TIDMTRP

RNS Number : 8900L

Tower Resources PLC

11 September 2019

Tower Resources plc

Interim Results to 30 June 2019

11 September 2019

Tower Resources plc (the "Company" or "Tower" (TRP.L, TRP LN)),

the AIM-listed oil and gas company with its focus on Africa,

announces its Interim Results for the six months ended 30 June

2019.

HIGHLIGHTS

-- January 2019 placing of 170 million new ordinary shares at 1p

to raise GBP1.7 million (gross), together with issuance of placing

warrants, broker warrants, and agreement of directors to accept

warrants in lieu of fees;

-- February 2019 announcement by Total of a 1 billion boe

gas-condensate discovery at its Brulpadda well in the Outeniqua

basin, on its Blocks 11B/12B in South Africa, which is immediately

adjacent to the Company's 50%-owned Algoa-Gamtoos license;

-- Release of Operator's estimates of 510 Million boe of mean

unrisked recoverable resource potential in the Algoa-Gamtoos

license, including a 346 million boe prospect in the Outeniqua

basin section of the license;

-- April 2019 announcement of a Bridging Loan of US$750,000,

with associated warrants, provided by Pegasus Petroleum Ltd and

other parties to fund working capital while the Company pursues a

farm-out of its Thali license in Cameroon;

-- June 2019 subscription of 15 million new ordinary shares at

1p to raise GBP150,000 of further working capital.

POST REPORTING PERIOD EVENTS

-- July 2019 award in the Company's favour by the First-Tier

Tribunal (Tax Chamber) in respect of the Company's VAT dispute with

HMRC (where HMRC has subsequently requested leave to appeal to the

Higher Tribunal);

-- Ongoing well planning and preparatory work for the intended

2019 Thali drilling programme in Cameroon;

-- Continuation of farm-out processes in respect of both the

Thali license in Cameroon and the Algoa-Gamtoos license in South

Africa;

-- Substantial farm-out discussions in respect of Thali

-- Extension of bridging loan until 31 August 2019 with grace

period until 30 September 2019

-- Now seeking funding for working capital and to repay bridging

loan.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

Contacts

Tower Resources plc info@towerresources.co.uk

Jeremy Asher

Chairman and CEO

Andrew Matharu

VP - Corporate Affairs

SP Angel Corporate Finance

LLP

Nominated Adviser and joint

broker +44 20 3470 0470

Stuart Gledhill

Caroline Rowe

Whitman Howard Limited

Joint Broker

Nick Lovering

Hugh Rich +44 20 7659 1234

Turner Pope Investments

(TPI) Limited

Joint Broker

Andy Thacker +44 20 3621 4120

Yellow Jersey PR Limited

Sarah Hollins +44 7764 947 137

Henry Wilkinson +44 7951 402 336

CHAIRMAN AND CHIEF EXECUTIVE OFFICER'S STATEMENT FOR THE SIX

MONTHSED 30 JUNE 2019

In the months since we released our Annual Report we have been

working towards two key objectives: resolving the logistical

challenges associated with site preparation for our Njonji-3 well

in Cameroon; and obtaining financing for that well.

The site preparation issue arose when we found out in late April

that the previous license operator, Total, had not conducted a full

site survey with boreholes prior to its own drilling on this

location a few years ago. Until late April, this information had

simply been missing from the files provided to us when we took over

the license. While having boreholes drilled prior to jacking up a

rig is not a requirement for some operators and rigs, the owners of

both the Topaz Driller and the COSL Seeker and their marine

insurance providers do require such surveys to be performed. One

consequence of the relatively low level of drilling activity

recently is that there are not a large number of vessels capable of

conducting this kind of borehole survey that are active in the

Atlantic Basin, and we have to work around the existing commitments

and schedules of those vessels. We have identified a suitable

vessel some time ago, but it has been working on the other side of

the Atlantic and is only coming to West Africa later this month. We

are currently negotiating an LOI to use this vessel for the

survey.

This has required us to build more flexibility into our rig

arrangements to accommodate this uncertain schedule. We already

switched rigs from the Topaz Driller to the COSL Seeker for this

reason. The two rigs are former sister vessels, and Vantage, who

own the Topaz Driller, have been as flexible as they could be; but

the COSL Seeker provides greater flexibility as the rig is already

in Cameroon, having just completed a series of wells for Addax, and

is due to have its 5-year survey in Cameroon as well, which

provides further flexibility.

The critical path item is the site survey, and we do not now see

how this can be done in September. Assuming the site survey is

completed in October or November, this makes December a more

realistic date for spudding the well. This will of course require

the agreement of the Société Nationale des Hydrocarbures ("SNH")

and the Ministry ("MINMIDT") on behalf of the Government of

Cameroon due to the license anniversary having passed during the

intervening period, which we expect will be forthcoming as we have

been keeping them closely informed of our progress and we believe

that they understand the reasons for this delay. We will keep

shareholders advised of both further progress on the well schedule

and also of the outcome of discussions with MINMIDT.

At the same time we have also been working on the financing for

the well. The initial feedback we have had from banks has been that

the project should be suitable for bank financing after the NJOM-3

well has been completed and tested, since this should provide us

with proven reserves at Njonji, but we have not been able to put

either senior or mezzanine loans in place for the current well, so

we have been looking for partners to farm in to the license to help

fund the current well in order to minimise demands on shareholders.

We currently have substantial discussions underway with several

companies who are interested to farm in, but each of them requires

more time to finalise their own financing and to be able to commit

to the well. One positive consequence of the operational delay is

that it has provided us with more time to complete these farm-out

discussions which, provided they are successful, should allow us to

finance the NJOM-3 well with little or no further demand on

shareholders funds from that point on.

Overall, we remain confident about the Thali licence and the

Njonji development. Since the OIL Reserve Report which was

published last year, we have made substantial progress on well

preparations, despite the delays, and our internally projected well

costs are still running substantially below the cost estimates in

that report, with our long lead items now already acquired and in

place in Douala. The overall project economics remain robust and

attractive, which is why we continue to attract farm-out

interest.

However, in the meantime we will still need to raise some funds

for working capital, because we have very little cash on hand. We

already committed the funds we raised in January to long lead items

and well planning (as promised at that time) and since April we

have been relying on the limited funds we raised from the Bridging

facility and a small share issue, together comprising less than

US$1 million, to keep the well on schedule and our other operations

working. As a result, the Company has substantial trade and other

creditors and the Bridging facility, which was extended until 31

August 2019, is now overdue for repayment though remains subject to

a grace period until 30 September 2019.

Our cash on hand and the funds we are expecting from our current

VAT refund claim amount to just over US$160,000 at time of writing.

HMRC has advised us that, as expected, they are seeking leave to

appeal against the First Tier Tribunal (Tax Chamber) ("FTT") award

in our favour, which was announced in July 2019; however HMRC's

obligation is to process our VAT returns as usual pending the

conclusion of their appeal process, which we expect will take more

than a year. We are confident that the FTT award will be upheld;

nevertheless, to be conservative, we have maintained the provision

for VAT in our accounts and will maintain that provision until

HMRC's appeal is finally resolved.

In respect of our other licenses, the main news (already

discussed in our Annual Report) has been the successful Brulpadda

well drilled by Total on their license adjoining our Algoa-Gamtoos

license in South Africa, which is a 50-50 joint venture with our

partner and operator, NewAge Energy Algoa (Pty) Ltd ("NewAge").

Total has announced a 1 billion boe gas-condensate discovery in the

Outeniqua basin at Brulpadda, and our understanding is that Total

is now planning further wells in the Outeniqua basin between the

current discovery well and our own license. As NewAge has advised

us that they have identified from our 2D seismic data a potential

364 million boe Deep Albian structure, analogous to Brulpadda, in

the Outeniqua Basin Slope on the Algoa-Gamtoos license, this is an

exciting development for us.

We are also working on finalisation of the JOA with Namcor and

our local partner in respect of our new petroleum agreement in

Namibia.

Altogether we have been busy all summer and making progress on

our projects, even though we are quite frustrated at the delays to

getting our NJOM-3 well underway in Cameroon. But we are continuing

to press ahead as fast as we can, and we look forward to having

more concrete news in the near future.

Jeremy Asher

Chairman and Chief Executive

10 September 2019

INTERIM CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Six months ended Six months ended

30 June 2019 30 June 2018

(unaudited) (unaudited)

Note $ $

-------------------------------------------------------------------- ----- ----------------- --- -----------------

Revenue - -

Cost of sales - -

-------------------------------------------------------------------- ----- ----------------- --- -----------------

Gross profit - -

Other administrative expenses (811,925) (444,354)

Share-based payment charges incurred on issue of new equity 8 (301,222) -

Share-based payment charges incurred on incentivisation of staff

and consultants 8 (125,549) (102,155)

Pre-licence expenditures (810) (3,584)

Impairment / (reversal of impairment) of exploration and evaluation

assets 4 (30,924) (2,806,166)

-------------------------------------------------------------------- ----- ----------------- --- -----------------

Total administrative expenses (1,270,430) (3,356,259)

-------------------------------------------------------------------- ----- ----------------- --- -----------------

Group operating loss (1,270,430) (3,356,259)

Finance income 655 1,043

Finance expense (328,259) 3,792

-------------------------------------------------------------------- ----- ----------------- --- -----------------

Loss for the period before taxation (1,598,034) (3,351,424)

Taxation - -

-------------------------------------------------------------------- ----- ----------------- --- -----------------

Loss for the period after taxation (1,598,034) (3,351,424)

-------------------------------------------------------------------- ----- ----------------- --- -----------------

Other comprehensive income - -

-------------------------------------------------------------------- ----- ----------------- --- -----------------

Total comprehensive expense for the period (1,598,034) (3,351,424)

-------------------------------------------------------------------- ----- ----------------- --- -----------------

Basic loss per share (USc) 3 (0.30c) (0.89c)

-------------------------------------------------------------------- ----- ----------------- --- -----------------

Diluted loss per share (USc) 3 (0.30c) (0.89c)

-------------------------------------------------------------------- ----- ----------------- --- -----------------

INTERIM CONSOLIDATED STATEMENT OF FINANCIAL POSITION

30 June 2019 31 December 2018

(unaudited) (audited)

Note $ $

----------------------------------- ----- -------------- -----------------

Non-current assets

Property, plant and equipment - -

Exploration and evaluation assets 4 22,107,324 19,646,399

----------------------------------- ----- -------------- -----------------

22,107,324 19,646,399

----------------------------------- ----- -------------- -----------------

Current assets

Trade and other receivables 5 33,385 23,979

Cash and cash equivalents 330,029 331,395

----------------------------------- ----- -------------- -----------------

363,414 355,374

----------------------------------- ----- -------------- -----------------

Total assets 22,470,738 20,001,773

----------------------------------- ----- -------------- -----------------

Current liabilities

Trade and other payables 6 2,127,944 1,292,492

----------------------------------- ----- -------------- -----------------

Total liabilities 2,127,944 1,292,492

----------------------------------- ----- -------------- -----------------

Net assets 20,342,794 18,709,281

----------------------------------- ----- -------------- -----------------

Equity

Share capital 7 18,244,493 15,599,626

Share premium 142,219,109 142,376,317

Retained losses (140,120,808) (139,266,662)

----------------------------------- ----- -------------- -----------------

Total shareholders' equity 20,342,794 18,709,281

----------------------------------- ----- -------------- -----------------

Signed on behalf of the Board of Directors

Jeremy Asher

Chairman and Chief Executive

10 September 2019

INTERIM CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Share (1) Share-based Retained Total

capital premium payments losses

reserve

$ $ $ $ $

At 1 January 2018 15,558,095 142,361,529 6,387,408 (141,969,571) 22,337,461

------------------------------------------- ----------- ------------ ---------------- -------------- ------------

Shares issued on settlement of third party

fees 41,531 14,788 - - 56,319

Total comprehensive income for the period - - 102,155 (3,351,424) (3,249,269)

At 30 June 2018 15,599,626 142,376,317 6,489,563 (145,320,995) 19,144,511

------------------------------------------- ----------- ------------ ---------------- -------------- ------------

Shares issued on settlement of third party - - - - -

fees

Total comprehensive income for the period - - 35,029 (470,259) (435,230)

At 31 December 2018 15,599,626 142,376,317 6,524,592 (145,791,254) 18,709,281

------------------------------------------- ----------- ------------ ---------------- -------------- ------------

Shares issued for cash 2,405,461 - - - 2,405,461

Shares issued on settlement of fees 44,062 - - - 44,062

Shares issued on settlement of staff

remuneration 195,344 - - - 195,344

Shares issue costs - (157,208) - - (157,208)

Total comprehensive income for the period - - 743,888 (1,598,034) (854,146)

At 30 June 2019 18,244,493 142,219,109 7,268,480 (147,389,288) 20,342,794

------------------------------------------- ----------- ------------ ---------------- -------------- ------------

(1) The share-based payment reserve has been included within the

retained loss reserve and is a non-distributable reserve.

INTERIM CONSOLIDATED STATEMENT OF CASH FLOWS

Six months ended Six months ended

30 June 2019 30 June 2018

(unaudited) (unaudited)

Note $ $

----------------------------------------------------------------------- ----- ----------------- -----------------

Cash outflow from operating activities

Group operating loss for the period (1,270,430) (3,356,259)

Depreciation of property, plant and equipment - 415

Share-based payments 8 743,888 102,155

Impairment of intangible exploration and evaluation assets 4 30,924 2,806,166

----------------------------------------------------------------------- ----- ----------------- -----------------

Operating cash flow before changes in working capital (495,618) (447,523)

Decrease / (increase) in receivables and prepayments (9,406) 2,572

Increase / (decrease) in trade and other payables 835,452 39,456

----------------------------------------------------------------------- ----- ----------------- -----------------

Cash used in operations 330,428 (405,495)

Interest received 655 1,043

----------------------------------------------------------------------- ----- ----------------- -----------------

Cash used in operating activities 331,083 (404,452)

----------------------------------------------------------------------- ----- ----------------- -----------------

Investing activities

Exploration and evaluation costs 4 (2,491,849) (716,554)

Net cash used in investing activities (2,491,849) (716,554)

----------------------------------------------------------------------- ----- ----------------- -----------------

Financing activities

Cash proceeds from issue of ordinary share capital net of issue costs 7 2,487,659 56,319

Finance costs (328,259) 3,792

----------------------------------------------------------------------- ----- ----------------- -----------------

Net cash from financing activities 2,159,400 60,111

----------------------------------------------------------------------- ----- ----------------- -----------------

Decrease in cash and cash equivalents (1,366) (1,060,895)

Cash and cash equivalents at beginning of period 331,395 2,151,476

----------------------------------------------------------------------- ----- ----------------- -----------------

Cash and cash equivalents at end of period 330,029 1,090,581

----------------------------------------------------------------------- ----- ----------------- -----------------

NOTES TO THE INTERIM FINANCIAL INFORMATION

1. Accounting policies

a) Basis of preparation

This interim financial report, which includes a condensed set of

financial statements of the Company and its subsidiary undertakings

("the Group"), has been prepared using the historical cost

convention and based on International Financial Reporting Standards

("IFRS") including IAS 34 'Interim Financial Reporting' and IFRS 6

'Exploration for and Evaluation of Mineral Reserves', as adopted by

the European Union ("EU").

The condensed set of financial statements for the six months

ended 30 June 2019 is unaudited and does not constitute statutory

accounts as defined in Section 434 of the Companies Act 2006. They

have been prepared using accounting bases and policies consistent

with those used in the preparation of the audited financial

statements of the Company and the Group for the year ended 31

December 2018 and those to be used for the year ending 31 December

2019. The comparative figures for the half year ended 30 June 2018

are unaudited. The comparative figures for the year ended 31

December 2018 are not the Company's full statutory accounts but

have been extracted from the financial statements for the year

ended 31 December 2018 which have been delivered to the Registrar

of Companies and the auditors' report thereon was unqualified and

did not contain a statement under sections 498(2) and 498(3) of the

Companies Act 2006.

This half-yearly financial report was approved by the Board of

Directors on 10 September 2019.

b) Going concern

The Group will need to raise further funds or to agree a farm

out or other transaction involving one or more of the Group's

licenses in order to meet its liabilities as they fall due within

the next 12 months. The Directors believe that they will need to

raise funds of approximately GBP9.8 million in total over the

coming twelve months to meet its minimum commitments (mainly to

fund drilling activities in respect of the Thali license) but not

all of this needs to be raised prior to the well spud. The

Directors consider that there are a number of options available to

them either through capital markets, farm-outs or asset disposals

and are confident that these will be concluded satisfactorily

within the necessary timeframes. The financial statements have

therefore been prepared on a going concern basis.

However, there can be no guarantee that the required funds may

be raised or transactions completed within the necessary

timeframes. Consequently a material uncertainty exists that may

cast doubt on the Group's ability to continue to operate and to

meet its commitments and discharge its liabilities in the normal

course of business for a period of not less than twelve months from

the date of this report. The financial statements do not include

the adjustments that would result if the Group was unable to

continue in operation such as the impairment of the exploration

assets.

2. Operating segments

The Group has two reportable operating segments: Africa and Head

Office. Non-current assets and operating liabilities are located in

Africa, whilst the majority of current assets are carried at Head

Office. The Group has not yet commenced production and therefore

has no revenue. Each reportable segment adopts the same accounting

policies. In compliance with IAS 34 'Interim Financial Reporting'

the following table reconciles the operational loss and the assets

and liabilities of each reportable segment with the consolidated

figures presented in these Financial Statements, together with

comparative figures for the period-ended 30 June 2018.

Africa Head Office Total

Six months Six months Six months Six months Six months Six months

ended ended ended ended ended ended

30 June 2019 30 June 2018 30 June 2019 30 June 2018 30 June 2019 30 June 2018

$ $ $ $ $ $

---------------------- -------------- -------------- -------------- -------------- -------------- --------------

Loss by reportable

segment 30,539 2,822,162 1,567,495 529,262 1,598,034 3,351,424

Total assets by

reportable segment

(1) 22,272,862 19,167,793 197,876 1,069,077 22,470,738 20,236,870

---------------------- -------------- -------------- -------------- -------------- --------------

Total liabilities by

reportable segment

(2) (120,379) (599) (2,007,565) (1,091,760) (2,127,944) (1,092,359)

---------------------- -------------- -------------- -------------- -------------- -------------- --------------

(1) Carrying amounts of segment assets exclude investments in

subsidiaries.

(2) Carrying amounts of segment liabilities exclude intra-group

financing.

3. Loss per ordinary share

Basic & Diluted

30 June 2019 30 June 2018

$ $

----------------------------------------------------------------------- ------------- -------------

Loss for the period 1,598,034 3,351,424

Weighted average number of ordinary shares in issue during the period 541,483,262 375,151,046

Dilutive effect of share options outstanding - -

Fully diluted average number of ordinary shares during the period 541,483,262 375,151,046

Loss per share (USc) 0.30c 0.89c

------------------------------------------------------------------------ ------------- -------------

4. Intangible Exploration and Evaluation (E&E) assets

Exploration and evaluation assets Goodwill Total

Period-ended 30 June 2019 $ $ $

---------------------------------- ------------ -------------

Cost

At 1 January 2019 91,654,861 8,023,292 99,678,153

Additions during the period 2,491,849 - 2,491,849

Disposals during the period - - -

At 30 June 2019 94,146,710 8,023,292 102,170,002

-------------------------------- ---------------------------------- ------------ -------------

Amortisation and impairment

At 1 January 2019 (72,008,462) (8,023,292) (80,031,754)

Impairment during the period (30,924) - (30,924)

Disposals during the period - - -

At 1 January and 30 June 2019 (72,039,386) (8,023,292) (80,062,678)

-------------------------------- ---------------------------------- ------------ -------------

Net book value

At 30 June 2019 22,107,324 - 22,107,324

At 31 December 2018 19,646,399 - 19,646,399

-------------------------------- ---------------------------------- ------------ -------------

In accordance with the Group's accounting policies and IFRS 6

the Directors' have reviewed each of the exploration license areas

for indications of impairment. This is inherently an extremely

judgmental exercise requiring the Directors to place a value on

exploration projects that by definition are not in the development

stage and are not therefore cash generating units. Having done so,

based on the financial constraints on the Group, and specific

issues associated with each license it was concluded that no

further impairment was necessary beyond the impairment of the

Zambian licenses 40 and 41 already made in the 2018 accounts.

The additions during the period represent $2.4 million in

Cameroon (2018: $708k), $80k in South Africa (2018: $nil) and $31k

in Zambia (2018: $9k) (subsequently impaired). The focus of the

Group's activities during this period has been on further

evaluating the Thali block in Cameroon and delineating the most

suitable drilling location on the Njonji discovery for a 2019

appraisal well.

5. Trade and other receivables

30 June 2019 31 December 2018

(unaudited) (audited)

$ $

----------------------------- -------------- -----------------

Trade and other receivables 33,385 23,979

----------------------------- -------------- -----------------

6. Trade and other payables

30 June 2019 31 December 2018

(unaudited) (audited)

$ $

-------------------------- -------------- -----------------

Trade and other payables 1,958,399 1,246,863

Accruals 169,545 45,629

2,127,944 1,292,492

-------------------------- -------------- -----------------

Included within trade and other payables are amounts totalling

$1.1 million (2018: $944k) with respect to UK VAT payable.

As has been previously noted, HMRC have issued assessments

totalling GBP843k excluding interest and penalties. This was

appealed and referred to the First-Tier Tribunal, which ruled in

favour of the Company in July 2019.

Whilst Tower was successful in defending its position at the

First-Tier Tribunal, it does not propose reflecting any changes in

its financial statements until such time as the final position and

the status of any HMRC appeal is fully known. The amount therefore

included within trade and other payables represents the GBP843k

originally assessed against the Company (exclusive of interest).

Provision has been made against all ongoing receivables at the

balance sheet date, with any movements being charged to the income

statement.

The Company continues to firmly believe that it has complied in

all material respects with UK VAT legislation, which is further

supported by the findings of the judge at the First-Tier Tribunal

and discussions with its advisors.

7. Share capital

30 June 2019 31 December 2018

(unaudited) (audited)

$ $

---------------------------------------------------- ---- -------------- -----------------

Authorised, called up, allotted and fully paid

580,716,052 (2018: 377,335,427) ordinary shares of 1p 18,244,493 15,599,626

---------------------------------------------------------- -------------- -----------------

The share capital issues during the period are summarised

below:

30 June 2019 31 December 2018

(unaudited) (audited)

$ $

----------------------------------------------- ----------------- ------------------------------- -----------------

Authorised, called up, allotted and fully paid

580,716,052 (2018: 377,335,427) ordinary shares of 1p 18,244,493 15,599,626

------------------------------------------------------------------ ------------------------------- -----------------

Number of shares Share capital at nominal value Share premium

Ordinary shares $ $

----------------------------------------------- ----------------- ------------------------------- -----------------

At 1 January 2019 377,335,427 15,599,626 142,376,317

Shares issued for cash 185,000,000 2,405,461 -

Shares issued on settlement of fees 3,380,625 44,062 -

Shares issued on settlement of staff

remuneration 15,000,000 195,344 -

Share issue costs - - (157,208)

At 30 June 2018 580,716,052 18,244,493 142,219,109

----------------------------------------------- ----------------- ------------------------------- -----------------

Deferred shares $ $

----------------------------------------------- ----------------- ------------------------------- -----------------

At 1 January and 30 June 2019 653,483,333 - -

----------------------------------------------- ----------------- ------------------------------- -----------------

8. Share-based payments

In the Statement of Comprehensive Income the Group recognised the following charge in respect Six months ended 30 June 2019 Six months ended 30 June 2018

of its share based payment plan:

(unaudited) (unaudited)

-----------------------------------------------------------------------------------------------

$ $

----------------------------------------------------------------------------------------------- ------------------------------ ------------------------------

Included within administrative costs:

----------------------------------------------------------------------------------------------- ------------------------------ ------------------------------

Share-based payment charges incurred on issue of new equity (301,222) -

Share-based payment charges incurred on incentivisation of staff and consultants (125,549) (102,155)

----------------------------------------------------------------------------------------------- ------------------------------ ------------------------------

Included within finance expense:

----------------------------------------------------------------------------------------------- ------------------------------ ------------------------------

Share-based payment charges incurred on issue of options and warrants as part of loan (317,117) -

financing

facilities

------------------------------ ------------------------------

Total recognised share based payment plan charges (743,888) (102,155)

----------------------------------------------------------------------------------------------- ------------------------------ ------------------------------

Options

Details of share options outstanding at 30 June 2019 are as

follows:

Number in issue

--------------------------- ----------------

At 1 January 2019 1,617,400

Awarded during the period 70,000,000

----------------------------- ----------------

At 30 June 2019 71,617,400

----------------------------- ----------------

Date of grant Number in issue Option price (p) Latest exercise date

--------------- ---------------- ----------------- ---------------------

27 Dec 14 16,000 1.750 27 Dec 19

09 Dec 15 48,000 0.475 09 Dec 20

16 Mar 16 53,400 0.475 16 Mar 21

26 Oct 16 1,500,000 0.023 25 Oct 21

24 Jan 19 70,000,000 1.250 24 Jan 24

71,617,400

--------------- ---------------- ----------------- ---------------------

These options vest in the beneficiaries in equal tranches on the

first, second and third anniversaries of grant.

Warrants

Details of warrants outstanding at 30 June 2018 are as

follows:

Number in issue

At 1 January 2019 43,439,692

Awarded during the period 206,497,713

----------------

At 30 June 2019 249,937,405

----------------------------- ----------------

Date of grant Number in issue Warrant price (p) Latest exercise date

--------------- ---------------- ------------------ ---------------------

09 Nov 17 31,853,761 1.000 09 Nov 22

01 Jan 18 2,542,372 1.000 01 Jan 23

01 Apr 18 2,083,333 1.500 01 Apr 23

01 Jul 18 2,272,726 1.780 30 Jun 23

01 Oct 18 4,687,500 1.575 30 Sep 23

24 Jan 19 112,211,999 1.250 23 Jan 24

16 Apr 19 90,000,000 1.000 14 Apr 24

30 Jun 19 4,285,714 1.000 28 Jun 24

249,937,405

--------------- ---------------- ------------------ ---------------------

9. Subsequent events

1 July 2019: The Company issued 4,285,714 warrants to Directors

in lieu of GBP15,000 (in aggregate) of Directors fees to Peter

Taylor (non-executive director) and Jeremy Asher (as Chairman) in

partial settlement of fees due for the period from 1 July 2019 to

30 September 2019, to conserve the Company's working capital. The

warrants are exercisable at a price of 1.00 pence ("Warrants"),

which is a premium of 21% to the closing share price of 0.825 pence

on 28 June 2019, and are exercisable for a period of 5 years from

the date of issue;

9 July: The First-Tier Tribunal (Tax Chamber) has on 8th July

2019 delivered its decision in favour of the Company's appeal

against HMRC's 2016 decisions to deny it credit for input VAT. HMRC

has applied for leave to appeal to the Upper Tribunal;

30 July: The Company agreed an extension of its Bridging Loan

Facility ("Facility") of US$750,000. The terms of the extension

include the issue of 3 million of attached five-year 1.0 pence

warrants with the Facility now being due for repayment on or before

31 August 2019, representing a two month extension from its

original term;

28 August: The Company announced an update on operations on the

Thali block in Cameroon and on well financing. As disclosed in the

Company's operational update in May, the Company received

additional data from the original Total wells at NJOM-1 and NJOM-2,

which indicated that further site preparation work would be

required before the drilling rig for the NJOM-3 well is moved to

site. The most suitable vessel to undertake this site preparation

work is now en route to West Africa with the expectation that this

work can be completed during September 2019. The Company has also

signed an LOI to use the COSL Seeker jack-up rig for the NJOM-3

well, in place of the Vantage Topaz Driller.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR URVBRKBAKAAR

(END) Dow Jones Newswires

September 11, 2019 02:00 ET (06:00 GMT)

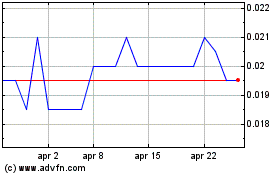

Grafico Azioni Tower Resources (LSE:TRP)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Tower Resources (LSE:TRP)

Storico

Da Apr 2023 a Apr 2024