TIDMSEQI

RNS Number : 6838P

Sequoia Economic Infra Inc Fd Ld

14 October 2019

14 October 2019

Sequoia Economic Infrastructure Income Fund Limited

("SEQI" or the "Company")

Net Asset Value as at 30 September 2019 and Investment

Update

The NAV for SEQI, the specialist investor in economic

infrastructure debt, increased to 105.30p from the prior month's

NAV of 104.62p per share. The changes in NAV arose primarily

through:

-- Interest income net of expenses of 0.59p;

-- A decrease of 0.07p in asset valuations;

-- Unhedged FX losses of 0.29p; and

-- Gain of 0.45p from issuing shares at a premium to NAV.

On 20 September 2019, the Company announced that its placing of

shares was significantly oversubscribed, raising gross proceeds of

GBP138.75m. On 30 September 2019, the Company deployed

substantially all the placing proceeds to repay c. GBP136.6m of

outstanding debt, resulting in a month-end cash balance of GBP70.5m

and outstanding debt balance of GBP63.4m. The Company also had

undrawn commitments and three additional investments in settlement

collectively valued at GBP137.3m.

The Company's invested portfolio comprised 62 private debt

investments and 16 infrastructure bonds across 8 sectors and 30

sub-sectors and had an annualised yield-to-maturity (or

yield-to-worst in the case of callable bonds) of 8.2% and a

weighted average life of approximately 4.2 years. Private debt

investments represented 88.4% of the total portfolio and 72.0% of

the portfolio comprised floating rate assets. The weighted average

purchase price of the Company's investments was 95.3% of par.

Investments which are pre-operational represented 15.7% of total

assets.

The Company's invested portfolio remains geographically diverse

with 49% located across the US, 16% in the UK, 28% in Europe, and

8% in Australia/New Zealand. Currently the Company is not investing

in Portugal or Italy but has selectively invested in opportunities

in Spain. The Company's pipeline of economic infrastructure debt

investments remains strong and is diversified by sector,

sub-sector, and jurisdiction.

At month end, approximately 93.1% of the Company's NAV consisted

of either Sterling assets or was hedged into Sterling. The Company

has adequate resources to cover the cash costs associated with its

hedging activities.

The Company's settled investment activities during September

include:

-- A $49m primary loan to Nasco Helium, a company that

specialises in the extraction and processing of helium from

productive oilfields;

-- An additional $5.0m secondary loan acquisition of Heritage

Power, a holding company that owns a portfolio of 16 power plants

located across Pennsylvania, Ohio, and New Jersey, USA;

-- An additional $3.0m secondary loan acquisition of Midcoast

Energy, a highly contracted NGL pipeline system in Texas, USA;

-- An additional $1.8m disbursement to Bourzou Equity LLC, a

company created for the construction of a data center in Virgina,

USA; and

-- A final EUR272k disbursement to Hatch Student Housing in Cork, Ireland.

The following investments were repaid in September in line with

expectations:

-- EUR35.5m and 2.3m Polish z oty senior loans to Project

Warsaw, a portfolio of solar-powered generation assets in

Poland.

Ordinary Portfolio Summary (15 largest settled investments)

Investment name Currency Type Ranking Value Sector Sub-sector Yield

GBPm(1) to maturity

/ worst

(%)

Hawaiki Mezzanine Undersea

Loan USD Private Mezz 60.4 TMT cable 11.6

Salt Creek Midstream USD Private Senior 55.9 Utility Midstream 8.1

Tracy Hills TL Residential

2025 USD Private Senior 48.8 Other infra 10.0

Scandlines Mezzanine

2032 EUR Private HoldCo 46.4 Transport Ferries 5.8

Euroports 2nd

Lien 2026 EUR Private Mezz 44.2 Transport Port 7.8

Nasco Senior Industrial

Secured 2020 USD Private Senior 41.4 Other infra 2.6

Bannister Senior

Secured GBP Private Senior 41.2 Accomm. Health care 8.4

Adani Abbot HoldCo

2021 AUD Private HoldCo 41.2 Transport Port 9.0

Kaveh Senior

Secured TL 2021 USD Private Senior 40.7 TMT Data centers 7.8

Whittle Schools Private

B USD Private Senior 40.5 Other schools 10.9

Bizkaia TL 2021 EUR Private HoldCo 37.9 Power Elec. generation 7.7

Aquaventure USD Private Senior 36.6 Utility Water 8.0

Heritage Power USD Private Senior 35.7 Power Elec. generation 8.6

Bulb Senior TL Electricity

2021 GBP Private Senior 35.0 Utility supply 7.2

Solar &

Sunrun Hera 2017-B USD Private Mezz 32.1 Renewables wind 7.8

Note (1) - excluding accrued interest

Market Summary

A total of 85 project finance transactions closed in September

throughout the Company's eligible jurisdictions, worth $31.4bn in

aggregate. Notable transactions outside of the Company's investment

activities during the month include:

-- A CAD $900m bond issue to finance the operations of the

Greater Toronto Airports Authority in Toronto, Canada;

-- A $508m financing of the construction of a 200MW wind farm in

South Dakota, USA; and

-- A $565m refinancing of the 644MW Bayonne Energy Center in New

Jersey, USA.

In September, the US economy added 136,000 new jobs, bringing

the unemployment rate down to 3.5%. The jobs report was below

expectations, but past months' estimates were revised higher,

leading to the decline in the unemployment rate. There remain

concerns about the strength of the economy so the Fed is expected

to cut interest rates by another quarter point.

The ECB announced a new stimulus plan during the month, cutting

interest rates and resuming bond buying. The Eurozone economy as a

whole is expected to grow 0.1% during Q3 2019.

The UK economy remains weak, with job decreases across the

services, construction, and manufacturing industries. This has

continued fears of a recession, with concerns that the economy has

contracted in Q3.

The Company's monthly investor report and additional portfolio

disclosure will be made available at http://www.seqifund.com/.

LEI: 2138006OW12FQHJ6PX91

For further information please contact:

Sequoia Investment Management Company +44 (0)20 7079 0480

Steve Cook

Dolf Kohnhorst

Randall Sandstrom

Greg Taylor

Stifel Nicolaus Europe Limited +44 (0)20 7710 7600

Neil Winward

Mark Bloomfield

Gaudi Le Roux

Tulchan Communications (Financial PR) +44 (0)20 7353 4200

James Macey White

Martin Pengelley

Elizabeth Snow

Praxis Fund Services Limited (Company Secretary) +44 (0) 1481 755530

Matt Falla

About Sequoia Economic Infrastructure Income Fund Limited

The Company seeks to provide investors with regular, sustained,

long-term distributions and capital appreciation from a diversified

portfolio of senior and subordinated economic infrastructure debt

investments. The Company is advised by Sequoia Investment

Management Company Limited.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NAVFFWFIFFUSEES

(END) Dow Jones Newswires

October 14, 2019 02:00 ET (06:00 GMT)

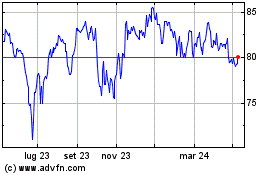

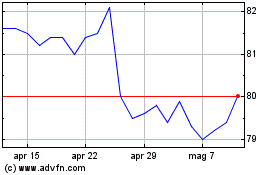

Grafico Azioni Sequoia Economic Infrast... (LSE:SEQI)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Sequoia Economic Infrast... (LSE:SEQI)

Storico

Da Apr 2023 a Apr 2024