Bitcoin At $26,900: Is It Well-Positioned For Breakout Despite Potential Drop?

28 Marzo 2023 - 10:25PM

NEWSBTC

Bitcoin (BTC) is currently experiencing a downtrend in response to

recent regulatory actions by US authorities against major players

in the cryptocurrency market. BTC has struggled to surpass its

significant resistance wall at $28,700, leading some investors to

suggest that a pullback would be healthy for the largest

cryptocurrency in the market. Bitcoin is trading at $26,800 and has

remained relatively stable since Monday, following a dip below its

annual high of $28,700 that was reached in March. Bitcoin has

recently experienced a strong uptrend, with a gain of over 45% from

its lower levels, but can BTC hold a 7% dip towards the %25,000

support? Related Reading: Shiba Inu Community Destroys 814 Million

SHIB, What’s Ahead? Healthy Pullback For Bitcoin Or Another Chance

For Bears To Take Over? According to the trader and crypto analyst

Rekt capital, Bitcoin needs to have a monthly candle close above

$25,000 to confirm a macro downtrend break, and with BTC trading at

$26,900 as of this writing and with three more days to hold above

that key level, there are good chances for bulls to confirm the new

trend. Furthermore, a monthly candle close above $25,000

would indicate a significant shift in Bitcoin’s long-term trend,

potentially leading to further gains, new yearly highs, and bullish

market sentiment. Despite the potential price drops, Bitcoin

is poised for a breakout and a macro trend shift. As the monthly

close approaches, Bitcoin’s market position looks favorable.

Interestingly, even if Bitcoin drops by $1,900 (7% of its current

price), it could still be well-positioned for a continuation of its

bull run. Will BTC’s Dominance In The Market Follow Its Price

Action? According to Rekt, Bitcoin’s dominance is in a Back Wedge

structure that has existed since May 2021. The analysts suggest

that Bitcoin’s dominance is also well positioned for a confirmed

breakout from this structure, with a potential monthly close beyond

the downtrend resistance dating back to May 2021. Rekt

Capital’s analysis suggests that Bitcoin dominance may dip into the

Wedge top, as seen in the chart above, leading to a potential

influx of money into altcoins. Bitcoin is trading within a broader

range of $26,700 to $28,600, and it’s challenging to predict its

price action until a significant break occurs. However, if Bitcoin

experiences a drop below $26,000 and approaches $25,000, it will

encounter strong support above the 55 exponential moving average

(EMA). This support level could help Bitcoin recover and make

another attempt to break above the resistance level. BTC has the

potential to recover the $30,000 level it lost during the June 2022

bear market. To achieve this, the cryptocurrency must maintain its

nearest support level and trade above the 55 EMA to attempt to take

by storm the $28,600 resistance. Related Reading: Are We At The

Early Stages Of A Bitcoin Bull Market? Bitfinex Analysts Reveals

Featured image from Unsplash, chart from TradingView.com

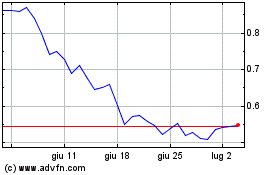

Grafico Azioni Mina (COIN:MINAUSD)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Mina (COIN:MINAUSD)

Storico

Da Mag 2023 a Mag 2024