TIDMPIRI

RNS Number : 8095K

Pires Investments PLC

24 April 2020

Pires Investments plc

(" Pires" or the "Company")

Placing and conditional placing to raise GBP1,060,000

Conditional grant of 53,000,000 Placing Warrants

Related party transaction

Pires announces that it has placed 53,000,000 new ordinary

shares to raise gross proceeds of GBP1,060,000. 22,714,286 new

ordinary shares in the Company (the "Placing Shares") have been

placed at a price of 2.0 pence per share (the "Placing Price"),

representing a 14.9% discount to the closing mid-market price on 23

April 2020, raising gross proceeds of GBP454,286 (the

"Placing").

Furthermore, conditional on shareholder authorities being

granted at the shortly to be convened Annual General Meeting, the

Company has placed a further 30,285,714 new ordinary shares in the

Company (the "Conditional Placing Shares") at the Placing Price,

raising additional gross proceeds of GBP605,714 (the "Conditional

Placing").

Placees will also conditionally receive one warrant for each

ordinary share subscribed for, exercisable at 4 pence for a period

of two years from their date of issue (the "Placing Warrants") and

expiring on the two-year anniversary of the date of issue . In

aggregate, 53,000,000 Placing Warrants have been conditionally

issued. The issue of the Placing Warrants is conditional on

shareholder authorities being granted at the shortly to be convened

Annual General Meeting.

Funds have been raised from both existing shareholders and new

investors. Mr. Chris Akers, a new investor in the Company, has

subscribed for 17,500,000 Placing Shares and Conditional Placing

Shares, representing 14.7% of the Company's enlarged issued share

capital (assuming that all three tranches of the Placing complete

in accordance with its terms).

The Placing Shares and the Conditional Placing Shares will be

issued in three tranches further details of which are set out in

the table below:-

Number of Shares Expected date Placing

Shares and Conditional

Placing Shares will

be admitted to trading

on AIM

Tranche 1 - Placing 7,571,429 15 May 2020

----------------- ------------------------

Tranche 2 - Placing 15,142,857 1 June 2020

----------------- ------------------------

Tranche 3 - Conditional 30,285,714 30 June 2020

Placing

----------------- ------------------------

Total 53,000,000

----------------- ------------------------

The Placing Shares and the Conditional Placing Shares will rank

pari passu with the existing ordinary shares.

Background to the Placing

In 2019, the Company extended its investing policy to focus on

the technology sector and has since invested in Sure Valley

Ventures (" SVV "), a venture capital fund focused on investing in

the software sector with a specific focus on the augmented/virtual

reality, artificial intelligence and IoT sectors. Since making the

investment in SVV, the Company has already achieved a return of

EUR803,274, of which EUR721,274 has already been received in cash

by the Company from the sale of one of SVV's portfolio companies,

Artomatix. The sale price of Artomatix represents around 500% of

the company's valuation at the time SVV made its initial investment

. Pires has a 13% interest in SVV.

On 10 March 2020, the Company announced that it had invested

EUR250,000 in Getvisibility, an artificial intelligence security

company, addressing problems corporations face in storing, sorting,

accessing and protecting data which is today even more important

given the recent increase in cybercrime associated with the

Covid-19 crisis.

The Company is now seeing an increased volume of new

opportunities and therefore the Board believes that it is important

to have additional funds available to take advantage of these

investment opportunities as they arise.

Related party transactions

RGO has an existing interest over 16,149,993 ordinary shares in

the Company, representing 24.3% of the Company's issued share

capital and, as such, is a substantial shareholder as defined in

the AIM Rules for Companies (" AIM Rules "). Accordingly, the

transaction between the Company and RGO is a related party

transaction (" Transaction ") pursuant to Rule 13 of the AIM Rules

. Nicholas Lee, a director of the Company, is also the Investment

Director of RGO and, accordingly, has not been involved in the

approval of the Placing by the Company's board. RGO has agreed to

subscribe for 10,750,000 new ordinary shares in the Placing,

bringing its aggregate holding to 26,899,993 or 22.5% of the

Company's issued share capital as enlarged by the Placing.

The directors of the Company independent of the Transaction,

having consulted with the Company's nominated adviser, Cairn

Financial Advisers LLP, consider the terms of the Transaction to be

fair and reasonable insofar as the Company's shareholders are

concerned.

Total voting rights

In conformity with DTR 5.6.1, the Company notifies that as at

the date of this announcement, it has a single class of shares in

issue being Ordinary Shares and the total number of Ordinary Shares

in issue is currently 66,672,465. There are no Ordinary Shares held

in treasury. Each Ordinary Share entitles the holder to a single

vote at general meetings of the Company. Th is figure will increase

to 119,472,465 Ordinary Shares once the proposed placing is

completed. Further announcements will be made in due course as and

when the Placing Shares are issued.

Peter Redmond, Chairman of Pires, commented:

"We are pleased that we have been able to raise new funding to

implement our strategy and we welcome Chris Akers as a new

shareholder with his proven track record of investing in the

technology sector. We believe this is a very exciting time for the

Company and I look forward to updating the market on subsequent

developments."

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

The person who arranged for the release of this information is

Nicholas Lee, a director of the Company.

Enquiries:

Pires Investments plc

Peter Redmond, Chairman Tel: +44 (0) 20 3368 8961

Nicholas Lee, Director

Nominated Adviser

Cairn Financial Advisers LLP Tel: +44 (0) 20 7213 0880

Liam Murray

Ludovico Lazzaretti

Broker

Peterhouse Capital Limited Tel: +44 (0) 20 7469 0935

Duncan Vasey/Lucy Williams Tel: +44 (0) 20 7469 0936

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCFLFIISRISFII

(END) Dow Jones Newswires

April 24, 2020 06:07 ET (10:07 GMT)

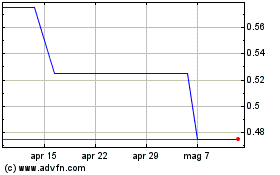

Grafico Azioni Mindflair (LSE:MFAI)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Mindflair (LSE:MFAI)

Storico

Da Apr 2023 a Apr 2024