Unveiling Bitcoin’s Drop To $65,000: Here’s How Much BTC Miners Sold

15 Giugno 2024 - 1:30PM

NEWSBTC

Bitcoin has faced a significant amount of selling pressure over the

past week, according to the latest on-chain data. Expectedly, this

bearish pressure has had a notable impact on the price of the

premier cryptocurrency. According to data from CoinGecko, the value

of Bitcoin has declined by nearly 5% in the past seven days. On

Friday, June 14th, the BTC price fell to around the $65,000 level —

its lowest level in nearly a month. Bitcoin Miners Offload Over

1,200 BTC In One Day In a recent post on the X platform, crypto

analyst Ali Martinez revealed that Bitcoin miners have been active

in the open market in recent days. Specifically, these network

entities have been trimming their BTC holdings, and selling their

assets for profit. Related Reading: Quiet Summer Ahead For Bitcoin,

But Ethereum Holds Potential for Surprise — QCP Capital Martinez

mentioned in his post that the Bitcoin miners offloaded more than

1,200 BTC (worth roughly $80 million) in a single day. According to

the crypto pundit, this increased selling activity by the miners

might have played a significant role in the premier crypto’s recent

correction to $65,000. This on-chain observation is in tandem with

CryptoQuant’s latest weekly report. The blockchain analytics firm

noted that miners were transferring their coins to exchanges and

over-the-counter (OTC) desks for sale, as the Bitcoin price hovered

between $69,000 and $71,000. According to CryptoQuant, the recent

decision of miners to offload their holdings Is associated with the

declining revenues following the halving event. With reduced

transaction fees and persistently high network hashrates, miner

revenues have continued to dwindle over the past few months.

Furthermore, CryptoQuant mentioned that historical patterns suggest

that sustained low revenues and high hashrate could imply a

potential market bottom. Ultimately, this means that the Bitcoin

market could be stabilizing or getting ready for upward movement.

Whales Join The Sell-Off, Dump 50,000 BTC Further on-chain

observations show that miners are not the only entities responsible

for the recent selling pressure. In another post on X, Martinez

revealed that Bitcoin whales have also been offloading significant

BTC amounts in recent days. Based on data from Santiment, whales

have sold 50,000 BTC (equivalent to about $3.3 billion) in the past

10 days. Bitcoin whales – in this particular data point – refer to

holders that own between 1,000 – 10,000 BTC. Related Reading: Red

Alert For Polkadot (DOT): Double-Digit Drop Sparks Investor Fears

While the price of BTC fell as low as 65,000 in the past day, it is

beginning to show some signs of recovery. As of this writing,

Bitcoin is valued at $66,266, reflecting a 0.7% decline in the past

24 hours. Featured image from iStock, chart from TradingView

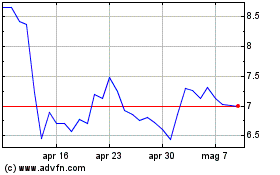

Grafico Azioni Polkadot (COIN:DOTUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Polkadot (COIN:DOTUSD)

Storico

Da Dic 2023 a Dic 2024