Volex PLC Acquisition of Servatron Inc (2132H)

30 Luglio 2019 - 12:42PM

UK Regulatory

TIDMVLX

RNS Number : 2132H

Volex PLC

30 July 2019

30 July 2019

Volex plc

("Volex" or the "Company")

Acquisition of Servatron

"Following through on Volex's strategy of building leading

positions in niche sectors with structural growth drivers"

Volex, the global supplier of complex assemblies for

performance-critical applications and power products, is pleased to

announce it has signed an agreement for the acquisition of all of

the issued stock shares and stock units of Servatron, Inc.

("Servatron") for a total consideration of up to $28.5 million,

including the assumption of net debt of approximately $6.7 million

(the "Acquisition"). We expect the transaction to close on 31 July

2019, subject to customary closing conditions.

Headquartered in Spokane, Washington, Servatron currently

supplies printed circuit board assemblies ("PCBA"), box builds and

complete sub-assembly solutions from a single manufacturing site in

the USA. For the year ended 31 December 2018, Servatron generated

sales of $35.6 million and profit before taxation of $2.5 million.

As a result of strong growth in the six months ended 31 June 2019,

it generated sales of $23.1 million and profit before taxation of

$2.0 million.

Background to the Acquisition

Servatron's business is a complementary fit with Volex's

strategy to maintain and build leading positions in niche sectors

with structural growth drivers and defensive characteristics.

Servatron adds complementary technologies including PCBA

manufacturing, state-of-the-art test capabilities and higher-level

system integration.

Anticipated Benefits from the Acquisition

-- By combining our cable-assemblies expertise and R&D

skills we will drive revenues for the newly enlarged Volex

-- Servatron adds complementary test technologies, higher levels

of system integration and PCBA assembly expertise

-- A strengthened footprint in North America

-- Increased organic growth through value-added services for our

existing cable harness customers

-- The incorporation into our business of a skilled local workforce and management team

-- The opportunity for further expansion of PCBA capabilities in other production locations

Consideration

The equity consideration of up to $21.8 million comprises:

-- $12.9 million in cash paid on completion of the Acquisition ("Completion")

-- $2.3 million satisfied by the issue of 2,233,712 million

ordinary shares in Volex (the "Consideration Shares") on

Completion

-- Up to $3.5 million in cash, which may be payable within two

years of Completion based on certain profit targets of Servatron

being met

-- Up to $3.1 million to be satisfied by the issue of 2,962,478

million ordinary shares in Volex within two years of Completion

based on certain profit and employment targets being met

The Consideration Shares are subject to a six-month lock-up.

Application has been made to the London Stock Exchange for the

admission of the Consideration Shares to trading on AIM

("Admission"). Admission is expected to take place at 8.00 am on 5

August 2019.

Following the issue of the Consideration Shares, the issued

share capital of the Company will comprise 149,601,645 ordinary

shares of 25 pence, each with one voting right. The above figure

may be used by shareholders in the Company as the denominator for

the calculations by which they will determine if they are required

to notify their interest in, or a change to their interest in, the

share capital of the Company.

Commenting on the acquisition, Nat Rothschild, Executive

Chairman of Volex, said:

"It is an extremely high-quality and well-managed business,

which will now be able to access our unique global footprint. Our

own world-class cable assemblies division gets a diverse range of

interconnect products and integrated solutions to offer our

existing accounts. This is a win-win deal."

The information contained within this announcement is deemed by

the Company to constitute inside information under Article 7 of the

Market Abuse Regulations (EU) No. 596/2014. The person responsible

for arranging the release of this information is Mr Daren Morris,

CFO of the Company.

Enquiries

For further information please contact:

Volex plc +44 7909 995 887

Nat Rothschild, Executive Chairman

Daren Morris, Chief Financial Officer and Company Secretary

N+1 Singer - Nominated Adviser & Joint Broker +44 20 7496

3000

Shaun Dobson

Whitman Howard - Joint Broker +44 20 7659 1234

Hugh Rich

Nick Lovering

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQDMGFNGGMGLZM

(END) Dow Jones Newswires

July 30, 2019 06:42 ET (10:42 GMT)

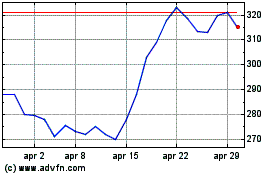

Grafico Azioni Volex (LSE:VLX)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Volex (LSE:VLX)

Storico

Da Apr 2023 a Apr 2024