Bitcoin Plunges Below $100K Despite Positive Coinbase Premium Signal – What’s Next?

08 Gennaio 2025 - 10:00AM

NEWSBTC

Bitcoin (BTC) has seen bullish but unsteady price action in early

2025, with recent data highlighting shifting sentiment among US

investors. After briefly crossing the $102,000 mark yesterday, the

asset has struggled to maintain upward momentum, shedding most of

its recent gains as it stands at just below $100,000. These

developments coincide with critical insights from key on-chain

metrics that offer a clearer view of Bitcoin’s short-term

trajectory. Related Reading: Bitcoin Forms First Daily Death Cross

On Dominance Chart In 4 Years, What To Expect Next Bitcoin’s Price

Struggles Despite Positive Coinbase Premium Index Signal A

CryptoQuant analyst known as Burak Kesmeci recently shared insights

on the Coinbase Premium Index (CPI), which turned positive for the

first time in 2025. The CPI measures the price difference between

Bitcoin on Coinbase and other global exchanges, serving as a

crucial indicator of US investor sentiment. 3 days ago, Coinbase

Premium Index crossed SMA14 for the 1st time in 26 days—Bitcoin is

now up 4% to $102K. In Nov 2024, a similar move saw Bitcoin rally

from $69K to $108K. U.S. buyers could be back in action.

pic.twitter.com/XtAlHUzzvv — CryptoQuant.com (@cryptoquant_com)

January 6, 2025 Alongside this positive shift, a notable 4,012 BTC

outflow from Coinbase was recorded, signaling renewed buying

interest among US-based investors. Historically, such patterns have

been associated with a rise in buying pressure, often laying the

groundwork for potential price surges. Despite these positive

signals, Bitcoin’s price performance remains restrained. After

briefly surpassing $102,000 on December 6, Bitcoin retreated and

now trades below $100,000, reflecting a modest 3.3% decrease over

the past 24 hours. This price mark from the largest cryptocurrency

by market capitalization puts it at approximately 8.9% below its

all-time high of $108,135, achieved in December 2024. Bitcoin Faces

Key Resistance Levels Notably, the current price action from BTC

suggests that while buying pressure exists, it may not yet be

sufficient to trigger another strong rally. According to

cryptocurrency analyst Ali, Bitcoin maintains a critical support

zone between $95,400 and $98,400, where over 1.77 million addresses

collectively hold 1.53 million BTC. Related Reading: Bitcoin’s

Miner Sentiment Signals: Are We Nearing a Market Rebound? This

support zone remains essential for stabilizing Bitcoin’s price amid

market uncertainty. Conversely, resistance appears limited, with

only 107,000 BTC supply positioned between $104,700 and $105,770.

This relatively thin resistance could pave the way for upward

movement if buying pressure intensifies. #Bitcoin sits well above

an important support zone between $95,400 and $98,400, where 1.77

million addresses bought over 1.53 million $BTC. However, there

isn’t significant resistance ahead, only a minimal supply wall of

107,000 #BTC between $104,700 and $105,770.

pic.twitter.com/MEATFegTV2 — Ali (@ali_charts) January 7, 2025

Meanwhile, zooming out, analysts remain bullish overall on Bitcoin.

Captain Faibik for instance has recently shared his outlook on BTC

suggesting that the asset is still poised for a rally to $112,000.

Featured image created with DALL-E, Chart from TradingView

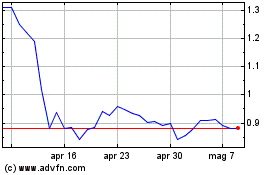

Grafico Azioni Flow (COIN:FLOWUSD)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Flow (COIN:FLOWUSD)

Storico

Da Gen 2024 a Gen 2025