Ethereum Price Broke Out Of Descending Channel, What’s Next?

25 Settembre 2022 - 6:00AM

NEWSBTC

Ethereum price has been trading within a descending trendline,

which is a sign of bearishness. Over the last 24 hours, the

Ethereum price has been different as the coin registered a 6%

appreciation. As the coin appreciated, it broke outside of the

descending channel. Over the last week, the Ethereum price lost

more than 7% of its value. The buyers have entered the market,

which has helped Ethereum climb on its chart. Although buyers are

attempting to make a comeback, the sellers continue to drive the

price action on the one-day chart. The $1,400 price mark continues

to remain a tough resistance zone for Ethereum price. A break past

from the aforementioned support line will help ETH revisit its next

price ceiling. The technical outlook for Ethereum continues to

remain bearish at the time of writing. Bitcoin’s price recovery has

helped major altcoins pick pace over the last 24 hours. Ethereum

Price Analysis: One Day Chart ETH was trading at $1,340 at the time

of writing. In the past 24 hours, the buyers have helped the coin

break outside of the descending trendline. The immediate and strong

resistance remained at $1,400. The altcoin has struggled to break

past that level over the last couple of weeks. Once the $1,400 mark

is broken, Ethereum can attempt to trade close to $1,700. On the

other hand, a fall from the $1,340 price mark will push ETH down to

$1,100 and then to the $1,000 level. The past trading session for

Ethereum was green, signifying an increase in the number of buyers.

Technical Analysis On its chart, ETH was attempting to recover.

However, the buyers have remained low at the time of writing.

Technical indicators have pointed towards a bearish outlook. The

Relative Strength Index was below the half-line, which also

indicated that buyers were fewer in number than sellers. Ethereum

price was below the 20-SMA line, which signified low demand. It

also meant that sellers were driving the price momentum in the

market. Related Reading: Can WAVES Flow Back From Its Low Ebb And

Reclaim $4.6? ETH’s other indicators have also shown that the

sellers were in control of the market at the time of writing. The

demand for the coin has to go up in order for the coin to touch its

next resistance mark. The Moving Average Convergence Divergence

indicates the price momentum and overall price action. MACD

witnessed a bearish crossover and formed red histograms at the time

of writing. This reading is connected to the sell signal for the

coin. The Chaikin Money Flow displays the capital inflows and

capital outflows at a given period in time. The CMF was below the

half-line and that points towards low capital inflows, although

there was an uptick on the indicator. Related Reading: Maker DAO

Shows Bullish Sentiment After A While, Eyes $800? Featured image

from UnSplash, Chart: TradingView.com

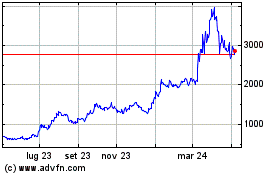

Grafico Azioni Maker (COIN:MKRUSD)

Storico

Da Mar 2024 a Apr 2024

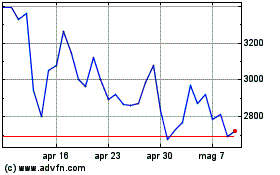

Grafico Azioni Maker (COIN:MKRUSD)

Storico

Da Apr 2023 a Apr 2024