Bitcoin Price Crashes Below $61,000: The Main Reasons

24 Giugno 2024 - 4:30PM

NEWSBTC

In the last 24 hours, the Bitcoin (BTC) price fell by up to 4.8%,

plummeting to a new low of $60,601 after trading above $64,000 just

a day earlier. This decline can be attributed to a combination of

factors, including developments from the Mt. Gox saga, a

significant liquidation of long positions, and ongoing miner

capitulation. #1 Mt. Gox News Shakes Market Confidence The sudden

and steep decline from $62,900 to $60,601 in Bitcoin’s price

coincided closely with a new announcement from the trustees of the

defunct Bitcoin exchange, Mt. Gox. This exchange, central to one of

the earliest and largest Bitcoin thefts, declared it would start

repaying victims using the stolen assets from a 2014 hack in July

2024. According to Nobuaki Kobayashi, the rehabilitation trustee,

the repayment process will include Bitcoin (BTC) and Bitcoin Cash

(BCH) and start in early July. “The Rehabilitation Trustee has been

preparing to make repayments in Bitcoin and Bitcoin Cash under the

Rehabilitation Plan […] The repayments will be made from the

beginning of July 2024,” the announcement reads. Related Reading:

Bitcoin Crash: Crypto Analyst Reveals Why Price Could Drop To

$52,000 This news was perceived negatively by the market, primarily

due to fears of oversupply from beneficiaries likely selling off

assets that have massively appreciated since their initial

investment period before 2013. In May 2023, the trustee moved over

140,000 BTC, worth approximately $9 billion. This transaction was

significant as it was the first movement of these funds in five

years, tracked closely by analysts and traders. Market reactions

were immediate; Bitcoin prices tumbled as speculations about

potential market flooding with these repaid coins took hold. #2

Record Liquidations Of Long Positions Adding to the downward

pressure, there was a notable surge in the liquidation of long BTC

positions. According to the latest data from Coinglass, a

staggering $85.4 million worth of long positions were liquidated.

This event marks the largest liquidation since April 30 and May 1,

when over $195 million ($95 million and $100 million respectively)

in longs were liquidated, correlating with a 12.5% price drop over

those two days. Such liquidations occur when the market price

reaches the liquidation price of leveraged positions, triggering

automatic sell-offs to cover the losses, further driving the price

down. This cascade effect contributes significantly to rapid price

declines and increased market volatility. #3 Ongoing Miner

Capitulation Adds To Sell Pressure The third critical factor

affecting Bitcoin’s price is the ongoing miner capitulation. Miner

capitulation refers to a situation where miners, particularly those

operating with marginal efficiency, begin selling their mined BTC

to cover operational costs due to unprofitability. This phase can

exert substantial downward pressure on Bitcoin prices as it

increases the supply of Bitcoin being sold in the market. Related

Reading: Bitcoin Drops Below $64,000, But Arthur Hayes Advocates

‘Buy The Dip’ As reported by NewsBTC, renowned crypto analyst Willy

Woo and others have pointed out that miner capitulation is a

crucial phase to monitor, especially following the Bitcoin halving

events that reduce miner rewards by half, thereby straining their

profitability. Woo noted recently that the recovery from such

capitulations has historically been slow and tied closely to the

resurgence in mining activity and hash rates. Crypto expert Jelle,

speaking via X, highlighted the ongoing nature of this capitulation

today, saying, “Hash Ribbons are showing that miner capitulation is

ongoing — exactly what you want to see post-halving. Generally

speaking, the market starts rallying once that capitulation phase

comes to an end.” At press time, BTC traded at $61,241. Featured

image from iStock, chart from TradingView.com

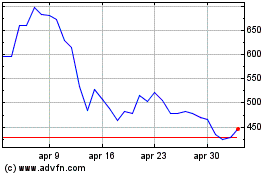

Grafico Azioni Bitcoin Cash (COIN:BCHUSD)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Bitcoin Cash (COIN:BCHUSD)

Storico

Da Feb 2024 a Feb 2025