Time To Buy The Dip? These Are The Large-Cap Crypto Assets To Watch

06 Luglio 2024 - 2:00PM

NEWSBTC

After a turbulent week for the crypto market, the drop in prices

has left an opportunity for investors to enter new or double down

on their various positions. Fortunately, the blockchain

intelligence firm Santiment has identified some of the large-cap

cryptocurrencies to consider. These Cryptocurrencies Are In The

Opportunity Zone: Santiment Santiment revealed via a post on the X

platform has provided an interesting outlook on the crypto market,

stating that some digital assets are showing “buy the dip”

opportunities. This is based on their Market Value to Realized

Value (MVRV) ratios, which measure the average profit/loss of all

coins in circulation according to the current price. An MVRV ratio

value greater than 1 indicates that the investors of a coin are

holding a net amount of profits at the time. On the other hand,

when the value of the metric is less than 1, it means that most

investors of the particular crypto are carrying losses. Meanwhile,

an MVRV ratio of 1 means that the unrealized profit on a blockchain

is equal to the unrealized profit. Related Reading: Dogecoin Vs.

Shiba Inu Vs. PEPE: Comparing The Profitability Of The Top Meme

Coins Typically, corrections are believed to be more likely when

profits are high, as investors are more inclined to sell as their

gains grow. On the flip side, crypto holders are likely to refrain

from dumping assets when they are in the red, leading to the

formation of price bottoms. This forms the rationale behind

Santiment’s Opportunity and Danger Zone investment analysis. In its

recent post on X, Santiment mentioned that all notable large-cap

crypto assets (except Toncoin) are in the buying opportunity in the

short term. As shown in the chart below, the 30-day Market Value to

Realized Value ratio of these assets is deep in the negative,

implying there is less risk attached to investing in them at the

moment. According to Santiment’s data, Dogecoin (DOGE) — with an

MVRV ratio of –19.7% — has the best “buy the dip” potential. It is

followed by Uniswap’s governance token UNI, with a Market Value to

Realized Value ratio of –16.3%. To round up the top three is

Litecoin (LTC), which bears an MVRV ratio of –15%. Bitcoin, the

largest cryptocurrency by market cap, is amongst the mentioned

assets within the opportunity zone. Having undergone a steep

correction in the past week, the MVRV indicator is signaling that

the premier cryptocurrency might have bottomed out and could be

preparing for a move to the upside. Crypto Market On A Downturn The

crypto market suffered a massive decline over the past week, with

the total market capitalization falling by nearly 8%. This market

downturn seems even deeper on bigger timeframes. For instance, in

the last 30 days, the digital market has shed more than 21.5% of

its value. Related Reading: Shiba Inu Sees Sharp 100% Decline In

Whale Activity, Is This Good Or Bad For Price? Featured image from

Shutterstock, chart from TradingView

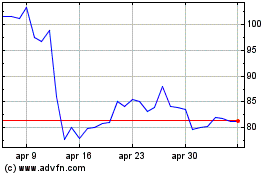

Grafico Azioni Litecoin (COIN:LTCUSD)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Litecoin (COIN:LTCUSD)

Storico

Da Feb 2024 a Feb 2025