TIDMSEIT

RNS Number : 8573Q

SDCL Energy Efficiency Income Tst

24 June 2020

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, TO US PERSONS OR INTO THE UNITED

STATES, AUSTRALIA, CANADA, JAPAN, NEW ZEALAND OR THE REPUBLIC OF

SOUTH AFRICA OR INTO ANY OTHER JURISDICTION WHERE TO DO SO MIGHT

CONSTITUTE A VIOLATION OR BREACH OF ANY APPLICABLE LAW. PLEASE SEE

THE IMPORTANT NOTICE AT THE OF THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT HAS BEEN DETERMINED TO CONTAIN INSIDE

INFORMATION.

24 June 2020

SDCL Energy Efficiency Income Trust plc

("SEEIT", or the "Company")

Result of Placing and Offer for Subscription and Total Voting

Rights

The Board is pleased to announce that the Initial Issue of New

Ordinary Shares (the "Initial Issue") announced on 18 June 2020 has

received a strong level of support from investors.

Taking into account the Company's acquisition pipeline, the

Board, after consultation with the Investment Manager and Jefferies

International Limited, the bookrunner, has determined to increase

the size of the Initial Issue from gross proceeds of GBP60 million

to GBP110 million by re-allocating New Ordinary Shares available

under the Share Issuance Programme to the Initial Issue.

Accordingly, the Initial Issue will result in the issue of

105,769,231 New Ordinary Shares at the Issue Price of 104 pence per

share. The Investment Manager remains confident in its ability to

efficiently apply the gross proceeds to its broad pipeline of

investment opportunities and in addition the Company may partly pay

down its existing debt facilities.

As applications for the New Ordinary Shares have exceeded the

gross proceeds accepted, a scaling back exercise has taken

place.

Tony Roper, Chairman of SDCL Energy Efficiency Income Trust plc

said:

"In light of our offer being significantly oversubscribed and

the Company's strong acquisition pipeline, we have increased the

issue size. We are very grateful for the continued support from

existing shareholders and are also pleased to welcome new investors

to the Company. The growing interest in SEEIT substantiates our

view that there has never been a more critical time for investment

in energy efficiency, particularly given the twin challenges of

Covid-19 and climate change. We have an advanced near-term

investment pipeline consisting of projects that would help to

further expand and diversify our portfolio and to deliver

attractive returns for our shareholders."

Admission of New Ordinary Shares and Total Voting Rights

Applications have been made for all of the New Ordinary Shares

to be admitted to the Premium Listing segment of the Official List

of the UK Financial Conduct Authority (the "FCA") and to trading on

the London Stock Exchange's Main Market for listed securities

("Admission"). It is expected that Admission will take effect, and

dealings in the Placing Shares will commence, at 8.00 a.m. (London

time) on 26 June 2020.

The New Ordinary Shares will be issued in registered form and

may be held in uncertificated form. The New Ordinary Shares

allocated will be issued to Placees through the CREST system unless

otherwise stated. The New Ordinary Shares will be eligible for

settlement through CREST with effect from Admission. The New

Ordinary Shares, when issued, will rank pari passu with the

existing Ordinary Shares including the right to receive all

dividends and other distributions declared, made or paid after the

date of issue.

Immediately following Admission, the Company will have

426,143,739 ordinary shares in issue and therefore the total voting

rights in the Company will be 426,143,739. This figure may be used

by shareholders as the denominator for the calculations by which

they may determine whether or not they are required to notify their

interest in, or a change to their interest in, the share capital of

the Company under the FCA's Disclosure Guidance and Transparency

Rules.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014. Upon the publication of

this announcement, this inside information is now considered to be

in the public domain. Unless otherwise defined, capitalised terms

used in this announcement shall have the same meaning as set out in

the Prospectus published on 19 June 2020.

Dealing codes

Ticker SEIT

ISIN for the Ordinary Shares GB00BGHVZM47

SEDOL for the Ordinary Shares BGHVZM4

For Further Information

Sustainable Development Capital T: +44 (0) 20 7287 7700

LLP

Jonathan Maxwell

Eugene Kinghorn

Keith Driver

Jefferies International Limited T: +44 (0) 20 7029 8000

Tom Yeadon

Gaudi Le Roux

Neil Winward

TB Cardew T: +44 (0) 20 7930 0777

Ed Orlebar M: +44 (0) 7738 724 630

Joe McGregor E: seeit@tbcardew.com

Legal Entity Identifier (LEI): 213800ZPSC7XUVD3NL94

DISCLAIMERS

This announcement is not an offer to sell or a solicitation of

any offer to buy the Shares in the Company in the United States,

Australia, Canada, New Zealand or the Republic of South Africa,

Japan, or in any other jurisdiction where such offer or sale would

be unlawful.

This communication is not for publication or distribution,

directly or indirectly, in or into the United States of America.

This communication is not an offer of securities for sale into the

United States. The securities referred to herein have not been and

will not be registered under the U.S. Securities Act of 1933, as

amended, and may not be offered or sold in the United States,

except pursuant to an applicable exemption from registration. No

public offering of securities is being made in the United

States.

The Company has not been and will not be registered under the US

Investment Company Act of 1940 (the "Investment Company Act") and,

as such, holders of the Shares will not be entitled to the benefits

of the Investment Company Act. No offer, sale, resale, pledge,

delivery, distribution or transfer of the Shares may be made except

under circumstances that will not result in the Company being

required to register as an investment company under the Investment

Company Act.

This announcement may not be used in making any investment

decision. This announcement does not contain sufficient information

to support an investment decision and investors should ensure that

they obtain all available relevant information before making any

investment. This announcement does not constitute and may not be

construed as an offer to sell, or an invitation to purchase or

otherwise acquire, investments of any description, nor as a

recommendation regarding the possible offering or the provision of

investment advice by any party. No information in this announcement

should be construed as providing financial, investment or other

professional advice and each prospective investor should consult

its own legal, business, tax and other advisers in evaluating the

investment opportunity. No reliance may be placed for any purposes

whatsoever on this announcement or its completeness.

Nothing in this announcement constitutes investment advice and

any recommendations that may be contained herein have not been

based upon a consideration of the investment objectives, financial

situation or particular needs of any specific recipient.

The information and opinions contained in this announcement are

provided as at the date of the document and are subject to change

and no representation or warranty, express or implied, is or will

be made in relation to the accuracy or completeness of the

information contained herein and no responsibility, obligation or

liability or duty (whether direct or indirect, in contract, tort or

otherwise) is or will be accepted by the Company, SDCL, Jefferies

or any of their affiliates or by any of their respective officers,

employees or agents in relation to it. No reliance may be placed

for any purpose whatsoever on the information or opinions contained

in this announcement or on its completeness, accuracy or fairness.

The document has not been approved by any competent regulatory or

supervisory authority.

The information in this announcement may include forward-looking

statements, which are based on the current expectations and

projections about future events and in certain cases can be

identified by the use of terms such as "may", "will", "should",

"expect", "anticipate", "project", "estimate", "intend",

"continue", "target", "believe" (or the negatives thereon) or other

variations thereon or comparable terminology. These forward-looking

statements, as well as those included in any related materials, are

subject to risks, uncertainties and assumptions about the Company,

including, among other things, the development of its business,

trends in its operating industry, and future capital expenditures

and acquisitions. In light of these risks, uncertainties and

assumptions, the events in the forward-looking statements may not

occur.

Each of the Company, SDCL, Jefferies and their affiliates and

their respective officers, employees and agents expressly disclaim

any and all liability which may be based on this announcement and

any errors therein or omissions therefrom.

No representation or warranty is given to the achievement or

reasonableness of future projections, management targets,

estimates, prospects or returns, if any. Any views contained herein

are based on financial, economic, market and other conditions

prevailing as at the date of this announcement. The information

contained in this announcement will not be updated.

This announcement does not constitute or form part of, and

should not be construed as, any offer or invitation or inducement

for sale, transfer or subscription of, or any solicitation of any

offer or invitation to buy or subscribe for or to underwrite, any

share in the Company or to engage in investment activity (as

defined by the Financial Services and Markets Act 2000) in any

jurisdiction nor shall it, or any part of it, or the fact of its

distribution form the basis of, or be relied on in connection with,

any contract or investment decision whatsoever, in any

jurisdiction. This announcement does not constitute a

recommendation regarding any securities.

Prospective investors should take note that the Company's Shares

may not be acquired by: (i) investors using assets of: (A) an

"employee benefit plan" as defined in Section 3(3) of US Employee

Retirement Income Security Act of 1974, as amended ("ERISA") that

is subject to Title I of ERISA; (B) a "plan" as defined in Section

4975 of the US Internal Revenue Code of 1986, as amended (the "US

Tax Code"), including an individual retirement account or other

arrangement that is subject to Section 4975 of the US Tax Code; or

(C) an entity which is deemed to hold the assets of any of the

foregoing types of plans, accounts or arrangements that is subject

to Title I of ERISA or Section 4975 of the US Tax Code; or (ii) a

governmental, church, non-US or other employee benefit plan that is

subject to any federal, state, local or non-US law that is

substantially similar to the provisions of Title I of ERISA or

Section 4975 of the US Tax Code.

Jefferies is authorised and regulated in the United Kingdom by

the Financial Conduct Authority. Jefferies is acting for the

Company and no one else in connection with the Placing, and will

not be responsible to anyone other than the Company for providing

the protections afforded to clients of Jefferies or for affording

advice in relation to any transaction or arrangement referred to in

this announcement. This announcement does not constitute any form

of financial opinion or recommendation on the part of Jefferies or

any of its affiliates and is not intended to be an offer, or the

solicitation of any offer, to buy or sell any securities.

In accordance with the Packaged Retail and Insurance-based

Investment Products Regulation (EU) No 1286/2014, the Key

Information Document relating to the Company is available to

investors at www.sdcleeit.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ROIMZGZVGFLGGZZ

(END) Dow Jones Newswires

June 24, 2020 02:00 ET (06:00 GMT)

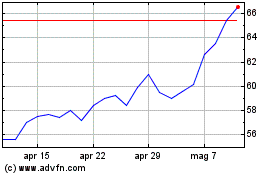

Grafico Azioni Sdcl Energy Efficiency I... (LSE:SEIT)

Storico

Da Mar 2024 a Apr 2024

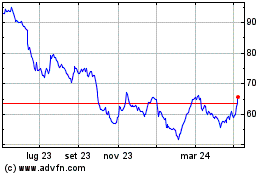

Grafico Azioni Sdcl Energy Efficiency I... (LSE:SEIT)

Storico

Da Apr 2023 a Apr 2024