Generali Buys Liberty Seguros From Liberty Mutual in $2.5 Billion Deal

15 Giugno 2023 - 5:05PM

Dow Jones News

By Adria Calatayud

Assicurazioni Generali said Thursday that it has agreed to buy

Liberty Seguros from Liberty Mutual Group in a 2.3 billion-euro

($2.49 billion) deal that expands its European footprint.

The Italian insurer said the deal will strengthen its position

in the property-and-casualty segment in Spain and Portugal and

allow it to enter that market in Ireland and Northern Ireland.

Liberty Seguros is profitable and will contribute more than EUR1.2

billion in premiums, predominantly in the property-and-casualty

segment, Generali said.

The price of the deal includes all excess capital of Liberty

Seguros and is subject to customary closing adjustments, Generali

said.

The acquisition, which is subject to regulatory approvals, is

expected to generate additional economies of scale throughout the

group driven by cost reductions, information-technology

optimization and cross-selling of Generali products, the insurer

said. Generali said the deal is aligned with its strategy.

The insurer said the estimated impact of the acquisition on its

regulatory solvency ratio--a measure of capital strength--is

expected to be around minus 9.7 percentage points. Generali said

its solvency ratio was above 330% at the end of last year.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

June 15, 2023 10:50 ET (14:50 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

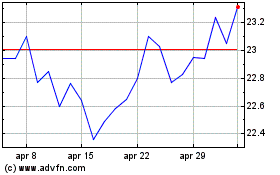

Grafico Azioni Generali (BIT:G)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Generali (BIT:G)

Storico

Da Apr 2023 a Apr 2024