TIDMSEQI

RNS Number : 3303T

Sequoia Economic Infra Inc Fd Ld

14 November 2019

14 November 2019

Sequoia Economic Infrastructure Income Fund Limited

("SEQI" or the "Company")

Net Asset Value as at 31 October 2019 and Investment Update

The NAV for SEQI, the specialist investor in economic

infrastructure debt, increased to 104.08p from the prior month's

NAV of 103.74p per share (being the 30 September cum-income NAV of

105.30p less the dividend of 1.5625p per share declared in respect

of the quarter ended 30 September 2019). The changes in NAV arose

primarily through:

-- Interest income net of expenses of 0.59p;

-- A decrease of 0.30p in asset valuations; and

-- Unhedged FX gains of 0.04p.

As at 31 October 2019, the Company had cash of GBP55.8m and

outstanding drawings on its Revolving Credit Facility of GBP114.2m.

The Company also had undrawn commitments, and four additional

investments in settlement, collectively valued at GBP158.8m.

The Company's invested portfolio comprised of 65 private debt

investments and 15 infrastructure bonds across 8 sectors and 30

sub-sectors. It had an annualised yield-to-maturity (or

yield-to-worst in the case of callable bonds) of 8.3% and a

weighted average life of approximately 4.0 years. Private debt

investments represented 89% of the total portfolio and 73% of the

portfolio comprised floating rate assets. The weighted average

purchase price of the Company's investments was 94.2% of par.

Investments which are pre-operational represented 15.3% of total

assets.

The Company's invested portfolio remains geographically diverse

with 46% located across the US, 19% in the UK, 28% in Europe, and

7% in Australia/New Zealand. Currently the Company is not investing

in Portugal or Italy but has selectively invested in opportunities

in Spain. The Company's pipeline of economic infrastructure debt

investments remains strong and is diversified by sector,

sub-sector, and jurisdiction.

At month end, approximately 100% of the Company's NAV consisted

of either Sterling assets or was hedged into Sterling. The Company

has adequate resources to cover the cash costs associated with its

hedging activities.

The Company's settled investment activities during October

include:

-- A GBP28.0m primary loan to Base Student Housing, a student

accommodation building in Glasgow, Scotland;

-- A GBP25.0m primary loan to NewCold Wakefield, a cold storage facility in Wakefield, UK;

-- A $25.0m primary participation in Raptor 2019-1C bonds backed by a portfolio of aircraft;

-- An initial EUR13.5m primary loan to Project Swordfish, a

company that operates waterbus passenger transport systems in

Antwerp, Belgium;

-- A $10.0m secondary acquisition of EIF Van Hook Midstream, a

midstream oil & gas company that operates primarily in North

Dakota, USA; and

-- An additional $2.2m disbursement to Bourzou Equity LLC, a

company created for the construction of a data center in Virgina,

USA.

The following investments were sold in October:

-- $12.0m of North Las Vegas Water 6.572% 2040 bonds; and

-- $10.0m of Adani Abbot Point Terminal 4.45% 2022 bonds.

Ordinary Portfolio Summary (15 largest settled investments)

Investment name Currency Type Ranking Value Sector Sub-sector Yield

GBPm(1) to maturity

/ worst

(%)

Hawaiki Mezzanine Undersea

Loan USD Private Mezz 57.4 TMT cable 11.6

Salt Creek Midstream

Senior Debt USD Private Senior 53.1 Utility Midstream 7.9

Tracy Hills TL Residential

2025 USD Private Senior 45.4 Other infra 9.8

Scandlines Mezzanine

2032 EUR Private HoldCo 45.1 Transport Ferries 5.8

Euroports 2nd

Lien 2026 EUR Private Mezz 43.0 Transport Port 7.8

Bannister Senior

Secured 2025 GBP Private Senior 41.2 Accomm. Health care 8.4

Adani Abbot HoldCo

2021 AUD Private HoldCo 39.9 Transport Port 9.2

Kaveh Senior

Secured TL 2021 USD Private Senior 38.6 TMT Data centers 7.6

Whittle Schools Private

B USD Private Senior 38.5 Other schools 10.8

Nasco Senior Industrial

Secured 2020 USD Private Senior 38.2 Other infra 7.5

Electricity

Bizkaia TL 2021 EUR Private HoldCo 36.8 Power generation 7.7

Bulb Senior TL Electricity

2021 GBP Private Senior 35.0 Utility supply 7.2

Aquaventure Senior

Secured USD Private Senior 34.8 Utility Water 7.8

Heritage Power Electricity

Senior Secured USD Private Senior 34.0 Power generation 8.3

EIF Van Hook

TL B 2024 USD Private Senior 31.4 Utility Midstream 8.8

Note (1) - excluding accrued interest

Market Summary

A total of 41 project finance transactions closed in October

throughout the Company's eligible jurisdictions, worth $5.6bn in

aggregate. Notable transactions outside of the Company's investment

activities during the month include:

-- EUR780m financing of the construction of the Fryslan Offshore

Wind Farm in the Netherlands;

-- A GBP450m refinancing of Ark Data Centres' senior debt in the

UK; and

-- A EUR580m refinancing of the Liefkenshoek Rail Tunnel in

Belgium.

In October, the US economy added 128,000 new jobs, with the

unemployment rate up to 3.6%, as 325,000 people started looking for

work. At the end of the month, the Federal Reserve cut interest

rates by a quarter of a point, in line with expectations.

The Eurozone economy remains weak, with low expectations for

growth and warnings from outgoing ECB president Draghi that further

stimulus is needed.

The UK economy also remains weak, with continued Brexit

uncertainty and challenging global conditions.

The Company's monthly investor report and additional portfolio

disclosure will be made available at http://www.seqifund.com/.

LEI: 2138006OW12FQHJ6PX91

For further information please contact:

Sequoia Investment Management Company +44 (0)20 7079 0480

Steve Cook

Dolf Kohnhorst

Randall Sandstrom

Greg Taylor

Stifel Nicolaus Europe Limited +44 (0)20 7710 7600

Mark Bloomfield

Alex Miller

Tulchan Communications (Financial PR) +44 (0)20 7353 4200

James Macey White

Martin Pengelley

Elizabeth Snow

Praxis Fund Services Limited (Company Secretary) +44 (0) 1481 755530

Matt Falla

About Sequoia Economic Infrastructure Income Fund Limited

The Company seeks to provide investors with regular, sustained,

long-term distributions and capital appreciation from a diversified

portfolio of senior and subordinated economic infrastructure debt

investments. The Company is advised by Sequoia Investment

Management Company Limited.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NAVFFFFMDFUSEDF

(END) Dow Jones Newswires

November 14, 2019 02:01 ET (07:01 GMT)

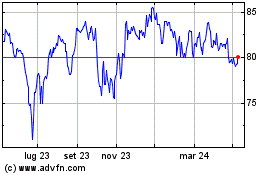

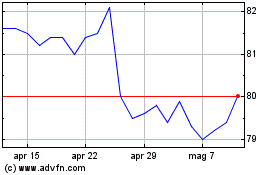

Grafico Azioni Sequoia Economic Infrast... (LSE:SEQI)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Sequoia Economic Infrast... (LSE:SEQI)

Storico

Da Apr 2023 a Apr 2024