Is Bitcoin Bull Run Over? What This Legendary Metric Says

26 Dicembre 2024 - 8:00PM

NEWSBTC

Here’s what the historical trend of the Bitcoin Market Value to

Realized Value (MVRV) Ratio suggests regarding whether the current

bull run is over or not. Bitcoin MVRV Ratio Could Hint At Where BTC

Is In Current Cycle In a new post on X, CryptoQuant founder and CEO

Ki Young Ju shared a chart showcasing the past pattern in the

Bitcoin MVRV Ratio. The MVRV Ratio refers to a popular on-chain

metric that, in short, keeps track of how the value held by the BTC

investors (that is, the market cap) compares against the value that

they initially put into the asset (the realized cap). Related

Reading: XRP Jumps 4%, Whale Reacts With $69 Million Coinbase

Deposit When the value of the ratio is greater than 1, it means the

investors as a whole can be assumed to be in a state of profit. On

the other hand, it is under the mark, implying the dominance of

loss in the market. The version of the MVRV Ratio posted by Young

Ju isn’t the ordinary one, but rather a modified form called the

“True MVRV.” This variation takes into account for only the data of

the coins that were involved in some kind of transaction activity

during the past seven years. Coins that are older than seven years

can be assumed to be lost forever, either due to being forgotten or

because of having their wallet keys misplaced. As such, the True

MVRV, which excludes these coins that are probable to never return

back into circulation, can provide a more accurate picture of the

sector than the normal version of the metric. Now, here is a chart

that shows the trend in this Bitcoin indicator over the history of

the cryptocurrency: As displayed in the above graph, the Bitcoin

True MVRV has climbed to relatively high levels during this bull

run. This implies the average investor is carrying notable profits.

Historically, the higher the holder gains get, the more likely they

become to participate in a mass selloff with the motive of

profit-taking. Thus, whenever the MVRV Ratio rises high, a top can

become probable for BTC. From the chart, it’s visible that the tops

during the past cycles occurred when the indicator surpassed a

specific line. So far, the metric hasn’t come close to retesting

this level in the latest epoch. Related Reading: Bitcoin Sentiment

Still Close To Extreme Greed: More Cooldown Needed For Bottom?

According to the CryptoQuant founder, the reason the market cap

hasn’t overheated relative to the realized cap yet is that there is

still $7 billion in capital inflows entering the Bitcoin market

every week. If the current cycle is going to show anything similar

to the previous ones, then the True MVRV being high, but not

extremely high, could potentially suggest room for BTC left in the

current bull run. BTC Price Bitcoin has retraced its Christmas

rally as its value is now back down to $95,700. Featured image from

Dall-E, CryptoQuant.com, chart from TradingView.com

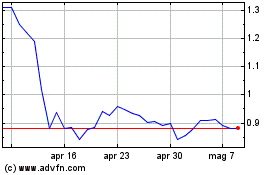

Grafico Azioni Flow (COIN:FLOWUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Flow (COIN:FLOWUSD)

Storico

Da Dic 2023 a Dic 2024