TIDMMPO

RNS Number : 9545B

Macau Property Opportunities Fund

06 October 2022

6 October 2022

Macau Property Opportunities Fund Limited

("MPO" or the "Company")

Annual results for the year ended 30 June 2022

Macau Property Opportunities Fund Limited announces its results

for the year ended 30 June 2022. The Company, which is managed by

Sniper Capital Limited, holds strategic property investments in

Macau.

FINANCIAL HIGHLIGHTS

Fund performance

-- MPO's portfolio value(1) declined 8.3% over the year to US$242 million.

-- Adjusted NAV was US$103.4 million, which translates to

US$1.67 (138 pence(2) ) per share, a 19.7% decrease year-on-year

(YoY).

-- IFRS NAV was US$77.6 million or US$1.25 (104 pence(2) ) per share, a 20.8% decrease YoY.

Capital management

-- As at 30 June 2022, MPO's balance sheet held assets worth a

total of US$220million, against combined liabilities of US$142.5

million.

-- The Company ended the financial year with a consolidated cash

balance (including deposits with lenders) of US$3.8 million.

-- As at 30 June 2022, gross borrowing stood at US$131 million,

which translates to a loan-to-value ratio of 53.3%.

(1) Calculation was adjusted to reflect like-for-like

comparisons to 30 June 2022 due to the divestment of properties

during the year.

(2) Based on the Dollar/Sterling exchange rate of 1.212 on 30

June 2022.

PORTFOLIO HIGHLIGHTS

-- The Waterside

- T he divestment strategy for The Waterside was pivoted in H1

2022 with the commencement of strata sales to a select range of

motivated buyers.

- This strategy led to the successful initial sale of four

targeted units - one simplex and three standard apartments - in Q2

2022. The combined transaction value of US$14.4 million represented

an overall discount of 6.8% to a valuation of the units conducted

by Savills as at 30 June 2022, with the proceeds earmarked

primarily for debt reduction.

- Subsequently, a further contracted sale of an apartment at The

Waterside has been secured, with completion scheduled for November

2022.

- Occupancy maintained at 30% as a year ago, despite an

extremely shallow leasing market. The average rental was US$2.2 per

square foot per month, down 4% YoY. Leasing decisions are carefully

balanced against strata sales targets.

-- The Fountainside

- During the financial year, the two duplexes at the property

have been reconfigured as three smaller units and two car-parking

spaces, for which on-site works were completed in Q3. Occupancy

permits are expected by the end of 2022, clearing the way for

sales.

- For the four villas, sales efforts remain hindered by Macau's

entry controls and COVID quarantine requirements, which have

limited the number of in-person site visits.

-- Penha Heights

- The Company continues with the sales and marketing push with

specialist property agents from Q4 2020.

- Despite weak market sentiment, six viewings have been

conducted since the beginning of 2022, with several parties

progressing to various stages of due diligence.

Mark Huntley, Chairman of Macau Property Opportunities Fund,

said:

"The financial year can best be described as one of exceptional

challenges associated primarily with Macau's continued response to

COVID-19 which was in lockstep with that in China. Border

restrictions, together with a major lockdown in June, have severely

affected our planned divestments of assets compounded by a

worsening economic environment in Macau."

"The successful implementation of a strata sales programme for

The Waterside, which delivered the sale of four of 59 units and a

further contacted sale of another unit due to complete in November

2022, is therefore a notable achievement in difficult

conditions."

"The outlook in the near term remains challenging with COVID-19

policies continuing to impact the economy in Macau and investors'

sentiment and their willingness to make substantial investments

such as property purchases. The Manager continues to work actively

on delivery of further sales of each of our assets. Marketing has

now actively recommenced following the end of the lockdown in Macau

and we continue to vigorously implement our divestment strategy

against this difficult backdrop."

For more information, please visit www.mpofund.com for the

Company's full Annual Report 2022.

The Manager will be available to speak to analysts and the

media. If you would like to arrange a call, please contact Investor

Relations of Sniper Capital Limited at info@snipercapital.com .

- End -

About Macau Property Opportunities Fund

Premium listed on the London Stock Exchange, Macau Property

Opportunities Fund Limited is a closed-end investment company

registered in Guernsey and is the only quoted property fund

dedicated to investing in Macau, the world's largest gaming market

and the only city in China where gaming is legal.

Launched in 2006, the Company targets strategic property

investment and development opportunities in Macau. Its current

portfolio comprises prime residential property assets.

The Company is managed by Sniper Capital Limited , an Asia-based

property investment manager with an established track record in

fund management and investment advisory.

Stock Code

London Stock Exchange: MPO

LEI 213800NOAO11OWIMLR72

For further information:

Manager

Sniper Capital Limited

Group Communications

Tel: +853 28705151

Email: info@snipercapital.com

Corporate Broker

Liberum Capital

Darren Vickers / Owen Matthews

Tel: +44 20 3100 2000

Company Secretary & Administrator

Ocorian Administration (Guernsey) Limited

Kevin Smith

Tel: +44 14 8174 2742

MACAU PROPERTY OPPORTUNITIES FUND LIMITED

ANNUAL RESULTS & ACCOUNTS FOR THE YEARED 30 JUNE 2022

CORPORATE INTRODUCTION

M acau Property Opportunities Fund Limited, a closed-end

investment company, was incorporated and registered in Guernsey

under the Companies (Guernsey) Law, 2008 (as amended) on 18 May

2006, under registration number 44813. The Company is an authorised

entity under the Authorised Closed-Ended Investment Schemes Rules

2008. The Company is premium listed on the London Stock

Exchange.

Sniper Capital Limited, the Manager for Macau Property

Opportunities Fund, is responsible for the day-to-day management of

the Company's property portfolio and the identification and

execution of divestment opportunities.

The Company is managed with the objective of realising the value

of all remaining assets in its portfolio, individually, in

aggregate or in any other combination of disposals or transaction

structures, in a prudent manner. The overriding aim is to deliver

cost-effective and timely divestment of the three remaining

properties, to enable further returns of capital to the

shareholders. The Company has ceased to make any new investments

and will not undertake additional borrowings other than to

refinance existing loans or for short-term working capital

purposes.

The Board provides a diversity of ethnicity, of investment

company and real estate experience and geographical perspective,

coupled with an essential understanding of the unique features of

Macau, its property market and the Company's portfolio. The Board

has assessed that it has the capacity to fulfil its obligations in

the context of the latest corporate governance guidelines, taking

full account of the late phase divestment stage that the Company is

in and its clearly defined business objectives.

Pursuant to resolutions passed at MPO's Annual General Meeting

(AGM) in 2016, the Company is subject to annual continuation votes.

The first, second, third and fourth Continuation Resolutions were

passed at General Meetings held on 5 July 2018, 29 November 2019,

30 November 2020 and 31 December 2021, respectively. The next

Continuation Resolution will be put to shareholders no later than

31 December 2022. The Board will be recommending the continuation

of the Company at the AGM, which is expected to be held in

December. A Notice and Agenda of meeting will be issued in November

2022 together with an update on any developments.

Currently 100% of Macau Property Opportunities Fund's investment

portfolio is allocated to residential property investments in

Macau.

KEY FACTS

Exchange

London Stock Exchange

Main Market

Symbol

MPO

Lookup

Reuters - MPO.L

Bloomberg - MPO:LN

Domicile

Guernsey

Shares In Issue

61,835,733

Shares Held in Treasury

Nil

Share Denomination

Pound Sterling, Reporting currency US Dollars

Fee Structure

A realisation focussed fee structure which incentivises the

Manager to realise assets

Inception Date

5 June 2006

Amount Returned to Shareholders

US$173 million

Distributions US$97.4 M; Share buybacks US$75.3M

ADVISERS & SERVICE PROVIDERS

Company Secretary and Administrator

Ocorian Administration (Guernsey) Limited

Corporate Broker

Liberum Capital Limited

External Auditor

Deloitte LLP

CHAIRMAN'S MESSAGE

I present my report for the financial year ended 30 June 2022,

together with our perspective on the way forward for the

Company.

The financial year is best described as one of exceptional

challenges and frustrating developments associated primarily with

Macau's continued response to COVID-19, which was in lock-step with

that of China. It severely affected our planned divestments of

assets, and has been compounded by a worsening economic environment

in the territory.

Against this difficult backdrop, and in the context of

prevailing market dynamics, the commencement of The Waterside

strata sales programme and the completed sale of an initial four of

59 units at the development represent a notable achievement and an

important step in our divestment strategy. The resulting reduced

debt levels and improved loan-to-value (LTV) ratio were welcome, as

was the release of working capital. Subsequently a further

contracted sale of an apartment at The Waterside has been secured,

with completion scheduled for November 2022.

Shortly after the first sales at The Waterside, and with

negotiations related to other assets taking place, a major outbreak

of COVID-19 in June 2022 saw Macau enter a period of lock-down and

mass-testing which dampened sales momentum. Although sales and

marketing have now recommenced in earnest, the timeline for

delivering results will be extended. The divestment timeframe is

influenced by sentiment regarding Macau's outlook and concerns over

potentially intensified border restrictions in the near-term. Such

matters are beyond the Company's control or influence.

To complement sales processes driven by the Manager, Hodes

Weill, a seasoned global advisory firm, was appointed to market the

portfolio to a carefully selected group of prospective investors.

Although a number of prospects have carried out detailed due

diligence, changing circumstances in Macau and the challenges

around whole portfolio pricing have meant this process has yet to

offer up any meaningful prospects. We continue to explore multiple

avenues to achieve our divestment objectives. Further sales success

represents one means by which we can advance towards the

possibility of a full portfolio sale.

Although Macau's high-end real estate segment remained stagnant,

sentiment in the broader marketplace was buoyed by increased

clarity over the renewal of gaming licences, a lack of which had

created a climate of uncertainty and speculation that has been

largely dispelled. However, a sweeping clampdown by the Chinese

authorities on junket operators in the gaming sector, and the

impact of that move on VIP gaming revenues, had an adverse effect

on the luxury property segment.

Much lower visitor numbers and reduced gaming activity

translated into a downturn in the economy in Q4 2021 and well into

2022. Arrests of individuals associated with junket operations and

the abrupt closure of high-profile operators such as Sun City

prompted some unwelcome distressed property sales, which

misrepresented the base-level in the luxury property market.

Macau and the COVID-19 response

At the start of the last financial year, we outlined

developments that encouraged us towards the view that Macau could

slowly emerge from the effects of COVID-19 restrictions.

Developments signaling more relaxed COVID measures included

reductions in quarantine periods, the opening of borders subject to

health checks, and the reopening of Macau to certain categories of

overseas visitors and workers. However, outbreaks of the more

transmissible Omicron variant of the virus in mainland China and

Hong Kong saw major Chinese cities locked down and stopped a

gradual move to a pan-China and SAR travel bubble in its tracks.

Visitor numbers remained erratic as outbreaks and related

restrictions continued.

The emerging "dynamic zero" policy mandated by the Chinese

government, which was also applied to Macau and, until recently,

Hong Kong, severely reduced the essential visitor traffic required

to rebuild the economy and bolster external investor confidence in

the real estate market. Instead, we saw a series of restrictions

that included lockdowns and changing quarantine restrictions that

were difficult to predict. The dynamic zero policy protected

Macau's population from infection, but at the cost of damaging the

economy and investor confidence. A major COVID outbreak in Macau in

June 2022 eclipsed previous infection clusters by some margin and

claimed a small number of fatalities among elderly residents.

The lack of a quarantine-free travel bubble beyond the existing

arrangement between Macau and certain parts of China resulted in a

downturn in Macau's economy from Q4 2021 onwards. As it continued

into 2022, it was further amplified by the June lockdown and the

consequences of the collapse of junket gaming revenues.

Some of the leadership that we had hoped for in terms of a

policy direction by the Macau government has not yet materialised.

For Macau's luxury property market to move forward, a pan-China SAR

travel bubble including Hong Kong would be a key positive change,

reigniting the prospect of sales to an expanded pool of

international and regional investors. However, even though opening

up to the wider world would come as a welcome development, it is

not seen as essential. With property valuations at comparably low

levels, the nascent demand seen in the local market could very

quickly translate into a re-rating of valuations and an increase in

sales activity for what remains a very attractive, well-maintained

portfolio of assets.

The negative impact of the dynamic zero COVID-19 policy on the

mainland Chinese economy cannot be overlooked. Recent policy shift

suggests that Chinese authorities are concerned about the outlook

for the country's economy. The lowering of bank lending rates with

a particular focus on the mortgage market suggests that the

reported distress in the Chinese property sector is a growing

concern and, by extension, the potential impact on the banking

sector.

It is important to understand the perspective of the Chinese

authorities and to respect the specific challenges posed by the

pandemic, particularly those in relation to rural China, for

instance where access to medical facilities is limited. The more

recently emergent Omicron COVID variants which are proving less

damaging to health than earlier incarnations of the virus, may lead

to a gradual change in policy, although this is not expected in the

near term, as evidenced by recent lockdowns of the cities of

Chengdu and Shenzhen. The latter saw a population of 17.5 million

subjected to lockdown measured based on fewer than 50 reported

cases. In a Western context, this action would be difficult to

comprehend.

In response to these changing circumstances, banks have been

applying more stringent terms and conditions to loans. The

company's relationship with its lenders remains strong, however

during such challenging times cash flow comes naturally into focus.

In this context, dialogue with our lenders is ongoing, however the

key to navigating the coming months will be making continued

progress on the Company's sales strategy. This will facilitate debt

repayment and the availability of sufficient working capital.

There are, however, some noteworthy positive signs in Macau in

the form of new casino developments, most of which are planned to

be unveiled this year and next, supported by continued government

investment in transportation infrastructure. Yet our own future

relies more on the impact of nearer-term developments, around which

increased clarity over gaming concessions and diversification into

leisure offerings with broader appeal bodes well for us in terms of

laying improved foundations for future growth post-COVID.

We have seen staggering levels of recovery in tourism in other

destinations around the world that have emerged from COVID

restrictions. The potential effects of resurgent tourism and gaming

activity in Macau should not be overlooked, especially if

international traveling remains restricted for Chinese citizens. It

is also worth noting that when the Macau government recently

announced that resumption of package tours and eVisas for mainland

Chinese visitors to Macau from November 2022, shares of gaming

operators immediately leapt more than 10% amid optimism that the

move signalled a path towards normalcy for the territory.

Financial Performance

Our financial performance reflects the ongoing headwinds that

the Company faced during the last financial year. Macau's COVID

outbreak and consequent lockdown in June saw lower cash reserves at

year-end, affecting some debt repayment scheduling. The situation

was reversed, however, once sales were completed and pending debt

repayments were made.

The Company's Adjusted Net Asset Value (NAV) was US$103.4

million as of 30 June 2022. This is equivalent to US$1.67 (138

pence) per share and represents a decline of 19.7% (8.2% in

sterling terms) compared to the year ended 30 June 2021. The Net

Asset Value at the year-end was US$1.25 per share, down 20.8% from

the previous year. The Company remained in compliance with its debt

covenants. The valuation of the portfolio fell by 8.3% from 30 June

2021, reflecting market conditions, specifically much muted

transaction activity in our segment of Macau's property market.

In the near term, further sales remain impeded by sluggish buyer

sentiment and travel restrictions imposed by Macau's government on

regional investors from Hong Kong and abroad. The Company's share

price closed at 38.2 pence for the reporting period. Following the

year-end date, however, it rebounded to 57 pence in mid-September,

reflecting a more positive investor outlook and the recent weakness

in Pound Sterling.

The Portfolio

With the exception of the sale of four among the 59 units at The

Waterside, the portfolio remained unchanged. The reconfiguration of

two duplex units into three smaller, more marketable units at The

Fountainside has been largely completed and the new residences are

awaiting the final government approvals before they can be offered

to prospective investors. Active marketing of the larger units has

generated a degree of interest that the Manager is continuing to

pursue.

The Waterside remains a premier development both in the context

of the other six towers at One Central Residences and Macau's

high-end property sector more broadly. This status requires

effective and attentive management of the apartments, alongside

selective refurbishment, clearly directed towards sales and leasing

which have maintained tenancy levels and delivered improved tenant

quality in a move away from the junket sector. Leasing decisions

must be carefully balanced with strata sales targets, and

coordinated between The Waterside's Manager and Managing Agent. A

renegotiation for reduced service charges at One Central Residences

by the Property Manager has come as welcome support for cost

control and tenant retention. Appropriate consideration of

environmental impacts is also an area of focus, including air

conditioning and domestic appliances.

Penha Heights is being maintained to enhance opportunities to

sell the property to a very select number of prospects. No further

construction development is envisaged at this stage.

Debt Management

The Manager has maintained an active dialogue with our bank

lenders, which have had to accommodate a sales delay of a further

year due to market conditions. The worsening situation in the

Chinese economy, and particularly the real estate sector, has led

to a stiffening of terms for loan renewals. Our Waterside lender

has agreed in principle to extend a new tranche of US$6.4 million

to partially refinance debt repayment due in September 2022.

Repayment and reduction of debt remains a core near-term objective,

together with maintaining working capital at levels to support the

cost of operating the Company, with a plan for lower operating

costs having been executed while the portfolio remains unsold.

As of 30 June 2022, the Company's total gross bank borrowings

stood at US$131 million, translating to a LTV ratio of 53.3%.

Following the completion of sales of units at The Waterside in

August, the Company utilised US$11.9 million from the sales

proceeds for loan repayments and earmarked the balance for working

capital. The loan repayments reduced total bank borrowings to

US$119 million, resulting in the overall portfolio LTV ratio

improving to 51%. Please refer to Note 8 for further details.

Environmental, Social and Governance (ESG) considerations

ESG continued to be a core priority in our operations during the

year. In terms of governance, I am pleased to report the

appointment of Carmen Ling to the Board. Carmen has brought

continuity of knowledge of the region and also a deep insight into

key matters affecting the Company, especially debt management, and

she has supported the Manager in our regional engagement with

lenders at a critical time.

COVID-related travel restrictions have constrained how meetings

have been conducted, but increased physical attendance, including

by the Manager, was achieved once UK and Guernsey lockdowns and

quarantine restrictions ceased. This greatly assisted our approach

to very challenging circumstances, ensuring that dialogue remained

constructive and focused on our objectives.

The Company is at a late stage of its life, and having carefully

assessed our board composition, we arrived at the view that

continuity is important and further changes to the Board would not

be helpful at this point in the process of divestment. The need to

understand the specifics of each property and the detailed aspects

of the implementation of our strategy requires in-depth knowledge

of the properties. With travel to Macau still heavily restricted,

we remain of the view that retention of that operating knowledge

among board members is important. In this regard, Alan Clifton,

whilst exceeding the normal tenure, remains fully independent in

his approach, and we greatly value his continued contribution.

Moreover, we know from a process conducted in 2021 that finding

directors willing to act for a short period in difficult market

circumstances is not easy. For this reason, we will be proposing

that Mr.Clifton continue as a director of the Company.

Our approach to environmental and recruitment considerations,

including contractors and appointed service providers, continued in

compliance with our previously stated policies. ESG remains an

important consideration in executing our plans where our primary

focus is to reduce our debt levels, achieve sales at optimal levels

taking into account prevailing conditions, and work towards an

early return of capital.

Outlook

The Macau government's swift and decisive action under its

zero-COVID policy has kept COVID-19 infections under control in the

territory and has been complemented by an impressively high

vaccination rate across the whole population. However, that same

policy has also created considerable uncertainty regarding Macau's

economic position and outlook. Fundamental to Macau's COVID

response is the need to remains in lock-step with mainland China's

approach to COVID, in order to keep its borders open to mainland

visitors who remain the lifeblood of its economy. The outlook in

the near-term remains challenging, as the policy continues to

affect investor sentiment and potential buyers' propensity to make

substantial investments such as property purchases. The Manager

continues to work actively on delivering further sales of each of

our assets in these demanding circumstances.

Looking beyond the immediate circumstances, we remain cautiously

optimistic about Macau's prospects, particularly given the post

COVID rebounds experienced elsewhere in the world. The territory

retains its unique position as the only legal gaming destination

within Greater China, and the development pipeline of 34 hotel

projects planned or under construction, demonstrates the long-term

commitment and belief of investors in Macau's future. Once travel

restrictions between Macau, mainland China and Hong Kong are

lifted, the territory's economy will likely experience a

substantial boost. The subsequent recovery of the city's luxury

residential segment, where supply continues to be limited, should

only be a matter of time.

Extension of Life

Pursuant to resolutions passed at MPO's Annual General Meeting

in 2016, the Company is subject to annual continuation votes. The

first, second, third and fourth Continuation Resolutions were

passed at General Meetings held on 5 July 2018, 29 November 2019,

30 November 2020 and 31 December 2021, respectively. The next

Continuation Resolution will be put to shareholders no later than

31 December 2022. As detailed in the Director's Report and Note 1,

although the Financial Statements are prepared on a going concern

basis, material uncertainty exists in relation to the Company's

continued status as a going concern.

A forced sale of assets, particularly under current market

conditions and levels of gearing, would realise significantly lower

returns than a continued, measured disposal of our remaining

assets. The Board will be recommending the continuation of the

Company at the next Annual General Meeting.

MARK HUNTLEY

CHAIRMAN

MACAU PROPERTY OPPORTUNITIES FUND LIMITED

5 October 2022

BOARD OF DIRECTORS

MARK HUNTLEY

Chairman

Mark Huntley has over 40 years' experience in the fund and

fiduciary sectors. His involvement in the fund and private asset

sectors has spanned real estate, private equity and emerging

markets investments. He has served on boards of listed and private

investment funds and management/general partner entities. He holds

board appointments at Stirling Mortimer No.8 Fund UK Limited and

Stirling Mortimer No.9 Fund UK Limited. Mr Huntley is a resident of

Guernsey.

ALAN CLIFTON

Non-executive Director

Chairman of Audit Committee

Alan Clifton began his career at stockbroker Kitcat &

Aitken, first as an analyst, thereafter becoming a Partner and then

a Managing Partner, prior to the firm's acquisition by The Royal

Bank of Canada. He was subsequently invited to take up the role of

Managing Director of the asset management arm of Aviva plc, the

UK's largest insurance group. He is currently a Director of Canada

Life Asset Management and several other investment companies. Mr

Clifton is a UK resident.

CARMEN LING

Non-executive Director

Carmen Ling has over 25 years' banking experience. She was

Managing Director for Citigroup and Standard Chartered Bank. She

has extensive experience across client coverage, real estate,

transaction banking and network strategy. Her role as global head

of RMB Internationalisation/Belt & Road for Standard Chartered

Bank added unique knowledge and experience to her as an

international banker. Prior to banking, she worked in the

hospitality industry for hotel project developments for North Asia,

including China and Japan. Ms Ling is a resident of Hong Kong.

Financial Review

2018 2019 2020 2021 2022

NAV (IFRS) (US$

million) 212.8 131.1 100.6 97.9 77.6

--------------------- ----- -------- ----- ----- -----

NAV per share (IFRS;

US$) 2.78 2.12 1.63 1.58 1.25

--------------------- ----- -------- ----- ----- -----

Adjusted NAV (US$

million) (a) 260.6 174.9(c) 136.5 128.8 103.4

--------------------- ----- -------- ----- ----- -----

Adjusted NAV per

share (US$) (a) 3.41 2.83 2.21 2.08 1.67

--------------------- ----- -------- ----- ----- -----

Adjusted NAV per

share (pence)(1,

a) 258 223 179 150 138

--------------------- ----- -------- ----- ----- -----

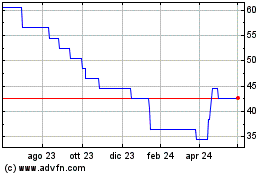

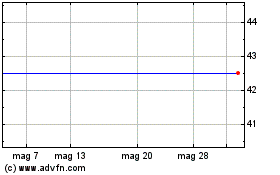

Share price (pence) 194.0 146.0 61.75 67.5 38.2

--------------------- ----- -------- ----- ----- -----

Portfolio valuation

(US$ million) (b) 338.4 311.1 275.6 265.4 242.0

--------------------- ----- -------- ----- ----- -----

Loan-to-value ratio

(%) 34.7 43.5 49.6 49.3 53.3

--------------------- ----- -------- ----- ----- -----

(1) Based on the following US dollar/sterling exchange rates on

30 June - 2018: 1.321; 2019: 1.270; 2020: 1.231; 2021: 1.386; 2022:

1.212

(a) Refer to Note 18 for calculation of Adjusted NAV and Adjusted NAV per share

(b) Refer to Notes 6 & 7 for independent valuations of the

Group's portfolio including investment property and inventories

(c) MPO returned US$50.5 million (50p per share) to shareholders in 2018

During the financial year, Macau's economy deteriorated further

as mainland China's zero-COVID measures, which stand in stark

contrast to those in other parts in the world, dealt a severe blow

to the city's twin economic engines - tourism and gaming. Visitor

arrivals and gross gaming revenue (GGR) fell to new lows, and the

impact of the territory's economic woes affected various sectors,

including the luxury property market.

Amid fragile local sentiment, the Manager launched the Company's

strata sales programme with the carefully orchestrated divestment

of four units at The Waterside. Although the sales of the units may

signal a return of affluent buyers targeting the city's luxury

residential segment for the first time in several years, further

sales will remain heavily dependent on the government's ongoing

COVID policies and their ultimate effect on buyer sentiment. The

sales and marketing programme for the assets has resumed following

COVID outbreak in June, although the overall market sentiment

remains hesitant.

Financial Results

Ongoing economic difficulties, coupled with tighter capital

controls and tougher lending restrictions, had an adverse effect on

the Company's financial results. MPO's portfolio, comprising three

main assets, was valued at US$242 million as at 30 June 2022, an

8.3% decline year on year (YoY). The lower valuations reflected a

continued decline in transaction prices over the past year,

especially at the luxury end of the residential segment, which was

adversely affected by low transaction activity and a limited number

of distressed sales.

MPO's Adjusted NAV was US$103.4 million, which translates to

US$1.67 (138 pence) per share, a 19.7% decrease YoY. IFRS NAV,

which records inventory at cost rather than market value, was

US$77.6 million, or US$1.25 (104 pence) per share, a 20.8% drop

over the one-year period.

Capital Management

As at 30 June 2022, the Company held total assets of US$220

million, with total liabilities of US$142.5 million, including a

loan tranche of US$18.3 million relating to The Waterside debt

facility due for repayment in September 2022. The lender of The

Waterside has agreed in principle to extend a new tranche of US$6.4

million to partially refinance this debt repayment, with the

remaining US$11.9 million having been repaid from the sales

proceeds generated by the Company's recent divestments.

As of year-end, the Company's consolidated cash balance,

including deposits pledged for banking facilities, was US$3.8

million, of which US$1.6 million represented a six-month interest

reserve, pledged and classified as a non-current asset. Usage of

the balance of US$1.9 million is subject to the prior consent of

the lender. Total gross bank borrowings stood at US$131 million,

translating to an LTV ratio of 53.3%.

Approximately 90% of the net sale proceeds derived from the

divestment of the four units at The Waterside have been utilised

for loan repayments, with the balance earmarked as working capital

for the Company. Following these loan repayments, the Company's

total bank borrowings were reduced to US$119 million, resulting in

its overall portfolio LTV falling to 51%.

PORTFOLIO OVERVIEW

Project Portfolio

Acquisition development Market composition

Commitment cost cost valuation Changes (based

(US$ (US$ (US$ (US$ (based on market on market

Property Sector million) million) million) million) value) value)

Over Since

the year acquisition

------------ ---------- ----------- ----------- ---------- --------- ------------ ------------

The Waterside

Tower Six

at One

Central Luxury

Residences* residential 100.7 86.8 13.9 181.5 -9.1% 109% 75.0%

------------ ---------- ----------- ----------- ---------- --------- ------------ ------------

The Low-density

Fountainside** residential 6.2 2.0 4.2 18.3 -7.1% 815% 7.6%

------------ ---------- ----------- ----------- ---------- --------- ------------ ------------

Luxury

Penha Heights residential 28.4 26.7 1.7 42.2 -5.3% 58% 17.4%

------------ ---------- ----------- ----------- ---------- --------- ------------ ------------

Total 135.3 115.5 19.8 242.0 -8.3% 110% 100%

---------- ----------- ----------- ---------- --------- ------------ ------------

* One Central is a trademark registered in Macau SAR under the

name of Basecity Investments Limited. Sniper Capital Limited, Macau

Property Opportunities Fund Limited, MPOF Macau (Site 5) Limited,

Bela Vista Property Services Limited and The Waterside are not

associated with Basecity Investments Limited, Shun Tak Holdings

Limited or Hongkong Land Holdings Limited.

** Information listed refers to the remaining units and parking

spaces available for sale.

PORTFOLIO UPDATES

The Waterside

The Waterside , a premium luxury residential apartment

development, is MPO's flagship asset, located in the prime Macau

Peninsula area.

Stringent zero-COVID policies adopted by Macau and mainland

China have severely impacted the territory's economy and posed

challenges to the Company's preferred en-bloc exit strategy for The

Waterside. The pressure on the luxury segment was compounded by a

crackdown on junket operators in late 2021 that led to several

distressed property sales, albeit in less prominent luxury

developments.

With these factors in mind, the divestment strategy for The

Waterside was pivoted in H1 2022 with the commencement of strata

sales to a select range of motivated buyers.

The Manager leveraged its well-established local network to

pursue a targeted marketing campaign that focused intently on

promoting The Waterside's exceptional location and unit quality.

This strategy led to the successful sale of all four targeted units

- one simplex and three standard apartments - in Q2 2022, with all

transactions completed in full following the Company's year-end.

The combined transaction value of US$14.4 million represented an

overall discount of 6.8% to a valuation of the units conducted by

Savills as at 30 June 2022, with the proceeds earmarked primarily

for debt reduction. The timing of the sales was fortuitous,

considering the severe hit to local sentiment that occurred in July

as a result of a COVID outbreak in Macau the previous month.

Under its leasing programme, The Waterside's occupancy level

remained largely unchanged from the previous year, at 30%, despite

an extremely shallow leasing market - a testament to the efforts of

the leasing team, which has successfully engineered a more

sustainable tenant mix with reduced dependence on the volatile

junket segment. The proportion of non-gaming tenants, comprising

entrepreneurs, businesspeople and banking executives, rose to

approximately 70% of the overall tenant profile. Rents have held

steady at an average monthly rental of US$2.20 per square foot.

Until the ease of travel is fully restored to pre-pandemic levels,

the pool of potential new tenants will remain limited, and the

overall strategy is now shifting towards achieving further unit

sales.

The Fountainside

The Fountainside is a low-density, freehold residential

development in Macau's Penha Hill district. Among its 42 units, all

36 standard units have been sold, leaving four villas and two

duplexes, which have been reconfigured into three smaller

apartments and two car-parking spaces for sale.

Investor interest in high-end residential properties such as The

Fountainside has remained subdued due to continued restrictive

mortgage policies, Macau's faltering economy, and pandemic measures

that have deterred potential purchasers. As market demand among

small families and young individuals for affordable units remains

strong, the two duplexes at the property have been reconfigured as

three smaller units, in which on-site works were completed in Q3.

Occupancy permits from the Land, Public Works and Transport Bureau

for the three smaller units are expected by the end of 2022,

clearing the way for sales.

Although the Manager has identified several potential regional

buyers for the four villas, sales efforts remain hindered by

Macau's entry controls and COVID quarantine requirements, which

have limited the number of in-person site visits.

Penha Heights

Penha Heights is a prestigious, five-storey, colonial-style

villa covering an area of more than 12,000 square feet, nestled

amid lush greenery atop Penha Hill, an exclusive and highly

desirable residential enclave. The property has been enhanced

through works undertaken during the pandemic to take advantage of

the lull in the property market.

Although the Manager has deployed carefully targeted marketing

efforts and various strategies to divest the asset, including a

refreshed sales and marketing push with specialist property agents,

Macau's pandemic control measures have severely disrupted the

process, weighed on investor sentiment, and weakened potential

buyers' appetites for such a trophy home in the territory.

Nevertheless, since the beginning of 2022, six viewings have

been conducted, with several parties progressing to various stages

of due diligence.

Divestment Background

Since its inception, the Company has returned US$97.4 million to

shareholders, with the most recent distribution of US$50.5 million

being made following the divestment of its retail redevelopment

site Senado Square in 2018. In addition, total share repurchases

valued at US$75 million - equivalent to 41% of the Company's

original outstanding share capital - have been undertaken.

The sale of Senado Square left the Company's portfolio focused

primarily on Macau's premium luxury residential segment, which -

due to a multitude of factors, including restrictive mortgage

limits, a special stamp duty of up to 20%, and the reduced market

presence of junket operators - has suffered from decreasing levels

of liquidity. Although further divestments of US$30.3 million were

achieved from mid-2019 onwards, the protracted nature of the

pandemic and the severe impact of China's zero-COVID policy

inevitably resulted in multiple setbacks for the Company's

divestment programme. Since 2020, liquidity in the luxury segment

has fallen to new lows, making further divestments in the segment

even more challenging.

Despite the economic turmoil suffered by Macau, its residents

generally remain cash-rich with low levels of personal debt

compared to other cities in the region. Current valuations indicate

that Macau residential property is at its lowest prices in a decade

both in absolute terms and on a relative basis compared to

neighbouring Hong Kong and Guangdong. According to Savills Macau,

the value proposition is especially compelling for properties of

more than 1,600 square feet, as prices have dropped almost 30%

cumulatively over the past five years. Standard apartments at The

Waterside have an average gross floor area of 2,300 square feet,

and with prices having fallen to a competitive range, the units are

becoming more appealing to affluent local investors.

For more prestigious properties, including Penha Heights and the

four villas at The Fountainside, we will continue to orchestrate a

carefully designed marketing campaign with specialist property

agents targeting high net worth families across Asia-Pacific. The

supply of trophy homes in Macau remains extremely scarce.

Realtor JLL Macau, however, forecasts that Macau's property

market will remain under pressure in the absence of favourable

factors such as quarantine-free travel between the territory and

Hong Kong, and to foreign destinations. It also predicts that

further potential for interest rate increases will contribute to

downward pressure on the market. Macau's local property market is

priced in Hong Kong dollars, a currency tied to the US dollar, and

therefore to US interest rates. All of these factors will likely

prolong the divestment timeline.

Our recent divestments at The Waterside marked an important

first step towards orderly strata sales of all remaining 55

apartments at the development, and may indicate rising demand for

ultra-high-quality homes in the city, which remain in very short

supply. The Manager will aim to build on this small but important

milestone to advance the strata sales programme in the medium term,

although further sales will remain heavily dependent on local

market conditions and the government's approach towards COVID

control.

To complement the Manager's sale and marketing efforts, the

Company has enhanced its outreach to a wider audience of potential

buyers by appointing Hodes Weill, a global advisory firm with a

strong track record of real estate capital market. Hodes Weill has

worked closely with the Manager to launch a sales campaign for the

Company's assets designed to target a select group of prospective

purchasers within the firm's network. This process is ongoing.

Company Life

At the Company's last Annual General Meeting, shareholders

passed a resolution to extend its life for a further year until 31

December 2022. At present, the Macau government's zero-COVID policy

is likely to remain in lockstep with that imposed by China. There

are currently no indications of a return to pre-pandemic ease of

travel, such as the reopening of international borders and the

restoration of quarantine-free travel for foreigners, despite some

measures to allow certain categories of foreigners to enter

Macau.

These uncertainties are likely to impact the timely completion

of the Company's divestment programme. Although the Manager will

deploy all possible strategies to achieve further sales, based on

our current assessment, it is probable that a further proposal for

an extension of the Company's life until the end of 2023 will be

required to enable its divestment programme to continue in an

orderly manner. The Company envisages that the current management

terms agreed with the Manager will apply to the extended period of

its life.

MACROECONOMIC OUTLOOK

Zero-COVID policies cripple Macau's economy

In contrast to most of the world, and at a huge cost to the

economy, Macau has maintained a strict dynamic zero-COVID stance,

in line with that of China. Historically, mainland Chinese

travellers account for more than 70% of Macau's visitors and

contribute the bulk of its Gross Gaming Revenue (GGR). Because only

travellers from mainland China are permitted to travel

quarantine-free to Macau, the territory is now even more reliant on

them in the short term to power the twin drivers of its economy -

gaming and tourism. As such, Macau has acted in accordance with

Beijing in deploying strict dynamic zero-COVID measures, including

travel restrictions, lockdowns, closures of non-essential

businesses, city-wide COVID testing, the isolation of confirmed

cases, and the quarantine of close contacts.

The caution embodied by Macau's zero-COVID measures was

demonstrated when the territory's most severe COVID-19 outbreak to

date was detected in mid-June. Fuelled by the highly contagious

Omicron BA.5.1 variant, the territory's total COVID case numbers

surged from 83 to more than 1,800. The government responded swiftly

in an effort to identify sources of infection and curb the further

spread of the virus, enacting more than 11 rounds of city-wide

testing and a 12-day lockdown in July, during which non-essential

businesses and services, including casinos, were closed. The city

returned to normalcy after a month-and-a-half of various COVID

related restrictions.

At the end of June, more than 90% of Macau's population of

677,300 had been fully inoculated against the virus, with only six

COVID fatalities to date, all of whom were in the most vulnerable

over-80 age group. On a positive note, border controls for

travellers coming from Hong Kong and abroad were relaxed during the

reporting period - from three weeks of required hotel quarantine to

one week. As of September, visitors entering mainland China from

Macau are required to show proof of a negative COVID test within

the previous 48 hours, relaxed from 24 hours.

Nascent economic recovery quickly reversed

In Q3 2021, travel restrictions imposed in response to COVID

flare-ups across mainland China saw a downturn begin, hampering an

anticipated strong rebound in Macau's gaming industry and GDP.

Macau's FY2021 GDP grew 18% YoY, significantly lower than an

earlier 61% forecast by the International Monetary Fund.

The economy remained affected in Q1 2022 as lockdowns and travel

restrictions impacting an increasing number of COVID hotspots in

mainland China continued to weigh on Macau's gaming and tourism

sectors, which account for most of the territory's GDP. Macau's GDP

for the first half of the year shrunk 24.5% YoY as its economy was

hit by zero-COVID measures.

Since Macau's June COVID outbreak, analysts have cut their

forecasts for the territory's FY2022 GDP, with the Economist

Intelligence Unit predicting a contraction of 30% YoY for FY2022,

in stark contrast with the International Monetary Fund's April 2022

projection of 16% YoY growth for the full year.

Tourism on a path towards normalcy

Macau's tourist arrivals grew 31% YoY in 2021 to 7.7 million,

approximately 20% of pre-pandemic 2019 numbers. Mainland Chinese

accounted for 91% of visitors, with those from neighbouring

Guangdong Province making up 62% of the total. By comparison, in H1

2022, tourist arrivals fell 12% YoY to less than 3.5 million,

approximately 17% of the pre-pandemic peak of 20.3 million during

the same period in 2019.

The fluctuation in tourist numbers reflects Macau's heavy

dependence on a stable COVID situation both locally and in mainland

China as tightened travel restrictions and quarantines for

travellers remain key tools in the zero-COVID arsenal. As

zero-COVID measures took effect, Macau's visitor numbers in June

declined 28% YoY, while July's numbers were lower by 99% YoY.

A more positive development was the Macau government's

announcement in late September of the resumption in package tours

and Individual Visit Scheme's eVisas for mainland Chinese visitors

to Macau, which will likely bring a significant boost to both

tourism and gaming. After a hiatus of almost three years, the first

phase will commence in November, involving the city of Shanghai and

four provinces including neighbouring Guangdong Province with a

population of over 120 million people. In addition, overseas

visitors from 41 countries were permitted to enter Macau from

September 2022, albeit subject to seven days quarantine.

Conversely, in Hong Kong, the government has recently abolished

hotel quarantine for international arrivals, requiring instead

three days of restricted access to public spaces upon arrival. The

long-awaited move follows intense pressure from the business

community to restore Hong Kong's standing as a global financial and

aviation hub. Macau's government, however, has unequivocally stated

that it will not follow in Hong Kong's footsteps in the immediate

future, given its dependence on maintaining an open border with

mainland China to keep its economy running. In addition to mainland

Chinese tourists, a significant proportion of Macau's workforce

crosses into the territory daily from the neighbouring city of

Zhuhai.

Clarity on new gaming laws despite a series of shocks

Macau's gaming operators have endured an immensely difficult

operating environment since the start of the pandemic. Towards the

end of 2021, clarity finally emerged regarding the new gaming

regime, when the government unveiled the main features of new

licensing arrangements, which include a maximum of six gaming

concessions for 10 years, down from 20 years previously, with the

potential to extend for a further three years. The new gaming law

was passed by the Legislative Assembly on 21 June 2022 and the new

concessions are expected to take effect from the beginning of 2023.

On 14 September, seven companies submitted bids for Macau gaming

concessions, including surprise contender Genting Malaysia.

The Chinese government's efforts to clamp down on capital flight

escalated in 2021. The chief executives of Macau's top two junket

operators were arrested and junket operators were ordered to stop

providing credit to customers. The subsequent closure of junket

operations resulted in a sharp drop in VIP gaming revenues, with a

spill over into the luxury property market as demand for luxury

accommodation for VIP gaming executives and their customers

contracted.

In H1 2022, the continued impact of Macau's zero-COVID measures

was demonstrated by a sharp decline in GGR, with six-month GGR down

46% compared to the same period the previous year and 82% lower

than in 2019.

GGR plummeted by 95% YoY in July 2022 amid a 12-day closure of

casinos at the height of Macau's zero-COVID measures. July's GGR,

at MOP398 million (US$49.2 million), was its lowest since 2003,

when the territory had only 11 casinos under a single operator.

Analysts estimate that for H1 2022, Macau's 41 casinos suffered

combined losses of US$2 billion due to COVID-19 restrictions and

that the sector is unlikely to see a robust recovery until later in

2023.

PROPERTY MARKET OVERVIEW

Luxury residential transactions decline

The luxury end of the real estate market declined as pandemic

measures and the consequent economic downturn continued to weigh on

market sentiment. Although sales volumes and prices remained

stagnant in FY 2021, from H1 2022 onward, the number of

transactions in the segment more than halved, dropping 53% YoY to

173, while the average price per square foot, measured in gross

floor area, fell by 13% YoY to HKD7,406 (US$944). The luxury

residential segment accounted for 11% of overall residential

property transactions in Macau in H1 2022.

The decline in luxury residential transactions was driven by

several factors. Firstly, bearish market sentiment as a result of

Macau's economic downturn led cash-rich investors to adopt a "wait

and see" attitude and delay property investments. Secondly, second

and subsequent property purchases still attracted stamp duties of

5-10%, adding to transaction costs while deterring speculation.

Thirdly, constant changes to border control measures also

discouraged potential cross-border buyers from entering the

property market.

The situation was compounded by multiple distressed sales due to

closure of junket operations and several satellite casinos from the

end of 2021 onwards. These sales intensified downward pressure on

the prices of luxury properties, since junket operators held

expansive real estate portfolios that included office space and

luxury residences.

Regional property agency Centaline predicts that the average

price and sale transaction of residential properties will continue

to face downward pressure in H2 2022, despite the near-term

sentiment boost from the recovery prospects of Macau's tourism

industry. The potential for further interest rate hikes, plummeting

stock prices and potential massive layoffs due to economic downturn

are listed as the major reasons contributing to the drop. On the

supply side, there are currently more than 9,800 residential units

either at the design stage, under construction, or completed,

indicating that the residential supply has plummeted a cumulative

69% since Q2 2017. New-builds are mainly smaller units, with just

5% designed as apartments with three or more bedrooms. Savills

Macau forecasts that the supply of private residential property

will remain limited as many private sites for potential development

saw permissions revoked by Macau's government under the New Land

Law.

Hong Kong luxury home values fall from peaks

Hong Kong home prices hit a two-year record high in H2 2021, but

since then, growth has slowed for a number of reasons. The

potential for further interest rate hikes and Hong Kong stock

market turbulence have affected the investor appetite for luxury

residential properties, and lockdowns of major cities in China have

crimped mainland Chinese buyers' ability to invest in the city. As

a result, Hong Kong's luxury home prices had fallen by Q2 2022,

with luxury apartment prices declining 2.9% quarter on quarter

(QoQ) and townhouse prices dropping 4.1% QoQ, although prices in

the super-luxury segment were less affected, according to Savills

Hong Kong.

China's real estate slump impacts its economic recovery

China's property sector is struggling amid the fallout of the

debt default by real estate giant Evergrande and other firms in the

industry. Adding to the sector's woes is an escalating mortgage

boycott by buyers refusing to make mortgage payments for unfinished

projects as property developers struggle to complete projects amid

a liquidity crunch and COVID lockdowns. Banks continue to limit

their exposure to China's property sector by imposing lending

restrictions, with an increase of overdue loans of 50% YoY at

China's biggest four banks, even in the supposedly low-risk

mortgage lending market.

Escalating geopolitical concerns affect sentiment

Investors have also been expressing increasing concerns over

sabre-rattling related to Taiwan following US House Speaker Nancy

Pelosi's visit to Taipei in August. China staged an unprecedented

number of military drills to protest the visit, resulting in a

dramatic spike in incursions into Taiwan's air defence

identification zone. The escalating tensions may be weighing on

investor sentiment towards China and delaying investment

decisions.

LOOKING AHEAD

COVID policy clouds outlook

Any sustained recovery in Macau's luxury property market remains

reliant on factors ranging from a more relaxed COVID policy to a

substantial recovery of the economy and the knock-on effect this

would have on local businesses and employment. While investors have

welcomed the rollback of COVID measures such as resuming electronic

eVisas application for mainland Chinese visitors to Macau, the

positive impact of these initiatives can be easily reversed by any

major COVID outbreak in either mainland China or Macau. It must

therefore be assumed that a high level of uncertainty as a result

of continued zero-COVID measures is likely to prevail for the

foreseeable future.

China's stringent maintenance of its zero-COVID policy appears

firmly entrenched, with 33 cities and an estimated 65 million

people remaining under varying levels of lockdown restrictions as

at mid-September. Although some commentators have suggested that

China may relax its zero-COVID stance following the Communist

Party's national congress in October, this is more likely to occur

gradually once a Chinese-developed mRNA vaccine succeeds in

obtaining regulatory approval, allowing a nationwide rollout to

occur. By the end of September, some cities previously in lockdown,

such as Chengdu with a population of 21 million, have gradually

returned to normalcy.

Macau's long-term value proposition, stemming from its unique

position as the only jurisdiction on Chinese soil that offers

licensed gaming, remains unchallenged. Nevertheless, the immediate

outlook for the territory's luxury property segment is likely to

remain uncertain, complicating the Manager's efforts to secure

further divestments in the near term.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE REPORT

1 About This Report

This Environmental, Social and Governance Report (the "ESG

Report") has been prepared with reference to The Ten Principles of

United Nations Global Compact ("UNGC"). The ESG Report elaborates

the environmental and social responsibility measures and

performances of Macau Property Opportunities Fund Limited (the

"Company").

1.1 Core Business of the Group

The Company is in the process of an orderly and managed

divestment of the three remaining portfolio properties. No further

new construction or development activities will be undertaken save

for the limited reconfiguration at The Fountainside.

The Company is solely focused on and exposed to the high-end

residential property market in Macau. It has never had any exposure

to any property or other investment in the gaming or associated

hospitality sectors and each investment is in full compliance with

the parameters set out in the Company's Prospectus.

1.2 Report Boundary

The ESG Report focuses on the environmental and social

responsibility performances of the Company's core business of

investment in properties in Macau, as listed below:

-- The Waterside

-- The Fountainside

-- Penha Heights

1.3 Overall ESG Approach

The Board understands the significance of ESG and has

incorporated ESG-related risks into the Company's risk management

processes. The overall ESG approach is aimed at creating profit for

shareholders in a responsible manner, while taking into

consideration environmental and social responsibility and supply

chain management.

The Company's ESG approach is developed based on The Ten

Principles of UNGC. UNGC is a voluntary multi stakeholder platform

which convenes multinational companies to align against The Ten

Principles covering human rights, labour, environment and

anti-corruption standards. The Board is committed to reflect the

basic concepts of fairness, honesty and respect for people and the

environment in its business actions.

2 Environment

2.1 Commitment Principle

The Company strives to adopt environmental-friendly practices

during our business operations so as to minimise the negative

impacts on the environment and natural resources. It complies

strictly with all the applicable environmental laws and regulations

in Macau. Different environmental protection measures have been

implemented at the key stages of property development, along with

the incorporation of green building designs and the implementation

of responsible construction practices at work sites. The Company

also upholds the principles of recycle and reuse at its

properties.

2.2 Initiatives and Performances

Property Design

The Company follows local green building requirements, which

take into consideration green design elements such as building

materials, indoor air quality, site selection and energy

considerations. Examples of green building designs and features are

provided as follows:

- Preserve and retain the cultural heritage façade of the historical building;

- Incorporation of passive building designs to improve

ventilation and optimise sunlight exposure;

- Use of water-efficient fixtures; and

- Greening of rooftops.

Indoor air quality is improved through the introduction of the

air purifying equipment. Measures capable of monitoring temperature

and humidity in residential units and thus enhance the living

conditions for residents have been implemented at One Central and

The Fountainside.

Property Management

Various green measures have been adopted in our properties to

improve the overall environmental performance. For example,

- Energy efficiency: energy consumption has been reduced by (i)

replacing lighting fixtures with LEDs, (ii) reducing the amount of

lighting used in common areas; and (iii) installing

air-conditioning systems with energy efficiency labelling in

accordance with local requirements.

- Tenants' engagement: tenants are encouraged to minimise their

resource consumption (electricity, water and material use) and are

provided with recycling facilities to reduce waste.

- Rechargeable battery recycling: public collection points for

rechargeable battery recycling have been provided and tenants are

encouraged to use these facilities for battery disposal. Certain

materials in rechargeable batteries, such as cadmium, are hazardous

to human health and the environment.

An effective environmental management system has been

implemented. Some of the Company's main environmental objectives

regarding property management are as follows:

- Use of pesticides and cleansing agents in accordance to

relevant regulations, aiming for zero incidents regarding their use

and storage; and

- Manage community wastewater, waste and noise according to local standards.

Regulatory Compliance

The Company is not aware of any non-compliance with

environmental regulatory requirements that may significantly impact

the Company's business.

3 Social Responsibility and Supply Chain Management

The Company strongly believes that quality property is a gateway

to quality living. The Company strives to provide a quality

property experience through innovation and sensitivity, as well as

operating with integrity. Through such efforts, the aim is to

improve the living quality of tenants and become their trusted

partners.

3.1 Supply Chain Management

During the process of property construction and redevelopment,

the Company carefully appoints external contractors by taking into

consideration various factors such as human rights protection,

non-discrimination of employment and occupation, environmental

protection, construction safety and product safety. While selecting

contractors for property construction, those who are familiar with

the environmental, social and safety requirements and are in line

with concerns over the abolition of child labour and

anti-corruption are sought. Close contacts with the contractors on

all constructions and sourcing affairs are established. Regular

meetings to facilitate two-way communications take place. In

addition, regular assessments of contractors, based on

environmental and social risks, are performed.

3.2 Quality Services

To ensure the consistently high quality in its property

management services, the Company aims to:

- Develop quality properties that embrace innovation and enhance the neighbourhood;

- Provide sincere service and ongoing improvement of its property management;

- Strive for high standards by building scientific and

standardised property management, and achieve customer

satisfaction; and

- Provide a tasteful living environment for residents.

3.3 Protection of Privacy

To ensure the well-being of tenants, there is regular

communication with them through satisfaction surveys which help to

identify potential areas for improvement. Customers' information is

kept confidential and access is restricted.

Regulatory Compliance

The Company is not aware of any non-compliance with supply chain

management that may significantly impact the Group's business.

GLOSSARY OF SOURCES

IMF INTERNATIONAL MONETARY FUND

DSEC THE STATISTICS AND CENSUS SERVICE (MACAU)

---------------------------------------------

DICJ THE GAMING INSPECTION AND COORDINATION BUREAU

(MACAU)

---------------------------------------------

DSF FINANCIAL SERVICES BUREAU (MACAU)

---------------------------------------------

MANAGER AND ADVISER

Sniper Capital

Manager Investment Adviser Sniper Capital

Sniper Capital Limited (Macau) Limited

--------------------------------------------------------------------------------------------------------

Research & Transaction Project Development Asset Management Corporate Communications Finance & Administration

* Macro & micro analysis * Consultant appointment & coordination * Property & estate management * Investor & media relations * Administration & accounting

* Forecasting & modelling * Project monitoring & reporting * Sales & leasing * Marketing & product positioning * Compliance & reporting

* Sourcing * Project delivery & handover * Facilities management * Statutory & regulatory * Cash management & treasury

* Due diligence * Asset value enhancement communication

* Divestment

-------------------------------------------- ------------------------------------- ------------------------------------------- ----------------------------------

Manager

The day-to-day responsibility for the management of the Macau

Property Opportunities Fund's ("MPOF", "Company" or "Group")

portfolio rests with Sniper Capital Limited.

Founded in 2004, Sniper Capital Limited focuses on capital

growth from carefully selected investment, development and

redevelopment opportunities in niche and undervalued property

markets.

Sniper Capital Limited is focused on the identification,

acquisition and development of properties chosen for their

location, current and potential value, or for the sustainable

demand for the accommodation or facilities they offer.

Sniper Capital Limited's team of over 30 professionals covers

all the required investment and development disciplines, including

research, site acquisition, project development, asset management,

divestment, investor relations and finance.

Working closely with Headland Developments Limited and Bela

Vista Property Services Limited, Sniper Capital Limited ensures

that all necessary project management skills and services are

provided in a way that will deliver each MPOF project to the right

standards and on budget.

With its 29 August 2022 holding of 11.88 million shares or

19.22% of the Company's issued share capital, Sniper Investments

Limited - an investment vehicle associated with Sniper Capital

Limited - is the largest shareholder in MPOF, which bears witness

to Sniper Capital Limited's belief in the Company.

The Manager is committed to the full disposal of the Company's

Portfolio at the earliest possible time while striving to return

maximum possible values to shareholders.

Adviser

The Company's Board of Directors and Manager are advised by

Sniper Capital (Macau) Limited, which has a highly developed

network of contacts and associates spanning Macau's financial and

business community.

The Investment Adviser's brief is to source, analyse and

recommend potential divestment opportunities, whilst providing the

Board with property investment and management advisory services in

relation to the Company's real estate assets.

For more information, please visit www.snipercapital.com

Investment Policy

The Company is managed with the objective of realising the value

of all remaining assets in the portfolio, individually, in

aggregate or in any other combination of disposals or transaction

structures, in a prudent manner consistent with the principles of

sound investment management with a view to making an orderly return

of capital to shareholders over time.

The Company may sell or otherwise realise its investments

(including individually, or in aggregate or other combinations) to

such persons as it chooses, but in all cases with the objective of

achieving the best exit values reasonably available within shortest

acceptable time scales.

The Company has ceased to make any new investments and will not

undertake additional borrowing other than to refinance existing

borrowing or for short-term working capital purposes.

Any net cash received by the Company after discharging any

relevant loans as part of the realisation process will be held by

the Company as cash on deposit and/or as cash equivalents prior to

its distribution to shareholders, which shall be at such intervals

as the Board considers appropriate.

The Company's Articles of Incorporation do not contain any

restriction on borrowings.

DIRECTORS' REPORT

The Directors present their report and audited financial

statements of the Group for the year ended 30 June 2022. This

Directors' report should be read together with Corporate Governance

Report.

Principal activities

Macau Property Opportunities Fund Limited (the "Company") is a

Guernsey-registered closed-ended investment fund traded on the

London Stock Exchange (the "LSE"). Following the passing of all

resolutions at the Extraordinary General Meeting held on 28 June

2010, the Company's shares obtained a Premium Listing on the LSE

Main Market on 30 June 2010.

The Company is an authorised entity under the Authorised

Closed-Ended Investment Schemes Rules and Guidance, 2021 and is

regulated by the Guernsey Financial Services Commission ("GFSC").

During the year, the principal activities of the Company and its

subsidiaries as listed in Note 4 to the consolidated financial

statements (together referred to as the "Group") were property

investment in Macau.

Business review

A review of the business during the year, together with likely

future developments, is contained in the Chairman's Message and in

the Manager's Report.

Going concern

The Group's business activities, together with the factors

likely to affect its future development, performance and position,

are set out in the Manager's Report. The financial position of the

Group, its cash flows and its liquidity position are described in

the Capital Management section of the Manager's Report.

The financial risk management objectives and policies of the

Group and the exposure of the Group to credit risk, market risk and

liquidity risk are discussed in Note 2 to the consolidated

financial statements.

In accordance with provision 30 of the 2018 revision of the UK

Corporate Governance Code, (the "UK Code"), and as a fundamental

principle of the preparation of financial statements in accordance

with IFRS, the Directors have assessed as to whether the Company

will continue in existence as a going concern for a period of at

least 12 months from signing of the financial statements, which

contemplates continuity of operations and the realisation of assets

and settlement of liabilities occurring in the ordinary course of

business.

The financial statements have been prepared on a going concern

basis for the reasons set out below and as the Directors, with

recommendation from the Audit and Risk Committee, have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the next twelve months after date of

approval of the Annual Report.

In reaching its conclusion, the Board have considered the risks

that could impact the Group's liquidity over the period to 31

October 2023. This period represents the period of at least 12

months from the date of signing of the Annual Report.

As part of their assessment the Audit Committee highlighted the

following key considerations:

1. Whether the Group can repay or refinance its loan facilities

to discharge its liabilities over the period to 31 October 2023

2. Extension of life of the Company

1. Whether, the Group can repay or refinance its loan facilities

to discharge its liabilities over the period to 31 October 2023

As at 30 June 2022, the Group had major debt obligations to

settle during the going concern period being:

i) principal repayment for The Waterside loan facility of

approximately US$18.3 million due for settlement in September

2022;

ii) principal repayment for The Waterside loan facility of

approximately US$5.1 million due for settlement in March 2023;

iii) principal repayment for The Waterside and the Fountainside

loan facilities of approximately US$9.5 million due for settlement

in September 2023;

iv) principal repayment for the Penha Heights Tai Fung Bank loan

facility of approximately US$1.6 million due for settlement in

quarterly instalments of US$318,600 commencing in September 2022;

and

v) principal repayment for the Penha Heights BCM loan facility

of approximately US$1.3 million due for settlement in 3 quarterly

payments of US$446,045 each in March, June and September 2023.

The lender of The Waterside loan facility has agreed in

principle to extend a new tranche of US$6.4 million to partially