DeFi Exploits Plunge 40% In 2024, But Centralized Exchange Losses Soar – Report

25 Dicembre 2024 - 6:00AM

NEWSBTC

According to a report published today by blockchain security firm

Hacken, decentralized finance (DeFi) protocols witnessed a steep

decline in exploits in 2024, while centralized finance (CeFi)

platforms more than doubled their losses due to security breaches.

DeFi Platforms Show Better Security Mechanisms In its annual “Web3

Security Report,” Hacken outlined the general trends in the

cryptocurrency industry with regard to scams and security

infrastructure. The report notes that total losses arising from

security failure in 2024 stood at $2.91 billion. Related Reading:

WazirX Exchange Releases Post-Mortem Report: Was North Korea Behind

The $235M Exploit? DeFi protocols accounted for $474 million in

losses this year, a 40% decline from $787 million in 2023. This

sharp drop reflects the growing adoption of advanced security

techniques, such as zero-knowledge cryptography and multi-party

computation, across the DeFi ecosystem. One key factor contributing

to the reduction in DeFi exploits was the sharp decline in

cross-chain bridge hacks. Losses from these attacks have

consistently fallen – from $1.89 billion in 2022 to $338 million in

2023, and finally to $114 million in 2024. In contrast, CeFi

platforms, including cryptocurrency exchanges, reported $694

million in losses in 2024, more than double the $339 million

recorded in 2023. CeFi accounted for nearly one-third of all

crypto-related incidents, highlighting persistent vulnerabilities

in centralized systems. Gaming and metaverse projects were another

major target in 2024, responsible for nearly 20% of all

crypto-related hacks, with $389 million in losses. The largest

gaming/metaverse breach of the year was the PlayDapp exploit in Q1

2024, which resulted in a $290 million loss. Phishing scams also

remained a significant concern, causing more than $600 million in

losses this year. These scams highlight increasingly sophisticated

social engineering tactics in the Web3 space. In November, the

sector faced a $129 million address poisoning attack. For context,

address poisoning phishing involves attackers sending small

transactions from an address that closely resembles one the victim

has interacted with, tricking them into mistakenly sending funds to

the fraudulent address in future transactions. Memecoins And

Rugpulls Continue To Prey On Users While memecoins were all the

rage for the majority of 2024 – particularly on the Solana (SOL)

blockchain due to its low transaction costs – a significant

proportion of them preyed on investors through presale scams and

celebrity-endorsed rug pulls. Related Reading: Dogecoin & Other

Memecoins No Longer Grabbing Social Media Attention: Santiment One

notable example is the Hawk Tuah memecoin, launched by viral

influencer Hailey Welch, popularly known as “Hawk Tuah Girl”. The

coin’s value plummeted 95% shortly after launch, sparking severe

backlash from the wider Web3 community. The rise in

memecoin-related scams also underscores the need for greater

investor education, particularly when engaging with such

speculative assets. At press time, Bitcoin (BTC) trades at $98,921,

up 5.8% in the past 24 hours. Featured image from Unsplash, chart

from Tradingview.com

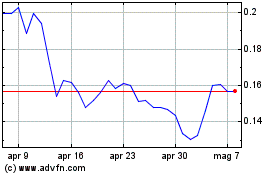

Grafico Azioni Dogecoin (COIN:DOGEUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Dogecoin (COIN:DOGEUSD)

Storico

Da Dic 2023 a Dic 2024