As filed with the Securities and Exchange Commission on February 2,

2024

Registration No. 333-273911

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Pre-Effective Amendment No. 1

To

Form S-3

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

ACTINIUM

PHARMACEUTICALS, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware |

|

74-2963609 |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

100 Park Ave., 23rd Floor

New York, NY 10017

(646) 677-3870

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Sandesh Seth

Chairman and Chief Executive Officer

Actinium Pharmaceuticals, Inc.

100 Park Ave., 23rd Floor

New York, NY 10017

(646) 677-3870

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With Copies to:

Rick A. Werner, Esq.

Jayun Koo, Esq.

Haynes and Boone, LLP

30 Rockefeller Plaza, 26th Floor

New York, New York 10112

Tel. (212) 659-7300

Fax (212) 884-8234

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this registration statement, as determined by market conditions and other factors.

If the only securities being registered on this Form are being offered

pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection

with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule

462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective

registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction

I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under

the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement

filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule

413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated

filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH

DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY

STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933,

AS AMENDED, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING

PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

Explanatory Note

This Pre-Effective Amendment No. 1 (this “Amendment”)

to the Registration Statement on Form S-3 (File No. 333-273911) (the “Registration Statement”) of Actinium Pharmaceuticals,

Inc. (the “Company”) is being filed to include updated disclosures since the Registration Statement was originally filed

on August 11, 2023.

The Registration

Statement, as amended by this Amendment, contains two prospectuses:

| ● | a base prospectus which covers the offering, issuance and

sale by us of up to $500,000,000 of our common stock, preferred stock, warrants, units and/or

subscription rights; and |

| ● | a sales agreement prospectus covering the offering, issuance

and sale by us of up to a maximum aggregate offering price of $200,000,000 of our common

stock that may be issued and sold under the Amended and Restated Capital on Demand™

Sales Agreement, dated June 28, 2022, with JonesTrading Institutional Services LLC and B.

Riley Securities, Inc. |

The base prospectus immediately follows this explanatory note. The

specific terms of any securities to be offered pursuant to the base prospectus other than the shares under the sales agreement will be

specified in a prospectus supplement to the base prospectus. The specific terms of the securities to be issued and sold under the sales

agreement are specified in the sales agreement prospectus that immediately follows the base prospectus. The $200,000,000 of common stock

that may be offered, issued and sold under the sales agreement prospectus is included in the $500,000,000 of securities that may be offered,

issued and sold by us under the base prospectus. Upon termination of the sales agreement, any portion of the $200,000,000 included in

the sales agreement prospectus that is not sold pursuant to the sales agreement will be available for sale in other offerings pursuant

to the base prospectus and a corresponding prospectus supplement, and if no shares are sold under the sales agreement, the full $500,000,000

of securities may be sold in other offerings pursuant to the base prospectus and a corresponding prospectus supplement.

The information in

this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the

Securities and Exchange Commission, of which this prospectus is a part, is effective. This prospectus is not an offer to sell these securities

and it is not soliciting an offer to buy these securities in any state where the offeror sale is not permitted

SUBJECT TO COMPLETION,

DATED FEBRUARY 2, 2024

Prospectus

Actinium Pharmaceuticals, Inc.

$500,000,000

Common Stock

Preferred Stock

Warrants

Units

Subscription Rights

We may offer and sell from time to time, in one or more series or

issuances and on terms that we will determine at the time of the offering, any combination of the securities described in this prospectus,

up to an aggregate amount of $500,000,000.

We will provide specific terms of any offering in a supplement to

this prospectus. Any prospectus supplement may also add, update, or change information contained in this prospectus. You should carefully

read this prospectus and the applicable prospectus supplement as well as the documents incorporated or deemed to be incorporated by reference

in this prospectus before you purchase any of the securities offered hereby.

These securities may be offered and sold in the same offering or in separate

offerings to or through underwriters, dealers, and agents or directly to purchasers. The names of any underwriters, dealers, or agents

involved in the sale of our securities, their compensation and any over-allotment options held by them will be described in the applicable

prospectus supplement. See “Plan of Distribution.”

Our common stock is listed on the NYSE American under the symbol

“ATNM.” On February 1, 2024, the last reported sale price of our common stock was $5.56 per share. We recommend that

you obtain current market quotations for our common stock prior to making an investment decision. We will provide information in any

applicable prospectus supplement regarding any listing of securities other than shares of our common stock on any securities exchange.

You should carefully read this prospectus, any prospectus supplement

relating to any specific offering of securities, and all information incorporated by reference herein and therein.

Investing in our securities involves a high degree of risk. These

risks are discussed in this prospectus under “Risk Factors” beginning on page 5 and in the documents incorporated by reference

into this prospectus.

Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation

to the contrary is a criminal offense.

The date of this prospectus is ,

2024.

Table of Contents

About

This Prospectus

This prospectus is part of a registration statement on Form S-3 that

we filed with the Securities and Exchange Commission using a “shelf” registration process. Under this shelf process, we may,

from time to time, sell any combination of the securities described in this prospectus in one or more offerings up to a total amount

of $500,000,000. The offer and sale of securities under this prospectus may be made from time to time, in one or more offerings, in any

manner described under the section in this prospectus entitled “Plan of Distribution.”

This prospectus provides you with a general description of the securities

we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the

terms of that offering. The prospectus supplement may also add to, update or change information contained in the prospectus and, accordingly,

to the extent inconsistent, information in this prospectus is superseded by the information in the prospectus supplement.

On June 28, 2022, we entered into an Amended and Restated Capital

on Demand™ Sales Agreement, or the sales agreement, with JonesTrading and B. Riley Securities. A new prospectus with respect

to the sales agreement is included in this Amendment No. 1 to the registration statement, pursuant to which, in accordance with the

terms of the sales agreement, we may, from time to time, offer and sell shares of our common stock having an aggregate offering

price of up to $200,000,000.

The prospectus supplement to be attached to the front of this prospectus

may describe, as applicable: the terms of the securities offered; the public offering price; the price paid for the securities; net proceeds;

and the other specific terms related to the offering of the securities.

Any prospectus supplement may also add to, update or change information

contained in the prospectus and, accordingly, to the extent inconsistent, information in this prospectus is superseded by the information

in the prospectus supplement.

You should only rely on the information contained or incorporated

by reference in this prospectus and any prospectus supplement or issuer free writing prospectus relating to a particular offering. No

person has been authorized to give any information or make any representations in connection with this offering other than those contained

or incorporated by reference in this prospectus, any accompanying prospectus supplement and any related issuer free writing prospectus

in connection with the offering described herein and therein, and, if given or made, such information or representations must not be

relied upon as having been authorized by us. Neither this prospectus nor any prospectus supplement nor any related issuer free writing

prospectus shall constitute an offer to sell or a solicitation of an offer to buy offered securities in any jurisdiction in which it

is unlawful for such person to make such an offering or solicitation. This prospectus does not contain all of the information included

in the registration statement. For a more complete understanding of the offering of the securities, you should refer to the registration

statement, including its exhibits.

You should read the entire prospectus and any prospectus supplement

and any related issuer free writing prospectus, as well as the documents incorporated by reference into this prospectus or any prospectus

supplement or any related issuer free writing prospectus, before making an investment decision. Neither the delivery of this prospectus

or any prospectus supplement or any issuer free writing prospectus nor any sale made hereunder shall under any circumstances imply that

the information contained or incorporated by reference herein or in any prospectus supplement or issuer free writing prospectus is correct

as of any date subsequent to the date hereof or of such prospectus supplement or issuer free writing prospectus, as applicable. You should

assume that the information appearing in this prospectus, any prospectus supplement or any document incorporated by reference is accurate

only as of the date of the applicable documents, regardless of the time of delivery of this prospectus or any sale of securities. Our

business, financial condition, results of operations and prospects may have changed since that date.

Prospectus

Summary

This summary provides an overview of selected information contained

elsewhere or incorporated by reference in this prospectus and does not contain all of the information you should consider before investing

in our securities. You should carefully read the prospectus, any prospectus supplement, the information incorporated by reference and

the registration statement of which this prospectus is a part in their entirety before investing in our securities, including the information

discussed under “Risk Factors” in this prospectus, any prospectus supplement, and the documents incorporated by reference

and our financial statements and notes thereto that are incorporated by reference in this prospectus. As used in this prospectus, unless

the context otherwise indicates, the terms “we,” “our,” “us,” or “the Company” refer

to Actinium Pharmaceuticals, Inc., a Delaware corporation, and its subsidiaries taken as a whole.

The Company

Actinium Pharmaceuticals, Inc. (“Actinium”) develops targeted

radiotherapies intended to meaningfully improve survival for patients with relapsed or refractory cancer who have failed existing therapies.

Our vision is to build a specialty, hospital-focused, radiotherapeutics company that develops and markets medicines for patients who

are treated primarily in large quaternary care hospitals and their catchment areas.

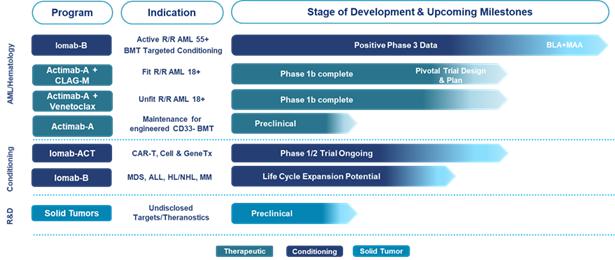

Pipeline Highlights

We intend to leverage the clinical data of our lead product candidates,

Iomab-B and Actimab-A, to potentially improve outcomes in patients with relapsed or refractory acute myeloid leukemia (“r/r AML”)

by launching two radiotherapy drugs over the next several years to address the significant need for better outcomes from treatment with

therapeutics or from undergoing a bone marrow transplant (“BMT”).

We also intend to further advance Iomab-B beyond acute myeloid leukemia

(“AML”) based on promising data as a disease control and conditioning agent for various other blood cancers. Based on early

clinical trial results, we are also working on a lower dose, next generation conditioning program, Iomab-ACT, for rapidly growing cell

and gene therapies.

Our Clinical Pipeline

AML is an aggressive, heterogeneous disease that is difficult-to-treat.

Over 50% of AML patients develop relapsed or refractory disease within one year of being afflicted and have an extremely poor prognosis

and dismal survival. Currently, a BMT is regarded as being able to provide the best treatment outcomes and is the only curative regimen

available for AML patients, however, access is limited to AML patients who are fit enough to withstand the challenges associated with

this treatment. The majority of AML patients are considered not transplantable in routine clinical practice as they are not fit enough

to withstand the rigors of the patient journey, which includes therapy to attain a remission, conditioning regimens to destroy diseased

marrow, the challenge of the transplant itself or post-transplant complications.

Our Iomab-B and Actimab-A product candidates have the potential to

fill the major unmet medical needs in r/r AML in a complementary fashion as they are directed at different parts of the patient journey.

Iomab-B is being developed as a targeted bridging therapy candidate that we believe could provide both disease control and conditioning

in one agent. We believe results from our Phase 3 SIERRA trial demonstrate the possibility for unprecedented access to a BMT and improved

survival in unfit patients who are currently not considered transplantable in routine clinical practice. We are developing Actimab-A

as a targeted therapy candidate for fit patients. Actimab-A has demonstrated an extension in survival in a proof-of-concept study and

is poised for advanced development in collaboration with the NCI, or National Cancer Institute (“NCI”). Together, we believe

these two product candidates could provide us the opportunity to transform the treatment of AML, especially in the relapsed and refractory

segment which represents over 50% of AML patients.

Iomab-B was evaluated in the pivotal Phase 3 Study of Iomab-B in

Elderly Relapsed or Refractor AML, or “SIERRA trial” with Iomab-B meeting the primary endpoint of durable Complete Remission

(“dCR”) with a high degree of statistical significance (p<0.0001). In February 2023, we announced full SIERRA trial results,

demonstrating unprecedented transplant access and improved outcomes in patients with r/r AML, with double 1-year and median overall survival

(“OS”) compared to control arm patients. These data were presented at the 2023 Tandem Meetings aka the Transplantation &

Cellular Therapy (“TCT”) Meetings of the American Society for Transplantation and Cellular Therapy (“ASTCT”)

and the Center for International Blood & Marrow Transplant Research (“CIBMTR”). We believe these results from the SIERRA

trial may provide the opportunity, if we are able to obtain U.S. Food and Drug Administration (“FDA”) approval, to establish

Iomab-B as a potentially new standard of care. On April 7, 2022, we entered into a license and supply agreement with Immedica Pharma

AB (“Immedica”), pursuant to which Immedica licensed the exclusive product rights for commercialization of Iomab-B in the

European Economic Area, Middle East and North Africa (“EUMENA”) region in exchange for an upfront payment of $35 million,

potential regulatory and commercial milestone payments totaling up to $417 million and royalties in mid-20 percent range on net product

sales.

Actimab-A is being developed under what we believe to be the current

industry-leading clinical-study program utilizing the potent alpha radiation emitting isotope Actinium-225 (“Ac-225”) with

clinical data in approximately 150 patients treated over six clinical trials. The potent linear energy transfer emitted by Ac-225 has

no known resistance mechanism. Actimab-A is being developed in combination with other regimens including chemotherapies and targeted

agents to exploit potential mechanistic synergies and leverage the mutation-agnostic mechanism of action of Ac-225 with the objective

of establishing it as a backbone therapy in AML, an extremely heterogenous disease. Phase 1 results from the Actimab-A + CLAG-M combination

trial showed high rates of response and minimal residual disease (“MRD”) negativity of 65% and 75% in all patients, respectively,

and one-year survival of 48% in patients who are typically expected to live two to four months. Of the patients eligible to proceed to

a BMT, 64% of eligible patients proceeded to BMT and had a median Overall Survival (“OS”) of 24-months. We believe the promise

of these results paved the way for the NCI Cooperative Research and Development Agreement (“CRADA”), announced in February

2023, to develop Actimab-A for the treatment of patients with AML and other hematologic malignancies. Actinium expects to initiate the

late-stage development of Actimab-A, including a potential pivotal trial, in combination as a backbone therapy for r/r AML under the

CRADA with the NCI.

We have also presented Phase 1 data showing that the combination

of Actimab-A + venetoclax was well-tolerated with responses, including a Complete Remission (“CR”) and a partial response

in early dose escalation cohorts. Additionally, we presented the first-ever preclinical data demonstrating the potential synergy of Actimab-A

with FLT3 inhibitors gilteritinib and midostaurin. Actimab-A was shown to have single-agent activity against FLT3 mutant AML cell lines,

supporting its mutation agnostic mechanism, and enhanced the anti-leukemic activity of the FLT3 inhibition in vitro. We believe these

results support continued evaluation of the combination with the goal of advancing to clinical trials. To explore the potential for a

broader development opportunity with our Actimab-A program, we are also studying the potential use of Actimab-A in solid tumor indications

through our R&D efforts. CD33-expressing myeloid derived suppressor cells (“MDSCs”) are present within the tumor microenvironment

and exert immunosuppressive effects. We have presented preclinical data that depicts Actimab-A’s role in the tumor microenvironment

to overcome immunosuppression driven by MDSCs. We believe that our findings thus far show Actimab-A’s potential to selectively

deplete MDSCs in lung and colorectal cancer based on superior depletion of human MDSCs compared to Mylotarg, a CD33-targeted antibody-drug

conjugate (“ADC”) in colorectal cancer (p<0.01), highlighting the powerful cytotoxicity and potential therapeutic benefit

of radiotherapy compared to naked antibodies or ADCs. We believe that the data we have gathered to-date continues to support our objective

to demonstrate the potential for Actimab-A to be a backbone therapy to broadly improve antitumor activity of immunotherapies and other

therapeutic modalities.

Our differentiated R&D efforts are further exemplified by our

next-generation Iomab-ACT conditioning program for rapidly growing cell and gene therapies. We have several ongoing programs in solid

tumors at the pre-clinical stage with investigational new drug (“IND”) enabling studies underway.

Our platform has been used to develop a pipeline of novel radiotherapeutic

assets to drive company growth. Preclinical pharmacology studies with our targeted radiotherapeutics directed at validated cancer targets

have shown strong improvement in tumor growth inhibition in various preclinical tumor models as single agents or in combination with

targeted agents. These results have prompted our team to spearhead efforts in multiple solid tumor programs.

Our intellectual

property (“IP”) portfolio includes over 220 issued patents and pending patent applications worldwide.

Corporate and Other Information

We were organized as a corporation in the State of Nevada in October

1997 and reorganized as a corporation in the State of Delaware in March 2013. Our principal executive offices are located at 100 Park

Ave., 23rd Floor, New York, NY 10017. Our telephone number is (646) 677-3870. Our website address is www.actiniumpharma.com. Information

accessed through our website is not incorporated into this prospectus and is not a part of this prospectus.

The Securities We May Offer

We may offer up to $500,000,000 of common stock, preferred stock,

warrants, units and/or subscription rights in one or more offerings and in any combination. This prospectus provides you with a general

description of the securities we may offer. A prospectus supplement, which we will provide each time we offer securities, will describe

the specific amounts, prices and terms of these securities.

Common Stock

We may issue shares of our common stock from time to time. The holders

of our common stock are entitled to one vote per share. Our certificate of incorporation does not provide for cumulative voting. Our

directors are divided into three classes. At each annual meeting of stockholders, directors elected to succeed those directors whose

terms expire are elected for a term of office to expire at the third succeeding annual meeting of stockholders after their election.

The holders of our common stock are entitled to receive ratably such dividends, if any, as may be declared by our board of directors

out of legally available funds; however, the current policy of our board of directors is to retain earnings, if any, for operations and

growth. Upon liquidation, dissolution or winding-up, the holders of our common stock are entitled to share ratably in all assets that

are legally available for distribution. The holders of our common stock have no preemptive, subscription, redemption or conversion rights.

The rights, preferences and privileges of holders of our common stock are subject to, and may be adversely affected by, the rights of

the holders of any series of preferred stock, which may be designated solely by action of our board of directors and issued in the future.

Our common stock is listed on the NYSE American under the symbol “ATNM.”

Preferred Stock

We may issue shares of our preferred stock from time to time, in one

or more series. Our board of directors will determine the rights, preferences, stated values, qualifications or limitations, without

any further vote or action by stockholders. Convertible preferred stock will be convertible into our common stock or exchangeable for

our other securities. Conversion may be mandatory or at your option or both and would be at prescribed conversion rates.

If we sell any series of preferred stock under this prospectus and

applicable prospectus supplements, we will fix the rights, preferences, privileges and restrictions of the preferred stock of such series

in the certificate of designation relating to that series. We will file as an exhibit to the registration statement of which this prospectus

is a part, or will incorporate by reference from reports that we file with the Securities and Exchange Commission, the form of any certificate

of designation that describes the terms of the series of preferred stock we are offering before the issuance of the related series of

preferred stock. We urge you to read the applicable prospectus supplement related to the series of preferred stock being offered, as

well as the complete certificate of designation that contains the terms of the applicable series of preferred stock.

Warrants

We may issue warrants for the purchase of common stock or preferred

stock in one or more series. We may issue warrants independently or together with common stock or preferred stock, and the warrants may

be attached to or separate from these securities. We will evidence each series of warrants by warrant certificates that we will issue

under a separate agreement. We may enter into warrant agreements with a bank or trust company that we select to be our warrant agent.

We will indicate the name and address of the warrant agent in the applicable prospectus supplement relating to a particular series of

warrants.

In this prospectus, we have summarized certain general features of

the warrants. We urge you, however, to read the applicable prospectus supplement related to the particular series of warrants being offered,

as well as the warrant agreements and warrant certificates that contain the terms of the warrants. We will file as exhibits to the registration

statement of which this prospectus is a part, or will incorporate by reference from reports that we file with the Securities and Exchange

Commission, the form of warrant agreement or warrant certificate containing the terms of the warrants we are offering before the issuance

of the warrants.

Units

We may issue units consisting of common stock, preferred stock and/or

warrants for the purchase of common stock or preferred stock in one or more series. In this prospectus, we have summarized certain general

features of the units. We urge you, however, to read the applicable prospectus supplement related to the series of units being offered,

as well as the unit agreements that contain the terms of the units. We will file as exhibits to the registration statement of which this

prospectus is a part, or will incorporate by reference reports that we file with the Securities and Exchange Commission, the form of

unit agreement and any supplemental agreements that describe the terms of the series of units we are offering before the issuance of

the related series of units.

Subscription Rights

We may issue subscription rights to purchase shares of common stock

or other securities. These subscription rights may be issued independently or together with any other security offered hereby and may

or may not be transferable by the stockholder receiving the subscription rights in such offering. In connection with any offering of

subscription rights, we may enter into a standby arrangement with one or more underwriters or other purchasers pursuant to which the

underwriters or other purchasers may be required to purchase any securities remaining unsubscribed for after such offering. We will file

as exhibits to the registration statement of which this prospectus is a part, or will incorporate by reference reports that we file with

the Securities and Exchange Commission, the form of such agreement and any supplemental agreements that describe the terms of the subscription

rights we are offering before the issuance of such subscription rights.

Risk

Factors

An investment in our securities involves a high degree of risk. The

prospectus supplement applicable to each offering of our securities will contain a discussion of the risks applicable to an investment

in our securities. Before deciding whether to invest in our securities, you should carefully consider the specific factors discussed

under the heading “Risk Factors” in the applicable prospectus supplement, together with all of the other information contained

or incorporated by reference in the prospectus supplement or appearing or incorporated by reference in this prospectus. You should also

consider the risks, uncertainties and assumptions discussed under Item 1A, “Risk Factors,” in our Annual Report on Form 10-K

for the fiscal year ended December 31, 2022, which is incorporated herein by reference, as updated or superseded by the risks and uncertainties

described under similar headings in the other documents that are filed after the date hereof and incorporated by reference into this

prospectus and any prospectus supplement related to a particular offering. The risks and uncertainties we have described are not the

only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect

our operations. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be

used to anticipate results or trends in future periods. If any of these risks actually occurs, our business, business prospects, financial

condition or results of operations could be seriously harmed. This could cause the trading price of our common stock to decline, resulting

in a loss of all or part of your investment. Please also read carefully the section below entitled “Special Note Regarding Forward-Looking

Statements.”

Special

Note Regarding Forward-Looking Statements

This prospectus, each prospectus supplement and the information incorporated

by reference in this prospectus and each prospectus supplement contain “forward-looking statements,” which include information

relating to future events, future financial performance, strategies, expectations, competitive environment and regulation. Words such

as “may,” “should,” “could,” “would,” “predicts,” “potential,”

“continue,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates,” and similar expressions, as well as statements in future tense, identify forward-looking

statements. Forward-looking statements should not be read as a guarantee of future performance or results and will probably not be accurate

indications of when such performance or results will be achieved. Forward-looking statements are based on information we have when those

statements are made or our management’s good faith belief as of that time with respect to future events, and are subject to risks

and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking

statements. Important factors that could cause such differences include, but are not limited to:

| ● | our history of recurring losses and negative cash flows from

operating activities, significant future commitments and the uncertainty regarding the adequacy

of our liquidity to pursue our complete business objectives; |

| ● | our ability to complete clinical trials as anticipated and

obtain and maintain regulatory approvals for our products; |

| ● | our ability to adequately protect our intellectual property; |

| ● | disputes over ownership of intellectual property; |

| ● | our dependence on a single manufacturing facility and our

ability to comply with stringent manufacturing quality standards and to increase production

as necessary; |

| ● | the risk that the data collected from our current and planned

clinical trials may not be sufficient to demonstrate that our products are an attractive

alternative to other procedures and products; |

| ● | intense competition in our industry, with competitors having

substantially greater financial, technological, research and development, regulatory and

clinical, manufacturing, marketing and sales, distribution and personnel resources than we

do; |

| ● | entry of new competitors and products and potential technological

obsolescence of our products; |

| ● | loss of a key customer or supplier; |

| ● | adverse economic conditions; |

| ● | adverse federal, state and local government regulation, in

the United States; |

| ● | price increases for supplies and components; |

| ● | inability to carry out research, development and commercialization

plans; |

| ● | loss or retirement of key executives and research scientists; |

| ● | our ability to maintain compliance with the continued listing

requirements of the NYSE American and the risk that our common stock will be delisted if

we cannot do so; |

| |

● |

the effects of health epidemics, including the global COVID-19 pandemic; and |

| ● | other factors discussed in this prospectus. |

You should review carefully the section entitled “Risk Factors”

beginning on page 5 of this prospectus for a discussion of these and other risks that relate to our business and investing in our securities.

The forward-looking statements contained or incorporated by reference in this prospectus or any prospectus supplement are expressly qualified

in their entirety by this cautionary statement. We do not undertake any obligation to publicly update any forward-looking statement to

reflect events or circumstances after the date on which any such statement is made or to reflect the occurrence of unanticipated events.

Use

of Proceeds

Unless we specify another use in the applicable prospectus supplement,

we will use the net proceeds from the sale of the securities offered by us for general corporate purposes, which may include, among other

things, debt repayment, working capital and/or capital expenditures.

We may also use such proceeds to fund acquisitions of product candidates

or technologies that complement our current business. We may set forth additional information on the use of net proceeds from the sale

of the securities we offer under this prospectus in a prospectus supplement related to a specific offering.

Investors are cautioned, however, that expenditures may vary substantially

from these uses. Investors will be relying on the judgment of our management, who will have broad discretion regarding the application

of the proceeds of this offering. The amounts and timing of our actual expenditures will depend upon numerous factors, including the

amount of cash generated by our operations, the amount of competition and other operational factors. We may find it necessary or advisable

to use portions of the proceeds from this offering for other purposes.

From time to time, we evaluate these and other factors and we anticipate

continuing to make such evaluations to determine if the existing allocation of resources, including the proceeds of this offering, is

being optimized. Circumstances that may give rise to a change in the use of proceeds include:

| ● | a change in development plan or strategy; |

| ● | delays or difficulties with our clinical trials; |

| ● | negative results from our clinical trials; |

| ● | difficulty obtaining regulatory approval; |

| ● | failure to achieve sales as anticipated; |

| ● | the addition of new product candidates or technologies; |

| ● | our ability to negotiate definitive agreement with acquisition

candidates; |

| ● | the availability and terms of debt financing to fund a portion

of the purchase price(s) for potential acquisitions; and |

| ● | the availability of other sources of cash including cash flow

from operations and new bank debt financing arrangements, if any. |

Pending other uses, we intend to invest the proceeds to us in investment-grade,

interest-bearing securities such as money market funds, certificates of deposit, or direct or guaranteed obligations of the U.S. government,

or hold as cash. We cannot predict whether the proceeds invested will yield a favorable, or any, return.

Description

of Capital Stock

The following description of common stock and preferred stock summarizes

the material terms and provisions of the common stock and preferred stock that we may offer under this prospectus, but is not complete.

For the complete terms of our common stock and preferred stock, please refer to our certificate of incorporation, as amended and our

amended and restated bylaws, as may be amended from time to time. While the terms we have summarized below will apply generally to any

future common stock or preferred stock that we may offer, we will describe the specific terms of any series of preferred stock in more

detail in the applicable prospectus supplement. If we so indicate in a prospectus supplement, the terms of any preferred stock we offer

under that prospectus supplement may differ from the terms we describe below.

We have authorized 1,050,000,000 shares of capital stock, par value

$0.001 per share, of which 1,000,000,000 are shares of common stock and 50,000,000 are shares of preferred stock. On January 30, 2024,

there were 27,764,233 shares of common stock issued and outstanding and no shares of preferred stock issued and outstanding. The

authorized and unissued shares of common stock and the authorized and undesignated shares of preferred stock are available for issuance

without further action by our stockholders, unless such action is required by applicable law or the rules of any stock exchange on which

our securities may be listed.

We also have warrants that are outstanding, which are described below.

Common Stock

The holders of our common stock are entitled to one vote per share.

Our Certificate of Incorporation does not provide for cumulative voting. Our directors are divided into three classes. At each annual

meeting of stockholders, directors elected to succeed those directors whose terms expire are elected for a term of office to expire at

the third succeeding annual meeting of stockholders after their election. The holders of our common stock are entitled to receive ratably

such dividends, if any, as may be declared by our board of directors out of legally available funds. Upon liquidation, dissolution or

winding-up, the holders of our common stock are entitled to share ratably in all assets that are legally available for distribution.

There are no preemptive, subscription, conversion rights, redemption or sinking fund provisions regarding the common stock. The rights,

preferences and privileges of holders of our common stock are subject to, and may be adversely affected by, the rights of the holders

of any series of preferred stock, which may be designated solely by action of our board of directors and issued in the future.

The transfer agent and registrar for our common stock is Securities

Transfer Corporation. The transfer agent’s address is 2901 N. Dallas Parkway, Suite 380, Plano, Texas 75093. Our common stock is

listed on the NYSE American under the symbol “ATNM.”

Preferred Stock

The board of directors is authorized, subject to any limitations prescribed

by law, without further vote or action by the stockholders, to issue from time to time up to 50,000,000 shares of preferred stock in

one or more series. Each such series of preferred stock shall have such number of shares, designations, preferences, voting powers, qualifications,

and special or relative rights or privileges as shall be determined by the board of directors, which may include, among others, dividend

rights, voting rights, liquidation preferences, conversion rights and preemptive rights. Issuance of preferred stock by our board of

directors may result in such shares having dividend and/or liquidation preferences senior to the rights of the holders of our common

stock and could dilute the voting rights of the holders of our common stock.

Prior to the issuance of shares of each series of preferred stock,

the board of directors is required by the Delaware General Corporation Law and our Certificate of Incorporation to adopt resolutions

and file a certificate of designation with the Secretary of State of the State of Delaware. The certificate of designation fixes for

each class or series the designations, powers, preferences, rights, qualifications, limitations and restrictions, including, but not

limited to, some or all of the following:

| ● | the number of shares constituting that series and the distinctive

designation of that series, which number may be increased or decreased (but not below the

number of shares then outstanding) from time to time by action of the board of directors; |

| ● | the dividend rate and the manner and frequency of payment

of dividends on the shares of that series, whether dividends will be cumulative, and, if

so, from which date; |

| ● | whether that series will have voting rights, in addition to

any voting rights provided by law, and, if so, the terms of such voting rights; |

| ● | whether that series will have conversion privileges, and,

if so, the terms and conditions of such conversion, including provision for adjustment of

the conversion rate in such events as the board of directors may determine; |

| ● | whether or not the shares of that series will be redeemable,

and, if so, the terms and conditions of such redemption; |

| ● | whether that series will have a sinking fund for the redemption

or purchase of shares of that series, and, if so, the terms and amount of such sinking fund; |

| ● | whether or not the shares of the series will have priority

over or be on a parity with or be junior to the shares of any other series or class in any

respect; |

| ● | the rights of the shares of that series in the event of voluntary

or involuntary liquidation, dissolution or winding up of the corporation, and the relative

rights or priority, if any, of payment of shares of that series; and |

| ● | any other relative rights, preferences and limitations of

that series. |

Once designated by our board of directors, each series of preferred

stock may have specific financial and other terms.

Anti-Takeover Law and Provisions of Our Certificate of Incorporation

and Bylaws

Provisions of our Certificate of Incorporation and Bylaws may delay

or discourage transactions involving an actual or potential change in our control or change in our management, including transactions

in which stockholders might otherwise receive a premium for their shares, or transactions that our stockholders might otherwise deem

to be in their best interests. Therefore, these provisions could adversely affect the price of our common stock. Among other things,

our Certificate of Incorporation and Bylaws:

| ● | permits our board of directors to issue up to 50,000,000 shares

of preferred stock, without further action by the stockholders, with any rights, preferences

and privileges as they may designate, including the right to approve an acquisition or other

change in control; |

| ● | provide that all vacancies, including newly created directorships,

may, except as otherwise required by law, be filled by the affirmative vote of a majority

of directors in office; |

| ● | divide our board of directors into three classes, with each

class serving staggered three-year terms; |

| ● | do not provide for cumulative voting rights (therefore allowing

the holders of a majority of the shares of common stock entitled to vote in any election

of directors to elect all of the directors standing for election, if they should so choose); |

| ● | provide that special meetings of our stockholders may be called

only by our board of directors, chairman or chief executive officer; and |

| ● | provide advance notice provisions with which a stockholder

who wishes to nominate a director or propose other business to be considered at a stockholder

meeting must comply. |

Description

of Warrants

As of January 30, 2024, there were 1,442,334 shares of common stock

that may be issued upon the exercise of outstanding warrants.

We may issue warrants for the purchase of common stock or preferred

stock in one or more series. We may issue warrants independently or together with common stock or preferred stock, and the warrants may

be attached to or separate from these securities.

We will evidence each series of warrants by warrant certificates that

we may issue under a separate agreement. We may enter into a warrant agreement with a warrant agent. Each warrant agent may be a bank

or transfer agent that we select which has its principal office in the United States. We may also choose to act as our own warrant agent.

We will indicate the name and address of any such warrant agent in the applicable prospectus supplement relating to a particular series

of warrants.

We will describe in the applicable prospectus supplement the terms

of the series of warrants, including:

| ● | the offering price and aggregate number of warrants offered; |

| ● | if applicable, the designation and terms of the securities

with which the warrants are issued and the number of warrants issued with each such security

or each principal amount of such security; |

| ● | if applicable, the date on and after which the warrants and

the related securities will be separately transferable; |

| ● | in the case of warrants to purchase common stock or preferred

stock, the number or amount of shares of common stock or preferred stock, as the case may

be, purchasable upon the exercise of one warrant and the price at which and currency in which

these shares may be purchased upon such exercise; |

| ● | the manner of exercise of the warrants, including any cashless

exercise rights; |

| ● | the warrant agreement under which the warrants will be issued; |

| ● | the effect of any merger, consolidation, sale or other disposition

of our business on the warrant agreement and the warrants; |

| ● | anti-dilution provisions of the warrants, if any; |

| ● | the terms of any rights to redeem or call the warrants; |

| ● | any provisions for changes to or adjustments in the exercise

price or number of securities issuable upon exercise of the warrants; |

| ● | the dates on which the right to exercise the warrants will

commence and expire or, if the warrants are not continuously exercisable during that period,

the specific date or dates on which the warrants will be exercisable; |

| ● | the manner in which the warrant agreement and warrants may

be modified; |

| ● | the identities of the warrant agent and any calculation or

other agent for the warrants; |

| ● | federal income tax consequences of holding or exercising the

warrants; |

| ● | the terms of the securities issuable upon exercise of the

warrants; |

| ● | any securities exchange or quotation system on which the warrants

or any securities deliverable upon exercise of the warrants may be listed or quoted; and |

| ● | any other specific terms, preferences, rights or limitations

of or restrictions on the warrants. |

Before exercising their warrants, holders of warrants will not have

any of the rights of holders of the securities purchasable upon such exercise, including, in the case of warrants to purchase common

stock or preferred stock, the right to receive dividends, if any, or, payments upon our liquidation, dissolution or winding up or to

exercise voting rights, if any.

Exercise of Warrants

Each warrant will entitle the holder to purchase the securities that

we specify in the applicable prospectus supplement at the exercise price that we describe in the applicable prospectus supplement. Unless

we otherwise specify in the applicable prospectus supplement, holders of the warrants may exercise the warrants at any time up to 5:00

P.M. eastern time, the close of business, on the expiration date that we set forth in the applicable prospectus supplement. After the

close of business on the expiration date, unexercised warrants will become void.

Holders of the warrants may exercise the warrants by delivering the

warrant certificate representing the warrants to be exercised together with specified information, and paying the required exercise price

by the methods provided in the applicable prospectus supplement. We will set forth on the reverse side of the warrant certificate, and

in the applicable prospectus supplement, the information that the holder of the warrant will be required to deliver to the warrant agent.

Upon receipt of the required payment and the warrant certificate properly

completed and duly executed at the corporate trust office of the warrant agent or any other office indicated in the applicable prospectus

supplement, we will issue and deliver the securities purchasable upon such exercise. If fewer than all of the warrants represented by

the warrant certificate are exercised, then we will issue a new warrant certificate for the remaining amount of warrants.

Enforceability of Rights By Holders of Warrants

Any warrant agent will act solely as our agent under the applicable

warrant agreement and will not assume any obligation or relationship of agency or trust with any holder of any warrant. A single bank

or trust company may act as warrant agent for more than one issue of warrants. A warrant agent will have no duty or responsibility in

case of any default by us under the applicable warrant agreement or warrant, including any duty or responsibility to initiate any proceedings

at law or otherwise, or to make any demand upon us. Any holder of a warrant may, without the consent of the related warrant agent or

the holder of any other warrant, enforce by appropriate legal action the holder’s right to exercise, and receive the securities

purchasable upon exercise of, its warrants in accordance with their terms.

Warrant Agreement Will Not Be Qualified Under Trust Indenture

Act

No warrant agreement will be qualified as an indenture, and no warrant

agent will be required to qualify as a trustee, under the Trust Indenture Act. Therefore, holders of warrants issued under a warrant

agreement will not have the protection of the Trust Indenture Act with respect to their warrants.

Governing Law

Each warrant agreement and any warrants issued under the warrant agreements

will be governed by New York law.

Description

Of Units

We may issue units comprised of one or more of the other securities

described in this prospectus or any prospectus supplement in any combination. Each unit will be issued so that the holder of the unit

is also the holder, with the rights and obligations of a holder, of each security included in the unit. The unit agreement under which

a unit is issued may provide that the securities included in the unit may not be held or transferred separately, at any time or at any

times before a specified date or upon the occurrence of a specified event or occurrence.

The applicable prospectus supplement will describe:

| ● | the designation and the terms of the units and of the securities

comprising the units, including whether and under what circumstances those securities may

be held or transferred separately; |

| ● | any unit agreement under which the units will be issued; |

| ● | any provisions for the issuance, payment, settlement, transfer

or exchange of the units or of the securities comprising the units; and |

| ● | whether the units will be issued in fully registered or global

form. |

Description

of Subscription Rights

The following is a general description of the terms of the subscription

rights we may issue from time to time. Particular terms of any subscription rights we offer will be described in the prospectus supplement

relating to such subscription rights, and may differ from the terms described herein.

We may issue subscription rights to purchase shares of common stock

or other securities offered hereby. These subscription rights may be issued independently or together with any other security offered

hereby and may or may not be transferable by the stockholder receiving the subscription rights in such offering. In connection with any

offering of subscription rights, we may enter into a standby arrangement with one or more underwriters or other purchasers pursuant to

which the underwriters or other purchasers may be required to purchase any securities remaining unsubscribed for after such offering.

The applicable prospectus supplement will describe the specific terms

of any offering of subscription rights for which this prospectus is being delivered, including the following:

| ● | whether common stock or other securities will be offered under

the stockholder subscription rights; |

| ● | the price, if any, for the subscription rights; |

| ● | the exercise price payable for each security upon the exercise

of the subscription rights; |

| ● | the number of subscription rights issued to each stockholder; |

| ● | the number and terms of the securities which may be purchased

per each subscription right; |

| ● | the extent to which the subscription rights are transferable; |

| ● | any other terms of the subscription rights, including the

terms, procedures and limitations relating to the exchange and exercise of the subscription

rights; |

| ● | the date on which the right to exercise the subscription rights

shall commence, and the date on which the subscription rights shall expire; |

| ● | the extent to which the subscription rights may include an

over-subscription privilege with respect to unsubscribed securities; |

| ● | if appropriate, a discussion of material U.S. federal income

tax considerations; and |

| ● | if applicable, the material terms of any standby underwriting

or purchase arrangement entered into by us in connection with the offering of subscription

rights. |

The description in the applicable prospectus supplement of any subscription

rights we offer will not necessarily be complete and will be qualified in its entirety by reference to the applicable subscription rights

certificate or subscription rights agreement, which will be filed with the Securities and Exchange Commission if we offer subscription

rights.

Plan

of Distribution

We may sell the securities being offered pursuant to this prospectus

to or through underwriters, through dealers, through agents, or directly to one or more purchasers or through a combination of these

methods. The applicable prospectus supplement will describe the terms of the offering of the securities, including:

| ● | the name or names of any underwriters, if any, and if required,

any dealers or agents; |

| ● | the purchase price of the securities and the proceeds we will

receive from the sale; |

| ● | any underwriting discounts and other items constituting underwriters’

compensation; |

| ● | any discounts or concessions allowed or reallowed or paid

to dealers; and |

| ● | any securities exchange or market on which the securities

may be listed or traded. |

We may distribute the securities from time to time in one or more

transactions at:

| ● | a fixed price or prices, which may be changed; |

| ● | market prices prevailing at the time of sale, directly by

us or through a designated agent; |

| ● | in “at the market offerings” within the meaning of

Rule 415 under the Securities Act of 1933, as amended, or through a market maker or into

an existing market, on an exchange, or otherwise; |

| ● | prices related to such prevailing market prices; |

| ● | in block trades in which a broker-dealer will attempt to sell

the securities as agent, but may position and resell a portion of the block as principal

to facilitate the transaction; or |

Only underwriters named in the prospectus supplement are underwriters

of the securities offered by the prospectus supplement.

We may also make direct sales through subscription rights distributed

to our existing shareholders on a pro rata basis, which may or may not be transferable. In any distribution of subscription rights to

our shareholders, if all of the underlying securities are not subscribed for, we may then sell the unsubscribed securities directly to

third parties or may engage the services of one or more underwriters, dealers or agents, including standby underwriters, to sell the

unsubscribed securities to third parties. In addition, whether or not all of the underlying securities are subscribed for, we may concurrently

offer additional securities to third parties directly or through underwriters, dealers or agents.

If underwriters are used in an offering, we will execute an underwriting

agreement with such underwriters and will specify the name of each underwriter and the terms of the transaction (including any underwriting

discounts and other terms constituting compensation of the underwriters and any dealers) in a prospectus supplement. The securities may

be offered to the public either through underwriting syndicates represented by managing underwriters or directly by one or more investment

banking firms or others, as designated. If an underwriting syndicate is used, the managing underwriter(s) will be specified on the cover

of the prospectus supplement. If underwriters are used in the sale, the offered securities will be acquired by the underwriters for their

own accounts and may be resold from time to time in one or more transactions, including negotiated transactions, at a fixed public offering

price or at varying prices determined at the time of sale. Any public offering price and any discounts or concessions allowed or reallowed

or paid to dealers may be changed from time to time. Unless otherwise set forth in the prospectus supplement, the obligations of the

underwriters to purchase the offered securities will be subject to conditions precedent, and the underwriters will be obligated to purchase

all of the offered securities, if any are purchased.

We may grant to the underwriters options to purchase additional securities

to cover over-allotments, if any, at the public offering price, with additional underwriting commissions or discounts, as may be set

forth in a related prospectus supplement. The terms of any over-allotment option will be set forth in the prospectus supplement for those

securities.

If we use a dealer in the sale of the securities being offered pursuant

to this prospectus or any prospectus supplement, we will sell the securities to the dealer, as principal. The dealer may then resell

the securities to the public at varying prices to be determined by the dealer at the time of resale. The names of the dealers and the

terms of the transaction will be specified in a prospectus supplement.

We may sell the securities directly or through agents we designate

from time to time. We will name any agent involved in the offering and sale of securities and we will describe any commissions we will

pay the agent in the prospectus supplement. Unless the prospectus supplement states otherwise, any agent will act on a best-efforts basis

for the period of its appointment.

We may authorize agents or underwriters to solicit offers by institutional

investors to purchase securities from us at the public offering price set forth in the prospectus supplement pursuant to delayed delivery

contracts providing for payment and delivery on a specified date in the future. We will describe the conditions to these contracts and

the commissions we must pay for solicitation of these contracts in the prospectus supplement.

In connection with the sale of the securities, underwriters, dealers

or agents may receive compensation from us or from purchasers of the securities for whom they act as agents, in the form of discounts,

concessions or commissions. Underwriters may sell the securities to or through dealers, and those dealers may receive compensation in

the form of discounts, concessions or commissions from the underwriters or commissions from the purchasers for whom they may act as agents.

Underwriters, dealers and agents that participate in the distribution of the securities, and any institutional investors or others that

purchase securities directly for the purpose of resale or distribution, may be deemed to be underwriters, and any discounts or commissions

received by them from us and any profit on the resale of the common stock by them may be deemed to be underwriting discounts and commissions

under the Securities Act of 1933, as amended.

We may provide agents, underwriters and other purchasers with indemnification

against particular civil liabilities, including liabilities under the Securities Act of 1933, as amended, or contribution with respect

to payments that the agents, underwriters or other purchasers may make with respect to such liabilities. Agents and underwriters may

engage in transactions with, or perform services for, us in the ordinary course of business.

To facilitate the public offering of a series of securities, persons

participating in the offering may engage in transactions that stabilize, maintain, or otherwise affect the market price of the securities.

This may include over-allotments or short sales of the securities, which involves the sale by persons participating in the offering of

more securities than have been sold to them by us. In addition, those persons may stabilize or maintain the price of the securities by

bidding for or purchasing securities in the open market or by imposing penalty bids, whereby selling concessions allowed to underwriters

or dealers participating in any such offering may be reclaimed if securities sold by them are repurchased in connection with stabilization

transactions. The effect of these transactions may be to stabilize or maintain the market price of the securities at a level above that

which might otherwise prevail in the open market. Such transactions, if commenced, may be discontinued at any time. We make no representation

or prediction as to the direction or magnitude of any effect that the transactions described above, if implemented, may have on the price

of our securities.

Unless otherwise specified in the applicable prospectus supplement,

any common stock sold pursuant to a prospectus supplement will be eligible for listing on the NYSE American, subject to official notice

of issuance. Any underwriters to whom securities are sold by us for public offering and sale may make a market in the securities, but

such underwriters will not be obligated to do so and may discontinue any market making at any time without notice.

In order to comply with the securities laws of some states, if applicable,

the securities offered pursuant to this prospectus will be sold in those states only through registered or licensed brokers or dealers.

In addition, in some states securities may not be sold unless they have been registered or qualified for sale in the applicable state

or an exemption from the registration or qualification requirement is available and complied with.

Legal

Matters

The validity of the securities offered by this prospectus will be

passed upon by Haynes and Boone, LLP, New York, New York.

Experts

The consolidated financial statements of Actinium Pharmaceuticals,

Inc. as of and for the years ended December 31, 2022 and 2021 appearing in Actinium Pharmaceuticals, Inc.’s Annual Report on Form

10-K for the year ended December 31, 2022, have been audited by Marcum LLP, as set forth in its report thereon, included therein, and

incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference in reliance upon such report

given on the authority of such firm as experts in accounting and auditing.

Where

You Can Find More Information

We are subject to the informational requirements of the Securities

Exchange Act of 1934, as amended, and in accordance therewith file annual, quarterly and current reports, proxy statements and other

information with the Securities and Exchange Commission. The Securities and Exchange Commission maintains a website that contains such

reports, proxy and information statements and other information regarding registrants that file electronically with the Securities and

Exchange Commission. The address of the Securities and Exchange Commission’s website is www.sec.gov.

We make available free of charge on or through our website at www.actiniumpharma.com,

our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or

furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after

we electronically file such material with or otherwise furnish it to the Securities and Exchange Commission.

We have filed with the Securities and Exchange Commission a registration

statement under the Securities Act of 1933, as amended, relating to the offering of these securities. The registration statement, including

the attached exhibits, contains additional relevant information about us and the securities. This prospectus does not contain all of

the information set forth in the registration statement. You can obtain a copy of the registration statement, at prescribed rates, from

the Securities and Exchange Commission at the address listed above, or for free at www.sec.gov. The registration statement and the documents

referred to below under “Incorporation of Certain Information By Reference” are also available on our website, www.actiniumpharma.com.

We have not incorporated by reference into this prospectus the information

on our website, and you should not consider it to be a part of this prospectus.

Incorporation

of Certain Information by Reference

The Securities and Exchange Commission allows us to “incorporate

by reference” the information we have filed with it, which means that we can disclose important information to you by referring

you to those documents. The information we incorporate by reference is an important part of this prospectus, and later information that

we file with the Securities and Exchange Commission will automatically update and supersede this information. We incorporate by reference

the documents listed below and any future documents (excluding information furnished pursuant to Items 2.02 and 7.01 of Form 8-K) we

file with the Securities and Exchange Commission pursuant to Sections l3(a), l3(c), 14 or l5(d) of the Securities Exchange Act of 1934,

as amended, subsequent to the date of this prospectus and prior to the termination of the offering:

| ● | Our Annual Report on Form

10-K for the fiscal year ended December 31, 2022, filed with the Securities and Exchange

Commission on March 31, 2023; |

| ● | Our Quarterly Reports on Form

10-Q for the quarterly periods ended March 31, 2023, June 30, 2023 and September 30,

2023 filed with the Securities and Exchange Commission on May 15,

2023, August

14, 2023 and November

2, 2023, respectively; |

| ● | Our

Current Report on Form

8-K filed with the Securities and Exchange Commission on December 1, 2023; and |

| ● | The description of the Company’s common stock and warrants

contained in Exhibit 4.15

to our Annual Report on Form

10-K for the fiscal year ended December 31, 2020, filed with the Securities and Exchange

Commission on March 31, 2021, including any amendments thereto or reports filed for

the purposes of updating this description. |

All filings filed by us pursuant to the Securities Exchange Act of

1934, as amended, after the date of the initial filing of this registration statement and prior to the effectiveness of such registration

statement (excluding information furnished pursuant to Items 2.02 and 7.01 of Form 8-K) shall also be deemed to be incorporated by reference

into the prospectus.

You should rely only on the information incorporated by reference

or provided in this prospectus. We have not authorized anyone else to provide you with different information. Any statement contained

in a document incorporated by reference into this prospectus will be deemed to be modified or superseded for the purposes of this prospectus

to the extent that a later statement contained in this prospectus or in any other document incorporated by reference into this prospectus

modifies or supersedes the earlier statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded,

to constitute a part of this prospectus. You should not assume that the information in this prospectus is accurate as of any date other

than the date of this prospectus or the date of the documents incorporated by reference in this prospectus.

We will provide without charge to each person to whom a copy of this

prospectus is delivered, upon written or oral request, a copy of any or all of the reports or documents that have been incorporated by

reference in this prospectus but not delivered with this prospectus (other than an exhibit to these filings, unless we have specifically

incorporated that exhibit by reference in this prospectus). Any such request should be addressed to us at:

Actinium Pharmaceuticals, Inc.

Attn: Steve O’Loughlin

100 Park Ave., 23rd Floor

New York, NY 10017

(646) 677-3870

You may also access the documents incorporated by reference in this

prospectus through our website at www.actiniumpharma.com. Except for the specific incorporated documents listed above, no information

available on or through our website shall be deemed to be incorporated in this prospectus or the registration statement of which it forms

a part.

$500,000,000

Common Stock

Preferred Stock

Warrants

Units

Subscription Rights

PROSPECTUS

The information in this prospectus is

not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange

Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities

in any state where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED FEBRUARY 2, 2024

Prospectus

Actinium Pharmaceuticals,

Inc.

Up to $200,000,000

Common Stock

We previously entered into an Amended and Restated Capital on Demand™

Sales Agreement, or the sales agreement, with JonesTrading Institutional Services LLC, or JonesTrading, and B. Riley Securities, Inc.,

or B. Riley Securities, dated June 28, 2022, relating to the sale of shares of our common stock, par value $0.001 per share, from time

to time through or to JonesTrading or B. Riley Securities, acting as agents or principals. In accordance with the terms of the sales

agreement, pursuant to this prospectus and the accompanying base prospectus, we may offer and sell our common stock having an aggregate

offering price of up to $200,000,000 from time to time through or to JonesTrading and B.Riley Securities. To date, we have sold an aggregate

of 12,230,618 shares pursuant to the sales agreement under a registration statement on Form S-3 (File No. 333-242322) filed on August

7, 2020, and declared effective on August 14, 2020, for aggregate gross proceeds of approximately $98.7 million.

Sales of our common stock, if any, under this prospectus will be made

by any method permitted that is deemed an “at the market offering” as defined in Rule 415 under the Securities Act of 1933,

as amended, or the Securities Act. JonesTrading and B. Riley Securities, referred to herein as the agents, will act as our sales agents

using commercially reasonable efforts consistent with their normal trading and sales practices. There is no arrangement for funds to

be received in any escrow, trust or similar arrangement.

The agents will be entitled to compensation at a commission rate up to

3.0% of the gross sales price per share sold under the sales agreement. See “Plan of Distribution” beginning on page 11 for

additional information regarding the compensation to be paid to the agents. In connection with the sale of the shares of common stock

on our behalf, each agent will be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation

of each agent will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution

to the agent with respect to certain liabilities, including liabilities under the Securities Act.

Investing in our securities involves a high degree

of risk. These risks are discussed in this prospectus under “Risk Factors” beginning on page 5 and in the documents incorporated

by reference into this prospectus.

Our common stock is listed on the NYSE American under the symbol

“ATNM.” On February 1, 2024, the last reported sale price of our common stock was $5.56 per share.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus.

Any representation to the contrary is a criminal offense.

JonesTrading

B. Riley Securities

The date of this prospectus is ,

2024.

Table

of Contents

About

This Prospectus

This prospectus is part of a registration statement on Form S-3 that