Chainlink (LINK) Forms Signal That Last Led To 123% Rally

23 Luglio 2024 - 11:00PM

NEWSBTC

On-chain data shows Chainlink has just seen a level of decline in

its exchange reserve that last led to a massive rally for the

cryptocurrency. Chainlink Exchange Supply Has Dropped By 1.6% In

The Past Month According to data from the on-chain analytics firm

Santiment, Chainlink has observed significant outflows from

exchanges recently. The indicator of interest here is “Supply on

Exchanges,” which, as its name suggests, keeps track of the

percentage of the total circulating LINK supply that’s currently

sitting in the wallets of all centralized exchanges. Related

Reading: Last Resistance: Bitcoin Now Testing Final Short-Term

Holder Cost Basis When the value of this metric rises, it means

these platforms are receiving a net amount of deposits right now.

As one of the main reasons why investors may transfer to exchanges

is for selling-related purposes, such a trend can have bearish

implications for the asset. On the other hand, the indicator

registering a decline implies a net outflow of coins is occurring

from the exchanges. Holders generally withdraw their coins

to self-custody when they plan to hold into the long term, so

this kind of trend can be bullish for the cryptocurrency’s price.

Now, here is a chart that shows the trend in the Chainlink Supply

on Exchanges over the past year or so: As displayed in the above

graph, the Chainlink Supply on Exchanges has witnessed a sharp

drawdown recently. More specifically, investors have withdrawn

around 1.6% of the asset’s entire supply in circulation over the

past month. This is a very notable decrease and suggests there is

some strong demand from the whales for accumulation. The last time

the metric saw a significant drop was in the early part of the

year. This last decrease of 1.1% led to a LINK price rally of

around 10%. In December, a similar trend was observed, with

withdrawals equivalent to 0.7% of the supply resulting in a 26%

jump in the coin. Both of these instances, though, saw outflows of

a smaller degree than what LINK has seen recently. From the chart,

it’s visible that the last time a similar percentage of supply

exited these platforms was between 15th of September and 14th of

October. What followed this withdrawal spree was a massive 123%

surge in the Chainlink price over the next four weeks. As a similar

decline has occurred again in the indicator with the exchange

supply dropping from 23% to 21.4%, it’s possible that LINK could

end up seeing a bullish effect this time as well. Related Reading:

Solana Cooling Off After 16% Surge? TD Sell Signal Goes Off It only

remains to be seen, though, if any resulting rally would be of a

similar scale as that other instance, or if only a small increase

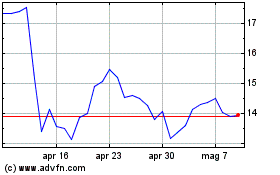

will happen, like after the last two outflow streaks. LINK Price At

the time of writing, Chainlink is trading around $13.9, down more

than 2% over the past 24 hours. Featured image from

Shutterstock.com, Santiment.net, chart from TradingView.com

Grafico Azioni ChainLink Token (COIN:LINKUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni ChainLink Token (COIN:LINKUSD)

Storico

Da Dic 2023 a Dic 2024