Toncoin (TON) Hits New Yearly Peaks, Surging 60% On Buzz Surrounding Potential Telegram IPO

13 Marzo 2024 - 10:00PM

NEWSBTC

Toncoin (TON) has experienced a notable uptrend in recent weeks,

driven by significant news and announcements surrounding the

popular social media platform Telegram, the latest being a

potential initial public offering (IPO). Telegram User Base

Surpasses 900 Million According to his latest appearance, aside

from his constant announcements through his channel on the social

media platform, Pavel Durov, the CEO of Telegram, shared that the

messaging app has amassed over 900 million users, up from 500

million in 2021, and is steadily approaching profitability.

Related Reading: Bitcoin Whales Are Cashing Out Amid Push To New

All-Time High In an interview with the Financial Times, Durov

revealed that Telegram’s introduction of advertising and premium

subscription services two years ago has enabled the company to

generate “hundreds of millions of dollars” in revenues. With yearly

expenses at less than 70 cents per monthly user, Telegram’s

financial growth is gaining momentum. Telegram is implementing

various strategies as part of its ongoing efforts to generate

revenue. As reported by NewsBTC, the company is planning to

introduce revenue sharing with channel creators, offering them a

50% share of the marketing budget. Additionally, Telegram is

launching business accounts and a “social discovery” feature, which

will reportedly facilitate user interaction and help connect

individuals nearby. These initiatives aim to diversify Telegram’s

revenue streams and provide additional value to its user base.

Potential Valuation Exceeds $30 Billion Telegram has reportedly

garnered significant interest from potential investors, with offers

exceeding $30 billion in valuation. However, during the interview

with the Financial Times, Durov emphasized that the company’s

priority is to remain independent, and an IPO would serve as a

means to “democratize” access to Telegram’s value. Durov stated:

The main reason why we started to monetize is because we wanted to

remain independent. Generally speaking, we see value in [an IPO] as

a means to democratize access to Telegram’s value. While Durov did

not provide a specific timeline or venue for the potential IPO, two

people familiar with the matter told the Financial Times that

Telegram may pursue a US listing once profitability is achieved and

market conditions are favorable. Notably, the messaging app

platform has already raised approximately $2 billion in debt

financing through bond offerings, providing flexibility for future

financial decisions. In the event of an IPO, Telegram is

considering selling an allocation of stock to loyal users, similar

to Reddit’s recent announcement. This approach aims to involve the

community and foster a sense of ownership. Furthermore,

Telegram is exploring the possibility of a smaller equity raise to

fuel its artificial intelligence (AI) ambitions, including

introducing an AI-powered chatbot. The company also plans to

enhance its moderation processes and deploy AI-related mechanisms

to address potential issues, particularly during global elections.

TON Climbs The Ranks With Telegram’s endorsement and integration of

TON into the app’s user interface and introducing a new ad

revenue-sharing system, Toncoin has surged 97% in the past month,

marking new yearly highs for the token. Related Reading:

Number Of Ethereum Short-Term Holders Increasing – Is A Bull Rally

Next? In addition, Telegram’s potential initial public offering has

further bolstered Toncoin’s upward trajectory, with a 20% spike in

the past 24 hours, resulting in a current trading price of $4.40.

On top of that, TON has climbed into the top 13 largest

cryptocurrencies on the market with a capitalization of $15

billion, surpassing other major coins such as Polkadot (DOT),

Polygon (MATIC) and Chainlink (LINK). Featured image from

Shutterstock, chart from TradingView.com

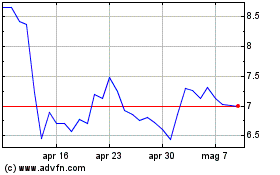

Grafico Azioni Polkadot (COIN:DOTUSD)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Polkadot (COIN:DOTUSD)

Storico

Da Apr 2023 a Apr 2024