Richland Resources Ltd Equity Fundraising of £150,000 (5146Z)

13 Gennaio 2020 - 8:00AM

UK Regulatory

TIDMRLD

RNS Number : 5146Z

Richland Resources Ltd

13 January 2020

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA OR

JAPAN OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A

BREACH OF THE RELEVANT SECURITIES LAWS OF SUCH JURISDICTION.

This announcement does not constitute a prospectus or offering

memorandum or an offer in respect of any securities and is not

intended to provide the basis for any investment decision in

respect of Richland Resources Ltd or other evaluation of any

securities of Richland Resources Ltd or any other entity and should

not be considered as a recommendation that any investor should

subscribe for or purchase any such securities.

13 January 2020

Richland Resources Ltd

("Richland" or the "Company")

Equity Fundraising of approximately GBP150,000 gross

Richland (AIM: RLD) is pleased to announce that the Company has

conditionally raised, in aggregate, approximately GBP150,000

(before expenses) through a placing of 105,000,000 new common

shares of US$0.0003 each in the capital of the Company ("Common

Shares") (the "Placing Shares") (the "Placing") with certain new

investors at an issue price of 0.10 pence per Placing Share (the

"Issue Price") and a subscription for a further 45,000,000 new

Common Shares (the "Subscription Shares") by a new investor also at

the Issue Price (the "Subscription") (the Placing and Subscription

together being the "Equity Fundraising").

Details of the Equity Fundraising

The Placing was arranged via Peterhouse Capital Limited

("Peterhouse") as agent of the Company. Pursuant to the Placing and

Subscription, in aggregate, 150,000,000 new Common Shares will be

issued at the Issue Price to certain new investors. The Issue Price

represents a discount of approximately 5 per cent. to the closing

price of a Common Share of 0.105 pence on 9 January 2020, which was

used to set the Issue Price, and a discount of approximately 31 per

cent. to the closing middle market price of a Common Share of 0.145

pence on 10 January 2020, being the latest practicable business day

prior to this announcement.

Peterhouse are due 5 per cent. commission on the gross proceeds

of the Placing and 1 per cent. commission on the gross proceeds of

the Subscription which it has agreed will be settled by the issue

of 5,700,000 new Common Shares to Peterhouse (the "Commission

Shares"). In addition, Peterhouse has agreed that its initial six

monthly retainer fee for 2020 will be settled by the issue to it of

a further 10,000,000 new Common Shares at the Issue Price (the

"Broker Fee Shares").

The Equity Fundraising is conditional upon admission of the

Placing Shares and Subscription Shares to trading on AIM

("Admission").

The Placing Shares and Subscription Shares (together, the

"Equity Fundraising Shares") represent, in aggregate, approximately

14.64 per cent. of the Company's enlarged issued share capital (as

enlarged by the Equity Fundraising Shares, the Commission Shares

and the Broker Fee Shares). The Equity Fundraising Shares,

Commission Shares and Broker Fee Shares will rank pari passu in all

respects with the Company's existing Common Shares and will be

issued fully paid.

Admission to trading

Application will be made to the London Stock Exchange for

Admission of the abovementioned new Common Shares and it is

expected that Admission will become effective and that dealings in

the Equity Fundraising Shares, Commission Shares and Broker Fee

Shares (together, the "New Shares") will commence at 8.00 a.m. on

16 January 2020. Following Admission, the Company will have

1,024,839,558 Common Shares with voting rights in issue and holds a

further 7,275,000 Common Shares in treasury.

Use of Proceeds

As previously announced on 2 January 2020, the Company is

currently an AIM Rule 15 cash shell and, as such, is required to

complete a reverse takeover under AIM Rule 14 or otherwise seek

re-admission to trading on AIM as an investing company pursuant to

AIM Rule 8 by 30 June 2020. Accordingly, the Company is seeking to

identify a suitable reverse takeover transaction in the mining

sector and the net proceeds from the Equity Fundraising will be

utilised to provide the Company with additional general working

capital and to satisfy the costs and expenses associated with

pursuing such a transaction. However, there can be no guarantee

that the Company will be able to secure a suitable reverse takeover

transaction and subsequently be re-admitted to AIM.

For further information, please contact:

Anthony Brooke Edward Nealon Mike Allardice

Chief Executive Officer Chairman Group Company Secretary

+66 81 854 1755 +61 409 969 955 +852 91 864 854

Nominated Adviser Broker

Strand Hanson Limited Peterhouse Capital Limited

James Harris Duncan Vasey / Lucy Williams

Matthew Chandler (Broking)

James Bellman Eran Zucker (Corporate

+44 (0) 20 7409 3494 Finance)

+44 (0) 20 7469 0930

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014.

Note to Editors:

Further information is available on the Company's website:

www.richlandresourcesltd.com. Neither the contents of the Company's

website nor the contents of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into, or forms part of, this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOEGPUUGGUPUGRP

(END) Dow Jones Newswires

January 13, 2020 02:00 ET (07:00 GMT)

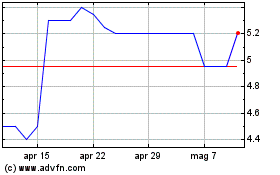

Grafico Azioni Lexington Gold (LSE:LEX)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Lexington Gold (LSE:LEX)

Storico

Da Apr 2023 a Apr 2024