TIDMRED

RNS Number : 9589R

RedT Energy PLC

01 November 2019

THE INFORMATION CONTAINED IN THIS ANNOUNCEMENT IS INSIDE

INFORMATION FOR THE PURPOSES OF ARTICLE 7 OF REGULATION

596/2014

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED IN IT IS

RESTRICTED AND IT IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION,

IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED

STATES, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR AUSTRALIA OR

ANY OTHER STATE OR JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION

OR DISTRIBUTION WOULD BE UNLAWFUL

1 November 2019

redT energy plc ("redT", the "Company")

Interim funding secured

Proposed merger with Avalon Battery Corporation and fundraising

progressing

redT energy plc (AIM:RED), the energy storage technology

company, is pleased to announce that, further to the announcement

on 25 July 2019 of the proposed merger with Avalon Battery

Corporation ("Avalon") (the "Merger") and the proposal to raise at

least US$30m (GBP23m(1) ) of new funds (the "Fundraising"), redT

has agreed an interim loan of up to US$2.5m (GBP1.9m) (the "Interim

Loan") from Avalon to fund ongoing working capital requirements and

expenses relating to the Merger via a monthly drawdown schedule.

The Interim Loan from Avalon is funded by up to US$5m (GBP3.9m)

being made available to Avalon by Bushveld Minerals Limited

("Bushveld"). Bushveld is an integrated primary vanadium producer

based in Johannesburg and traded on the AIM market of the London

Stock Exchange ("AIM"). Its subsidiary, Bushveld Energy Limited, is

an energy storage solutions provider that supports a number of

companies in the vanadium redox flow battery sector.

As announced in July, the Merger will constitute a reverse

takeover ("RTO") under the AIM Rules for Companies, which involves

considerable expense and also time during which redT will continue

to consume cash. The Interim Loan will enable redT to complete the

due diligence process, finalise the negotiation of the Merger and

progress the Fundraising. redT's Board expects that, with the

Interim Loan in place, the Company and Avalon will move swiftly

towards completing the Merger and the Fundraising and, as a larger

and financially robust business, embark upon its exciting

development and growth strategy. The merged business will be a

leading player in the growing energy storage market. With

operations in North America, Europe, and Asia and sales offices in

Australia and Africa, the merged business will have a global

footprint able to capitalise on the significant opportunities for

energy storage presented by the worldwide shift to renewable

energy.

In addition to the Interim Loan, redT has entered into a

separate agreement with Bushveld (the "Bushveld Agreement") under

which, if the Merger completes successfully, the US$5m provided to

Avalon by Bushveld will convert into ordinary shares in the merged

business ("Ordinary Shares"). Bushveld will become a shareholder in

the merged business on the same terms (subject to certain

conditions) as other investors participating in the Fundraising.

Bushveld will have the right but not the obligation to invest

further funds into the merged business as part of the Fundraising

and on the same terms as other investors, at a maximum price of

1.65p per Ordinary Share.

Bushveld will, upon completion of the Merger and the

Fundraising, receive a commitment fee of 20 per cent. of the

principal amount of its loan to Avalon (the "Commitment Fee").

Bushveld will also receive interest at a rate of 12 per cent. per

annum which, together with the Commitment Fee, will roll up and

convert into Ordinary Shares on completion of the Merger and the

Fundraising. The Ordinary Shares received by Bushveld will be

issued at a maximum price of 1.65p per Ordinary Share and on the

same terms as other investors participating in the Fundraising.

redT has also agreed, subject to the completion of the Merger

and the Fundraising, to grant Bushveld a right of first refusal to

supply vanadium products to the merged business for two years, and

thereafter subject inter alia to Bushveld continuing to

beneficially own at least five per cent. of the issued Ordinary

Shares. Bushveld will also, subject to it continuing to

beneficially own at least five per cent. of the issued Ordinary

Shares, have for one year from completion of the Merger and the

Fundraising, the right to nominate a member of the Board of the

Company. Bushveld will retain that right after one year provided it

beneficially owns at least 10 per cent. of the issued Ordinary

Shares. In addition, for so long as Bushveld beneficially owns at

least 20 per cent. of the issued Ordinary Shares, it shall have a

right to nominate two members of the Company's board.

In the event that the Merger and the Fundraising do not complete

successfully, the terms of the Interim Loan provide that the

principal amount of up to US$2.5m, together with interest at 12 per

cent. per annum, becomes repayable to Avalon six months after any

announcement by the Company that the Merger is no longer

proceeding. redT has granted security over certain of its assets to

Avalon as part of the Interim Loan.

Trading in redT's ordinary shares on AIM will remain suspended

until either the publication of an admission document in relation

to the Merger or confirmation is given that the Merger is no longer

proceeding. The parties remain committed to publishing the

admission document as soon as possible.

Based on redT's latest cash flow forecasts, which assume the

full Interim Loan of US$2.5m is received, the Board expects that

the Company will have sufficient cash to complete the Merger and

the Fundraising process in the first quarter of 2020.

The Merger and the Fundraising remain subject inter alia to

further due diligence by each party, definitive legal agreements

being reached and a successful Fundraising to provide the necessary

funds for the enlarged business. The Fundraising and the Merger

will be subject to the approval of redT's shareholders and the

Merger itself is also subject to the approval of the shareholders

of Avalon.

Further announcements will be made in due course.

Information on Avalon and the combined business

Avalon Battery Corporation is a Delaware Corporation with

offices in the San Francisco area, operations in Vancouver and a

low-cost manufacturing presence in China. Avalon's technology is

very similar to that of redT and the combination of the two

businesses will enable the merged business to reduce costs and

accelerate product development, combining the best features of each

company's products and reducing the costs of manufacture. Both

companies already have a substantial sales opportunity pipeline,

which the combined business will be well placed to supply with its

world-leading products.

Neil O'Brien, Executive Chairman of redT commented:

"I am delighted that we have secured this interim funding. It

enables us to progress the Merger planning with Avalon together

with our fundraising and I hope and expect that we will be able to

embark on this exciting new phase in the Company's development

soon. We believe the market for storage assets to support renewable

energy targets is developing rapidly and the combination of redT

and Avalon will be a leading player in this market. We are looking

forward to working with Bushveld as a partner and strategic

investor once we have completed the merger."

Larry Zulch, Chief Executive Officer of Avalon commented:

"The merger of Avalon and redT has become only more compelling

as we learn about each other while working through the merger and

due diligence process. Bushveld Energy provided funding to Avalon

with the intention that some would be used by redT to support this

transaction, an example of Bushveld Energy's broad support of the

vanadium redox flow battery market. We are grateful for Bushveld's

support and look forward to building a business that conclusively

realizes the potential of our combined capabilities in renewable

energy storage."

(1) US$ denominated amounts converted at US$/GBP rate of

GBP1.293 on 31/10/2019

For further information, please contact:

redT energy plc

Neil O'Brien, Executive Chairman

Fraser Welham, Chief Financial Officer

Joe Worthington, Investor & Media Relations +44 (0)20 7121 6111

Avalon Battery Corporation

Larry Zulch, CEO

Matt Harper, President +1 604 563 2144

VSA Capital Limited (Financial Adviser)

Andrew Raca / Simon Barton +44 (0)20 3005 5000

VSA Capital Limited (Broker)

Andrew Monk +44 (0)20 3005 5000

Investec Bank plc (Nominated Adviser

and Joint Broker)

Jeremy Ellis +44 (0)20 7597 4000

Notes to Editors

About redT energy

redT energy plc are experts in energy storage, specialising in

the design, manufacture, installation and operation of energy

storage infrastructure which creates revenue alongside reliable,

low-cost renewable generation for businesses, industry and

electricity distribution networks. Using patented vanadium redox

flow technology to store energy in liquid, redT's own energy

storage machines can be run continually with no degradation:

charging and discharging for over 25 years, matching the lifespan

of renewable assets in on-grid, off-grid and weak-grid

settings.

redT's energy storage solutions, developed over the past 15

years, address today's changing energy market by providing a

flexible platform for time shifting surplus renewable power,

securing electricity supplies and earning revenue through grid

services. The company has customers in the UK, Europe, sub-Saharan

Africa, Australia and Asia Pacific. redT energy plc is admitted to

trading on AIM (AIM:RED) and has experts located in the UK, Europe,

Australia and Africa. For more information, visit

www.redtenergy.com

For sales, press or investor enquiries, please contact the redT

team on +44 (0)207 061 6233.

About Avalon

Avalon Battery was founded on the principle that productized

vanadium-based flow batteries will revolutionize energy projects

and play a critical role in a renewable energy future. With

operations in Fremont, California, USA and Vancouver, Canada, and a

low-cost manufacturing presence in Suzhou, China, Avalon produces

dependable, safe, and economical energy storage systems.

Avalon believes the foundations of its product excellence are

its technology and engineering team. Since 2005, its team has been

one of the global leaders in design, production and deployment of

vanadium flow batteries(2) ; the team now counts over 140 years'

experience in vanadium flow battery development, has been involved

in the deployment of over 15MWh of vanadium flow batteries since

2005, and has invented over 50 related independent patents.

www.avalonbattery.com

(2) Based on searches of the US DOE Global Storage Database for

electro-chemical, vanadium flow batteries understood to be in

operation as at 29 October 2019.

This announcement is not intended to, and does not, constitute

or form part of any offer, invitation or the solicitation of an

offer to purchase, otherwise acquire, subscribe for, sell or

otherwise dispose of, any securities whether pursuant to this

announcement or otherwise.

The distribution of this announcement in jurisdictions outside

the United Kingdom may be restricted by law and therefore persons

into whose possession this announcement comes should inform

themselves about, and observe, such restrictions. Any failure to

comply with the restrictions may constitute a violation of the

securities law of any such jurisdiction.

MAR

The information contained within this announcement is considered

by the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No.596/2014. Upon the publication

of this announcement via a Regulatory Information Service, this

inside information will be considered to be in the public

domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCUGGRPGUPBUBG

(END) Dow Jones Newswires

November 01, 2019 05:45 ET (09:45 GMT)

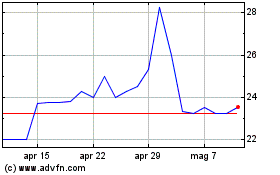

Grafico Azioni Invinity Energy Systems (LSE:IES)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Invinity Energy Systems (LSE:IES)

Storico

Da Apr 2023 a Apr 2024