Manufacturers Offer Dark Outlook -- WSJ

29 Aprile 2020 - 9:02AM

Dow Jones News

Caterpillar, Harley, 3M among U.S. companies idling factories,

trying to preserve their cash

By Austen Hufford and Bob Tita

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 29, 2020).

Major U.S. manufacturers said some closed plants may never

reopen and new product introductions could be delayed, after the

coronavirus pandemic slashed demand for everything from motorcycles

to industrial paint.

Caterpillar Inc. said Tuesday that its first-quarter revenue

fell by a fifth, and Harley-Davidson Inc. said retail sales of its

motorcycles slumped around the world during the quarter.

3M Co. said it would furlough workers and idle some factory

lines apart from its booming N95 mask business, a sign of the broad

economic malaise affecting even companies with a hot product.

"The impact of Covid-19 on our business has been significantly

more severe and chaotic than any cyclical downturn we had

envisioned," Caterpillar CEO Jim Umpleby said on a conference

call.

The hit to the companies' earnings was lighter than some

analysts expected. Shares in Caterpillar rose less than 1% to

$115.46, while shares in 3M climbed 2.6% to $157.61 and Harley's

rose 15% to $21.82.

But executives offered a dark outlook for a sector of the

economy that was already faltering before the coronavirus crisis

sapped demand and hobbled plants and supply chains. Caterpillar,

3M, Harley and other companies have suspended their financial

guidance for the year.

Big chunks of the U.S. industrial base remain closed as part of

the effort to contain the virus. Other factories are closed due to

declining demand or parts shortages. Caterpillar and 3M said a

quarter of their factories are offline. Harley, which idled

assembly plants in mid-March, said it is restarting some

production. The Milwaukee-based company also said, though, that the

worsening economic outlook has prompted it to reconsider when to

introduce some new models it is counting on to draw new customers.

Nearly two-thirds of its U.S. dealers remain closed.

"We have challenges to address that have become more apparent in

this crisis, including the high level of complexity across the

organization that needs to be minimized " Jochen Zeitz, Harley's

acting CEO, said on a call.

Some factories may not come back online. Caterpillar said it was

considering closing plants in Germany.

Manufacturers said the economic fallout from the pandemic has

followed the spread of the virus. Demand first dropped in China

early this year and then spread to Europe, mostly acutely in Italy,

executives said. Demand in the U.S. started to plummet in

mid-March. Manufacturing output in March fell 6.3% from the prior

month, according to the Federal Reserve, the biggest drop since the

end of World War II.

Minnesota-based 3M, which makes a range of products, said

adjusted April sales in the Americas region were down 20% from a

year earlier as factories suspended production, dentists cut back

on operations and office managers bought fewer supplies for

workforces now at home.

Caterpillar said it expects the current quarter to be the

weakest for the global economy. "With the general economic

uncertainty, we did see people defer buying machines," Caterpillar

finance chief Andrew Bonfield said in an interview.

Manufacturers said they were cutting back on investments this

year to save cash. 3M said it would cut capital spending this year

to about $1.3 billion; it had previously planned to spend up to

$1.8 billion. Paint maker PPG Industries Inc. said it would spend

up to $250 million on capital investments this year, down from $413

million in 2019.

"Never before have we experienced a crisis as broad as the

Covid-19 pandemic," PPG Chief Executive Michael McGarry said on a

call.

Harley said it would restrict spending and preserve cash,

including by suspending share buybacks and slashing its shareholder

dividend to 2 cents a share for the second quarter from 38 cents

for the first quarter.

Harley reported more than $1.09 billion in quarterly

motorcycle-related revenue, down from $1.19 billion a year earlier

though better than analysts expected. Profit fell to $69.7 million

from $127.9 million in last year's first quarter.

Caterpillar reported a first-quarter profit of $1.09 billion

compared with $1.88 billion a year earlier. The Illinois-based

company said its adjusted earnings were $1.60 a share. Analysts had

forecast adjusted earnings of $1.69 a share.

3M's revenue grew 2.7% to $8.08 billion in the first quarter,

while profit rose 45% to $1.29 billion. The company posted adjusted

earnings per share of $2.16, above the $2.03 expected by

analysts.

Write to Austen Hufford at austen.hufford@wsj.com and Bob Tita

at robert.tita@wsj.com

(END) Dow Jones Newswires

April 29, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

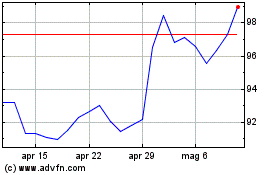

Grafico Azioni 3M (NYSE:MMM)

Storico

Da Mar 2024 a Apr 2024

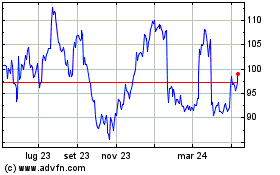

Grafico Azioni 3M (NYSE:MMM)

Storico

Da Apr 2023 a Apr 2024