TIDMORR

RNS Number : 5088A

Oriole Resources PLC

22 January 2020

Oriole Resources PLC

('Oriole Resources' or 'the Company' or 'the Group')

High-grades Continue at Bibemi

Oriole Resources, the AIM-quoted exploration company focused on

West Africa, is pleased to provide an update on its Bibemi gold

project in Cameroon, where it is earning up to a 90% interest

through its partnership with Bureau d'Etudes et d'Investigations

Géologico-minières, Géotechniques et Géophysiques SARL ("BEIG3").

Recent mapping over the main Bakassi area has confirmed the

continuation of mineralisation in Zone 1 by 1.3 kilometres to over

5.0 kilometres, with rock-chip samples from stacked veins returning

up to 35.86 per tonnes ("g/t") gold ("Au").

Highlights

-- Drill collars pegged for planned 1,500 metre initial drill programme;

-- Rock-chip sampling of 'Category 1' quartz tourmaline veins

all mineralised, returning up to 35.86 g/t Au;

-- Mapping over north-east Bakassi zone confirms mineralisation

continues over more than 5.0 kilometres - presence of stacked veins

is highly prospective for enhanced concentrations of gold

mineralisation;

-- Further drill holes being planned to test north-eastern Bakassi area.

Oriole Resources CEO, Tim Livesey, said: "The results of our

initial mapping, trenching and sampling programmes in 2018/19

confirmed extensive gold anomalism but it was clear that gaining a

better understanding of the structural setting would be essential

in order for us to identify the most prospective areas of

mineralisation where there is potential to define a resource.

"We are delighted to see such positive results at the beginning

of the 2020 field season. The mapping has confirmed extension of

the Zone 1 structure to the north-east and, importantly, the

presence of sub-horizontal stacked veins is very encouraging for

the development of a resource target.

"Rock-chip sampling along this structure has returned consistent

gold mineralisation, with all 10 samples from "Category 1" veins

showing gold mineralisation, the highest grade being 35.86 g/t

Au.

"This again highlights the prospectivity of the Bakassi area,

continuing to confirm our geological model and affording us the

opportunity to go on to identify significant widths of gold

mineralisation in the system.

"This has been a fantastic start to our field season in

Cameroon. It's rare to have your geological models advanced and

supported so strongly, with every analysis coming back positive for

gold. This is a great credit to our geological team who have

developed and tested this hypothesis, yet again highlighting the

value of having "boots on the ground".

"We look forward to following-up with further field work and a

targeted diamond drill programme during 2020."

Further Details

During Q4-2019, the Oriole team completed ground-truthing of 14

proposed drill locations for its planned initial 1,500 metre

diamond drilling programme (announcement dated 14 November 2019).

The work has confirmed that only minimal preparation works are

required ahead of drilling and the holes have been pegged

accordingly. Drilling will focus on the Bakassi area and will test

the depth-extension of mineralisation identified to date, including

beneath previous best intersection of 9.0 metres grading 3.14 g/t

Au from trench BT-021 (announcement dated 21 May 2019).

The team also completed detailed (1:2,000 scale) mapping over a

5.2 square kilometre area at the north-eastern end of the Bakassi

area, including to the north of BT-021, where earlier selective

rock-chip sampling returned up to 135.40 g/t Au (announced dated 27

November 2018). Mapped lithologies are consistent with those

identified previously, namely meta-sediments (phyllite, metapelite,

shale, and quartzite) in the eastern part of the mapped area (Zone

2), tonalite and granodiorite in western part of mapped area (Zone

1) and meta-sediments intercalated with mafic schists in the area

in between Zone 1 and Zone 2.

Structurally-speaking, the entire Bakassi area appears to be a

succession of folds with north-northeast axes. Mapping has

confirmed the extension of mineralisation within the Zone 1

structural corridor by 1.3 kilometres to the north-east, to

approximately 5.3 kilometres. The team also identified multiple

sets of sub-horizontal, stacked quartz veins that could support

enhanced volumes of gold mineralisation in this area. 10 selective

samples of 'Category 1' quartz-tourmaline veins, previously

identified as being the most prospective for gold mineralisation,

were taken to support the mapping. All samples were mineralised

(>0.10 g/t Au) and seven samples graded greater than 2.00 g/t

Au, with best results of 35.86 g/t Au, 23.30 g/t Au and 19.70 g/t

Au (Table 1). One sample (BBR001) from a 'Category 2' saccharoidal

quartz vein with iron oxides, not expected to carry grade, was

confirmed to be barren and, together with the mineralised examples,

reaffirm the team's understanding of the structural controls on

gold mineralisation.

Table 1. Rock-chip sampling results from northern Bakassi

area

Sample ID Grade (g/t Vein type

Au)*

BBR001 <0.02 Category 2

----------- -----------

BBR002 19.61 Category 1

----------- -----------

BBR003 0.69 Category 1

----------- -----------

BBR004 2.61 Category 1

----------- -----------

BBR005 35.86 Category 1

----------- -----------

BBR006 3.61 Category 1

----------- -----------

BBR007 0.19 Category 1

----------- -----------

BBR008 2.54 Category 1

----------- -----------

BBR009 0.91 Category 1

----------- -----------

BBR010 23.14 Category 1

----------- -----------

BBR011 4.37 Category 1

----------- -----------

* 0.10 g/t Au cut off

On the basis of the work completed, the team is currently

planning additional drill holes to supplement the initial planned

c.1,500 programme. The Company plans to complete the programme

during 2020.

For further information, including a map showing the latest

results and JORC Table 1, please see the following page of our

website

https://orioleresources.com/projects/bibemi-and-wapouze/.

Competent Persons Statement

The information in this release that relates to Exploration

Results has been compiled by Claire Bay (VP Exploration and

Business Development). Claire Bay (MGeol, CGeol) is a Competent

Person as defined in the JORC code and takes responsibility for the

release of this information. Claire has reviewed the information in

this announcement and confirms that she is not aware of any new

information or data that materially affects the information

reproduced here.** ENDS **

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014. Following the

publication of this announcement, this inside information is now

considered to be in the public domain.

For further information please visit www.orioleresources.com,

@OrioleResources on Twitter,

or contact:

Oriole Resources Plc Tel: +44 (0)20 7830 9650

Tim Livesey / Bob Smeeton / Claire

Bay

Blytheweigh (IR/PR Contact) Tel: +44 (0)20 7138 3204

Tim Blythe / Megan Ray / Rachael Brooks

Grant Thornton UK LLP Tel: +44 (0)20 7383 5100

Samantha Harrison / Ben Roberts / Niall McDonald

WH Ireland Tel: +44 (0)20 7220 1666

Adrian Hadden / Darshan Patel / Lydia

Zychowska

Notes to Editors:

Oriole Resources PLC is an AIM-quoted exploration company,

focussed on West Africa. It is focused on early-stage exploration

in Cameroon (Bibemi and Wapouzé projects) and the more advanced

Senala gold project in Senegal, where IAMGOLD has the option to

spend US$8m to earn a 70% interest. Year 1 commitments have been

met at all three projects. The Company has several interests and

royalties in companies operating throughout Africa and Turkey that

could deliver future cash flow, and it continues to assess new

opportunities in both regions.

.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DRLUAAWRRVUAUAR

(END) Dow Jones Newswires

January 22, 2020 02:00 ET (07:00 GMT)

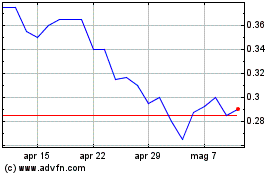

Grafico Azioni Oriole Resources (LSE:ORR)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Oriole Resources (LSE:ORR)

Storico

Da Apr 2023 a Apr 2024