Bitcoin Cash (BCH): Analyst Pinpoints Prime Moment For Strategic Buy

15 Agosto 2024 - 6:30PM

NEWSBTC

Recently, crypto analysts have been attracted to Bitcoin Cash

(BCH); Alan Santana provided an extremely intricate analysis

concerning the coin’s future. He advises investors though to hold

off on accumulating BCH until the market shows clearer signs of

stability. Related Reading: HODLing Resurgence? 374,000 Bitcoin

Transfer Ignites Crypto Recovery The cautious outlook for Santana

was based on the notion that, from his belief, the correction in

the market wasn’t over yet. He indicated that BCH still might be

due for a little room down to the bottom, likely to precede the

bull market expected in 2025. Strategic Accumulation And Market

Timing The analyst focuses on a meticulous accumulation strategy.

Santana advises investors to wait for signals of the bottoming of

the market before buying BCH. He says such patience can pay off

handsomely. He also encourages one to look at both linear and

logarithmic graphs, for each offers a different perspective into

price action. This gives a greater overview of where BCH might be

headed when both of them are combined. ✴️ Bitcoin Cash Pre-2025

Bull-Market Accumulation Zone & Strategy Another amazing

cryptocurrency project. You know our motto, we love all

cryptocurrencies; the more the better. Good evening ladies and

gentlemen… Are you ready to be entertained? Bitcoin Cash peaked

before… pic.twitter.com/DMLJ077ufN — Alan Santana (@lamatrades1111)

August 13, 2024 Of course, these potential returns would be for

those willing to follow the advice. However, he also cautioned that

such gains would most likely have to travel through further

declines on the market. Timing and patience in riding out wildly

swinging markets are thus what seem to be emphasized more than

anything else with his strategy. BCH is independent of the broad

market trend. In 2021, BCH led in May, a little ahead of other

altcoins. In the year 2023, BCH started off in June to peak in

April 2024. This time difference right here can give BCH an added

strategic advantage for investors who understand that market

behavior. World Of Charts, another analyst, recently offered an

upbeat prediction for Bitcoin Cash’s (BCH) price trajectory. WOC

believes that BCH is almost ready for a big bounce in the upcoming

weeks. BCH was trying a number of resistance levels at the time of

his research. These milestones functioned as obstacles that BCH had

to clear in order to pursue new annual highs. According to the

analyst, a significant price gain may occur if BCH is able to

overcome these resistance levels. Related Reading: Bitcoin SV Makes

A Surprise Move With 10% Uptick – Details Short-Term Outlook:

Resistance And Growth While Santana’s view for the long term is

very conservative, the short-term BCH forecasts are pretty

optimistic. CoinCheckup data interprets this to mean a possible

4.80% increase BCH over the next three months. This growth could be

driven by steady accumulation and mild bullish momentum. Though

modest, this could position BCH to test the $230-$240 resistance

zone. Further out, the six-month outlook for BCH is a projected 14%

rise. Assuming BCH can break out of its current resistance levels,

the target will be the $270-$280 zone. But more so important will

be how the market reacts at those levels, and that shall be the

determinant as to whether BCH will keep the momentum or there will

be heavy pullbacks. Featured image from Pintu, chart from

TradingView

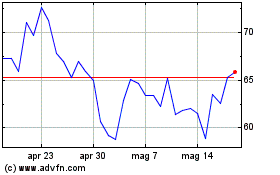

Grafico Azioni Bitcoin SV (COIN:BSVUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Bitcoin SV (COIN:BSVUSD)

Storico

Da Dic 2023 a Dic 2024