Schroder Real Estate Refinancing of Long Term Debt and Dividend Increase

08 Ottobre 2019 - 8:00AM

UK Regulatory

TIDMSREI

For release 8 October 2019

Schroder Real Estate Investment Trust Limited

("SREIT"/ the "Company" / "Group")

REFINANCING OF LONG TERM DEBT AND DIVIDEND INCREASE

Schroder Real Estate Investment Trust, the actively managed UK-focused REIT, is

implementing a strategy focused on growing net operating income which delivered

a 5% dividend increase in the financial year to March 2019. Today the Company

announces a significant refinancing and a further dividend increase:

* GBP129.6 million fixed rate loan with Canada Life Investments extended from

8.5 to average 16.5 years

* Reduction in the total interest rate from 4.4% to approximately 2.3% per

annum, generating an immediate interest saving of approximately GBP2.8

million per annum

* Negotiated break cost of approximately GBP28 million funded by cash realised

from disposals

* Interest saving to be paid to shareholders as an increased dividend of

approximately GBP16.2 million per annum, equating to an increase of

approximately 20%

* The transaction is due to complete on 15 October 2019. The final interest

rate and break cost will be based on the closing reference Gilt rates on 14

October 2019

Background to the refinancing

The Company's strategy is focused on growing net operating income to continue

the progressive dividend policy. This has included asset management, selective

acquisitions and, over the last 12 months, a disposal programme totalling GBP85.6

million, reflecting an average net initial yield of 3.1%. These disposals

crystallised gains from asset management and contributed to sustained

outperformance of the underlying portfolio against the IPD/MSCI Benchmark of

2.0% and 2.3% per annum over one and three years to June 2019 respectively.

This activity resulted in the Board increasing the Company's dividend by 5% in

the financial year to March 2019.

In order to lock into low finance costs for a longer term as well as to further

increase the net income return to our shareholders, the Company announces that

it has refinanced its GBP129.6 million term loan with Canada Life Investments and

extended its maturity with 50% of the loan maturing in 13 years and 50% of the

loan maturing in 20 years. The transaction reduces the cost of debt on the loan

from 4.4% to approximately 2.3% resulting in interest savings of approximately

GBP2.8 million per annum. The interest savings will be used to increase the

Company's dividend by approximately 20%, starting at the period 1 October 2019.

The refinancing has resulted in a negotiated break cost of approximately GBP28

million, equating to a reduction in the NAV per share of 5.5 pence. The

transaction is due to complete on 15 October 2019 at which point the Company

will confirm the final terms. The final interest rate and break cost will be

based on the closing reference Gilt rates on 14 October 2019.

Future growth in earnings

Following this activity and on completion of contracted disposals in November,

the Company will have approximately GBP80 million of cash and undrawn revolving

credit facilities. This provides the Company with operational flexibility to

invest in the underlying portfolio and take advantage of more attractively

priced investment opportunities that deliver further sustainable growth in

earnings.

Duncan Owen, Global Head of Schroder Real Estate, commented:

"The transaction increases net operating income post all costs and debt

reduction, and leads to a material increase in the dividend, thereby increasing

shareholder's returns. In addition, it reduces risk with long term and low cost

debt. The Company is well positioned; it has long term debt with a conservative

LTV and the capacity to take advantage of lower pricing in the real estate

markets, with available cash and undrawn revolving debt facilities."

-ENDS-

For further information:

Schroder Real Estate Investment Management 020 7658 6000

Limited:

Duncan Owen / Nick Montgomery / Frank Sanderson

Northern Trust: 01481 745529

Andy Dovey / James Machon

FTI Consulting: 020 3727 1000

Dido Laurimore / Richard Gotla

END

(END) Dow Jones Newswires

October 08, 2019 02:00 ET (06:00 GMT)

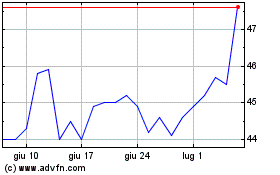

Grafico Azioni Schroder Real Estate Inv... (LSE:SREI)

Storico

Da Mar 2024 a Apr 2024

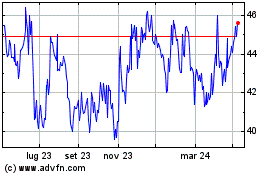

Grafico Azioni Schroder Real Estate Inv... (LSE:SREI)

Storico

Da Apr 2023 a Apr 2024