Billionaire Warns Of Financial Turmoil—Will Bitcoin Save Investors?

06 Marzo 2025 - 1:30AM

NEWSBTC

The United States, with its cycle of growing debt and debt

servicing, may face a financial crisis in the next few years. Ray

Dalio, the billionaire investor and founder of Bridgewater

Associates, boldly claims a looming debt crisis and calls it a

“potential heart attack.” In a statement, Dalio argued that once we

reach a point in the cycle where one borrows more money to service

debt and bond holders say that it’s risky, it becomes a “debt debt

spiral.” Dalio compares the current debt crisis to a heart attack

waiting to happen if authorities fail to provide interventions.

Related Reading: Bitcoin ‘Won’t Stop At $150K’ This Year, Research

Firm Chief Says Understanding The Current US Debt Issue Dalio’s

insights on the current economic landscape and the country’s

looming debt crisis come as the crypto market cap drops to $2.76

trillion in one day. During the market shakeoff this week, the

overall crypto market cap dropped by 8%, with Ethereum and Bitcoin

leading the losers with 11% and 8%, respectively. The US is

currently facing a growing debt and excessive budget deficits.

According to recent data, the country’s national debt is now $33.6

trillion, with a massive deficit of $1.7 trillion in 2023, equal to

5.8% of the total GDP. Researchers are also warning about the

increasing cost of servicing the debt, hitting $879 billion in

2023, comparable to the size of the country’s budget for national

defense. Recognize that conflicts are essential for great

relationships because they are how people determine whether their

principles are aligned and resolve their differences.

pic.twitter.com/MbBpHO76mN — Ray Dalio (@RayDalio) February 6, 2018

Dalio Says Alternative Stores Of Value Can Help In an interview on

the Odds Lots podcast, Dalio offered insights on how the general

public responds to an economic crisis. He mentioned that in times

of economic uncertainties, many investors are looking at

alternative stores of value. Dalio asks: What’s an alternative to

money with a stable supply? He mentioned the growing role of

Bitcoin and digital assets as leverage against inflation.

“Recognize that conflicts are essential for great relationships

because they are how people determine whether their principles are

aligned and resolve their differences.” he added. Dalio’s insights

followed US President Trump’s announcement on the proposed US

strategic reserve, which includes top coins such as Bitcoin,

Ethereum, Solana, Ripple, and Cardano. Trump’s statement was

followed by a spike in crypto prices, with Bitcoin surging to over

$90k after revisiting $80k. While Bitcoin’s price surged for the

day, its dominance dipped from 55.4% to 50%, reflecting the shift

in capital to altcoins. Historically, a decline in Bitcoin’s

dominance catalyzes an altcoin run, which now excites many on

social media. Is Bitcoin The Answer? Although Ray Dalio didn’t

categorically mention Bitcoin as the “potential savior”, his recent

statements suggest a favorable view on the premier digital asset.

Due to its decentralization, Dalio highlighted the asset’s

potential as a hedge against economic uncertainties. Related

Reading: Ripple Co-Founder Tied To Untouched XRP Holdings Worth

Billions—Crypto Sleuth Unlike traditional assets governments can

confiscate, Bitcoin and other cryptocurrencies work beyond

traditional financial mechanisms, promoting wealth preservation.

Dalio also acknowledged Bitcoin’s role, insisting that previous

economic crises have shown that these assets, while they struggle,

still are able to retain their values. Featured image from Business

Standard, chart from TradingView

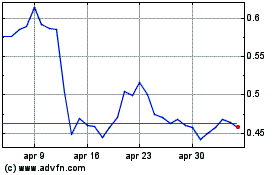

Grafico Azioni Cardano (COIN:ADAUSD)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Cardano (COIN:ADAUSD)

Storico

Da Mar 2024 a Mar 2025