Bitcoin: This Indicator Flashes Green For The First Time Since January 2024

14 Maggio 2024 - 11:00PM

NEWSBTC

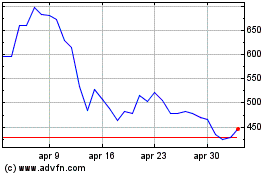

According to the candlestick arrangement in the daily chart,

Bitcoin is moving inside a range. BTC is also down roughly 20% from

the all-time high at spot rates. Though the series of lower lows

posted in the past few trading days is bearish, one analyst

is upbeat, expecting an encouraging recovery in the sessions

ahead. This Indicator Flashes Green: Time For Bitcoin To Rally?

Taking to X, the analyst notes that the 50-day Williams %R

oscillator is turning from oversold territory, signaling that the

bear run could end. Historically, the indicator has accurately

signaled buying opportunities whenever it turns from oversold

territory. The Williams %R oscillator is a crucial technical

indicator chartists use to assess momentum and identify potential

oversold or overbought conditions. When the indicator falls below

-80, it suggests the asset being analyzed is oversold, potentially

indicating a buying opportunity. Conversely, when it rises above

+20, it may mean that the asset is overbought, prompting the trader

to adjust their strategy accordingly. Related Reading: Newbie

Bitcoin Whales Buying 200,000 BTC Per Week, Data Shows Since the

beginning of 2023, the analyst observes that the 50-day Williams %R

oscillator mapping Bitcoin prices has dipped into oversold

territory on four occasions. Notably, each time the oscillator

reversed from this zone, BTC prices rose in tandem. Now, with

the Williams %R oscillator returning from the oversold territory

roughly ten days ago, the analyst is optimistic. It returned from

the oversold territory in January 2024, preceding the bull run in

Q1 2024. If past performance is anything to go by, BTC is

likely ready for a leg up. Considering the extended sideways

movement and lower lows since prices peaked in mid-March 2024, this

development will be a massive boost for the coin. Does BTC Stand A

Chance After Extended Consolidation? The asset has become more

dynamic since the approval of spot Bitcoin exchange-traded funds

(ETFs). Broader market conditions, such as regulatory changes,

macroeconomic trends, and investor sentiment increasingly influence

it. Subsequently, this dynamism can impact the accuracy of

technical indicators like the Williams % R oscillator. This tool

lags and doesn’t factor in events in real time. Therefore, while

the oscillator has been reliable in the past, it may not

necessarily accurately predict the future cycle. For this reason,

the coming days and weeks will be crucial for Bitcoin. If the price

breaks out of its current range upwards, it could lend credence to

the bullish interpretation. Related Reading: Brace For Impact: Mt.

Gox Set To Inject 142,000 BTC And 143,000 Bitcoin Cash Into The

Market- Here’s When Currently, BTC is in a narrow range. According

to the daily chart, support is at $56,500, and resistance is at

$66,000. Feature image from DALLE, chart from TradingView

Grafico Azioni Bitcoin Cash (COIN:BCHUSD)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Bitcoin Cash (COIN:BCHUSD)

Storico

Da Feb 2024 a Feb 2025