenue

First half revenue increased by 6.8% on a constant currency

basis, comprising like-for-like sales growth of 2.0%, net contract

gains of 4.1% and the impact of acquisitions of 0.7%. At actual

exchange rates, total revenue grew by 7.1%, to GBP1,261.6m. Revenue

in the first half of the Group's financial year is typically lower

than in the second half, as a significant part of our business

serves the leisure sector of the travel industry, which is

particularly active during the summer in the northern

hemisphere.

Like-for-like sales in the air sector grew more strongly than in

rail driven by the continued growth in air passenger numbers.

Like-for-like sales growth in the second quarter were 1.5%, but was

impacted by the timing of Easter, which this year fell into the

second half, and by the "Gilets Jaunes" protests in France.

Excluding these factors, like-for-like sales growth in the second

quarter would have been above 2%. Like-for-like sales growth in the

UK, North America and the Rest of the World was in line with our

expectations. In Continental Europe like-for-like sales were

impacted by the protests in France and disruption at some of our

major airport sites as a consequence of redevelopments, most

notably Copenhagen and Malaga. With the ongoing level of economic

uncertainty and disruption, our expectation for like-for-like sales

growth in the full year is around 2%.

We have seen significant expansion in the first half, delivering

net contract gains of 4.1% with strong contributions from

Continental Europe (+3.1%), North America (+8.7%) and the Rest of

the World (+4.2%). In Continental Europe, net gains were driven by

new unit openings at Montparnasse station in Paris, Charleroi and

Barcelona Airports and a new contract for 29 Starbucks units in

railway stations in the Netherlands and at the end of the first

half, the commencement of the mobilisation of the motorway service

areas across Germany. Net gains in North America included new

openings at LaGuardia, Los Angeles and Seattle Airports. In the

Rest of the World, net gains included new unit openings at airports

in Hong Kong, Phuket in Thailand and across a number of airports in

India including Delhi, Mumbai and Kolkata. In the first half, more

of our unit openings have been at brand new sites compared to the

first half last year and as a consequence we have incurred higher

preopening costs. Following the strong start and looking ahead at

the pipeline, our expectations for net gains has increased from 3%

to between 4% and 5%.

The acquisition of Stockheim added 0.7% to first half revenues

and will add about 0.3% for the full year.

Trading results from outside the UK are converted into Sterling

at the average exchange rates for the period. The overall impact of

the movement of foreign currencies on revenue (principally the

Euro, US Dollar and pegged currencies, Norwegian Krone and Indian

Rupee) during the first half of 2019 compared to the 2018 average

was positive 0.3%. If the current spot rates were to continue

through to the end of 2019, we would expect a negative currency

impact on revenue in the full year of around 0.5% compared to the

average rates used for 2018. However this is a translation impact

only.

Underlying operating profit

Underlying operating profit increased to GBP62.5m, an increase

of 14.6% on a constant currency basis. The underlying operating

margin increased by 30 bps, on a constant currency basis, to 5.0%,

driven by solid like-for-like sales growth and the continued roll

out of our strategic initiatives, and was delivered despite the

impact of higher preopening costs arising from the significant new

contract opening programme.

Gross margin increased by 90 bps year-on-year, on a constant

currency basis. The sales mix in the first half, with stronger

growth in the air sector relative to the rail sector, contributed

approximately 10 bps of this improvement. The strong underlying

performance was driven by the continued roll out of our strategic

initiatives, including improved ranging and mix management, food

procurement, and waste and loss reduction.

The 20bps deterioration in the labour cost ratio largely

reflects the short term impact of preopening costs due to the first

half weighting of our significant new opening programme. We have

continued to see significant labour cost inflation, both in the UK

and North America, which has been broadly offset by the ongoing

efficiency programme.

Concession fees rose by 80bps, or c. 70bps after adjusting for

the stronger air sales. The higher year on year increase compared

to recent trends is mainly due to the scale of the first half

opening programme, with many contracts still in their mobilisation

phase. We would expect the underlying increase to revert to more

normal levels over the full year.

Looking forward to the second half and full year, and with the

expectation of lower pre-opening costs in the second half compared

to the first half, we now anticipate the overall operating margin

to increase by between 30 and 40 bps, up from our previous estimate

of 20 bps for the full year.

Operating profit

Operating profit was GBP61.6m, on a reported basis (H1 2018:

GBP54.2m), reflecting an adjustment for the amortisation of

acquisition-related intangible assets of GBP0.9m (H1 2018:

GBP1.0m).

Regional performance

The following shows the Group's segmental performance. For full

details of our key reporting segments, refer to note 2.

UK (including Republic of Ireland)

Change

H1 2019 H1 2018

GBPm GBPm Reported Constant currency LFL

--------- ------------------ ------

Revenue 385.2 369.5 +4.2% +4.3% +1.4%

-------- -------- --------- ------------------ ------

Underlying operating profit 39.1 33.4 +17.1% +17.4%

-------- -------- --------- ------------------ ------

Underlying operating margin 10.2% 9.1% +110 bps +110 bps

-------- -------- --------- ------------------ ------

Note - Statutory reported operating profit was GBP38.4m (H1

2018: GBP32.7m) and operating margin was 10.0% (H1 2018: 8.8%)

reflecting an adjustment for the amortisation of acquisition

related intangible assets of GBP0.7m (H1 2018: GBP0.7m).

Revenue increased by 4.3% on a constant currency basis,

comprising like-for-like growth of 1.4% and net contract gains of

2.9%. Like-for-like growth in the air sector was driven by

increasing passenger numbers, which was helped by the reversal of

the impact of the closure of Monarch Airlines last year, but held

back slightly by the timing of Easter, which this year fell into

the second half. In the rail sector, the underlying trends remained

broadly unchanged and we continued to see some impact from station

redevelopments in London, mainly at Liverpool Street, Victoria and

Waterloo. Net gains were stronger in the first half, driven mainly

by new M&S Simply Food unit openings in London stations and the

M&S Food to Go in Birmingham Airport.

Underlying operating profit for the UK increased by 17.4%, on a

constant currency basis, to GBP39.1m, with underlying operating

margin increasing by 110 bps, on a constant currency basis, to

10.2%. This represented a good performance, given the modest

like-for-like sales growth, with our operating efficiency

programmes continuing to deliver margin benefits.

Continental Europe

Change

H1 2019 H1 2018

GBPm GBPm Reported Constant currency LFL

--------- ------------------ ------

Revenue 452.7 440.5 +2.8% +4.1% -0.8%

-------- -------- --------- ------------------ ------

Underlying operating profit 17.7 21.8 -18.8% -15.3%

-------- -------- --------- ------------------ ------

Underlying operating margin 3.9% 4.9% -100 bps -90 bps

-------- -------- --------- ------------------ ------

Note - Statutory reported operating profit was GBP17.5m (H1

2018: GBP21.5m) and operating margin was 3.9% (H1 2018: 4.9%)

reflecting an adjustment for the amortisation of acquisition

related intangible assets of GBP0.2m (H1 2018: GBP0.3m).

Revenue increased by 4.1% on a constant currency basis,

comprising a like-for-like decline of 0.8%, net contract gains of

3.1%, and the acquisition of Stockheim adding a further 1.8%. The

lower like-for-like sales were driven by the impact of protests in

France largely in the second quarter. Like-for-like sales were also

impacted by slower growth in Nordics and Spain where some of our

airports were impacted by redevelopment works. Net gains in the

first half were stronger than normal, driven by a large opening

programme of new units at Montparnasse station in France, Charleroi

Airport in Belgium and the mobilisation of 29 Starbucks units in

Netherlands.

On a constant currency basis, underlying operating profit was

15.3% lower than last year, but excluding the impact of higher

depreciation costs arising from the new contact investments, EBITDA

was down 4%. Profit margins were, as expected, impacted by the

lower like for like sales arising from the protests in France and

airport redevelopment disruption as well as the significant

preopening costs associated with the large new opening

programme.

North America

Change

H1 2019 H1 2018

GBPm GBPm Reported Constant currency LFL

--------- ------------------ ------

Revenue 235.9 198.4 +18.9% +14.1% +5.4%

-------- -------- --------- ------------------ ------

Underlying operating profit 9.5 6.4 +48.4% +51.6%

-------- -------- --------- ------------------ ------

Underlying operating margin 4.0% 3.2% +80 bps +100 bps

-------- -------- --------- ------------------ ------

Note - There are no adjustments between underlying operating

profit and statutory reported operating profit.

Revenue increased by 14.1% on a constant currency basis,

comprising like-for-like growth of 5.4% and net contract gains of

8.7%. Like-for-like growth benefited from positive trends in

airport passenger numbers in the North American market. Net

contract gains of 8.7% included the benefit of the full year effect

of the major contracts that started in the second half of last

year, in particular at LaGuardia, Los Angeles and Seattle.

Underlying operating profit increased to GBP9.5m, an increase of

51.6% on a constant currency basis. This reflects the benefit of

the reversal of an impairment charge in the first half of 2018 in

relation to Houston airport. Excluding this, EBITDA increased by

around 9%, held back slightly by the impact of preopening costs

associated with new units at JFK T7, LaGuardia, Seattle and Phoenix

Airports.

Rest of the World

Change

H1 2019 H1 2018

GBPm GBPm Reported Constant currency LFL

--------- ------------------ ------

Revenue 187.8 169.4 +10.9% +10.6% +6.4%

-------- -------- --------- ------------------ ------

Underlying operating profit 15.9 13.6 +16.9% +16.3%

-------- -------- --------- ------------------ ------

Underlying operating margin 8.5% 8.0% +50 bps +40 bps

-------- -------- --------- ------------------ ------

Note - There are no adjustments between underlying operating

profit and statutory reported operating profit.

Revenue increased by 10.6% on a constant currency basis, with an

increase in like-for-like sales of 6.4% and net contract gains of

4.2%. Like-for-like sales were stronger than expected, driven by

ongoing passenger growth in India and Egypt, which continues its

recovery from the terrorist incidents a few years ago.

Like-for-like sales further benefitted from closure of competitor

units in Hong Kong, a trend that is expected to reverse in the

second half. Towards the end of the period we started to see some

impact from the suspension of operations of Jet Airways in India

and the grounding of Boeing 737 Max aircraft.

Net gains came mainly from new units at Phuket in Thailand and

at Delhi in India, as well as the new contract at Cebu Airport in

the Philippines which opened last year.

Underlying operating profit for the Rest of the World was

GBP15.9m, an increase of 16.3% on a constant currency basis, driven

by the strong like-for-like sales.

Share of profit of associates

The Group's share of profit from associates was GBP2.1m (H1

2018: GBP0.2m) reflecting good performances from associate

operations in Cyprus and profit improvement in our associate in

France which operate in Charles de Gaulle Airport.

Net finance costs

Underlying net finance costs increased over the prior period to

GBP10.4m (H1 2018: GBP6.7m), primarily due to the higher net debt

compared to last year. Reported net finance costs were GBP12.3m (H1

2018: GBP6.0m), the additional charge primarily relates to the

GBP1.6m revaluation of the financial liability to acquire the

remaining 16% interest in TFS. Underlying net finance costs are

expected to be at a similar level in the second half with full year

costs of around GBP20m.

Taxation

The Group's underlying tax charge for the period was GBP12.0m

(H1 2018: GBP10.7m), equivalent to an effective tax rate of 22.1%

(H1 2018: 22.0%) of underlying profit before tax. On a reported

basis the tax charge for the period was GBP12.1m (H1 2018:

GBP10.5m). Looking forward we expect the underlying tax rate to

remain around 22% for the full year.

Non-controlling interests

The profit attributable to non-controlling interests was

GBP11.0m (H1 2018: GBP11.1m), most of which relate to our joint

venture businesses in North America and the Rest of the World. For

the full year, we expect the profit attributable to our

non-controlling interests to be approximately GBP28m.

Earnings per share

Underlying earnings per share was 6.7 pence per share (H1 2018:

5.6 pence per share), an increase of 19.6% year-on-year. Reported

earnings per share was 6.1 pence per share (H1 2018: 5.6 pence per

share).

Dividends

The Board has declared an interim dividend of 5.8 pence per

share (H1 2018: 4.8 pence), with a view to maintaining the pay-out

ratio for the full year at 40%, consistent with the Group's stated

priorities for the uses of cash and after careful review of the

capital expenditure requirements for the coming years. The dividend

will be paid on 28 June 2019 to shareholders registered on 7 June

2019. The ex-dividend date will be 6 June 2019.

Post balance sheet events

On 11 April 2019, the Group signed an agreement to issue US

Private Placement notes (the 'Notes') of US$ 199.5m and EUR58.5m.

The notes represent SSP's second issue in the US Debt Private

Placement market, following its inaugural issue in 2018 and carry a

fixed rate of interest.

On 15 April 2019, the Company completed a share consolidation to

maintain the comparability of the Company's share price before and

after the special dividend.

In April 2019, the Group acquired a further 16% stake and

thereby completed the planned acquisition of its 49% stake in

Travel Food Services Private Limited ("TFS"), one of India's

largest travel food companies.

Cash flow

The table below presents a summary of the Group's cash flow for

the first half of 2019:

H1 2019 H1 2018

GBPm GBPm

Underlying operating profit(1) 62.5 55.2

Depreciation and amortisation 52.8 47.7

Working capital (36.3) (0.5)

Net tax (18.7) (17.6)

Other (3.0) 7.0

Underlying net cash flow from operating activities 57.3 91.8

Capital expenditure(2) (108.2) (61.5)

Acquisition of subsidiaries, adjusted for net debt acquired (3) (3.4) (18.8)

Net dividends to non-controlling interests and from associates (15.5) (11.5)

Underlying operating cash flow (69.8) (0.0)

Net finance costs (6.1) (6.1)

Other - (0.4)

-------- ---------

Underlying free cash flow (75.9) (6.5)

Dividend paid (25.2) (23.5)

-------- ---------

Underlying net cash flow (101.1) (30.0)

-------- ---------

(1) Presented on an underlying basis (refer to page 15 for

details)

(2) Capital expenditure is net of capital contributions from

non-controlling interests of GBP3.5m (H1 2018: GBP2.6m)

(3) Current period amount relates to the acquisition of SSP

D&B DFW LLC in the US. Prior period amount relates to Stockheim

and comprises consideration GBP19.3m less cash and cash equivalents

acquired GBP0.5m

The Group generated underlying net cash flow from operating

activities of GBP57.3m (H1 2018: GBP91.8m) and saw an underlying

free cash outflow of GBP75.9m, which was GBP69.4m higher than the

first half of 2018. This is driven by the seasonality of our

working capital cycle in the first half (mainly due to timing of

Easter) and higher capital expenditure in the first half of the

year compared to last year.

The working capital usage of GBP36.3m was GBP35.8m higher than

last year, reflecting the later timing of Easter and, in

particular, the unusual performance last year, where we saw almost

no cash usage. Last year Easter fell exactly at the end of the

first half and as a consequence working capital benefitted from the

seasonal sales uplift as well as a number of material rent payments

falling into the second half. For the full year we anticipate a

normal cash inflow as a consequence of an increase in the negative

working capital in the business.

Capital expenditure was GBP108.2m, up GBP46.7m vs last year. The

increase compared to last year reflects the phasing of the

investment, with new unit development being very first half

weighted. In the full year we expect capital spend in the region of

GBP160m. The increase of approximately GBP15m from the previous

guidance reflects an increase in our expectations for net gains

from c. 3% to between 4% and 5% for the full year.

Net finance costs paid of GBP6.1m were in line with the first

half of 2018. Overall, the Group had net cash outflow of GBP101.1m

during the period.

The dividend paid of GBP25.2m reflects the payment of the 2018

final dividend of 5.4 pence per share.

Balance sheet and net debt

Net assets increased slightly in the first half to GBP461.0m (30

September 2018: GBP458.3m), with net debt increasing to GBP433.4m

(30 September 2018: GBP334.7m) reflecting the normal seasonality of

the business ahead of the peak summer trading period.

GBPm

Opening net debt (1 October 2018) (334.7)

Net cash flow (excluding impact of foreign exchange) (101.1)

Impact of foreign exchange rates 8.2

Other (5.8)

--------

Closing net debt (31 March 2019) (433.4)

--------

The increase in net debt of GBP98.7m was driven by the net cash

outflow of GBP101.1m partially offset by a foreign exchange

translation impact of GBP8.2m arising from the strengthening of

Sterling during the period.

Leverage in the first half with net debt: EBITDA at 1.4 times,

compared with 1.1 times at 31 March 2018. By the year end we

anticipate leverage remaining at c. 1.4 times, reflecting strong

operating cash generation in the second half and after the payment

of the GBP150m special dividend in April 2019.

Going concern

After making due enquiries, the Directors have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for at least 12 months from the date of

approval of this report and, therefore, continue to adopt the going

concern basis in preparing the accounts.

Principal risks

The principal risks facing the Group for the remainder of the

year are unchanged from those reported in the Annual Report and

Accounts 2018.

These risks, together with the Group's risk management process,

are detailed on pages 17 to 22 of the Annual Report and Accounts

2018, and relate to the following areas: business environment;

retention of existing client relationships; Brexit; labour laws and

unions; implementation of efficiency programmes; changing client

behaviours; regulatory compliance; execution and mobilisation of

new contracts; expansion into new markets; senior management

capability and retention; competitive intensity; outsourcing

programmes; cyber security; maintenance/development of brand

portfolio; business development capability and investment; and tax

compliance and management.

Alternative Performance Measures

The Directors use alternative performance measures for analysis

as they believe these measures provide additional useful

information on the underlying trends, performance and position of

the Group. The alternative performance measures are not defined by

IFRS and therefore may not be directly comparable with other

companies' performance measures and are not intended to be a

substitute for IFRS measures.

Revenue growth

As the Group operates in over 30 countries, it is exposed to

translation risk on fluctuations in foreign exchange rates, and as

such the Group's reported revenue and operating profit will be

impacted by movements in actual exchange rates. The Group presents

its financial results on a constant currency basis in order to

eliminate the effect of foreign exchange rates and to evaluate the

underlying performance of the Group's businesses. The table below

reconciles reported revenue to constant currency sales growth,

like-for-like sales growth, net contract gains/(losses) and the

impact of acquisitions where appropriate.

(GBPm) UK Continental Europe North America RoW Total

H1 2019 Revenue at actual rates by segment 385.2 452.7 235.9 187.8 1,261.6

Impact of foreign exchange 0.1 4.4 (7.2) (0.9) (3.6)

------ ------------------- -------------- ------ --------

H1 2019 Revenue at constant currency(1) 385.3 457.1 228.7 186.9 1,258.0

------ ------------------- -------------- ------ --------

H1 2018 Revenue at constant currency 369.5 439.2 200.4 169.0 1,178.2

Constant currency sales growth 4.3% 4.1% 14.1% 10.6% 6.8%

Which is made up of:

Like-for-like sales growth(2) 1.4% (0.8)% 5.4% 6.4% 2.0%

Net contact gains/(losses)(3) 2.9% 3.1% 8.7% 4.2% 4.1%

Impact of acquisitions(4) - 1.8% - - 0.7%

------ ------------------- -------------- ------ --------

4.3% 4.1% 14.1% 10.6% 6.8%

------ ------------------- -------------- ------ --------

(1) Constant currency is based on average 2018 exchange rates

weighted over the financial year by 2018 results.

(2) Like-for-like sales represent revenues generated in an

equivalent period in each financial period in outlets which have

been open for a minimum of 12 months. Like-for-like sales are

presented on a constant currency basis.

(3) Net contract gains/(losses) represent the net year-on-year

revenue impact from new outlets opened and existing units closed in

the past 12 months. Net contract gains/(losses) are presented on a

constant currency basis.

(4) Acquisition impact represents the revenue impact from

acquired outlets owned for less than 12 months. Acquisition impact

is presented on a constant currency basis. Once the acquisition

annualises revenue is included in like-for-like sales or net

contract gains where appropriate.

Underlying profit measures

The Group presents underlying profit measures, including

operating profit, profit before tax and earnings per share, which

excludes the amortisation of intangible assets arising on the

acquisition of the SSP business in 2006 and the revaluation of the

obligation to acquire an additional 16% ownership share of TFS. A

reconciliation from the underlying to the statutory reported basis

is presented below.

H1 2019 H1 2018

Underlying Adjustments Total Underlying Adjustments Total

Operating profit (GBPm) 62.5 (0.9) 61.6 55.2 (1.0) 54.2

Operating margin 5.0% (0.1)% 4.9% 4.7% (0.1)% 4.6%

Profit before tax (GBPm) 54.2 (2.8) 51.4 48.7 (0.3) 48.4

Earnings per share (p) 6.7 (0.6) 6.1 5.6 (0.0) 5.6

Responsibility statement of the Directors in respect of the

half-yearly report

We confirm that to the best of our knowledge:

-- The condensed set of financial statements has been prepared

in accordance with IAS 34 Interim Financial Reporting as adopted by

the EU;

-- The interim management report includes a fair review of the information required by:

- DTR 4.2.7R of the Disclosure and Transparency Rules, being an

indication of important events that have occurred during the first

six months of the financial year and their impact on the condensed

set of financial statements; and a description of the principal

risks and uncertainties for the remaining six months of the year;

and

- DTR 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the entity during

that period; and any changes in the related party transactions

described in the last annual report that could do so.

On behalf of the Board

Kate Swann Jonathan Davies

Chief Executive Officer Chief Financial Officer

14 May 2019 14 May 2019

Independent review report to SSP Group plc

Conclusion

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 31 March 2019 which comprises the condensed

consolidated income statement, the condensed consolidated statement

of other comprehensive income, the condensed consolidated balance

sheet, the condensed consolidated statement of changes in equity,

the condensed consolidated cash flow statement, and the related

explanatory notes.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 31

March 2019 is not prepared, in all material respects, in accordance

with IAS 34 Interim Financial Reporting as adopted by the EU and

the Disclosure Guidance and Transparency Rules ("the DTR") of the

UK's Financial Conduct Authority ("the UK FCA").

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity issued by the Auditing Practices Board for use in the

UK. A review of interim financial information consists of making

enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures. We read the other information contained in the

half-yearly financial report and consider whether it contains any

apparent misstatements or material inconsistencies with the

information in the condensed set of financial statements.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK) and

consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

The impact of uncertainties due to the UK exiting the European

Union on our review

Uncertainties related to the effects of Brexit are relevant to

understanding our review of the condensed financial statements.

Brexit is one of the most significant economic events for the UK,

and at the date of this report its effects are subject to

unprecedented levels of uncertainty of outcomes, with the full

range of possible effects unknown. An interim review cannot be

expected to predict the unknowable factors or all possible future

implications for a company and this is particularly the case in

relation to Brexit.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the DTR of the UK FCA.

The annual financial statements of the group are prepared in

accordance with International Financial Reporting Standards as

adopted by the EU. The directors are responsible for preparing the

condensed set of financial statements included in the half-yearly

financial report in accordance with IAS 34 as adopted by the

EU.

Our responsibility

Our responsibility is to express to the company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

The purpose of our review work and to whom we owe our

responsibilities

This report is made solely to the company in accordance with the

terms of our engagement to assist the company in meeting the

requirements of the DTR of the UK FCA. Our review has been

undertaken so that we might state to the company those matters we

are required to state to it in this report and for no other

purpose. To the fullest extent permitted by law, we do not accept

or assume responsibility to anyone other than the company for our

review work, for this report, or for the conclusions we have

reached.

Nicholas Frost

for and on behalf of KPMG LLP

Chartered Accountants

KPMG LLP

15 Canada Square

London

E14 5GL

14 May 2019

Condensed consolidated income statement

for the six months ended 31 March 2019

Six months ended 31 March 2019 Six months ended 31 March 2018

Notes Underlying* Adjustment Total Underlying* Adjustment Total

GBPm GBPm GBPm GBPm GBPm GBPm

Revenue 2 1,261.6 - 1,261.6 1,177.8 - 1,177.8

Operating costs 4 (1,199.1) (0.9) (1,200.0) (1,122.6) (1.0) (1,123.6)

Operating profit 62.5 (0.9) 61.6 55.2 (1.0) 54.2

Share of profit of associates 2.1 - 2.1 0.2 - 0.2

Finance income 5 1.0 - 1.0 1.1 0.7 1.8

Finance expense 5 (11.4) (1.9) (13.3) (7.8) - (7.8)

Profit before tax 54.2 (2.8) 51.4 48.7 (0.3) 48.4

Taxation (12.0) (0.1) (12.1) (10.7) 0.2 (10.5)

Profit for the period 42.2 (2.9) 39.3 38.0 (0.1) 37.9

------------ ----------- ---------- ------------ ----------- ----------

Profit attributable to:

Equity holders of the parent 31.2 (2.9) 28.3 26.9 (0.1) 26.8

Non-controlling interests 11.0 - 11.0 11.1 - 11.1

Profit for the period 42.2 (2.9) 39.3 38.0 (0.1) 37.9

------------ ----------- ---------- ------------ ----------- ----------

Earnings per share (p):

- Basic 3 6.7 6.1 5.6 5.6

- Diluted 3 6.6 6.0 5.5 5.5

*Presented on an underlying basis, refer to page 15 for

details

Condensed consolidated statement of other comprehensive

income

for the six months ended 31 March 2019

Six months ended 31 March 2019 Six months ended 31 March 2018

GBPm GBPm

Other comprehensive income/(expense)

Items that will never be reclassified to the income

statement

Remeasurements on defined benefit pension schemes (2.3) (0.6)

Income tax credit relating to items that will not

be reclassified 0.2 1.7

Items that are or may be reclassified subsequently

to the income statement

Net gain on hedge of net investment in foreign

operations 8.5 5.2

Other foreign exchange translation differences (14.2) (22.1)

Effective portion of changes in fair value of cash

flow hedges (3.3) 2.0

Cash flow hedges - reclassified to the income

statement 2.2 2.3

Income tax credit relating to items that are or may

be reclassified 2.8 0.3

Other comprehensive expense for the period (6.1) (11.2)

Profit for the period 39.3 37.9

Total comprehensive income for the period 33.2 26.7

------------------------------- -------------------------------

Total comprehensive income attributable to:

Equity shareholders 20.2 18.2

Non-controlling interests 13.0 8.5

Total comprehensive income for the period 33.2 26.7

------------------------------- -------------------------------

Condensed consolidated balance sheet

as at 31 March 2019

Notes 31 March 2019 30 September 2018

GBPm GBPm

Non-current assets

Property, plant and equipment 420.5 371.4

Goodwill and intangible assets 724.8 731.2

Investments in associates 13.8 10.6

Deferred tax assets 25.7 23.7

Other receivables 54.9 49.2

Other financial assets 8 - 5.1

1,239.7 1,191.2

Current assets

Inventories 35.9 35.1

Tax receivable 8.2 2.0

Trade and other receivables 178.1 178.0

Cash and cash equivalents 8 166.1 147.8

388.3 362.9

Total assets 1,628.0 1,554.1

-------------- ------------------

Current liabilities

Short term borrowings 8 (90.5) (31.5)

Trade and other payables (461.9) (499.7)

Tax payable (21.9) (25.5)

Provisions (3.5) (3.4)

Obligation to acquire additional share of subsidiary undertaking (22.4) (20.5)

(600.2) (580.6)

Non-current liabilities

Long term borrowings 8 (509.0) (456.1)

Post-employment benefit obligations (16.0) (13.0)

Other payables (2.7) (2.5)

Provisions (22.4) (28.0)

Derivative financial liabilities 8 (4.2) (3.2)

Deferred tax liabilities (12.5) (12.4)

(566.8) (515.2)

Total liabilities (1,167.0) (1,095.8)

-------------- ------------------

Net assets 461.0 458.3

-------------- ------------------

Equity

Share capital 4.8 4.8

Share premium 461.2 461.2

Capital redemption reserve 1.2 1.2

Other reserves (19.0) (13.0)

Retained losses (71.9) (77.7)

Total equity shareholders' funds 376.3 376.5

Non-controlling interests 84.7 81.8

Total equity 461.0 458.3

-------------- ------------------

Condensed consolidated statement of changes in equity

for the six months ended 31 March 2019

Share capital Share premium Other Retained Total parent NCI Total equity

reserves (1) losses equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

At 1 October

2017 4.7 461.2 (10.3) (55.3) 400.3 64.7 465.0

Profit for the

period - - - 26.8 26.8 11.1 37.9

Other

comprehensive

expense for

the period - - (8.0) (0.6) (8.6) (2.6) (11.2)

Issue of

ordinary

shares under

share option

schemes 0.1 - - - 0.1 - 0.1

Capital

contributions

from NCI - - - - - 2.6 2.6

Dividends paid

to equity

shareholders - - - (23.5) (23.5) - (23.5)

Dividends paid

to NCI - - - - - (11.5) (11.5)

Share-based

payments - - - 4.4 4.4 - 4.4

Current and

deferred tax

on share

schemes - - - 1.0 1.0 - 1.0

At 31 March

2018 4.8 461.2 (18.3) (47.2) 400.5 64.3 464.8

-------------- -------------- -------------- -------------- ------------- ------- -------------

At 1 October

2018 4.8 461.2 (11.8) (77.7) 376.5 81.8 458.3

Profit for the

period - - - 28.3 28.3 11.0 39.3

Other

comprehensive

(expense) /

income for

the period - - (6.0) (2.1) (8.1) 2.0 (6.1)

Issue of - - - - - - -

ordinary

shares under

share option

schemes

Capital

contributions

from NCI - - - - - 3.5 3.5

NCI arising on

acquisition - - - - - 0.7 0.7

Dividends paid

to equity

shareholders - - - (25.2) (25.2) - (25.2)

Dividends paid

to NCI - - - - - (14.3) (14.3)

Share-based

payments - - - 4.7 4.7 - 4.7

Current and

deferred tax

on share

schemes - - - 0.1 0.1 - 0.1

-------------- -------------- -------------- -------------- ------------- ------- -------------

At 31 March

2019 4.8 461.2 (17.8) (71.9) 376.3 84.7 461.0

-------------- -------------- -------------- -------------- ------------- ------- -------------

(1) The other reserves includes the capital redemption reserve,

translation reserve, cash flow hedging reserve and the obligation

to acquire an additional share of a joint venture accounted for as

a subsidiary.

Condensed consolidated cash flow statement

for the six months ended 31 March 2019

Notes Six months ended 31 March 2019 Six months ended 31 March 2018

GBPm GBPm

Cash flows from operating activities

Cash flow from operations 6 76.0 103.9

Tax paid (18.7) (17.6)

Net cash flows from operating activities 57.3 86.3

Cash flows from investing activities

Investment in associate (1.3) (1.0)

Dividends received from associates 0.1 1.1

Interest received 0.6 0.8

Purchase of property, plant and equipment (101.5) (55.0)

Purchase of other intangible assets (10.2) (3.6)

Acquisition of subsidiary, net of cash and

cash equivalents acquired (3.4) (18.8)

Net cash flows from investing activities (115.7) (76.5)

Cash flows from financing activities

Receipt of US Private Placement debt 133.3 -

Repayment of finance lease and other loans (12.7) (1.8)

Financing fee paid (1.0) (2.0)

Investment in other financial assets - 3.4

Interest paid (6.7) (6.9)

Dividends paid to equity shareholders (25.2) (23.5)

Dividends paid to non-controlling interests (14.3) (11.6)

Capital contribution from non-controlling

interests 3.5 2.6

Net cash flows from financing activities 76.9 (39.8)

Net increase / (decrease) in cash and cash

equivalents 18.5 (30.0)

Cash and cash equivalents at beginning of

the period 147.8 178.1

Effect of exchange rate fluctuations on

cash and cash equivalents (0.2) (2.6)

Cash and cash equivalents at end of the

period 166.1 145.5

------------------------------- -------------------------------

Reconciliation of net cash flow to movement

in net debt

Net increase / (decrease) in cash in the

period 18.5 (30.0)

Cash inflow US Private Placement debt (133.3) -

Cash outflow from change in debt and

finance leases 12.7 1.8

Financing fee paid 1.0 2.0

Cash inflow from investment in other

financial assets - (3.4)

Change in net debt resulting from cash

flows (101.1) (29.6)

Translation differences 8.2 2.3

Other non-cash changes (5.8) (0.6)

Increase in net debt in the period (98.7) (27.9)

Net debt at beginning of the period (334.7) (262.2)

Net debt at end of the period (433.4) (290.1)

------------------------------- -------------------------------

Notes

1 Preparation

Basis of preparation and statement of compliance

The condensed consolidated half-yearly financial statements of

SSP Group plc (the Group) have been prepared in accordance with

International Accounting Standard (IAS) 34, Interim Financial

Reporting as adopted by the EU. The annual consolidated financial

statements of the Group are prepared in accordance with

International Financial Reporting Standards as adopted by the EU

(IFRS) and the Companies Act 2006 applicable to companies reporting

under IFRS. These condensed consolidated half-yearly financial

statements do not comprise statutory accounts within the meaning of

Section 435 of the Companies Act 2006, and should be read in

conjunction with the Annual Report and Accounts 2018. The

comparative figures for the six months ended 31 March 2018 are not

the Group's statutory accounts for that financial year. Those

accounts were reported upon by the Group's auditors and delivered

to the registrar of companies. The report of the auditors was

unqualified, did not include a reference to any matters to which

the auditors drew attention by way of emphasis without qualifying

their report and did not contain statements under Section 498 (2)

or (3) of the Companies Act 2006.

These financial statements are presented in Sterling and unless

stated otherwise, rounded to the nearest GBP0.1 million. The

financial statements are prepared on the historical cost basis

except for the derivative financial instruments which are stated at

their fair value.

Except as described below, the accounting policies adopted in

the preparation of these condensed consolidated half-yearly

financial statements to 31 March 2019 are consistent with the

accounting policies applied by the Group in its consolidated

financial statements as at, and for the year ended, 30 September

2018 as required by the Disclosure and Transparency Rules of the

UK's Financial Conduct Authority.

Changes in accounting policy and disclosures

IFRS 9 'Financial Instruments' and IFRS 15 'Revenue from

contracts with customers' were adopted this financial year. IFRS 9

replaced IAS 39 'Financial Instruments: Recognition and

measurement' whereas IFRS 15 replaced IAS 11 'Construction

contracts' and IAS 18 'Revenue'.

The remaining accounting policies adopted are consistent with

those of the previous year.

The following standards, issued by the IASB and endorsed by the

EU, have not yet been adopted:

IFRS 16 'Leases' (effective for the year ending 30 September

2020) requires lessees to recognise operating leases on the Group's

balance sheet. However, where leases have a lease term of 12 months

or less or the underlying asset has a low value, an election can be

made not to recognise such assets. The standard, which replaces IAS

17 'Leases', will give rise to the recognition of an asset

representing the right-of-use of the leased item and a related

liability being the future lease payment obligations. Therefore,

costs currently classified as operating lease costs will be

reclassified and split between the depreciation of the asset, on a

straight-line basis, and interest on the lease liability. This

reclassification will increase EBITDA with corresponding increases

in the depreciation charge and interest expense. The Group will

adopt a modified retrospective approach to transition and is

currently working on an implementation plan. IFRS 16 will have a

material impact on the Group's consolidated results and an

associated impact on both assets and liabilities.

2 Segmental reporting

SSP operates in the food and beverage travel sector, mainly at

airports and railway stations.

Management monitors the performance and strategic priorities of

the business from a geographic perspective, and in this regard has

identified the following four key "reportable segments": the UK,

Continental Europe, North America and Rest of the World (RoW). The

UK includes operations in the United Kingdom and the Republic of

Ireland; Continental Europe includes operations in the Nordic

countries and in Western and Southern Europe; North America

includes operations in the United States and Canada; and RoW

includes operations in Eastern Europe, the Middle East, Asia

Pacific and India. These segments comprise countries which are at

similar stages of development and demonstrate similar economic

characteristics.

The Group's management assesses the performance of the operating

segments based on revenue and underlying operating profit. Interest

income and expenditure are not allocated to segments, as they are

managed by a central treasury function, which oversees the debt and

liquidity position of the Group. The non-attributable segment

comprises costs associated with the Group's head office function

and depreciation of central assets.

UK Continental North RoW Non-attributable Total

Europe America

GBPm GBPm GBPm GBPm GBPm GBPm

Six months ended 31 March 2019

------ ------------ --------- ------ ----------------- --------

Revenue 385.2 452.7 235.9 187.8 - 1,261.6

------ ------------ --------- ------ ----------------- --------

Underlying operating profit/(loss) 39.1 17.7 9.5 15.9 (19.7) 62.5

------ ------------ --------- ------ ----------------- --------

Six months ended 31 March 2018

------ ------------ --------- ------ ----------------- --------

Revenue 369.5 440.5 198.4 169.4 - 1,177.8

------ ------------ --------- ------ ----------------- --------

Underlying operating profit/(loss) 33.4 21.8 6.4 13.6 (20.0) 55.2

------ ------------ --------- ------ ----------------- --------

The following amounts are included in underlying operating

profit:

UK Continental North RoW Non-attributable Total

Europe America

GBPm GBPm GBPm GBPm GBPm GBPm

Six months ended 31 March 2019

------ ------------ --------- ------ ----------------- -------

Depreciation and amortisation* (7.4) (17.9) (15.3) (9.0) (3.2) (52.8)

------ ------------ --------- ------ ----------------- -------

Six months ended 31 March 2018

------ ------------ --------- ------ ----------------- -------

Depreciation and amortisation* (5.7) (16.2) (15.6) (8.3) (1.9) (47.7)

------ ------------ --------- ------ ----------------- -------

* Excludes amortisation of acquisition related intangible

assets.

A reconciliation of underlying operating profit to profit before

and after tax is provided as follows:

Six months ended 31 March 2019 Six months ended 31 March 2018

GBPm GBPm

Underlying operating profit 62.5 55.2

Adjustments to operating costs (note 4) (0.9) (1.0)

Share of profit from associates 2.1 0.2

Finance income 1.0 1.1

Finance expense (11.4) (7.8)

Adjustments to finance expense (note 5) (1.9) 0.7

------------------------------- -------------------------------

Profit before tax 51.4 48.4

Taxation (12.1) (10.5)

------------------------------- -------------------------------

Profit after tax 39.3 37.9

------------------------------- -------------------------------

3 Earnings per share

Basic earnings per share is calculated by dividing the result

for the period attributable to ordinary shareholders by the

weighted average number of ordinary shares outstanding during the

period. Diluted earnings per share is calculated by dividing the

result for the period attributable to ordinary shareholders by the

weighted average number of ordinary shares outstanding during the

period adjusted by potentially dilutive outstanding share

options.

Underlying earnings per share is calculated the same way except

that the result for the period attributable to ordinary

shareholders is adjusted for specific items as detailed below:

Six months ended 31 March 2019 Six months ended 31 March 2018

GBPm GBPm

Profit attributable to ordinary shareholders 28.3 26.8

Adjustments:

Amortisation of acquisition-related intangibles 0.9 1.0

Net revaluation and discount unwind of the TFS

financial liability (note 5) 1.9 (0.7)

Tax effect of adjustments 0.1 (0.2)

------------------------------- -------------------------------

Underlying profit attributable to ordinary

shareholders 31.2 26.9

------------------------------- -------------------------------

Basic weighted average number of shares 466,385,491 476,769,504

Dilutive potential ordinary shares 4,356,506 8,667,255

------------------------------- -------------------------------

Diluted weighted average number of shares 470,741,997 485,436,759

------------------------------- -------------------------------

Earnings per share (p):

- Basic 6.1 5.6

- Diluted 6.0 5.5

Underlying earnings per share (p):

- Basic 6.7 5.6

- Diluted 6.6 5.5

The number of ordinary shares in issue as at 31 March 2019 was

467,021,646 (31 March 2018: 479,392,339).

4 Operating costs

Six months ended 31 March 2019 Six months ended 31 March 2018

GBPm GBPm

Cost of food and materials:

Cost of inventories consumed in the period (369.4) (356.3)

Labour cost:

Employee remuneration (385.1) (356.7)

Overheads:

Depreciation of property, plant and equipment (48.7) (44.2)

Amortisation of intangible assets - software (4.1) (3.5)

Amortisation of acquisition-related intangible

assets (0.9) (1.0)

Rentals payable under operating leases (248.6) (222.3)

Other overheads (143.2) (139.6)

(1,200.0) (1,123.6)

------------------------------- -------------------------------

Adjustments to operating costs

Amortisation of intangible assets arising on

acquisition (0.9) (1.0)

------------------------------- -------------------------------

(0.9) (1.0)

------------------------------- -------------------------------

5 Finance income and expense

Six months ended 31 March 2019 Six months ended 31 March 2018

GBPm GBPm

Finance income

Interest income 1.0 1.0

Net foreign exchange gains - 0.1

Net revaluation and discount unwind of TFS

financial liability - 0.7

------------------------------- -------------------------------

Total finance income 1.0 1.8

------------------------------- -------------------------------

Finance expense

Total interest expense on financial liabilities

measured at amortised cost (7.2) (4.4)

Net change in fair value of cash flow hedges

utilised in the period (2.2) (2.3)

Unwind of discount on provisions (0.3) (0.2)

Net interest expense on defined benefit pension

obligations - (0.1)

Net foreign exchange losses (0.7) -

Net revaluation and discount unwind of TFS (1.9) -

financial liability

Other (1.0) (0.8)

------------------------------- -------------------------------

Total finance expense (13.3) (7.8)

------------------------------- -------------------------------

Adjustments to finance expense

The adjustments to finance expense in the period to 31 March

2019 include the revaluation and discount unwind of the obligation

to acquire an additional 16% share of TFS in April 2019.

Six months ended 31 March 2019 Six months ended 31 March 2018

Unwind of discount on obligation to acquire

additional share of subsidiary undertaking (0.3) (0.2)

Foreign exchange (loss) / gain on revaluation of

obligation to acquire additional share of

subsidiary undertaking (1.6) 0.9

Net revaluation and discount unwind of TFS

financial liability (1.9) 0.7

------------------------------- -------------------------------

6 Cash flow from operations

Six months ended 31 March 2019 Six months ended 31 March 2018

GBPm GBPm

Profit for the period 39.3 37.9

Adjustments for:

Depreciation 48.7 44.3

Amortisation 5.0 4.4

Share-based payments 4.7 7.1

Finance income (1.0) (1.8)

Finance expense 13.3 7.8

Share of profit of associates (2.1) (0.2)

Taxation 12.1 10.5

------------------------------- -------------------------------

120.0 110.0

Increase in trade and other receivables (5.8) (16.1)

Increase in inventories (0.8) (1.4)

Increase/(decrease) in trade and other payables

including provisions (37.4) 11.4

Cash flow from operations 76.0 103.9

------------------------------- -------------------------------

7 Dividends

Six months ended 31 March 2019 Six months ended 31 March 2018

GBPm GBPm

Prior year final dividend of 5.4p per share paid in

the period (2018: 4.9p) (25.2) (23.5)

(25.2) (23.5)

------------------------------- -------------------------------

The proposed interim dividend of 5.8 pence per share (H1 2018:

4.8 pence per share), totalling GBP25.8m (H1 2018: GBP22.2m), will

be paid on 28 June 2019 to shareholders on the register on 7 June

2019.

8 Fair value measurement

Certain of the Group's financial instruments are held at fair

value.

The fair values of financial instruments held at fair value have

been determined based on available market information at the

balance sheet date, and the valuation methodologies detailed

below:

- the fair values of the Group's borrowings are calculated based

on the present value of future principal and interest cash flows,

discounted at the market rate of interest at the balance sheet

date; and

- the derivative financial liabilities relate to interest rate

swaps. The fair values of interest rate swaps have been determined

using relevant yield curves and exchange rates as at the balance

sheet date.

Carrying value and fair values of certain financial

instruments

The following table shows the carrying value of financial assets

and financial liabilities. It does not include information for

financial assets and financial liabilities not measured at fair

value if the carrying value is a reasonable approximation of fair

value.

Carrying value

31 March 30 September

2019 2018

GBPm GBPm

Financial instruments measured at fair value:

Non-current

Derivative financial liabilities (4.2) (3.2)

Financial instruments not measured at fair value:

Non-current

Other financial assets - 5.1

Long term borrowings (509.0) (456.1)

Current

Cash and cash equivalents 166.1 147.8

Short term borrowings (90.5) (31.5)

Financial assets and liabilities in the Group's consolidated

balance sheet are either held at fair value, or their carrying

value approximates to fair value, with the exception of loans,

which are held at amortised cost. The fair value of total

borrowings estimated using market prices at 31 March 2019 is

GBP604.3m (30 September 2018: GBP492.1m).

All of the financial assets and liabilities measured at fair

value are classified as level 2 using the fair value hierarchy

whereby inputs, which are used in the valuation of these financial

assets, and liabilities and have a significant effect on the fair

value, are observable either directly or indirectly. There were no

transfers during the period.

9 Post balance sheet events

On 11 April 2019, the Group signed an agreement to issue US

Private Placement notes (the 'Notes') of US$199.5m and EUR58.5m.

The notes represent SSP's second issue in the US Debt Private

Placement market, following its inaugural issue in 2018 and carry a

fixed rate of interest. The notes will be issued in July 2019 and

December 2019 in four series: US$66.5m at 4.06% to be issued in

July 2019 and maturing in July 2026; US$66.5m at 4.25% to be issued

in December 2019 and maturing in December 2027; US$66.5m at 4.35%

to be issued in December 2019 and maturing in December 2029; and

EUR58.5m at 2.11% to be issued in July 2019 and maturing in July

2031.

On 15 April 2019, the Company completed a share consolidation to

maintain the comparability of the Company's share price before and

after the special dividend. Each shareholder received 20 new

ordinary shares in substitution for every 21 existing ordinary

shares held at the record date. Following this, on 26 April 2019,

the special dividend of 32.1 pence per share was paid to

shareholders equating to c. GBP150m.

In April 2019, the Group completed the planned acquisition of

its 49% stake in Travel Food Services Private Limited ("TFS"), one

of India's largest travel food companies. In line with the terms of

the acquisition originally announced in October 2016, SSP agreed to

create the joint venture with K Hospitality Corp, a leading player

in the F&B industry in India, and acquire a 49% stake in two