BNP PARIBAS SA: Notification by the ECB of the 2023 Supervisory Review and Evaluation Process (SREP)

01 Dicembre 2023 - 6:15PM

BNP PARIBAS SA: Notification by the ECB of the 2023 Supervisory

Review and Evaluation Process (SREP)

Paris, 1 December 2023

NOTIFICATION BY THE ECB

OF THE 2023 SUPERVISORY REVIEW AND EVALUATION PROCESS

(SREP)

BNP Paribas has received the

notification by the European Central Bank of the outcome of the

2023 Supervisory Review and Evaluation Process (SREP), which states

capital requirements and leverage ratio on a consolidated basis in

force for the Group.

The Common Equity Tier 1 (CET1) requirement that

the Group has to respect as at 1st January 2024 on a consolidated

basis is 10.02% (excluding the Pillar 2 guidance). It includes

1.50% for the G-SIB buffer, 2.50% for the Conservation buffer,

1.11% for the Pillar 2 requirement1 and 0.41% of countercyclical

buffer2.

The requirement for the Tier 1 Capital is 11.81%

(of which 1.40% for the Pillar 2 requirement).

The requirement for the Total Capital is 14.18%

(of which 1.77% for the Pillar 2 requirement).

The BNP Paribas Group is well above the

regulatory requirements with, as at 30 September 2023, a CET1 ratio

at 13.44%3, a Tier 1 ratio at 15.55%3 and a Total Capital ratio at

17.80%3. The Group’s CET1 ratio target for 2025 is 12%.

The leverage ratio requirement that the Group

has to respect as from 1st January 2024 on a consolidated basis is

3.85% (excluding Pillar 2 guidance). The BNP Paribas Group is well

above the regulatory requirements with, as at 30 September 2023, a

leverage ratio de 4.49%. The Group’s leverage ratio target for 2025

is 4.3%.

About BNP Paribas BNP Paribas

is the European Union’s leading bank and key player in

international banking. It operates in 65 countries and has nearly

185,000 employees, including more than 145,000 in Europe. The Group

has key positions in its three main fields of activity: Commercial,

Personal Banking & Services for the Group’s commercial &

personal banking and several specialised businesses including BNP

Paribas Personal Finance and Arval; Investment & Protection

Services for savings, investment and protection solutions; and

Corporate & Institutional Banking, focused on corporate and

institutional clients. Based on its strong diversified and

integrated model, the Group helps all its clients (individuals,

community associations, entrepreneurs, SMEs, corporates and

institutional clients) to realise their projects through solutions

spanning financing, investment, savings and protection insurance.

In Europe, BNP Paribas has four domestic markets: Belgium, France,

Italy and Luxembourg. The Group is rolling out its integrated

commercial & personal banking model across several

Mediterranean countries, Turkey, and Eastern Europe. As a key

player in international banking, the Group has leading platforms

and business lines in Europe, a strong presence in the Americas as

well as a solid and fast-growing business in Asia-Pacific. BNP

Paribas has implemented a Corporate Social Responsibility approach

in all its activities, enabling it to contribute to the

construction of a sustainable future, while ensuring the Group's

performance and stability.

Press contactSandrine Romano –

sandrine.romano@bnpparibas.com / +33 6 71 18 23 05

1 CET1 requirement related to Pillar 2

requirement now includes 100% of the add-on related to

non-performing exposures on aged loans granted before 26 April

2019.2 Computation based on RWA as at 30.09.23, excluding the 0.18%

impact of the increase in France's countercyclical buffer from 2

January 2024.3 CRD5 including IFRS9 transitional arrangements.

- PR_BNPParibas_SREP2023_EN vdef

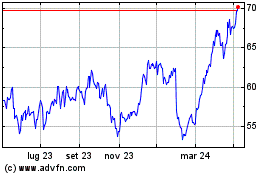

Grafico Azioni BNP Paribas (BIT:1BNP)

Storico

Da Nov 2024 a Dic 2024

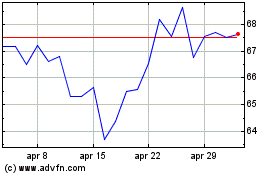

Grafico Azioni BNP Paribas (BIT:1BNP)

Storico

Da Dic 2023 a Dic 2024