Commodity Currencies Lower After Apple Warning

18 Febbraio 2020 - 3:12AM

RTTF2

The commodity currencies such as the Australian, the New Zealand

and the Canadian dollars fell against their major counterparts in

the Asian session on Tuesday, as risk sentiment faded amid

coronavirus concerns and as tech giant Apple warned it does not

expect to achieve its revenue forecast for the March quarter due to

lower iPhone sales and weak Chinese demand.

Asian stocks were mostly lower after Apple said it would not

meet its revenue guidance for the second quarter due to lower

smartphone demand, and temporary work slowdowns related to

coronavirus outbreak in China.

The warning offset investor optimism about economic stimulus

from Beijing to mitigate the fallout from the coronavirus

outbreak.

The Chinese government said that the virus has killed 1,868

people and infected 72,436 so far.

Worries intensified after the director of Wuchang Hospital in

Wuhan has died from virus despite rescue efforts.

Reversing from its early highs of 0.6715 versus the greenback

and 73.78 against the yen, the aussie dropped to a 1-week low of

0.6684 and an 8-day low of 73.30, respectively. On the downside,

0.64 and 72.00 are likely seen as the next support levels for the

aussie against the greenback and the yen, respectively.

After rising to 1.6131 against the euro and 0.8888 against the

loonie earlier in the session, the aussie weakened to a 5-day low

of 1.6201 and more than a 2-week low of 0.8859, respectively.

Extension of downtrend is likely to see the aussie testing support

around 1.63 against the euro and 0.87 against the loonie.

The kiwi also dropped, touching a 5-day low of 1.6900 against

the euro, 6-day lows of 0.6406 versus the greenback and 70.27

against the yen, easing off from its previous highs of 1.6821,

0.6442 and 70.76, respectively. The kiwi is seen challenging

support around 1.70 against the euro, 0.63 versus the greenback and

69.00 against the yen.

The kiwi was down against the aussie at 1.0442, retreating from

a 5-day high of 1.0415 set in early trading. The next near term

support for the kiwi is found around the 1.06 mark.

The loonie slipped to 4-day lows of 1.3256 versus the greenback

and 82.74 against the yen, after having risen to 1.3229 and 83.03,

respectively in early deals. The loonie is likely to face around

support around 1.35 versus the greenback and 79.00 against the

yen.

The loonie fell against the euro, with the EUR/CAD pair hitting

1.4356. Immediate support for the loonie is possibly seen around

the 79.00 level.

Looking ahead, German ZEW economic sentiment index for February,

U.K. ILO unemployment rate for three months ended December and

claimant count rate for January are due in the European

session.

Canada manufacturing sales for December, New York Fed's empire

manufacturing data and NAHB housing market index for February are

scheduled for release in the New York session.

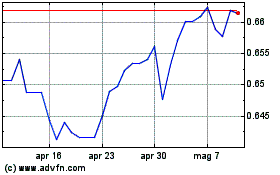

Grafico Cross AUD vs US Dollar (FX:AUDUSD)

Da Mar 2024 a Apr 2024

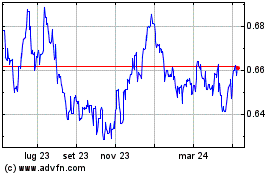

Grafico Cross AUD vs US Dollar (FX:AUDUSD)

Da Apr 2023 a Apr 2024