AAVE Soars 18% Amidst Adverse Market Conditions – Details

18 Agosto 2024 - 5:00PM

NEWSBTC

With the general sentiment in the market cooling down, AAVE scores

a win as it maintains high profitability even as the market dips

slightly. According to CoinGecko, the token is up over 18% since

last week, a sign that AAVE is continuing the market’s bullishness

despite the latter grinding to a near stop. Related Reading:

Polkadot (DOT) Investor Confidence Falls As Token Loses 16% AAVE is

looking to expand the reach of its operations with a proposal that

sees to activate the Aave v3 on zkSync, leveraging the latter’s

rollup capabilities to keep transactions cheap for users. Yes

To Aave v3 Activation On zkSync Aave v3’s activation on zkSync is

part of a long-term deployment of Aave v3 on the zkSync chain. It

was first outlined back on June 11th, citing zkSync’s scalability

and efficiency while “maintaining the security and decentralization

of the Ethereum mainnet… Deposit and borrowing activities can

greatly benefit from the reduced transaction costs and increased

throughput offered by zkSync.” Once activated, users of Aave can

expect low transaction fees and fast finalization which helps

improve user experience while enhancing the network’s

scalability. The voting process for the proposal is still

ongoing, but the general consensus at the moment is an outstanding

“Yes” for the community with nearly 47,000 votes in favor of

activation. However, the proposal needs 320,000 votes to pass,

giving more time for users to weigh in the pros and cons of the

activation. Secured Levels Open Opportunities For AAVE As of

writing, AAVE returned to its pre-August level at $110.43, opening

the potential of reaching $124 in the short term. But this also

opens the question of whether the crypto has momentum to reach this

price target. The $105-$115 price range opens the door to

higher levels once bullishness resumes. With the market stagnating

after a couple of days of bullish action, we might see the coin

rest on this price level before a continuation rally occurs next

week. Related Reading: Cosmos Price Analysis: Why This

Analyst Says ATOM Has ‘A Great Chart’ However, this movement is

hinging on the probability that the market resumes its bull run. If

the market sentiment continues to encourage selling, we might see

the token return to pre-$100 levels in the coming days, possibly to

the $93 floor price. But the current relative strength index

(RSI) figures suggest that AAVE still has some wiggle room to

squeeze some short-term gains. Along with improving macroeconomic

factors, we might see another wave of capital inflow from budding

retail investors trying the market out for some time.

Investors and traders should be positive within the coming days, as

the token stabilizes around the current price range to retain

momentum for the long term. Featured image from Shrimpy

Academy, chart from TradingView

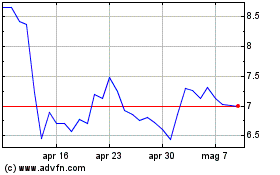

Grafico Azioni Polkadot (COIN:DOTUSD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Polkadot (COIN:DOTUSD)

Storico

Da Nov 2023 a Nov 2024