Bitcoin Price Action Watch: 3 Pivotal Zones That Could Sway BTC’s Next Move

19 Agosto 2024 - 7:28PM

NEWSBTC

As the Bitcoin price consolidates below the $60,000 threshold, the

market has been characterized by a mix of indicators and technical

levels, leading to a divided forecast and heightened uncertainty.

Mixed Signals Cloud Bitcoin Price Trajectory According to Bitcoin

maximalist Mark Cullen, the current Bitcoin price action presents a

complex technical picture. He suggests that the $57.5,000 level

will likely be tested, and the key question is whether it will

hold. Cullen believes it will, at least initially, before

potentially breaking lower. He also highlights the importance of

the $59,500 level, stating that if Bitcoin can push through, it

would be a strong signal to heavily long the asset with a tight

stop-loss below. Related Reading: MATIC Price (Polygon) Sets Sights

Higher: Can It Gain Bullish Momentum? However, Cullen also warns of

the potential for a sweep of the liquidity below the $54,500 level,

which could pave the way for a move to new lows in the $40,000

range if that level is breached. Crypto analyst Axel Adler also

points to a similar picture, highlighting that as the Bitcoin price

currently trades below its 200-day simple moving average (SMA),

this could lead to further bearish continuation for BTC. According

to Adler’s analysis, the next support level is the 365-day SMA at

$50,000. What Do BTC’s On-Chain Fundamentals Say? Compounding the

technical uncertainty, the data intelligence platform Glassnode has

reported that Swissblock’s Bitcoin Fundamental Index (BFI) moved

from positive to neutral territory last week. According to

the platform’s co-founders Yan Alleman and Jan Happel, this shift

reflects the uncertainty surrounding the Black Monday event and the

post-Consumer Price Index (CPI) bull trap felt on the chain. The

BFI, composed of two sub-metrics measuring network liquidity and

network growth, has recently shown a bifurcation. While network

liquidity has dropped into neutral territory, network growth has

risen, painting a complex picture of Bitcoin’s fundamental outlook.

Related Reading: XRP Price Set To Breakout: Will It Trigger A

Strong Rally? Alleman and Happel note that the drop in network

liquidity, while concerning the short term, is not necessarily a

bearish signal in the long run. They explain that increased network

liquidity is desirable, as it enhances Bitcoin’s functionality as a

medium of exchange. However, the rise in network growth is seen as

a strong bullish sign, indicating that more players interact with

the Bitcoin network on an entity-adjusted basis. This effectively

creates a deeper pool of crypto-native capital, which could support

the asset’s long-term valuation. The Glassnode co-founders stated:

Given the current store-of-value ‘digital gold’ narrative and the

increased ease of getting BTC exposure via ETFs, CEXes, etc.,

rising network growth is a strong bullish sign. When writing, the

Bitcoin price is $58,680, down over 2% in the last 24 hours.

Featured image from DALL-E, chart from TradingView.com

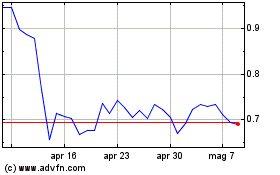

Grafico Azioni Polygon (COIN:MATICUSD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Polygon (COIN:MATICUSD)

Storico

Da Nov 2023 a Nov 2024