Schroder Real Estate Net Asset Value(s) & Dividend Declaration

17 Febbraio 2020 - 8:00AM

UK Regulatory

TIDMSREI

For release 17 February 2020

Schroder Real Estate Investment Trust Limited

ANNOUNCEMENT OF NAV AND DIVID FOR QUARTER TO 31 DECEMBER 2019

Schroder Real Estate Investment Trust (the 'Company'), the actively managed

UK-focused REIT, announces its net asset value ('NAV') and dividend for the

quarter to 31 December 2019.

Net Asset Value

The unaudited quarterly NAV as at 31 December 2019 was GBP321.4 million or 62.0

pence per share ('pps'). During the quarter the Company completed a major

refinancing that incurred costs of GBP27.2 million. The refinancing generated an

immediate interest saving of GBP2.5 million per annum that will be paid to

shareholders as an annualised 19% dividend increase to 0.7715 pps with effect

from the forthcoming dividend to be paid on 13 March 2020.

Following the refinancing, the Company has approximately GBP90 million of cash

and undrawn debt facilities to invest in income enhancing asset management and

new acquisitions that are under active consideration.

The NAV of 62.0 pps reflects a like-for-like decrease of 1.7% compared with the

NAV as at 30 September 2019 adjusted for the refinancing costs. Based on the

quarterly dividend paid in December 2019 of 0.65 pps, the NAV total return

excluding the refinancing costs was -0.7%. A breakdown is set out below:

GBPm pps Comments

NAV as at 30 354.3 68.3

September 2019

Refinancing costs (27.2) (5.2) Break costs and related fees of GBP

25.8 million together with writing

off unamortised finance costs of GBP

1.4 million.

NAV at 30 September 327.1 63.1

2019 adjusted for

the refinancing

costs

Unrealised change in (4.6) (0.9)

valuation of direct

real estate

portfolio and joint

ventures

Capital expenditure (1.5) (0.3) GBP800,000 relates to works linked

to pre-lets such as Bedford,

Milton Keynes and Leeds.

Remainder principally relates to

refurbishment of multi-let

industrial estates.

Realised gains on 0.3 0.1 GBP200,000 gain on Peterborough

disposals (completed December 2019) and GBP

100,000 gain on Hinckley

(completed November 2019).

Net revenue 3.4 0.7 Quarterly earnings.

Dividend paid (3.4) (0.7) Reflects the 0.65 pps September

2019 quarterly dividend which was

paid in December 2019, equating to

100% dividend cover.

Others 0.1 Nil Lease incentive adjustments and

rounding.

NAV as at 31 321.4 62.0 Reflects a 1.7% decrease in the

December 2019 NAV adjusted for the refinancing

costs

Dividend payment

The Company announces an interim dividend of 0.7715 pps for the period 1

October 2019 to 31 December 2019. This reflects the previously announced 19%

increase over the prior period following the refinancing in October 2019.

The dividend payment will be made on 13 March 2020 to shareholders on the

register as at 28 February 2020. The ex-dividend date will be 27 February 2020.

The dividend of 0.7715 pps will be designated 0.3500 pps as an interim property

income distribution ('PID') and 0.4215 pps as an interim ordinary dividend.

Performance versus MSCI Index

Over the quarter to 31 December 2019, the underlying portfolio produced a total

return of 0.1%, in line with the MSCI Benchmark Index. The portfolio's

quarterly income return of 1.6% compared with the Benchmark at 1.1%.

For the calendar year 2019, the underlying portfolio produced a total return of

4.0% compared with MSCI of 1.6%, with the sector total return breakdown as

follows:

Calendar year 2019 portfolio Total return %

total return

SREIT MSCI Benchmark

Index

Industrial 8.9 6.8

Offices 6.0 4.7

Retail -4.8 -7.0

Other 2.7 5.5

Total 4.0 1.6

Property portfolio

The underlying portfolio comprised 39 properties valued at GBP413.9 million as at

31 December 2019, which produced a rent of GBP23.7 million per annum reflecting a

net initial yield of 5.4% (MSCI Benchmark Index 4.8%). The portfolio rental

value is GBP30 million per annum, resulting in a reversionary yield of 7.2% (MSCI

Benchmark Index 5.3%).

As at 31 December 2019, the void rate was 7.9%, calculated as a percentage of

rental value. The Company has ongoing totalling annualised rental income of

approximately GBP700,000. Successful completion of these leases under offer

would reduce the void rate to approximately 6%. The average unexpired lease

term, assuming all tenants vacate at the earliest opportunity, was 5.8 years.

The tables below summarise the portfolio information as at 31 December 2020:

Sector weightings Weighting %

SREIT MSCI Benchmark

Index

Industrial 28.0 26.2

Offices 39.2 25.6

Retail 25.2 28.0

Primary use retail 19.2 N/A

Ancillary use retail 6.0 N/A

Other 7.6 20.1

Regional weightings Weighting %

SREIT MSCI Benchmark

Index

Central London 8.9 13.8

South East excluding Central 20.2 38.8

London

Rest of South 8.7 15.1

Midlands and Wales 28.0 12.7

North 31.5 14.7

Scotland 2.7 4.9

Transactions

The Company completed five disposals during the quarter totalling GBP45 million

reflecting a 15% net premium to the valuation at March 2019. These included:

* Edinburgh, Haston House - Completed 1 October 2019. Sale price of GBP6.5

million compared with the 31 March 2019 independent valuation of GBP5.5

million.

* Alfreton, Recticel Unit - Completed 8 October 2019. Sale price of GBP10.4

million compared with the 31 March 2019 independent valuation of GBP10.2

million.

* Acton, Allied Way Estate - Completed 15 November 2019. Sale price of GBP18.9

million compared with the 31 March 2019 independent valuation of GBP17.2

million.

* Hinckley, Coventry Road - Completed 22 November 2019. Sale price of GBP2.2

million compared with the 31 March 2019 independent valuation of GBP2.0

million.

* Peterborough, Finmere Park - Completed 12 December 2019. Sale price of GBP7.0

million compared with the 31 March 2019 independent valuation of GBP3.8

million following the re-letting of the unit on a 10.5 year lease.

Asset management

The Company continues to focus on actively managing the portfolio. Highlights

during the quarter include:

St John's Retail Park, Bedford (Retail warehouse)

The lease to DSG Retail (t/a Curry's PC World) has been extended from 2021 to

2029 at the passing rent of GBP280,000 per annum. DSG will receive an incentive

of 6 months' rent free.

In addition, a simultaneous surrender of Majestic Wine's lease with a new

10-year lease to Easy Bathrooms has completed at the existing rent of GBP64,200

per annum.

These transactions and the previously announced agreements for lease with Lidl

and Home Bargains increase the unexpired term from 3.9 years to 8.2 years and

will support the future trading performance of the asset. The income yield

following completion of the Lidl and Home Bargains lettings will be

approximately 7%.

Horton Park, Telford (Industrial)

A new five year lease for a 6,535 sq ft unit to Evolution Foods completed at GBP

5.50 per sq ft, equating to GBP36,000 per annum.

A five year lease renewal with Activ Projects on a 16,663 sq ft unit at GBP83,315

per annum equating to GBP5.50 per sq ft representing a 39.2% increase on the

previous passing rent.

Post period end activity

Since the calendar year end 15 new lettings, renewals and rent reviews have

completed, generating additional income of approximately GBP135,000 per annum.

The focus is now on completing lettings under offer that have the potential to

generate additional annualised income of GBP700,000 per annum.

Debt

The Company has two loan facilities, a GBP129.6 million term loan with Canada

Life and a revolving credit facility ('RCF') with Royal Bank of Scotland

International ('RBSI').

On 8 October 2019 the Company announced the refinancing of its GBP129.6 million

loan with Canada Life. This extended the average maturity from 8.5 to 16.5

years and reduced the interest rate from 4.4% to 2.5% per annum. The

refinancing generated an immediate interest saving of GBP2.5 million per annum to

be paid to shareholders as an increased dividend of GBP16.0 million per annum,

equating to an increase of 19%, starting at the period 1 October 2019. As at 31

December 2019, the RCF facility of GBP52.5 million remained undrawn. The loans

are fully compliant with their covenants.

In addition to the properties secured against the Canada Life and RBSI loan

facilities, the Company has unsecured properties with a value of GBP36.9 million

and cash of approximately GBP40.9 million. This results in a loan to value ratio,

net of cash, of approximately 21%.

Duncan Owen, Global Head of Schroder Real Estate, said:

"It has been an active quarter for the Company as we have executed our strategy

with the refinancing enabling the delivery of a 19% increase in dividend. The

underlying portfolio has continued to outperform over the 12 months to 31

December 2019 against the Benchmark by 2.3%. We are continuing our active asset

management programme and have a robust pipeline of reinvestment opportunities

to drive returns and grow net income in a sustainable way."

-ENDS-

For further information:

Schroder Real Estate Investment Management 020 7658 6000

Limited:

Duncan Owen / Nick Montgomery / Frank

Sanderson

Northern Trust: 01481 745 001

Lisa Garnham

FTI Consulting: 020 3727 1000

Dido Laurimore / Richard Gotla / Methuselah

Tanyanyiwa

END

(END) Dow Jones Newswires

February 17, 2020 02:00 ET (07:00 GMT)

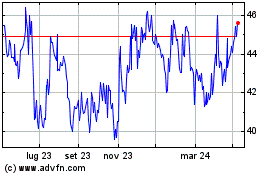

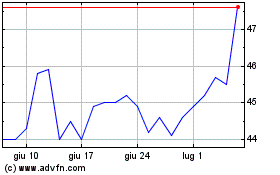

Grafico Azioni Schroder Real Estate Inv... (LSE:SREI)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Schroder Real Estate Inv... (LSE:SREI)

Storico

Da Apr 2023 a Apr 2024