Ethereum Funding Rates Hit Key Bullish Level – Price Surge Ahead?

09 Novembre 2024 - 4:30PM

NEWSBTC

Following Donald Trump’s victory in the US presidential election on

November 5, Ethereum (ETH), alongside the general cryptocurrency

market, has experienced notable price gains. In particular, the

second-largest cryptocurrency has witnessed its value increase by

24.31% in the past four days as it approaches a crucial $3,000

resistance zone. Related Reading: Ethereum Analyst Sees Altseason

Potential As BTS Is Still Outpacing ETH – Time To Buy Altcoins?

Ethereum Prepares For Potential Surge As Funding Rates Hit 0.02

Amidst the recent price rally in the last week, crypto analyst

Burak Kesmeci notes that Ethereum funding rates have now climbed

above 0.02, which can be described as a strong bullish

signal. Generally, funding rates are periodic payments made

between traders in the perpetual future contracts during funding

intervals. A funding rate of 0.02 indicates long position

domination and demands that long traders pay 2% of the notional

value of their position to short traders in order to maintain the

price of perpetual contracts close to the spot market price of an

asset. According to Kesmeci, long positions in futures

markets are crucial to initiating strong bull rallies in the same

vein as spot market acquisitions. Interestingly, historical

data as shared by the analyst shows that Ethereum has consistently

experienced a major price uptrend whenever funding rates have risen

and stayed above 0.02. For context, when funding rates hit 0.02 on

July 1, 2020, the ETH market recorded a price gain of over 100% in

50 days. Likewise, on November 2, 2020, Ethereum also embarked on a

bullish course surging by over 1000% in 350 days. Most

recently, Kesmeci notes that the altcoin’s price grew by 150% in

150 days as the funding rates crossed 0.02 on October 4, 2023.

Therefore, the analyst postulates ETH may be primed for a robust

bullish run in the coming days. In addition, this potential uptrend

is expected to influence other altcoin markets due to Ethereum’s

position as the largest altcoin by market cap. Related Reading:

Ethereum L2 Project Spark Launches On-Chain Order Book On Fuel

Network To Enhance Trading ETH Meets Crucial $3,000 Resistance

Level With Ethereum’s price hovering above $2,900, the token is set

to soon encounter a major resistance at the $3,000 price

mark. According to a report by blockchain analytics company

IntoTheBlock, this particular resistance level which can be

described as a historically significant demand zone is normally

expected to provide much opposition to Ethereum’s ascent.

However, the current bullish momentum in the ETH market is likely

to subdue this resistance, allowing the asset to maintain its

current rally. If Ethereum breaks beyond $3,000, the altcoin could

attain a $4,000 price target. Albeit a rejection would result in

ETH trading as low as $2,400. At the time of writing, Ethereum

continues to trade at $2,970 following a 0.98% gain in the last

day. Featured image from Mandrex, chart from Tradingview

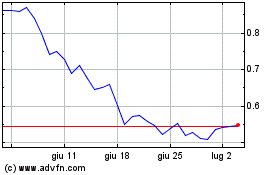

Grafico Azioni Mina (COIN:MINAUSD)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Mina (COIN:MINAUSD)

Storico

Da Feb 2024 a Feb 2025