TIDMRDW

RNS Number : 9647B

Redrow PLC

05 February 2020

FOR IMMEDIATE RELEASE

Wednesday 5 February 2020

Redrow plc

Interim results for the six months to 31 December 2019

ROBUST FIRST HALF PERFORMANCE AND

STRONG START TO SECOND HALF

EXPECTATIONS FOR FULL YEAR UNCHANGED

Financial Results

H1 2020 H1 2019 % Change

Private Net Reservations GBP936m GBP795m 18

--------- --------- ---------

Total Order Book GBP1.2bn GBP1.2bn -

--------- --------- ---------

Revenue GBP870m GBP970m (10)

--------- --------- ---------

Legal Completions 2,554 2,970 (14)

--------- --------- ---------

Profit Before Tax GBP157m GBP185m (15)

--------- --------- ---------

EPS 37.2p 41.5p (10)

--------- --------- ---------

ROCE 25% 28% (11)

--------- --------- ---------

Interim Dividend per share 10.5p 10p 5

--------- --------- ---------

Operational Summary

-- Balance of Homes Turnover weighted to second half with 40:60 split (2019: 46:54)

-- Average number of outlets expected to rise to 131 for the year (2019: 126)

-- First half Private Net Reservations up 18% to GBP936m

-- Second half Private Net Reservations to date up 15% at GBP180m (2019: GBP156m)

Financial Summary

-- Group revenue of GBP870m (2019: GBP970m) due to the second half weighting of Homes Turnover

-- First half pre-tax profit of GBP157m (2019: GBP185m)

-- Earnings per share (EPS) of 37.2p (2019: 41.5p)

-- Return on capital employed of 25% (2019: 28%)

-- Net cash of GBP14m (Dec 2018: GBP101m)

-- Interim dividend of 10.5p per share (2019: 10p), up 5%

Board Changes

-- John Tutte to step-down to non-executive Chairman from July

2020 and retire ahead of the AGM in 2021

-- Search for an independent non-executive Chairman to commence towards end of 2020

-- Matthew Pratt to be appointed Group Chief Executive from 1st July 2020

John Tutte, Executive Chairman of Redrow, said

"Redrow has once again delivered a robust operational and

financial first-half performance consistent with our expectation

that revenue will be considerably more weighted than usual to the

second half.

The Group delivered a record value of first half reservations at

GBP936m (2019: GBP795m), a pre-tax profit of GBP157m (2019:

GBP185m) and ended the period with net cash of GBP14m (2019:

GBP101m). Given our confidence in the full year performance we have

declared an interim dividend of 10.5p, up 5% on the previous

year.

The market in the first five weeks of the second half has been

resilient with the value of reservations up 15% at GBP180m (2019:

GBP156m).

Current market conditions, combined with our very strong order

book give me confidence this will be yet another year of progress

for Redrow and our expectations for the full year remain

unchanged."

Enquiries:

Redrow plc

John Tutte, Executive Chairman

Barbara Richmond, Group Finance 01244 527411

Director 01244 527411

Instinctif Partners 0207 457 2020

Mark Garraway 07814 379412

James Gray 07583 936031

There will be an analyst and investor meeting at 10.30 am at The

London Stock Exchange, 10 Paternoster Square, London, EC4M 7LS.

Coffee will be served from 10.00 am.

A live audio webcast and slide presentation of this event will

be available at 10.30 am on www.redrowplc.co.uk.

Participants can also dial in to hear the presentation live at

10.30 am on +44 (0) 20 3936 2999 or UK Toll Free

0800 640 6441; access code 607244.

A recording will be available until 4th March 2020 on +44 (0) 20

3936 3001; access code 120712.

Chairman's Statement

Redrow has once again delivered a robust operational and

financial set of results for the first-half of the financial year

and traded strongly despite an uncertain political and economic

background.

The results are consistent with our expectations highlighted in

September, that returns will be considerably more weighted than

usual to the second-half due to constrained outlet growth last year

and the timing of apartment block completions.

We secured a record number of private reservations in the six

months to the end of December and the value of our total forward

order book was maintained at December 2018's record level and

closed 15% ahead of the opening position at the beginning of

July.

Our Financial Performance

Group revenue was GBP870m in the first half compared to GBP970m

last year due to legal completions reducing from 2,970 to 2,554.

Private completions were down by 99 and social completions were 317

lower and accounted for 19% (2019: 27%) of total completions. The

private average selling price was similar to last year at

GBP387,000 (2019: GBP391,000).

The gross margin was 23.9% (2019: 24%) as the impact of build

cost inflation was largely offset by the change in tenure mix.

Overheads increased from GBP46m to GBP49m following the opening

our new Thames Valley division in July. Operating profit reduced

from GBP187m to GBP159m, mainly due to the reduced turnover, and

pre-tax profit was GBP157m (2019: GBP185m). Earnings per share were

37.2p (2019: 41.5p).

Net cash at the end of December 2019 was GBP14m (2019: GBP101m)

despite paying out GBP149m in dividends and tax in the first-half

(2019: GBP105m).

Return on Capital Employed reduced to 25% (2019: 28%) in the

first-half due to the lower profits.

Given the Group's ongoing strong earnings and cash position, the

Board has declared an interim dividend of 10.5p (2019: 10p), a 5%

increase on the prior year. The interim dividend will be paid on 9

April 2020 to holders of ordinary shares on the register at the

close of business on 6 March 2020.

Operating Highlights

The wider housing market continued to be affected by political

uncertainty around Brexit and during the run-up to the general

election. This had an impact on the time taken to close new homes'

sales, particularly where extended chains were involved.

Notwithstanding this, the Group achieved a record number of private

reservations in the six months to the end of December with the

value of reservations up 18% at GBP936m (2019: GBP795m). Excluding

the Colindale PRS deal we announced in September, the value of

reservations was 3% ahead.

At the end of December 2019, we had a total order book of

GBP1.2bn, in line with last year's record level.

Outlets averaged the same as last year at 129 and the weekly

sales rate was 0.73 (2019: 0.61) and 0.62 excluding the Colindale

PRS sale.

The market was fairly consistent across all of our operating

areas with London showing some early signs of improvement. Pricing

was stable throughout the period and 36% (2019: 39%) of private

buyers utilised Help to Buy.

Our new Thames Valley division made a positive contribution to

Group profits in the first-half.

Our long-standing supplier and sub-contractor relationships and

cost saving initiatives are helping to ease cost pressures. We

anticipate underlying build cost inflation will reduce in calendar

year 2020 to around 3% and will be largely offset by modest house

price gains.

During 2019 we rolled-out our bespoke tablet-based quality

management system. We are now able to better track and measure

standards and deal more efficiently with workmanship issues during

the build process. Our industry-leading online reservation system

is now operating across nearly all of our developments and is

proving very popular with our customers. Our customer

recommendation score is currently running at 91.8%.

We continue to invest in creating great places to live that

respond to our customers' growing awareness of the environment and

the need to address climate change and the threat to biodiversity.

As part of this commitment, today we have published our social

impact review: Creating Communities - Giving Our Customers a Better

Way to Live. The review, which is available on our website, sets

out how our business makes a meaningful social impact and strives

to leave a positive environmental legacy.

Land and Planning

We remained active but cautious in the land market in the

first-half. The Group acquired 1,946 plots with planning and the

owned and contracted land holdings with planning closed at 28,125

plots (June 2019: 28,566 plots). The Group is processing a sizeable

pipeline of sites with terms agreed and we therefore expect

acquisitions to accelerate in the second-half.

Although our cautious approach to land acquisition during a

prolonged period of political and economic uncertainty impacted the

rate of outlet growth, our strategy to acquire larger sites has

reduced the rate at which outlets are now closing. As a result, we

are expecting outlet growth to be strong in the second-half despite

ongoing delays in the planning system.

Board Changes

My appointment as Executive Chairman and Matthew Pratt's

promotion to Chief Operating Officer earlier last year were

integral to a smooth transition to a more conventional board

structure following Steve Morgan's retirement. The transition has

gone well, and it is therefore my intention to step back to a

non-executive Chairman role from 1st July 2020 and to retire from

the board ahead of the AGM in 2021. Matthew Pratt will take up the

position of Group Chief Executive with effect from 1st July 2020

and the search for an independent non-executive Chairman to replace

me will start towards the end of this calendar year.

I am confident that under Matthew's leadership, supported by

Barbara Richmond and the wider executive team, Redrow will continue

to go from strength to strength. Barbara recently celebrated ten

exceptional years as Group Finance Director.

During the first half we further strengthened the board with the

appointment of Nicky Dulieu as a non-executive Director: Nicky's

extensive knowledge of retailing and customer service complements

the existing Board's wealth of experience.

Current Trading and Outlook

The market in the first five weeks of the second-half has been

resilient. Private reservations in terms of value are 15% ahead at

GBP180m (2019: GBP156m). We are currently operating from 134

outlets (2019: 128) and continue to expect to operate from an

average of 131 outlets for the full year (2019: 126).

Planned changes to Help to Buy next year will limit the scheme

to first-time buyers and introduce regional price caps. Whilst we

expect this will see demand increase in the short-term from buyers

that will not qualify for the scheme in 2021, we continue to urge

government to review the caps that, as they stand, will

disadvantage buyers in the North and Midlands.

Due to constrained outlet growth last year and the timing of

apartment block completions, we budgeted to deliver significantly

more completions than usual in the second-half. We are on-track to

do so and our expectations for the full year remain unchanged.

With our very strong order book, a promising start to the

second-half and a more stable political outlook, prospects are

encouraging and I am confident this will be another year of

progress for Redrow.

John Tutte

Executive Chairman

Consolidated Income Statement

Unaudited Audited

6 months ended 12 months

31 December ended

30 June

2019 2018 2019

Note GBPm GBPm GBPm

Revenue 870 970 2,112

Cost of sales (662) (737) (1,608)

---------------------------------------- ----- ------- -------- ----------

Gross profit 208 233 504

Administrative expenses (49) (46) (93)

---------------------------------------- ----- ------- -------- ----------

Operating profit 159 187 411

Financial income 1 1 3

Financial costs (3) (3) (8)

---------------------------------------- ----- ------- -------- ----------

Net financing costs (2) (2) (5)

Profit before tax 157 185 406

Income tax expense 2 (29) (35) (77)

---------------------------------------- ----- ------- -------- ----------

Profit for the period 128 150 329

---------------------------------------- ----- ------- -------- ----------

Earnings per share - basic 4 37.2p 41.5p 92.3p

- diluted 4 37.1p 41.4p 92.0p

Consolidated Statement of Comprehensive Income

Unaudited Audited

6 months ended 12 months

31 December ended

30 June

2019 2018 2019

Note GBPm GBPm GBPm

------------------------------------------------ ----- -------- ------- ----------

Profit for the period 128 150 329

Other comprehensive (expense):

Items that will not be reclassified to profit

or loss

Remeasurements of post-employment benefit

obligations 5 (3) (5) (7)

Deferred tax on remeasurements taken directly

to equity 1 1 1

------------------------------------------------ ----- -------- ------- ----------

Other comprehensive (expense) for the period

net of tax (2) (4) (6)

------------------------------------------------ ----- -------- ------- ----------

Total comprehensive income for the period 126 146 323

------------------------------------------------ ----- -------- ------- ----------

Consolidated Balance Sheet

Unaudited Audited

As at As at

31 December 30 June

2019 2018 2019

Note GBPm GBPm GBPm

Assets

Intangible assets 2 2 2

Property, plant and equipment 17 15 16

Lease right of use assets 8 - -

Investments 8 6 6

Deferred tax assets 4 4 4

Retirement benefit surplus 5 17 16 18

Trade and other receivables 7 7 9

----------------------------------------------- ----- ------------- ------ ---------

Total non-current assets 63 50 55

----------------------------------------------- ----- ------------- ------ ---------

Inventories 6 2,350 2,258 2,297

Trade and other receivables 37 43 48

Current corporation tax receivables 14 - -

Cash and cash equivalents 8 89 102 204

----------------------------------------------- ----- ------------- ------ ---------

Total current assets 2,490 2,403 2,549

----------------------------------------------- ----- ------------- ------ ---------

Total assets 2,553 2,453 2,604

----------------------------------------------- ----- ------------- ------ ---------

Equity

Retained earnings at 1 July 2019 1,481 1,379 1,379

Profit for the period 128 150 329

Other comprehensive (expense) for the period (2) (4) (6)

Dividends paid (72) (70) (218)

Movement in LTIP/SAYE 3 1 (3)

----------------------------------------------- ----- ------------- ------ ---------

Retained earnings 1,538 1,456 1,481

Share capital 10 37 37 37

Share premium account 59 59 59

Other reserves 8 8 8

----------------------------------------------- ----- ------------- ------ ---------

Total equity 1,642 1,560 1,585

----------------------------------------------- ----- ------------- ------ ---------

Liabilities

Bank loans 8 75 1 80

Trade and other payables 7 125 143 167

Deferred tax liabilities 4 4 4

Long-term provisions 8 9 8

----------------------------------------------- ----- ------------- ------ ---------

Total non-current liabilities 212 157 259

----------------------------------------------- ----- ------------- ------ ---------

Bank overdrafts and loans 8 - - -

Trade and other payables 7 699 702 726

Current income tax liabilities - 34 34

----------------------------------------------- ----- ------------- ------ ---------

Total current liabilities 699 736 760

----------------------------------------------- ----- ------------- ------ ---------

Total liabilities 911 893 1,019

Total equity and liabilities 2,553 2,453 2,604

----------------------------------------------- ----- ------------- ------ ---------

Redrow plc Registered no. 2877315

Consolidated Statement of Changes in Equity

Share

Share premium Other Retained

capital account reserves earnings Total

GBPm GBPm GBPm GBPm GBPm

----------------------------------- -------- -------- --------- --------- ------

At 1 July 2018 37 59 8 1,379 1,483

Total comprehensive income for

the period - - - 146 146

Dividends paid - - - (70) (70)

Movement in LTIP/SAYE - - - 1 1

At 31 December 2018 (Unaudited) 37 59 8 1,456 1,560

----------------------------------- -------- -------- --------- --------- ------

At 1 July 2018 37 59 8 1,379 1,483

Total comprehensive income for

the period - - - 323 323

Dividends paid - - - (218) (218)

Movement in LTIP/SAYE - - - (3) (3)

At 30 June 2019 (Audited) 37 59 8 1,481 1,585

----------------------------------- -------- -------- --------- --------- ------

At 1 July 2019 37 59 8 1,481 1,585

Total comprehensive income for

the period - - - 126 126

Dividends paid - - - (72) (72)

Movement in LTIP/SAYE - - - 3 3

At 31 December 2019 (Unaudited) 37 59 8 1,538 1,642

----------------------------------- -------- -------- --------- --------- ------

Consolidated Statement of Cash Flows

Unaudited Audited

6 months ended 12 months

31 December ended

30 June

2019 2018 2019

Note GBPm GBPm GBPm

Cash flows from operating activities

Operating profit 159 187 411

Depreciation and amortisation 3 1 3

Adjustment for non-cash items (3) (1) (7)

Decrease/(increase) in trade and other receivables 13 1 (6)

Increase in inventories (53) (40) (79)

(Decrease)/increase in trade and other payables (74) (3) 50

(Decrease)/increase in provisions - - (1)

----------------------------------------------------- ----- -------- ------- ----------

Cash inflow generated from operations 45 145 371

Interest paid (1) (1) (2)

Tax paid (77) (35) (77)

----------------------------------------------------- ----- -------- ------- ----------

Net cash (outflow)/inflow from operating

activities (33) 109 292

----------------------------------------------------- ----- -------- ------- ----------

Cash flows from investing activities

Acquisition of software, property, plant

and equipment (3) (1) (4)

Interest received - - 1

Net payments to joint ventures (2) - -

------------------------------------------------------------ -------- ------- ----------

Net cash (outflow) from investing activities (5) (1) (3)

----------------------------------------------------- ----- -------- ------- ----------

Cash flows from financing activities

Issue of bank borrowings 75 1 80

Repayment of bank borrowings (80) (5) (5)

Purchase of own shares - - (10)

Dividends paid 3 (72) (70) (218)

----------------------------------------------------- ----- -------- ------- ----------

Net cash outflow from financing activities (77) (74) (153)

----------------------------------------------------- ----- -------- ------- ----------

(Decrease)/increase in net cash and cash

equivalents (115) 34 136

Net cash and cash equivalents at the beginning

of the period 204 68 68

----------------------------------------------------- ----- -------- ------- ----------

Net cash and cash equivalents at the end

of the period 8 89 102 204

----------------------------------------------------- ----- -------- ------- ----------

NOTES (Unaudited)

1. Accounting policies

Basis of preparation

The condensed consolidated half-yearly financial information for

the half-year ended 31 December 2019 has been prepared on a going

concern basis in accordance with the Disclosure and Transparency

Rules of the Financial Conduct Authority and with IAS 34, 'Interim

financial reporting' as adopted by the European Union. The

half-yearly condensed consolidated report should be read in

conjunction with the annual consolidated financial statements for

the year ended 30 June 2019, which have been prepared in accordance

with IFRSs as adopted by the European Union.

These half-yearly financial results do not comprise statutory

accounts within the meaning of section 435 of the Companies Act

2006. This condensed half-yearly financial information has been

reviewed, not audited. The comparative figures for the financial

year ended 30 June 2019 are not the Group's statutory accounts for

that financial year. Audited statutory accounts for the year ended

30 June 2019 were approved by the Board of Directors on 4 September

2019 and delivered to the Registrar of Companies. The report of the

auditors on those accounts was unqualified, did not contain an

emphasis of matter paragraph, and did not contain any statement

under section 498 (2) of (3) of the Companies Act 2006.

The principal accounting policies adopted in the preparation of

this consolidated half-yearly report are included in the annual

consolidated financial statements for the year ended 30 June 2019.

The accounting policies are consistent with those followed in the

preparation of the financial statements to the year ended 30 June

2019 with the exception of one main new accounting standard which

has been adopted by the Group from 1 July 2019.

IFRS 16, 'leases' is the standard that has replaced the guidance

in IAS 17. Under IAS 17, the Group did not have any finance leases

only operating leases which were off balance sheet. IFRS 16

requires lessees to recognise a lease liability reflecting future

lease payments and a lease right of use asset for virtually all

lease contracts. Under IFRS 16, a contract is, or contains a lease,

if the contract conveys the right to control the use of the

identified asset in exchange for consideration. This standard is

effective for the Group for the year ending 30 June 2020.

The Group has a number of leases in relation to cars,

photocopiers and some office properties which have been brought

onto the balance sheet as a result of the adoption of IFRS 16. The

Group has used the modified retrospective method to implement IFRS

16. Under this approach, comparative information is not restated.

Rather at 1 July 2019, the Group recognised the accumulative effect

of the initial application as an adjustment to the opening balance

sheet, increasing both fixed assets and liabilities by GBP8m.

Discount rates are used in the calculation of the lease liability.

For photocopier leases, the discount rates implicit in the lease

have been used. For cars, the discount rate has been estimated

across the asset type based on a sample of implicit rates provided

by the lessor. For the office property leases an estimate has been

used based on adjusted borrowing rates.

As at 31 December 2019, lease right of use assets on the balance

sheet were GBP8m.

There were no other key judgements or estimates made in

assessing the impact of IFRS 16 on the Group.

The preparation of condensed half-yearly financial statements

requires management to make judgements, estimates and assumptions

that affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results may subsequently differ from these estimates. In preparing

these condensed half-yearly financial statements, the significant

judgements made by management in applying the Group's accounting

policies and the key sources of estimation uncertainty were the

same as those that applied to the annual consolidated financial

statements for the year ended 30 June 2019.

After making due enquiries and in accordance with the FRC's

'Going Concern and Liquidity Risk: Guidance for Directors of UK

Companies 2009', the Directors have a reasonable expectation that

the Group has adequate resources to continue trading for the

foreseeable future. Accordingly, the Directors continue to adopt

the going concern basis in preparing the condensed consolidated

half-yearly financial statements.

The main operation of the Group is focused on housebuilding. As

it operates entirely within the United Kingdom, the Group has only

one reportable business and geographic segment. After considering

the requirements of IFRS 15 to present disaggregated revenue, the

Group does not believe there is any disaggregation criteria

applicable to its one reportable business and geographic segment.

There is no material difference between any assets or liabilities

held at cost and their fair value.

Principal risks and uncertainties

As with any business, Redrow plc faces a number of risks and

uncertainties in the course of its day to day operations.

The principal risks and uncertainties facing the Group are

outlined within our half-yearly report 2020. We have reviewed the

risks pertinent to our business in the six months to 31 December

2019 and which we believe to be relevant for the remaining six

months to 30 June 2020. The only material change to those outlined

in our Annual Report 2019 is that economic uncertainty around

Brexit which has decreased following the recent election.

2. Income Tax expense

Income tax charge is recognised based on management's best

estimate of the weighted average annual income tax rate expected

for the full financial year (18.5% (2019: 19.0%)). Deferred

taxation balances have been valued at 17% being the corporation tax

rate from 1 April 2020 substantively enacted on 6 September

2016.

3. Dividends

A dividend of GBP72m was paid in the six months to 31 December

2019 (six months to 31 December 2018: GBP70m).

4. Earnings per share

The basic earnings per share calculation for the six months

ended 31 December 2019 is based on the weighted number of shares in

issue during the period of 344m (31 December 2018: 362m) excluding

those held in trust under the Redrow Long Term Incentive Plan,

which are treated as cancelled.

Diluted earnings per share has been calculated after adjusting

the weighted average number of shares in issue for all potentially

dilutive shares held under unexercised options.

6 months ended 31 December 2019 (Unaudited)

Earnings No. of shares Per share

GBPm millions Pence

Basic earnings per share 128 344 37.2

Effect of share options and SAYE - 1 (0.1)

-------------------- -------------- ----------

Diluted earnings per share 128 345 37.2

-------------------- -------------- ----------

6 months ended 31 December 2018 (Unaudited)

Earnings No. of shares Per share

GBPm millions Pence

Basic earnings per share 150 362 41.5

Effect of share options and SAYE - 1 (0.1)

-------------------- -------------- ----------

Diluted earnings per share 150 363 41.4

-------------------- -------------- ----------

12 months ended 30 June 2019 (Audited)

Earnings No. of shares Per share

GBPm millions Pence

Basic earnings per share 329 356 92.3

Effect of share options and SAYE - 2 (0.3)

-------------------- -------------- ----------

Diluted earnings per share 329 358 92.0

-------------------- -------------- ----------

5. Pensions

The amounts recognised in respect of the defined benefit section

of the Group's Pension Scheme are as follows:

Unaudited Audited

6 months ended 12 months

31 December ended 30

June

2019 2018 2019

GBPm GBPm GBPm

Amounts included within the consolidated income

statement

period operating costs

Scheme administration expenses - 1 (1)

Net interest on defined benefit liability - - 1

---------- ---------- -----------

- 1 -

---------- ---------- -----------

Amounts recognised in the consolidated income

statement of comprehensive income

Return on scheme assets excluding interest income 1 (5) 13

Actuarial gains arising from change in financial

assumptions (3) - (20)

Actuarial gains arising from change in demographic

assumptions (1) - -

Actuarial gains arising from experience adjustments - - -

---------- ---------- -----------

(3) (5) (7)

---------- ---------- -----------

Amounts recognised in the consolidated balance

sheet

Present value of the defined benefit obligation (134) (112) (130)

Fair value of the Scheme's assets 151 1 148

---------- ---------- -----------

Surplus in the consolidated balance sheet 17 1 18

---------- ---------- -----------

6. Inventories

Unaudited Audited

As at As at

31 December 30 June

2019 2018 2019

GBPm GBPm GBPm

Land for development 1,464 1,460 1,515

Work in progress 814 723 715

Stock of showhomes 72 75 67

------- ------ ---------

2,350 2,258 2,297

------- ------ ---------

7. Land Creditors

(included in trade and other payables)

Unaudited Audited

As at As at

31 December 30 June

2019 2018 2019

GBPm GBPm GBPm

Due within one year 229 244 271

Due in more than one year 125 143 167

------- ------ ---------

354 387 438

======= ====== =========

8. Analysis of Net Cash/(Debt)

Unaudited Audited

As at As at

31 December 30 June

2019 2018 2019

GBPm GBPm GBPm

Cash and cash equivalents 89 102 204

Bank overdrafts - - -

------- ------ ---------

Net cash and cash equivalents 89 102 204

Bank loans (75) (1) (80)

------- ------ ---------

14 101 124

======= ====== =========

Net cash excludes land creditors and lease liabilities arising

under IFRS 16.

9. Bank facilities

At 31 December 2019, the Group had total unsecured bank

borrowing facilities of GBP253m, representing GBP250m committed

facilities and GBP3m uncommitted facilities.

The Group's syndicated loan facility matures in December

2022.

10. Issued Share capital

Allotted, called up and fully paid.

GBPm

At 31 December 2018 - 369,799,938 ordinary shares of 10p

each (unaudited) 37

At 31 June 2019 - 352,190,420 ordinary shares of 10.5p each

(audited) 37

At 31 December 2019 - 352,190,420 ordinary shares of 10.5p

each (unaudited) 37

Number of ordinary

shares of 10.5p

each

As at 1 July 2019 and 31 December 2019 352,190,420

11. Contingent Liabilities

Performance bonds, financial guarantees in respect of certain

deferred land creditors and other building or performance

guarantees have been entered into in the normal course of

business.

12. Related parties

Key management personnel, as defined under IAS 24 'Related Party

Disclosures', are identified as the Executive Management Team and

the Non-Executive Directors. Summary key management remuneration is

as follows:

Unaudited Audited

6 months ended 12 months

31 December ended

30 June

2019 2018 2019

GBPm GBPm GBPm

Short-term employee benefits 3 3 5

Share-based payment charges 1 1 2

-------- ------- ----------

4 4 7

-------- ------- ----------

The Group did not undertake any material transactions with Menta

Redrow Limited or Menta Redrow (II) Limited. The Group's loans to

its joint ventures are summarised below:

Unaudited Audited

As at As at

31 December 30 June

2019 2018 2019

GBPm GBPm GBPm

Loans to joint ventures 7 4 4

======= ====== =========

13. Alternative performance measures

Redrow uses return on capital employed (ROCE) as one of its

financial measures. The Directors consider this to be an important

indicator of whether the Group is achieving appropriate returns on

its invested capital. As this is not defined or specified by IFRSs,

a definition and calculation is provided below:

Capital employed is defined as total equity plus net debt or

minus net cash.

ROCE - at half year end, this is calculated as operating profit

for the 12 months to December before exceptional items as a

percentage of the average of current year December and prior year

December capital employed.

December December

2019 2018

GBPm GBPm

-------------------------------- --------- --------------------------- ---------

Operating Profit

6 months to December 2019 159 6 months to December 2018 187

12 months to June 2019 411 12 months to June 2018 382

6 months to December 2018 (187) 6 months to December 2017 (175)

-------------------------------- --------- --------------------------- ---------

12 months to December 2019 383 12 months to December 2018 394

-------------------------------- --------- --------------------------- ---------

Capital Employed

Total equity December 2019 1,642 Total equity December 2018 1,560

Net cash December 2019 (14) Net cash December 2018 (101)

-------------------------------- --------- --------------------------- ---------

Capital employed December Capital employed December

2019 1,628 2018 1,459

-------------------------------- --------- --------------------------- ---------

Total equity December 2018 1,560 Total equity December 2017 1,343

Net cash December 2018 (101) Net debt December 2017 35

-------------------------------- --------- --------------------------- ---------

Capital employed December Capital employed December

2018 1,459 2017 1,378

-------------------------------- --------- --------------------------- ---------

Average capital employed 1,544 Average capital employed 1,419

-------------------------------- --------- --------------------------- ---------

ROCE % 25% ROCE % 28%

-------------------------------- --------- --------------------------- ---------

14. General information

Redrow plc is a public limited company incorporated and

domiciled in the UK and has its primary listing on the London Stock

Exchange.

The registered office address is Redrow House, St David's Park,

Flintshire, CH5 3RX.

Financial Calendar

Interim dividend record date 6 March 2020

Interim dividend payment date 9 April 2020

Announcement of results for the year to 30 June 2020 9 September

2020

Final dividend record date 25 September 2020

Circulation of Annual Report 28 September 2020

Annual General Meeting 6 November 2020

Final dividend payment date 13 November 2020

15. Shareholder enquiries

The Registrar is Computershare Investor Services PLC.

Shareholder enquiries should be

addressed to the Registrar at the following address:

Registrars Department

The Pavilions

Bridgwater Road

Bristol

BS99 6ZZ

Shareholder helpline: 0370 707 1257

16. Risks and Risk Management

Risk Risk Owners Key Controls and Mitigating Strategies

Housing Market Chief Operating Market conditions and trends are

The UK housing market Officer being closely monitored allowing

conditions have a management to identify and respond

direct impact on to any sudden changes or movements.

our business performance.

With underlying build costs continuing

to rise and house price inflation

remaining relatively subdued we maintain

tight controls on costs and continue

to build our relationships with key

suppliers and broaden our supplier

base.

Weekly review of sales at Group,

divisional and site level.

Ensuring strong relationships with

lenders and valuers to ensure they

recognise our premium product.

Ongoing and regular monitoring of

Government policy and lobbying as

appropriate.

Following the recent election delivering

a strong majority, there is a clearer

view of the direction of Brexit.

Although clear guidance is a benefit

to the economy

there remain considerable unknowns

surrounding the

UK leaving the EU.

-------------------------- ----------------------------------------------

Availability of Mortgage Group Finance Proactively engage with the Government,

Finance Director Lenders and

Availability of mortgage Insurers to support the housing market.

finance and increased

lending criteria Expert New Build Mortgage Specialists

requirements are provide updates on and monitoring

key factors in the of regulatory change.

current environment.

The threat of early withdrawal of

Help to Buy dissipated.

-------------------------- ----------------------------------------------

Liquidity and Funding Group Finance Suitable committed banking facilities

The Group requires Director with covenants and headroom.

appropriate facilities

for its short-term Regular communication with our investors

liquidity and long-term and relationship banks, including

funding. visits to developments.

Regular review of our banking covenants

and capital structure.

Ensuring our future cash flow is

sustainable through detailed budgeting

process and reviews.

Strong forecasting and budgeting

process.

-------------------------- ----------------------------------------------

Customer Service Group Customer My Redrow website to support our

Failure of our customer and Marketing customers purchasing their new home.

service could lead Director

to relative under Hard Hat Tours for customers of their

performance of our new home at an appropriate stage

business. of production.

Regular review of our marketing and

communications policy at both Group

and divisional level.

-------------------------- ----------------------------------------------

Land Procurement Group Development Proactive monitoring of the market

The ability to purchase Director conditions to implement a clear defined

land suitable for strategy at both Group and divisional

our products and level.

the timing of future

land purchases are Experienced and knowledgeable personnel

fundamental to the in our land, planning and technical

Group's future performance. teams.

Effective use of our Land Bank Management

system to support the land acquisition

process and monitor opportunities

has led to the risk decreasing overall.

Peer review by Legal Directors and

use of third party legal resources

for larger site acquisitions to reduce

risk.

-------------------------- ----------------------------------------------

Planning and Regulatory Group Development Close management and monitoring of

Environment Director planning expiry dates and CIL.

The inability to

adapt to changes Group Human Resources Well prepared planning submissions

within the planning Director addressing local concern and deploying

and regulatory environment good design.

could adversely impact Group Company

on our ability to Secretary Careful monitoring of the regulatory

comply with regulatory environment and regular communication

requirements. of proposed changes across the Group

through the Executive Management

Team.

Proactive approach to the introduction

of GDPR with a broad based project

team defining and implementing new

policies and procedures.

-------------------------- ----------------------------------------------

Appropriateness of Group Design and Regular review and product updates

Product Technical Director in response to the demand in the

The failure to design market and assessment of our customer

and build a desirable needs.

product for our customers

at the appropriate Design focused on high quality build

price may undermine and flexibility to planning changes.

our ability to fulfil

our business objectives. Regular site visits and implementation

of product changes to respond to

demands.

Introduction of Internal Product

Review Panel.

-------------------------- ----------------------------------------------

Attracting and Retaining Group Human Resources Personal Development Programmes supported

Staff Director by National training centres at four

The loss of key staff locations.

and/ or our failure

to attract high quality Graduate training, Undergraduate

employees will inhibit placements and

our ability to achieve Apprentice training programmes to

our business objectives. aid succession planning.

Development of a bespoke housebuilding

degree course in conjunction with

Liverpool John Moores University

and Coleg Cambria.

Remuneration strategy in order to

attract and retain talent within

the business is reviewed regularly

and benchmarked.

Engagement Team and continued refinement

of internal communications platform

in addition to annual employee survey

to create framework for strong, two-way

communication.

-------------------------- ----------------------------------------------

Health and Safety/ Group Health and Dedicated in-house team operating

Environment Safety and Environmental across the Group to ensure compliance

Instances of non-compliance Director of appropriate Health and Safety

with Health & Safety standards supported by external professional

standards and Environmental expertise.

regulations could

put our people and Separate focus on Assurance visits

the environment at to site and proactive management

risk, ultimately support to develop planning and processes.

damaging our reputation.

Increased levels Monthly Divisional H, S & E Leadership

of scrutiny of the meetings.

housebuilding industry

heightens the risk Tri-annual Group H, S & E Leadership

environment. meetings.

Internal and external training provided

to all employees.

Divisional Construction (Design and

Management) Regulation (CDM) inspections

carried out to assess our compliance

with our client duties under CDM.

Health and Safety discussion at both

Group and divisional level board

meetings.

CDM competency accreditation requirement

as a minimum for contractor selection

process.

-------------------------- ----------------------------------------------

Key Supplier or Subcontractor Group Commercial Use of reputable supply chain partners

Failure Director with relevant experience and proven

The failure of a track record.

key component of

our supply chain Monitoring of subcontract supply

to perform due to chain to maintain appropriate number

financial failure for each trade to identify potential

or production issues shortage in skilled trades in the

could disrupt our near future.

ability to deliver

our homes to programme Subcontractor utilisation on sites

and budgeted cost. monitored to align workload and capacity.

Materials forecast issued to suppliers

and reviewed regularly.

Group Monthly Product Development

meetings to identify and monitor

changes in the regulatory environment.

-------------------------- ----------------------------------------------

Cyber Security Chief Information Communication of IT policy and procedures

Failure of the Group's Officer to all employees.

IT systems and the

security of our internal Regular systems back up and storage

systems, data and of data offsite. Internal IT security

our websites can specialists.

have significant

impact to our business. Use of third party entity to test

The introduction the Group's cyber security systems

of GDPR has increased and other proactive approach for

the requirements cyber security including Cyber Essentials

for the control of Plus accreditation.

personal data.

Compulsory GDPR and IT security online

training to all employees within

our business.

-------------------------- ----------------------------------------------

Fraud/Uninsured Loss Group Finance Systems, policies and procedures

A significant fraud Director in place which are designed to segregate

or uninsured loss duties and minimise any opportunity

could damage the for fraud.

financial performance

of our business. Regular Business Process Reviews

undertaken to ensure compliance with

procedure and policies followed by

formal action plans.

Timely management reporting.

Insurance strategy driven by business

risks.

Fraud awareness training.

-------------------------- ----------------------------------------------

Responsibility Statement

We confirm that to the best of our knowledge:

-- the condensed set of financial statements has been prepared

in accordance with IAS 34 Interim Financial Reporting as adopted by

the EU; and

-- the interim management report includes a fair review of the information required by:

a) DTR 4.2.7R of the Disclosure Guidance and Transparency Rules,

being an indication of important events that have occurred during

the first six months of the financial year and their impact on the

condensed set of financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

b) DTR 4.2.8R of the Disclosure Guidance and Transparency Rules,

being related party transactions that have taken place in the first

six months of the current financial year and that have materially

affected the financial position or performance of the entity during

that period; and any changes in the related party transactions

described in the last annual report that could do so.

During the period since the approval of the Redrow plc Annual

Report for the year ended 30 June 2019, Nicky Dulieu was appointed

to the board on 6 November 2019 following the close of the 2019

Annual General Meeting.

The Directors of Redrow PLC as at the date of this statement

are:

John Tutte

Matthew Pratt

Barbara Richmond

Nicholas Hewson

Sir Michael Lyons

Vanda Murray

Nicky Dulieu

By order of the Board

Graham Cope

Company Secretary

4 February 2020

Redrow plc

Redrow House

St David's Park

Flintshire

CH5 3RX

Independent Review Report to Redrow plc

Report on the half-yearly report

Conclusion

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 31st December 2019 which comprises the

Consolidated Income Statement, Consolidated Statement of

Comprehensive Income, Consolidated Balance Sheet, Consolidated

Statement of Changes in Equity, Consolidated Statement of Cash

Flows and the related explanatory notes.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 31st

December 2019 is not prepared, in all material respects, in

accordance with IAS 34 Interim Financial Reporting as adopted by

the EU and the Disclosure Guidance and Transparency Rules ("the

DTR") of the UK's Financial Conduct Authority ("the UK FCA").

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity issued by the Auditing Practices Board for use in the

UK. A review of interim financial information consists of making

enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures. We read the other information contained in the

half-yearly financial report and consider whether it contains any

apparent misstatements or material inconsistencies with the

information in the condensed set of financial statements.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK) and

consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

The impact of uncertainties due to the UK exiting the European

Union on our review

Uncertainties related to the effects of Brexit are relevant to

understanding our review of the condensed financial statements.

Brexit is one of the most significant economic events for the UK,

and its effects are subject to unprecedented levels of uncertainty

of consequences, with the full range of possible effects unknown.

An interim review cannot be expected to predict the unknowable

factors or all possible future implications for a company and this

is particularly the case in relation to Brexit.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the DTR of the UK FCA.

The interim financial statements of the group are prepared in

accordance with International Financial Reporting Standards as

adopted by the EU. The directors are responsible for preparing the

condensed set of financial statements included in the half-yearly

financial report in accordance with IAS 34 as adopted by the

EU.

Our responsibility

Our responsibility is to express to the company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

The purpose of our review work and to whom we owe our

responsibilities

This report is made solely to the company in accordance with the

terms of our engagement to assist the company in meeting the

requirements of the DTR of the UK FCA. Our review has been

undertaken so that we might state to the company those matters we

are required to state to it in this report and for no other

purpose. To the fullest extent permitted by law, we do not accept

or assume responsibility to anyone other than the company for our

review work, for this report, or for the conclusions we have

reached.

Nick Plumb

For and on behalf of KPMG LLP

Chartered Accountants

KPMG LLP

8 Princes Parade

Liverpool

L3 1QH

4 February 2020

LEI Number:

2138008WJZBBA7EYEL28

Announcement Classification:

1.2: Half yearly financial report and audit reports/limited

reviews

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR BLGDDGUGDGGS

(END) Dow Jones Newswires

February 05, 2020 02:00 ET (07:00 GMT)

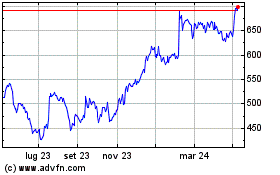

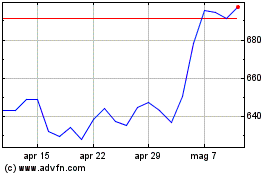

Grafico Azioni Redrow (LSE:RDW)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Redrow (LSE:RDW)

Storico

Da Mag 2023 a Mag 2024