Bitcoin Weekly RSI Entering Power Zone – Last Time BTC Soared 80%

12 Novembre 2024 - 8:30PM

NEWSBTC

Bitcoin experienced an explosive surge yesterday, with bulls

driving the price to a new all-time high (gain) at $89,980. This

relentless uptrend highlights growing optimism among investors as

Bitcoin continues to break new ground. Renowned trader and

analyst Cheds recently shared a compelling technical insight,

noting that Bitcoin’s weekly Relative Strength Index (RSI) is

nearing the “overbought” zone—historically a very bullish signal

for BTC. Entering this zone could indicate heightened demand and

momentum, suggesting further upside potential for Bitcoin in the

near term. Related Reading: Ethereum Weekly Volume Hits $60 Billion

As ETH Aims For Yearly Highs The coming days will be critical as

investors anticipate a possible pullback to enter fresh positions

at lower levels. However, the current price action remains bullish,

showing few signs of weakness. If the price holds, it could

fuel even greater buying interest, extending Bitcoin’s upward

momentum. Cheds’ analysis underscores the strong technical setup

for BTC, with RSI nearing a point that could attract more bullish

attention. Investors will be watching closely, as any sustained

movement in this high momentum phase may set the stage for

Bitcoin’s next big leg up. Bitcoin Showing Strength Bitcoin

has surged by over 32% in less than a week, with rapid, aggressive

moves to new highs reflecting strong market sentiment. Such

euphoria often precedes a correction, yet recent data indicates

Bitcoin could sustain this upward momentum. Top trader and

analyst Cheds recently shared a technical analysis on X,

highlighting that Bitcoin’s weekly Relative Strength Index (RSI) is

nearing the “power zone,” known as the overbought territory.

Historically, this zone has signaled powerful bullish phases for

BTC. The last time Bitcoin’s RSI reached similar levels, the price

rallied from around $40,000 to $70,000, suggesting another

substantial surge might be on the horizon. As Bitcoin enters this

new bullish phase, a continuation of the uptrend seems likely, but

it may not be a straightforward climb. Even in strong bull markets,

BTC typically requires periodic pullbacks to consolidate and gather

strength for further gains. A healthy retrace would provide

necessary support levels and allow BTC to “refuel” before another

upward push. This retracement is particularly important in avoiding

overstretched conditions that could lead to a more severe

correction. Related Reading: Ethereum Analyst Sees Altseason

Potential As BTS Is Still Outpacing ETH – Time To Buy Altcoins?

While the current bullish momentum points toward higher levels,

traders should anticipate some fluctuations, which are part of a

sustainable uptrend. Bitcoin’s ability to hold key support levels

during any potential pullback will be crucial for maintaining the

overall bullish structure. Bullish Price Action: Key Levels To

Watch Bitcoin is trading at $88,000 following two days of

unexpected price appreciation, defying analysts’ expectations of a

pause around $77,000 and a possible pullback to the previous

all-time high of $73,800. Instead, Bitcoin’s price has continued

its upward momentum, bringing it closer to the significant

psychological level of $90,000. Many investors consider this level

a key supply zone where profit-taking could emerge. Despite the

rapid climb, market sentiment remains highly bullish, and the price

structure suggests that Bitcoin is still targeting the

much-anticipated $100,000 milestone. The current price action

reflects a strong bullish trend, but a retracement toward the

$77,000 level could be a healthy move, allowing BTC to establish a

robust demand base. Such a pullback would offer a consolidation

phase, which is typical before another major leg-up in a sustained

rally. Related Reading: Avalanche Nears Breakout – Top Analyst Sets

$420 Target For AVAX This Cycle In the meantime, Bitcoin’s steady

price action above recent highs is boosting investor confidence and

keeping the overall outlook bullish, as BTC appears well-positioned

for further gains. Featured image from Dall-E, chart from

TradingView

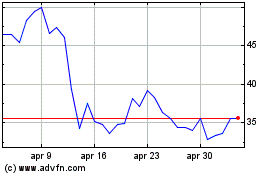

Grafico Azioni Avalanche (COIN:AVAXUSD)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Avalanche (COIN:AVAXUSD)

Storico

Da Gen 2024 a Gen 2025