Is The Crypto Winter Thawing? US Bitcoin ETFs Record First Inflows In Weeks – Coinshares

14 Maggio 2024 - 5:00AM

NEWSBTC

After experiencing outflows for four consecutive weeks, US spot

Bitcoin exchange-traded funds (ETFs) have marked a notable shift in

momentum, witnessing net inflows once again. According to recent

data from CoinShares, digital asset investment products have seen

inflows totaling $130 million for the first time in five weeks.

This change suggests renewed investor interest in crypto-focused

investment products, particularly in the United States, where most

of these inflows, totaling over $130 million, occurred. Related

Reading: Analyst Points Out Level To Beat If Bitcoin Is To Reach

$76,000 A Mixed Bag Of Global Investment Flows Grayscale, a major

player in the digital asset space, reported a significant decrease

in weekly outflows, recording its lowest since January at $171

million. This trend indicates a potential stabilization in the

market after a period of volatility and declining interest.

Meanwhile, interaction between US regulators and spot ETF issuers

has remained minimal, particularly for spot Ethereum ETF

applications. This lack of engagement has fuelled speculation that

approval for these ETFs might not be approaching, as reflected by

the amount of outflows from Ethereum-based products. James

Butterfill, Head of Research at Coinshares, particularly noted: Low

interaction by the US regulators with ETF issuer applications for a

spot Ethereum ETF have increased speculation that the ETF approval

is not imminent, this has been reflected in outflows which totalled

US$14m last week. On a global scale, the investment landscape

showed mixed signals. After a week of record inflows likely driven

by “seed capital” post-Bitcoin ETF launches, as highlighted by

Butterfill, Hong Kong saw a significant drop to $19 million in

inflows. Conversely, Switzerland experienced inflows amounting to

$14 million. Canada and Germany continued to see outflows, with

their year-to-date figures reaching a combined $660 million,

indicating sustained bearish sentiment in these markets. Bitcoin

has rebounded with $144 million in inflows, counteracting a

generally “weak month.” In contrast, short-Bitcoin exchange-traded

products (ETPs) recorded outflows totaling $5.1 million, up to $18

million over the last eight weeks. These figures highlight the

volatile dynamics within the crypto market, with Bitcoin currently

showing stronger performance than Ethereum. Bitcoin And Ethereum

Market Performance Over the past 24 hours, Bitcoin surged nearly

3%, while Ethereum increased by only 1.2%. Despite these gains,

both assets are down by 2.3% and 6% over the past week. Amidst

these market movements, crypto analyst Ali provided insights into

Bitcoin’s potential paths. According to Ali, Bitcoin could climb to

$76,000 if it reclaims $64,290 as a support level. Related Reading:

Bitcoin Cash Price At Make-Or-Break Moment, Key Levels To Watch

Failing to achieve this could see the flagship crypto drop to

support at $51,970, based on Market Value To Realized Value (MVRV)

extreme deviation pricing bands, identifying this figure as the

all-time mean. If #Bitcoin can reclaim $64,290 as support, it is

likely to rise towards $76,610. However, if it fails to surpass

$64,290, $BTC might retest support at $51,970.

pic.twitter.com/s4D1fTEU7k — Ali (@ali_charts) May 12, 2024

Featured image from Unsplash, Chart from TradingView

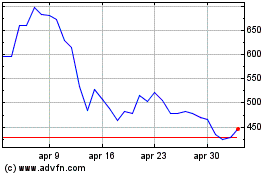

Grafico Azioni Bitcoin Cash (COIN:BCHUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Bitcoin Cash (COIN:BCHUSD)

Storico

Da Dic 2023 a Dic 2024