BNB Bounce From $500: A Temporary Recovery Or Start Of A Rally?

03 Febbraio 2025 - 12:00PM

NEWSBTC

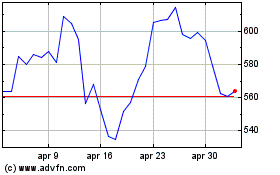

BNB has bounced off the crucial $500 support level, sparking

speculation about whether this marks the beginning of a bullish

resurgence or a temporary relief before another downturn. After

facing sustained selling pressure, buyers have stepped in to defend

this key level, fueling hopes for a potential recovery. However,

with resistance levels still looming, the true strength of this

rebound remains uncertain. Market sentiment remains uncertain as

bulls attempt to regain control while bears stay cautious. BNB’s

next move hinges on breaking key resistance levels and sustaining

higher prices. A successful breakout could confirm a bullish

continuation, while fading momentum may lead to another rejection

and a retest of lower support zones. Technical indicators such as

RSI and moving averages will play a crucial role in determining the

next move. Bulls may have the upper hand if the RSI trends upward

and key levels are reclaimed. On the other hand, if bearish

pressure resurfaces, the possibility of further downside cannot be

ignored. Analyzing The Buying Pressure On Price Currently, BNB is

displaying strong upside movements as it moves toward the $605

resistance level. The coin has been steadily climbing, indicating

buyers are regaining control and pushing its price higher. This

move comes after a successful rebound from the key $500 support

level, which has sparked renewed optimism among traders.

Related Reading: BNB Price Poised for Gains: Bulls Push for New

Highs Despite the ongoing bullish momentum, the price’s position

under the 100-day SMA signals that BNB has not yet fully regained a

strong positive trend in the longer term. It could also indicate

that there is still some selling pressure from bears that might

prevent the price from maintaining a steady rise. If BNB continues

to trade below this key moving average, it could have difficulty

sustaining its current upbeat momentum. The longer it remains below

the SMA, the greater the risk of a reversal or consolidation.

Additionally, the RSI (Relative Strength Index) indicator remains

in the oversold territory, showing no immediate signs of moving

back toward neutral or the overbought zone. An RSI reading below

30% typically implies that the asset is oversold, and there may be

more downside potential or a need for price correction.

However, the RSI’s failure to exit the oversold zone suggests that

the market is still under strain, with bearish pressure possibly

outweighing bullish pressure. For the bulls to take control and

push BNB higher, the RSI would need to gradually move back above

the 30-50% range, triggering a shift toward more balanced market

conditions. Is BNB Ready For A Breakout Or Heading For Another

Decline? In conclusion, BNB’s current upward movement is an

encouraging sign for the bulls, but the real test lies at the $605

resistance level. Should bulls succeed in pushing the price above

this level, a stronger rally may follow, resulting in the

cryptocurrency testing other resistance levels such as $680 and

$724. Related Reading: BNB Price Bounces Back Strongly: Is The

Rally Sustainable? Nevertheless, failure to clear the $605 zone

might lead to a consolidation phase or possible pullback to the

$531 and $500 support levels. Traders will need to closely monitor

market conditions and technical indicators to gauge whether the

current bullish sentiment can be sustained. Featured image from

Shutterstock, chart from Tradingview.com

Grafico Azioni Binance Coin (COIN:BNBUSD)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Binance Coin (COIN:BNBUSD)

Storico

Da Feb 2024 a Feb 2025