Chainlink Price Surge Powers Altcoin Market, Bulls Aim For $20 Target

02 Febbraio 2024 - 1:30PM

NEWSBTC

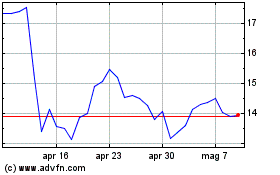

Chainlink (LINK), the leading oracle network on the blockchain, has

been on a tear, outperforming the broader market with a 30% gain in

the past week. This surge has pushed LINK’s price to $17.82,

solidifying its dominance among altcoins, as bulls set their sights

on the vaunted $20 target. Related Reading: Stablecoins Surge: USDT

Leads $400 Million Inflows, Signaling Investor Confidence Chainlink

On-Chain Activity Hints At Renewed Investor Interest Analysts point

to several factors driving the rally. Santiment, an on-chain data

provider, revealed a surge in activity from previously dormant

wallets, suggesting renewed investor interest. This is reflected in

the “Age Consumed” metric, which measures the total number of days

coins have been dormant before being moved. For Chainlink, this

metric hit a 5.38 billion spike – the highest ever recorded. Whales

Accumulating, But Liquidations Pose Minor Threat Santiment’s data

also indicated minor liquidations from some wallets, a phenomenon

often associated with fear or uncertainty. While these liquidations

could trigger short-term volatility, they might also present buying

opportunities for savvy investors. Additionally, reports suggest

whales accumulating LINK, further fueling bullish sentiment. The

rationale behind this perspective lies in the understanding that

fear-induced sell-offs might create temporary price dips, allowing

savvy investors to acquire assets at more favorable prices.

Moreover, recent reports have indicated a pattern of whales

accumulating LINK, contributing to the overall bullish sentiment

surrounding the cryptocurrency. Whale accumulation, where large

holders increase their positions, is often interpreted as a sign of

confidence in the asset’s future potential. Chainlink currently

trading at $17.94 on the daily chart: TradingView.com Technical

Analysis Paints Bullish Picture Crypto analyst Michael van de Poppe

identified a “higher low” on the LINK/BTC trading pair, which he

considers a bullish signal. He predicts a potential breakout, with

LINK reaching $25-$30 in the near future, fueled by a broader

altcoin market rally. Van de Poppe even envisions a 50-80% surge

for the altcoin market, pushing its valuation to a staggering $1.25

trillion. While Van de Poppe’s analysis sparks optimism, it’s

crucial to remember that expert predictions are not guarantees. The

cryptocurrency market remains inherently volatile, and past

performance is not indicative of future results. CFGI At

‘Neutral’ Meanwhile, LINK’s “Fear & Greed Index” is

currently positioned at 40, indicating a state of neutrality in the

market sentiment. This numerical assessment reflects a balance

between fear and greed among investors and traders in the context

of Chainlink’s performance. Related Reading: XRP Price Poised For

Liftoff? Whale Holdings Soar Despite Ripple Hack A “Neutral”

reading on the Fear & Greed Index implies that the market is

not heavily skewed towards either extreme optimism or pessimism. In

such a scenario, investors may exhibit a measured and cautious

approach, avoiding impulsive decisions driven solely by emotions.

Source: https://cfgi.io/ This equilibrium in sentiment suggests

that participants are likely assessing the market conditions with a

more rational and balanced perspective, considering various factors

before making significant moves. The “Fear & Greed Index”

serves as a valuable tool for market participants to gauge the

prevailing sentiment and potential market trends. In the case of

Chainlink’s current reading at 40, it signifies a market

environment where neither excessive fear nor greed is dominating

decision-making. Featured image from Adobe Stock, chart from

TradingView

Grafico Azioni ChainLink Token (COIN:LINKUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni ChainLink Token (COIN:LINKUSD)

Storico

Da Dic 2023 a Dic 2024