Residential Secure Income PLC Fund Management Fee (7876Z)

14 Gennaio 2020 - 5:05PM

UK Regulatory

TIDMRESI

RNS Number : 7876Z

Residential Secure Income PLC

14 January 2020

14 January 2020

Residential Secure Income plc

Satisfaction of the Equity Portion of the Fund Management

Fee

Residential Secure Income plc ("ReSI") (LSE: RESI) announces

that, in accordance with the terms of the Fund Management Agreement

with ReSI Capital Management Limited (the "Fund Manager") pursuant

to which 25 per cent of the fund management fee is payable in the

form of Ordinary Shares (the "Equity Portion") rather than cash, it

has today purchased 116,600 Ordinary Shares in the secondary market

(the "Fund Management Ordinary Shares") at an average price of 99.0

pence.

The Fund Management Ordinary Shares are subject to a minimum

lock-in period of 12 months from 1 January 2020, being when the

Fund Management Ordinary Shares became due and deliverable.

FOR FURTHER INFORMATION, PLEASE CONTACT:

ReSI Capital Management Limited / TradeRisks

Limited

Ben Fry

Alex Pilato

Mark Rogers

Jonathan Slater +44 (0) 20 7382 0900

Jefferies International Limited

Stuart Klein

Gary Gould +44 (0) 20 7029 8000

FTI Consulting +44 (0) 20 3727 1000

Richard Sunderland Email: resi@fticonsulting.com

Claire Turvey

Richard Gotla

NOTES:

Residential Secure Income plc (LSE: RESI) is a real estate

investment trust (REIT) listed on the premium segment of the Main

Market of the London Stock Exchange with the objective of

delivering secure inflation linked returns by investing in

affordable shared ownership, retirement and Local Authority housing

throughout the UK.

ReSI targets a secure, long-dated, inflation-linked dividend of

5.0 pence per share p.a. (paid quarterly) and a total return in

excess of 8.0% p.a. and has to date committed c. GBP300 million,

assembling a portfolio of 2,678 properties.

ReSI aims to make a meaningful contribution to alleviating the

UK housing shortage by meeting demand from housing developers

(Housing Associations, Local Authorities and private developers)

for long-term investment partners to accelerate the development of

socially and economically beneficial new affordable housing.

ReSI's subsidiary, ReSI Housing Limited, is registered as a

for-profit Registered Provider of Social Housing, and so provides a

unique proposition to its housing developer partners, being a long

term private sector landlord within the social housing regulatory

environment. As a Registered Provider, ReSI Housing can acquire

affordable housing subject to s106 planning restrictions and

housing funded by government grant.

ReSI is managed by ReSI Capital Management Limited, a

wholly-owned subsidiary of TradeRisks Limited which has an 18 year

track record of executing transactions within the UK social housing

sector and, to date, has arranged funding of over GBP10 billion in

the social housing, care and other specialist residential property

sectors.

Acquisitions by ReSI are limited to homes with sufficient

cashflows, counterparty credit quality and property security to be

capable of supporting long--term investment grade equivalent

debt.

ReSI does not manage or operate stock and uses experienced and

credit-worthy third party managers.

Further information on ReSI is available at

www.resi-reit.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCMZGMMKDDGGZM

(END) Dow Jones Newswires

January 14, 2020 11:05 ET (16:05 GMT)

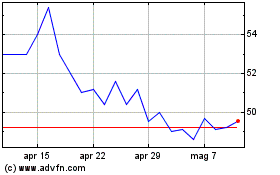

Grafico Azioni Residential Secure Income (LSE:RESI)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Residential Secure Income (LSE:RESI)

Storico

Da Apr 2023 a Apr 2024